Gold soars past $5,100 an ounce, silver hits new record on tariff and US shutdown fears – as it happened

Wall Street stocks have risen, at the start of a week of big tech earnings and a closely watched US Federal Reserve policy decision (no change in interest rates is expected).The Dow Jones rose by more than 200 points, or 0.45%, the S&P 500 gained 27 points, up 0.4%, and the tech-heavy Nasdaq climbed more than 50 points, or 0.2%.

Gold and silver hit new record highs, with gold rising above $5,100 an ounce, boosting US-listed shares of gold miners such as Gold Fields, Harmony Gold and Newmont.In London, miners are leading gains on the FTSE 100 index, such as Fresnillo, Antofagasta, Endeavour Mining, Anglo American and Rio Tinto.The index has risen 0.37% or 37 points, to 10,180.Our main stories:Thank you for reading.

We’ll be back tomorrow.Take care! – JKTim Reid, chief executive of UK Export Finance – the state-owned credit agency in charge of the loan guarantee scheme – told the Guardian that the loan package was not devised in direct response to Trump’s tariff threats.However, he acknowledged that some firms would appreciate extra financing during a period of political upheaval.There’s been significant news around tariffs and [we] can support business where they have potential impacts or concerns.This is about making sure that we can support UK businesses, doing business all around the world.

Reid highlighted that UKEF has been working to boost exports through numerous crises, having been operating for more than 100 years,The agency was established in 1919 to help firms hit by the submarine blockade after the first world war,A century later, UKEF mobilised to get £7,3bn of government-backed loans and financial support to companies such as Nissan, easyJet and British Airways whose revenues were upended by supply chain disruptions during the Covid pandemic,The government says the move secured up to 71,000 UK jobs.

Those efforts have helped the agency shake off bad press from a spate of scandals, with UKEF having been dragged into the high-profile Airbus bribery scandal that was still making headlines in 2020, and a separate judicial review over UKEF’s investment in a gas project in Mozambique.Ministers have struck a deal with the UK’s five largest banks to distribute £11bn of government-backed loans to British exporters, giving them a boost amid momentary relief from Donald Trump’s tariff threats.Senior bankers from NatWest, HSBC, Barclays, Lloyds Banking Group and Santander UK finalised the deal during a roundtable meeting in Westminster today, where business secretary Peter Kyle promised to put taxpayer money on the line.The business loans, worth up to £10m each, will come with a state guarantee that puts taxpayers on the hook for 80% of losses if firms fail to repay their debts.The arrangement is meant to encourage banks to and issue loans to small and medium-sized business, which are looking to launch or ramp up their international exports.

It means banks are taking far less risk and will only have to absorb 20% of the losses if things go wrong.Chancellor Rachel Reeves said in a statement:We’re turning the power of the City into rocket fuel for UK exporters - backing ambitious firms in every part of the country to break into new markets, create good jobs and drive the next decade of British growth.It comes at a febrile time for global trade, with Trump’s second term in the White House having been punctuated by unpredictable tariff threats that have created further uncertainty for British exporters.The Japanese yen recovered today to reclaim some of the value lost in recent weeks as foreign exchange traders speculated that the US Federal Reserve had mounted a joint operation to bolster the currency with the Bank of Japan.The dollar slipped to 154.

14 Japanese yen from 155.01 yen after trading at around 158 yen last week.Japanese exporters, which have benefited from three years of persistent declines in the yen againts the dollar, saw their value fall on the Nikkei stock market index.Sanae Takaichi, prime minister of Japan since 21 October and the country’s first female leader, has signalled she wants to embark on an unfunded spending spree if her conservative Liberal Democratic party is re-elected in a snap election on 8 February.Last week she raised the prospect of tax cuts, initially by suspending Japan’s 8% consumption tax on food.

The move was seen by critics as a way to quell growing disquiet at strongly rising food prices, especially rice.However, it spooked international investors, who fear the campaign promise will have the same effect as Liz Truss’s 2022 mini budget.Japan has $9tn of debt – equivalent to 230% of its economy – and the highest among G7 countries.Fed officials are due to meet on Tuesday and Wednesday to consider their next move on interest rates with pressure mounting from the White House to reduce the cost of borrowing at a faster pace than currently expected by financial markets.The Fed could use some of its vast resources to buy yen to support the currency, thoiugh it will have the opposite efect on the dollar, which weakened by almost 10% against a basket of international currencies last year and is expected to continue falling in value in 2026 as the Fed accelerates cuts to interest rates.

Analysts at UBS said Japan’s problems were largely driven by rising prices, and the situation was likely to prove temporary.They said food inflation would begin to ease, allowing the yen and Tokyo’s borrowing costs to fall.But politics could get in the way.If either fiscal largesse or shrinking labour supply push inflation higher, our cautious optimism on Japanese assets would have been unjustified.Bank of Scotland has been fined £160,000 by a UK Treasury body for processing payments that breached Russia financial sanctions rules.

The bank, which is part of Lloyds Banking Group, processed 24 payments to or from a personal current account held by a British citizen on the government’s list of sanctioned individuals, the Office of Financial Sanctions Implementation (OFSI) found.The payments totalled £77,383 and were made between 8 February 8 and 24 February 2023.The UK is among nations to have imposed sanctions on sectors, businesses and individuals who may be facilitating Russia’s invasion of Ukraine.Most individuals that are sanctioned under the OFSI are subject to an asset freeze and an investment ban.The OFSI found that the UK-designated person opened an account at Halifax in late 2020, using a UK passport that contained a spelling variation of their name that differed from the one on the sanctions list.

This meant the account was not flagged as a potential match by the bank’s automatic sanctions screening system.The fine was cut by half because it voluntarily disclosed the breaches a month after the payments were made.The boss of Waterstones has defended the government’s approach to the high street, arguing that controversial changes to business rates were “sensible” and had benefited outlets in struggling areas.James Daunt said the bookseller’s total business rates bill for this year was going to be similar to last year’s as big increases at large, successful sites such as its flagship on London’s Piccadilly had been offset by “quite significant” decreases at shops in more troubled locations.He said he believed “our main advantage is that we will get neighbours back again” in places such as Newport in Wales, Grimsby in Lincolnshire and Barrow-in-Furness in Cumbria, as retailers might now consider reopening amid lower business rates.

The chancellor, Rachel Reeves, has faced a backlash over the looming tax changes from leisure businesses, particularly pubs, which had faced a 76% rise on average over the next three years.She has now promised a support package to mitigate the impact that could come as early as Tuesday, but confirmed at Davos last week that the support would only be for pubs and not the wider hospitality sector.The FTSE 100 index has not moved much but is now in positive territory, trading 16 points higher at 10,159, up 0.16%.Germany’s Dax has dipped sligthly while France’s CAC and Spain’s Ibex have fallen by nearly 0.

3% and Italy’s FTSE MiB is 0.4% ahead.US stock futures have slipped as investors gear up for the Federal Reserve’s interest rate decision and corporate results from tech companies such as Apple, Microsoft, Facebook and Instagram owner Meta and Elon Musk’s Tesla this week.A total of 102 companies of the S&P 500 are due to report earnings.A big question is whether companies will start to show if they are benefiting from their spending on artificial intelligence.

The US central bank begins its two-day meeting and is due to announce its rate decision on Wednesday, with no change expected.Investors are looking for any hints on who Donald Trump will pick as his nominee to replace Fed chair Jerome Powell, whom he has strongly criticised for not lowering interest rates enough.The US president escalated his campaign against the central bank’s independence two weeks ago when the US department of justice opened a criminal investigation into Powell, whereupon global central banks issued an extraordinary joint statement offering “full solidarity” to Powell.A potential, partial US government shutdown is also on investors’ minds, ahead of a 30 January funding deadlie.Chuck Schumer, a top Democrat in the US Senate, said his party would oppose legislation that includes funding for the department of homeland security, which oversees Immmmigration and Customs Enforcement, after ICE agents shot another person in Minneapolis.

You can follow the latest developments here:Elon Musk’s AI chatbot Grok faces an investigation by the European Commission into whether it spreads illegal content such as manipulated sexualised images in the EU,The Commission said today that it will examine whether X properly assessed and mitigated risks related to Grok’s functionalities in the 27 country bloc,Users have been able to ask Grok on the social media platform to edit photos of people, including removing clothing and putting them in provocative poses, often without their consent, which were then published in replies on X,Grok AI generated about 3m sexualised images in less than two weeks, including 23,000 that appeared to depict children, according to researchers at the Center for Countering Digital Hate,EU technology chief Henna Virkkunen said:Non-consensual sexual deepfakes of women and children are a violent, unacceptable form of degradation.

In response to the investigation, X provided a link to a statement it published on 14 January:We remain committed to making X a safe platform for everyone and continue to have zero tolerance for any forms of child sexual exploitation, non-consensual nudity, and unwanted sexual content.Here’s our full story on Ryanair:Shares in the UK’s biggest private health provider have jumped after it confirmed that it is in early talks with two buyout firms to be taken private.Spire Healthcare shares jumped as much as 20%, and are now up 15% at 205.5p, valuing the company at nearly £826m and making it the biggest riser on the FTSE 250.However, they have fallen 11% over the past year.

The FTSE 250 index is down 15 points, while the FTSE 100 index is broadly flat, dipping just 3 points to 10,140.Spire said private equity firms Bridgepoint Advisers and Triton Investment Advisers are among the parties in discussions with the company, but added:These discussions remain at a preliminary stage.Spire first announced a strategic review of its operations in September, saying it was in discussions with several parties to explore options including a potential sale of the business.Spire runs 38 hospitals and more than 50 clinics, medical centres and consulting rooms across England, Wales and Scotland.It was founded with the acquisition and re-branding of 25 Bupa hospitals in 2007, and floated on the stock market in 2014.

It has come under pressure from investors, led by Harwood Capital Management, which told the Times last September that it felt Spire’s share price “fails to reflect the company’s value, most notably its unencumbered hospital portfolio worth in excess of £1.4 billion, and its occupational health business, where management has an ambition to deliver £40 million per annum of ebitda [earnings before interest, tax, depreciation and amortisation] over the medium term”.Spire owns the Claremont Hospital in Sheffield and has acquired a string of other sites, such as the historic St Anthony’s Hospital in south London from Daughters of the Cross, an order of nuns who had run the hospital for 120 years.The firm has also built two new hospitals, in Manchester and Nottingham.Spire warned in December that annual adjusted core profit would be at the bottom end of its guidance range of £270m to £285m.

While more people have been paying for private treatments out of their own pockets, and Spire also benefits from patients with private health insurance, work it carries out for the NHS has slowed.It said at the time:This has not been sufficient to offset the well-publicised recent slowdown in NHS commissioning activity to the independent sector, due to integrated care board budgetary restrictions.Ryanair would be open to using Elon Musk’s Starlink wifi on its planes in the future, its finance boss has suggested, amid a feud between the US tech billionaire and the boss of the Irish airline.The budget airline would look at “whoever is the best, when the tech and price is right”, Neil Sorahan, chief financial officer, said.It comes after an online spat between Ryanair boss Michael O’Leary and Musk, after O’Leary was asked whether he would follow Lufthansa and British Airways in installing Starlink satellite internet technology on his fleet of 650 aircraft.

The Ryanair chief executive rejected the idea, saying that adding antennas to the jets would result in a “2% fuel drag”, adding an extra $200-250m to its $5bn annual kerosene bill.Musk said the interpretation was “misinformed” in a post on his X platform, triggering a tit-for-tat exchange of insults, with each man calling the other an “idiot”.Sorahan said the spat was “good fun” and had brought more people to the Ryanair website.O’Leary said last week that his quarrel with Musk had boosted bookings between 2-3%.However, Sorahan added that in-flight wifi was still a long way away for Ryanair.

I have been looking at wifi for as long as I have been at Ryanair.There is still a fuel cost that we would have to absorb.Oil prices have slipped after a report that the oil cartel Opec and allies signalled steady output.Oil gave up earlier gains sparked by production disruptions in major US crude-and natural gas producing regions as winter storm Fern struck the US coast.Brent crude futures fell by 0.

3%, or 24 cents, to $65.65 a barrel, after rising to $66.30 a barrel earlier.US West Texas Intermediate crude hit $64.49 a barrel, up 0.

7%.Both benchmarks notched up weekly gains of 2.7% to close on Friday at their highest levels since 14 January.A US military aircraft carrier strike group and other assets are expected to arrive in the Middle East in the coming days.Opec+ delegates said they expect to stick with plans to keep oil production steady next month when they meet on Sunday, as the group grapples with a global surplus and a spate of geopolitical risks, Bloomberg News reported.

Key members led by Saudi Arabia and Russia will hold a monthly video conference to review a decision, first made in November, to freeze output levels during the first quarter, after rapidly ramping up production last year.Bloomberg cited four delegates as saying their expectation is that the policy will remain unchanged, although two added that discussions among members have yet to take place.Canadian prime minister Mark Carney said on Sunday his country has no intention of pursuing a free trade deal with China, in response to Donald Trump’s threat to impose a 100% tariff on goods imported from Canada if the country made a trade deal with Beijing.Carney said Canada’s recent agreement with China merely cuts tariffs on a few sectors that were recently hit with duties.Trump claimed otherwise, posting that “China is successfully and completely taking over the once Great Country of Canada

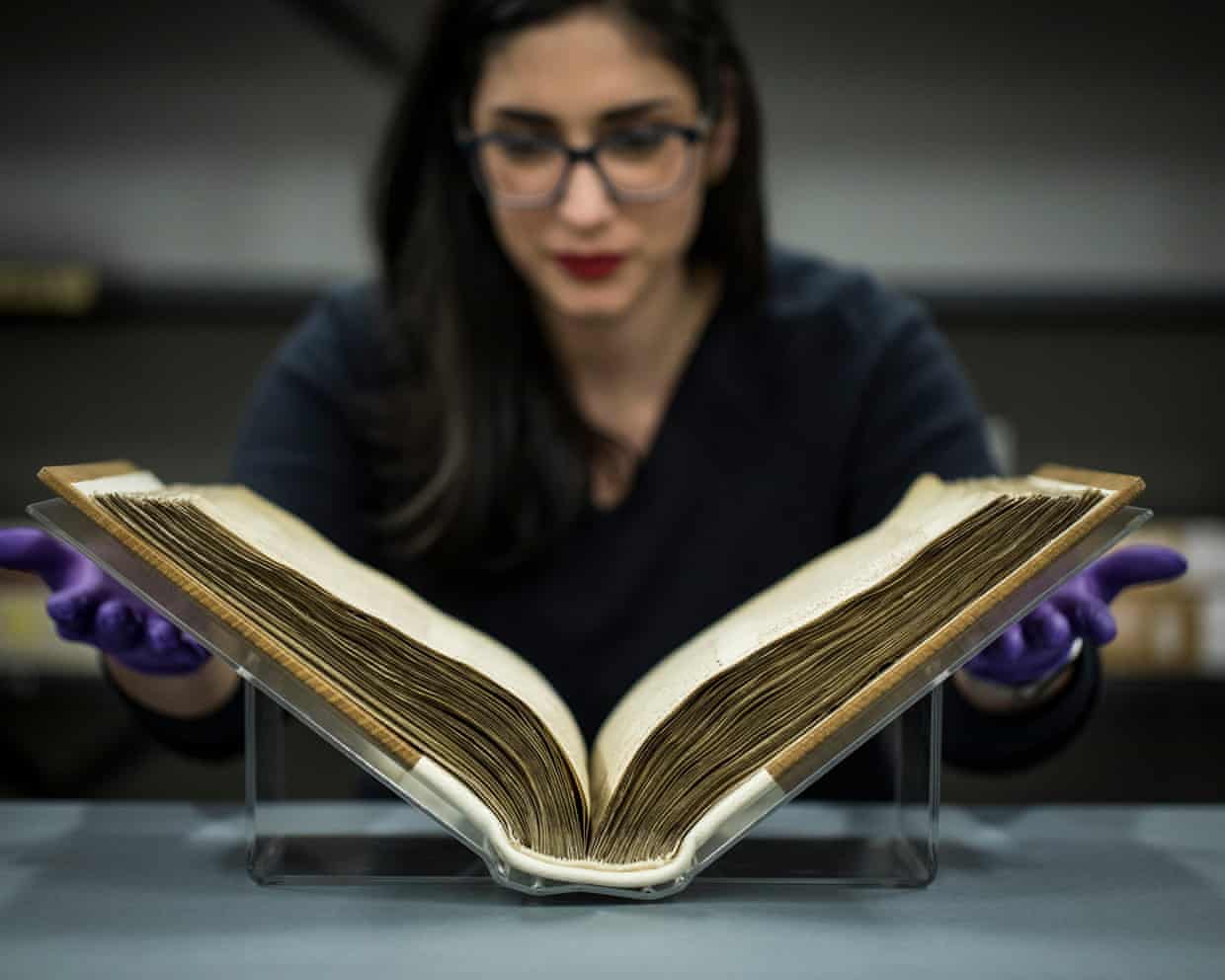

AI systems could use Met Office and National Archives data under UK plans

Met Office data and legal documents from the National Archives could be used by artificial intelligence systems as the UK government pushes ahead with plans to employ nationally owned material in AI tools.The government is providing funds for researchers to test how Met Office content could be used by the technology, such as in helping agencies and councils know when to buy more road grit. Another project will explore whether legal data from the National Archives – the UK’s repository for official documents – could help medium- and small-sized businesses with legal support.The government has also announced plans to license content from national institutions such as the National History Museum and the National Library of Scotland for AI development.Ian Murray, the minister for digital government and data, said the National Archives plan was “what smart use of the public sector” looked like

Sam Altman’s make-or-break year: can the OpenAI CEO cash in his bet on the future?

Sam Altman has claimed over the years that the advancement of AI could solve climate change, cure cancer, create a benevolent superintelligence beyond human comprehension, provide a tutor for every student, take over nearly half of the tasks in the economy and create what he calls “universal extreme wealth”.In order to bring about his utopian future, Altman is demanding enormous resources from the present. As CEO of OpenAI, the world’s most valuable privately owned company, he has in recent months announced plans for $1tn of investment into datacenters and struck multibillion-dollar deals with several chipmakers. If completed, the datacenters are expected to use more power than entire European nations. OpenAI is pushing an aggressive expansion – encroaching on industries like e-commerce, healthcare and entertainment – while increasingly integrating its products into government, universities, and the US military and making a play to turn ChatGPT into the new default homepage for millions

AI needs to augment rather than replace humans or the workplace is doomed | Heather Stewart

“Who wouldn’t want a robot to watch over your kids?” Elon Musk asked Davos delegates last week, as he looked forward with enthusiasm to a world with “more robots than people”.Not me, thanks: children need the human connection – the love – that gives life meaning.As he works towards launching SpaceX on to the stock market, in perhaps the biggest ever such share sale, the world’s richest man has every incentive to talk big.Yet as Musk waxed eccentrically about this robotic utopia, it was a reminder that major decisions about the direction of technological progress are being taken by a small number of very powerful men – and they are mainly men.In the cosy onstage chat, the World Economic Forum’s interim co-chair, Larry Fink, failed to ask Musk about whichever tweak of internal plumbing allowed his Grok chatbot to produce and broadcast what a New York Times investigation estimated was 1

Google AI Overviews cite YouTube more than any medical site for health queries, study suggests

Google’s search feature AI Overviews cites YouTube more than any medical website when answering queries about health conditions, according to research that raises fresh questions about a tool seen by 2 billion people each month.The company has said its AI summaries, which appear at the top of search results and use generative AI to answer questions from users, are “reliable” and cite reputable medical sources such as the Centers for Disease Control and Prevention and the Mayo Clinic.However, a study that analysed responses to more than 50,000 health queries, captured using Google searches from Berlin, found the top cited source was YouTube. The video-sharing platform is the world’s second most visited website, after Google itself, and is owned by Google.Researchers at SE Ranking, a search engine optimisation platform, found YouTube made up 4

How the ‘confident authority’ of Google AI Overviews is putting public health at risk

Do I have the flu or Covid? Why do I wake up feeling tired? What is causing the pain in my chest? For more than two decades, typing medical questions into the world’s most popular search engine has served up a list of links to websites with the answers. Google those health queries today and the response will likely be written by artificial intelligence.Sundar Pichai, Google’s chief executive, first set out the company’s plans to enmesh AI into its search engine at its annual conference in Mountain View, California, in May 2024. Starting that month, he said, US users would see a new feature, AI Overviews, which would provide information summaries above traditional search results. The change marked the biggest shake-up of Google’s core product in a quarter of a century

Latest ChatGPT model uses Elon Musk’s Grokipedia as source, tests reveal

The latest model of ChatGPT has begun to cite Elon Musk’s Grokipedia as a source on a wide range of queries, including on Iranian conglomerates and Holocaust deniers, raising concerns about misinformation on the platform.In tests done by the Guardian, GPT-5.2 cited Grokipedia nine times in response to more than a dozen different questions. These included queries on political structures in Iran, such as salaries of the Basij paramilitary force and the ownership of the Mostazafan Foundation, and questions on the biography of Sir Richard Evans, a British historian and expert witness against Holocaust denier David Irving in his libel trial.Grokipedia, launched in October, is an AI-generated online encyclopedia that aims to compete with Wikipedia, and which has been criticised for propagating rightwing narratives on topics including gay marriage and the 6 January insurrection in the US

‘They’re trying to milk us’: leaseholders tell of soaring charges amid Labour reform delays

Teachers in England driving homeless pupils to school and washing clothes, research shows

High on ... mustard? Cannabis industry teams up with chefs in push to stand out

Reform UK’s private health insurance plan would cost £1.7bn, Streeting to say

The ADHD grey zone: why patients are stuck between private diagnosis and NHS care

Seeing red over the Greens’ advocacy of ‘buy the supply’ housing policy | Letters