Brent crude tops $70 per barrel on Iran concern; gold and silver tumble from record highs – as it happened

Britain’s main stock market index has just hit a new record high, lifted by shares in oil companies and miners.The FTSE 100 shares index has just touched a new peak of 12,259 points, two points above the previous record high hit nearly two weeks ago.Copper producer Antofagasta is leading the charge; it’s up 11% today, as the copper prices has hit new record levels over $14,000/tonne (see earlier post), and after reporting a 9% increase in quarterly copper production earlier today.The jump in the oil price today has lifted Shell (+2.1%) and BP (+1.

9%); they’re among the larger companies on the Footsie, so are pushing the index higher.Other mining stocks are also rallying, as AJ Bell investment director Russ Mould explained this morning:“The FTSE 100 got off to a strong start as gold moved through $5,500 and oil ticked up amid mounting tensions between the US and Iran,“The mining sector did much of the heavy lifting for the index, buoyed by a positive production update from Glencore and the impact of precious metals strength on Fresnillo and Endeavour.BP and Shell were lifted by a stronger crude oil price.“Wall Street yesterday greeted the latest Federal Reserve decision with a shrug as interest rates were kept on hold – with much of the action coming after the market close as investors reacted to results from Tesla, Microsoft and Meta.Asian markets were more downbeat as the possibility of conflict in the Middle East was weighed up.

”And finally, the UK stock market has slipped away from today’s record high.The FTSE 100 has closed 17 points higher, or +0.17%, at 10,171 points, having scaled a new peak of 10,277 earlier today.The index slipped back as miners, and precious metal produceds, slipped as the gold, silver and copper prices dropped back dramatically from their latest highs.Gold is now down 2% today, while silver is 0.

8% lower.Oil is still higher, though – Brent crude is 3.3% up today at $70.66 a barrel, on concerns that the US might attack Iran.Iran’s foreign minister, Abbas Araghchi, will travel to Ankara for talks aimed at preventing a US attack, as Turkish diplomats seek to convince Tehran it must offer concessions over its nuclear programme if it is to avert a potentially devastating conflict.

Swiss bank UBS has today increased its gold price target to $6,200 per ounce for March, June and September 2026, compared with a prior forecast of $5,000.However, the bank projected a modest decline to $5,900 per ounce by end-2026, Reuters reports.David Meger, director of metals trading at High Ridge Futures, says:“We are seeing a dramatic sell-off after precious metals made new recent all-time highs.”The bitcoin price is also sliding, as investors pile out of risky assets.It’s down 5% today at $84,630.

The slump in the gold and silver price is dragging the FTSE 100 away from its record high.Precious metals producer Fresnillo, which had been among the top risers, is now one of the top fallers, down 6.7%.Ouch! The gold and silver prices are now turning south.Having hit record highs this morning, precious metal prices are now lurching lower.

Gold, which almost touchde $5,600 an ounce this morning, is now down 4.4% today at $5,164/oz.Silver is down over 5% too at $109/oz, having touched $120/oz earlier.These sudden moves follow a dramatic rise in precious metals prices during January, as speculators have piled into gold and silver.Bizarre vol pic.

twitter,com/XBmnhxVJN2The dollar, meanwhile, has slightly strengthened,Neil Wilson, Saxo UK investor strategist says:In the last few minutes gold and silver prices cratered seemingly under the weight of their own excess after ballooning to record highs,Copper too took a nosedive,We are seeing extreme volatility in metals and FX markets which is leading to serious dislocations and may well gnaw away at equity market sentiment.

SPX trades below 6,900 at last look with Microsoft’s 11% decline causing huge damage, while Meta steadied things a bit at +8% post earnings.The sharp reversal in metals took the shine off the FTSE 100’s rally, with the index dropping sharply in tandem with the move in metals.Earlier The FTSE 100 hit a fresh record high as mining stocks were propelled higher by what can only be called metal mania.Copper prices surged 10% to new record highs, silver hit $121 and gold attacked $5,600.Off the back of this rapid rise copper miner Antofagasta had led the charge on the blue chip index, with silver and gold plays Fresnillo and Endeavour Mining also chalking up sizeable gains on the day.

Oil majors Shell and BP also bounced nicely as crude oil prices surged 5% as fears about military intervention in Iran leading to disruption to oil supplies etc.But things are looking pretty messy out there regards metals markets.US factory orders rose more than expected in November, new data shows.New orders for manufactured goods increased by $16.2bn in November, a rise of 2.

7%, to $621,6bn, beating forecasts of a 1,6% rise,Oil futures are extending their gains,Brent crude is now up almost 5% at $71.

60 per barrel, the highest since 1 August 20205, amid rising concerns about a possible US military attack on Iran.Over on Wall Street, Microsoft’s shares have opened with a bump after its latest results disappointed investors.Microsoft reported slowing growth in its key cloud computing business last night, which has taken the shine off forecast-beating revenue and profits for the last quarter.The company also reported an increase in capital expenditure, which puts the spotlight on the high costs of AI rollout.As my colleague Ed Helmore reported:Microsoft reported revenues of $81.

27bn against expectations of $80.32bn, and improved from the 12.3% increase it recorded in the same quarter last year.Earnings came in at $4.14 per share against expectations of $3.

92.“We are only at the beginning phases of AI diffusion, and already Microsoft has built an AI business that is larger than some of our biggest franchises,” said the company’s CEO, Satya Nadella.“We are pushing the frontier across our entire AI stack to drive new value for our customers and partners.”Investors are pushing Microsoft’s shares down, though – they’re off 10% at $433 in early trading, down from $481 last night.They’re on track for their biggest one-day drop since March 2020, when the Covid-19 pandemic rocked the markets, Reuters reports.

This also knocks around $350bn off Microsoft’s valuation, as the company was worth around $3.58tn yesterday.On Iran, PVM analyst John Evans says:“The immediate (market) concern...

is the collateral damage done if Iran takes a swing at its neighbours or possibly even more tellingly, it closes the Strait of Hormuz to the 20 million barrels per day of oil that navigates it.”Brent crude has now climbed above $71 per barrel, up 4% today, to its highest level since 1 August last year.Gold producers are also among the top risers on the FTSE 100, points out Fiona Cincotta, senior market analyst at City Index.“The FTSE is rising, outperforming its European peers, boosted by miners and oil majors, as rising commodity prices and higher earnings lift spirits.With gold trading at fresh record highs of nearly 5,600, precious metal miners are outperforming.

Endeavour trades over 5% higher, whilst Fresnillo is up 2.8%.Gold has risen to record levels, driven by a weaker U.S.dollar, escalating geopolitical tensions, and erratic U.

S.policy, which have spurred safe-haven flows.Meanwhile, oil prices also jumped to 4-month highs as President Trump warned that time is running out for Iran to make a nuclear deal.Concerns that regional conflict could disrupt supply from OPEC’s fourth-largest member have lifted the risk premium on oil.Oil majors are tracking oil prices higher.

Corporate earnings have also come through thick and fast,Antofagasta is up over 6% after the mining giant reported a modest 1,6% decline in its copper production but maintained its 2026 outlook as copper futures reached $13,934 per metric tonne,Meanwhile, EasyJet, the budget airline, was also flying 2,6% higher after reiterating full-year guidance.

Gains in the FTSE could be limited by the strength of the pound, which trades at multi-year highs above 1.38 on U.S.dollar weakness.A strong pound results in a less favourable exchange rate for multinationals, which account for 80% of the FTSE.

”

UK’s first rapid-charging battery train ready for boarding this weekend

The UK’s first superfast-charging train running only on battery power will come into passenger service this weekend – operating a five-mile return route in west London.Great Western Railway (GWR) will send the converted London Underground train out from 5.30am to cover the full Saturday timetable on the West Ealing to Greenford branch line, four stops and 12 minutes each way, and now carrying up to 273 passengers, should its celebrity stoke up the demand.The battery will recharge in just three and a half minutes back at West Ealing station between trips, using a 2,000kW charger connected to a few metres of rail that only becomes live when the train stops directly overhead.There are hopes within government and industry that this technology could one day replace diesel trains on routes that have proved difficult or expensive to electrify with overhead wires, as the decarbonisation of rail continues

AstraZeneca to invest £11bn in China after rowing back on UK expansion

Britain’s biggest drugmaker AstraZeneca is to invest $15bn (£11bn) in China, it announced during Keir Starmer’s visit to the country, just months after cooling on plans for expansion in the UK.The Cambridge-based company said it would spend the money by 2030 to expand medicines manufacturing and research and development in China, where it already has a big presence. It includes the construction of a $2.5bn research hub in Beijing, which was announced last March.During the first visit by a British prime minister to China in eight years, Starmer said the move would help AstraZeneca to grow into a bigger business, thereby supporting thousands of UK jobs

What is behind the extraordinary rise in investment into silver and gold?

Last year’s extraordinary run in precious metals has only intensified in 2026, as Donald Trump has continued to rip up the rules of the global economy.Gold has been on a tear since last summer, repeatedly breaking records. It has risen by more than a quarter this month and hit a new high of just under $5,595 (£4,060) an ounce on Thursday.It dropped sharply later in the day to $5,250 (£3,810) as speculation swirled about possible US action in Iran, but that remains almost double the price as when Donald Trump’s second term in the White House began a year ago.Silver, meanwhile, was trading below $30 (£22) an ounce when the president prepared to announce his “liberation day” tariffs last April, but has since almost quadrupled in price, to more than $118 (£86) an ounce, with the most rapid run-up coming in the past month

‘Generational shift’ towards sparkling wine behind strong sales, says UK’s Chapel Down

Chapel Down has credited a “generational shift” towards sparkling wine for strong sales growth last year.The Kent-based wine maker, which listed on the Aim junior stock market in 2023, said sales rose by a better-than-expected 19% to £19.4m in the year to 31 December, led by a 38% increase in retail sales as well as strong exports.James Pennefather, the chief executive of Chapel Down, said: “In spite of continued economic pressures, consumers are continuing to find reasons to celebrate, with over 1m bottles of Chapel Down traditional method sparkling wines dispatched for the first time during 2025.“We are seeing a generational shift into English sparkling wine as millennials, who prefer a lighter, fresher, crisper style of wines, are increasingly adopting the category

Brent crude tops $70 per barrel on Iran concern; gold and silver tumble from record highs – as it happened

Britain’s main stock market index has just hit a new record high, lifted by shares in oil companies and miners.The FTSE 100 shares index has just touched a new peak of 12,259 points, two points above the previous record high hit nearly two weeks ago.Copper producer Antofagasta is leading the charge; it’s up 11% today, as the copper prices has hit new record levels over $14,000/tonne (see earlier post), and after reporting a 9% increase in quarterly copper production earlier today.The jump in the oil price today has lifted Shell (+2.1%) and BP (+1

Rate-rigging convictions of five bankers referred to UK appeals court

Five more former bankers convicted of rigging interest rates will be given a fresh chance to clear their names, after the supreme court overturned a decade-old ruling against the trader Tom Hayes last year.The Criminal Cases Review Commission (CCRC) said on Thursday that it had referred the ex-City traders’ convictions back to the court of appeal. The men were jailed between 2016 and 2019 on charges of manipulating the euro interbank offered rate, Euribor, or the now defunct London interbank offered rate, Libor.The Euribor and Libor rates affected the value of ordinary people’s pensions, mortgages and savings, as well as hundreds of trillions of pounds and euros worth of financial products around the world. Nine bankers accused of rigging the rates were given fraud convictions, including Hayes

‘It turned out I had a brain tumour …’ Six standup comics on what spurred them to get on stage

Claire Denis’s Stars at Noon: who knew the end of the world could feel so romantic?

Eric Huntley obituary

‘We get a lot of requests for it to be used in sex scenes’: how Goldfrapp made Ooh La La

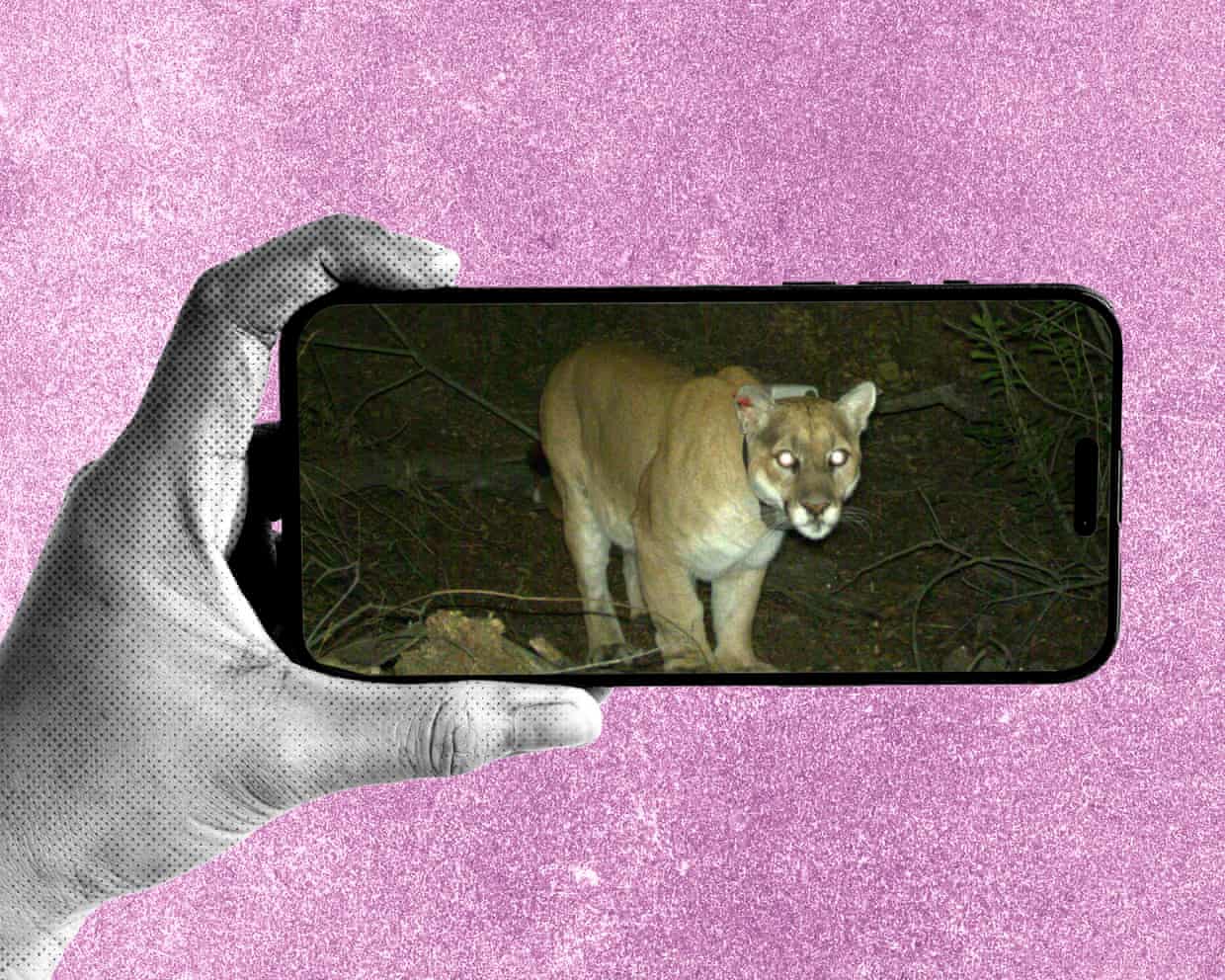

Blurry rats and coyotes with mange: the oddly thrilling subreddit dedicated to identifying wildlife

‘She was a bitch in the best possible way’: the life and mysterious death of drag queen Heklina