What is behind the extraordinary rise in investment into silver and gold?

Last year’s extraordinary run in precious metals has only intensified in 2026, as Donald Trump has continued to rip up the rules of the global economy.Gold has been on a tear since last summer, repeatedly breaking records.It has risen by more than a quarter this month and hit a new high of just under $5,595 (£4,060) an ounce on Thursday.It dropped sharply later in the day to $5,250 (£3,810) as speculation swirled about possible US action in Iran, but that remains almost double the price as when Donald Trump’s second term in the White House began a year ago.Silver, meanwhile, was trading below $30 (£22) an ounce when the president prepared to announce his “liberation day” tariffs last April, but has since almost quadrupled in price, to more than $118 (£86) an ounce, with the most rapid run-up coming in the past month.

Giuseppe Sersale, a strategist at Italy’s Anthilia, said the market had “all the hallmarks of a mania”, describing recent price moves as “parabolic”.Gold has always been the ultimate “safe haven” asset, acting as a store of value in the face of inflation risks or broader economic and geopolitical uncertainty, all of which Trump has provided in spades.The administration’s aggressive policies – including punitive tariffs on trading partners, threats to annex or bomb other countries such as Greenland and Iran and increasing pressure on the Federal Reserve to make it cut interest rates, including launching a criminal case against the central bank’s chair, Jerome Powell – have sent investors scurrying for the precious metal.Trump resumed his onslaught on Powell after the Fed’s latest decision to hold rates on Wednesday, posting on social media: “Even this moron admits that inflation is no longer a problem.” However, analysts warn tampering with the Fed’s independence risks further stoking price rises.

Daniela Hathorn, a senior market analyst at Capital.com, summed the situation up: “Gold and silver are reflecting more than short-term market stress; they are signalling a re-pricing of trust.Trust in currencies, in institutions, and in the stability of the post-cold war economic order.”The idea here is that even if US inflation were to get out of control, undermining the value of the dollar (an idea known as “debasement”), gold would hold its value.However, the same argument applies to cryptocurrencies such as bitcoin, which have not been subject to the same buying spree as precious metals.

As the World Gold Council (WGC) pointed out in its quarterly data release this week, another driver has been central banks adding to their reserves.This trend appears to represent a modest diversification away from the standard reserve asset of treasuries, as US government bonds are known, as Trump’s chaotic approach raises anxiety about the idea of holding billions of dollars in IOUs from Washington.However, WGC’s analysis also showed that while “central bank buying remained a prominent and additive factor” to global demand, such purchases were actually 21% lower in 2025 than a year earlier, at 863 tonnes.Instead, as in many booms and bubbles, a significant part of the recent uptick appears to represent retail investors – either buying into the “safe haven” trade amid catastrophic headlines or just seeing the price spike and piling in.Louise Street, a senior market analyst at WGC, said that last year “consumers and investors alike bought and held gold in an environment where economic and geopolitical risks have become the new normal”, adding: “Investment demand stole the show as investors raced to access gold through all available routes.

”In the UK, the Royal Mint website urges retail consumers to “take the first step towards fortifying your financial future with the timeless allure of gold”.The silver price appears to have been caught up in the same speculative frenzy as gold in recent weeks – perhaps because its lower price makes it more approachable as an asset class.Concerns about Fed independence and the broader stability of US policymaking are not just fuelling precious metals, but also seem to have been putting downward pressure on the dollar, which has been on the slide in the past week or so.The euro broke through $1.20 (£0.

90) on Tuesday before falling back modestly, while £1 was worth $1.38 on Thursday, up almost five cents in a fortnight.As Eszter Gárgyán of UniCredit put it in a research note: “The dollar has come under renewed depreciation pressure since mid-January, as geopolitical risks, rising trade tensions and concerns regarding Fed independence have resurfaced.”The Trump administration has sometimes seemed conflicted about whether it wants to see a weaker dollar – to aid the president’s endeavour of narrowing the trade deficit – or a stronger currency, as a symbol of economic power.The greenback fell to a four-year low against a basket of other currencies on Wednesday, after the president shrugged off the currency’s weakness, saying: “No, I think it’s great.

”But his Treasury secretary, Scott Bessent, asked later about rumours there could be coordinated central bank action to prop up the wobbling Japanese yen, insisted: “We don’t comment, other than to say we have a strong dollar policy.”Rapid market moves in Japan, with government bond yields up sharply as investors bet on a spending splurge after the upcoming snap election, are complicating the picture.Far from tanking, US stocks have performed strongly over the past 12 months, driven disproportionately by the “magnificent seven” tech companies, whose revenues have been soaring on the back of the AI boom.Including dividends, the S&P 500 was up 17.9% in 2025.

While many analysts, and a fair few tech bosses, fret that current elevated share prices may be a bubble, investors appear to believe that, as Chuck Prince, then chief executive of ill-fated bank Citigroup put it back in 2007, “as long as the music is playing, you’ve got to get up and dance”.And they are likely to have been buoyed up by hopes of fresh interest rate cuts in the coming months, if US inflation remains under control.Similarly, unlike a year ago when there was a brief sell-off in treasuries, the “sell America” narrative does not seem to have extended to bond markets – yet.

UK’s first rapid-charging battery train ready for boarding this weekend

The UK’s first superfast-charging train running only on battery power will come into passenger service this weekend – operating a five-mile return route in west London.Great Western Railway (GWR) will send the converted London Underground train out from 5.30am to cover the full Saturday timetable on the West Ealing to Greenford branch line, four stops and 12 minutes each way, and now carrying up to 273 passengers, should its celebrity stoke up the demand.The battery will recharge in just three and a half minutes back at West Ealing station between trips, using a 2,000kW charger connected to a few metres of rail that only becomes live when the train stops directly overhead.There are hopes within government and industry that this technology could one day replace diesel trains on routes that have proved difficult or expensive to electrify with overhead wires, as the decarbonisation of rail continues

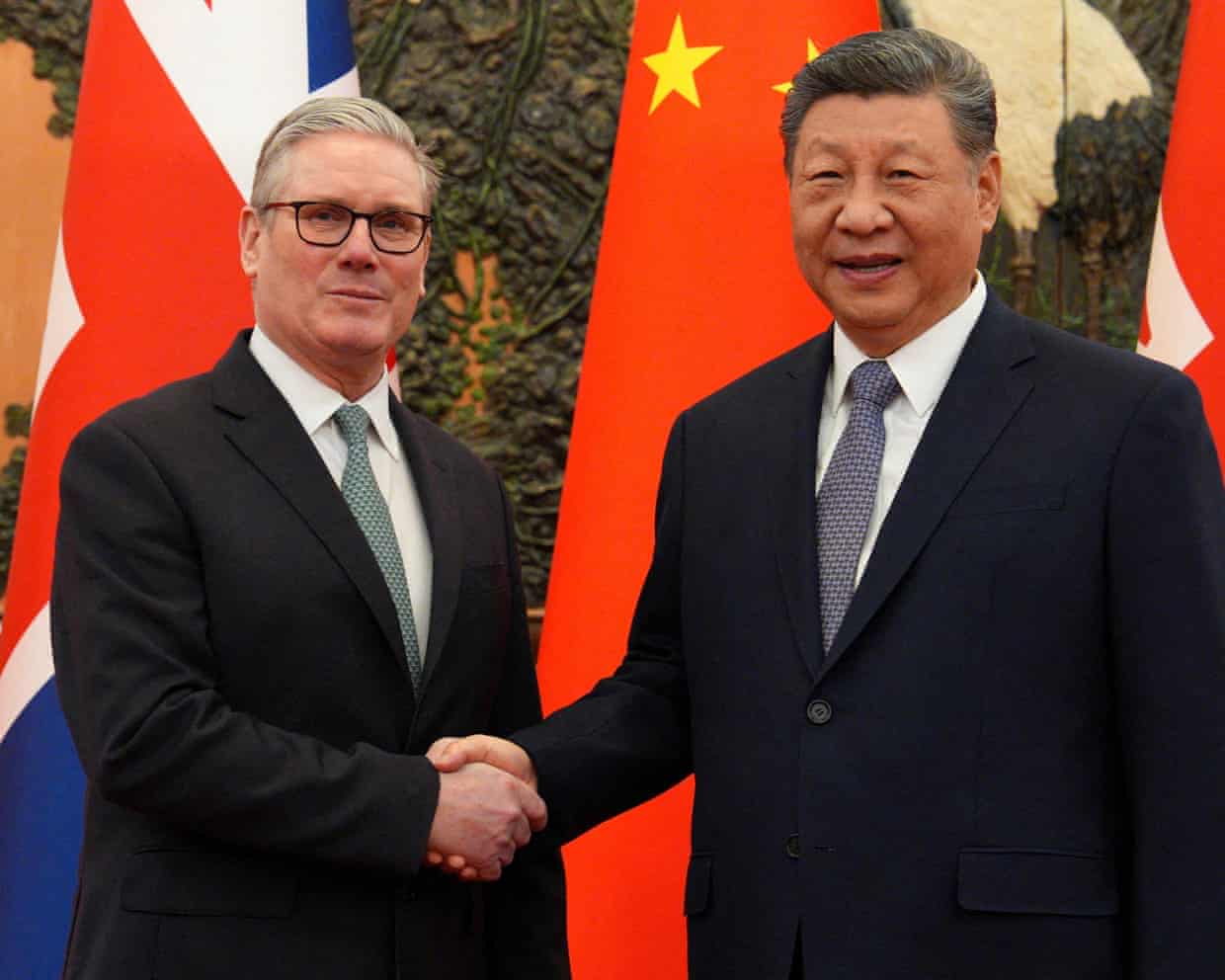

AstraZeneca to invest £11bn in China after rowing back on UK expansion

Britain’s biggest drugmaker AstraZeneca is to invest $15bn (£11bn) in China, it announced during Keir Starmer’s visit to the country, just months after cooling on plans for expansion in the UK.The Cambridge-based company said it would spend the money by 2030 to expand medicines manufacturing and research and development in China, where it already has a big presence. It includes the construction of a $2.5bn research hub in Beijing, which was announced last March.During the first visit by a British prime minister to China in eight years, Starmer said the move would help AstraZeneca to grow into a bigger business, thereby supporting thousands of UK jobs

What is behind the extraordinary rise in investment into silver and gold?

Last year’s extraordinary run in precious metals has only intensified in 2026, as Donald Trump has continued to rip up the rules of the global economy.Gold has been on a tear since last summer, repeatedly breaking records. It has risen by more than a quarter this month and hit a new high of just under $5,595 (£4,060) an ounce on Thursday.It dropped sharply later in the day to $5,250 (£3,810) as speculation swirled about possible US action in Iran, but that remains almost double the price as when Donald Trump’s second term in the White House began a year ago.Silver, meanwhile, was trading below $30 (£22) an ounce when the president prepared to announce his “liberation day” tariffs last April, but has since almost quadrupled in price, to more than $118 (£86) an ounce, with the most rapid run-up coming in the past month

‘Generational shift’ towards sparkling wine behind strong sales, says UK’s Chapel Down

Chapel Down has credited a “generational shift” towards sparkling wine for strong sales growth last year.The Kent-based wine maker, which listed on the Aim junior stock market in 2023, said sales rose by a better-than-expected 19% to £19.4m in the year to 31 December, led by a 38% increase in retail sales as well as strong exports.James Pennefather, the chief executive of Chapel Down, said: “In spite of continued economic pressures, consumers are continuing to find reasons to celebrate, with over 1m bottles of Chapel Down traditional method sparkling wines dispatched for the first time during 2025.“We are seeing a generational shift into English sparkling wine as millennials, who prefer a lighter, fresher, crisper style of wines, are increasingly adopting the category

Brent crude tops $70 per barrel on Iran concern; gold and silver tumble from record highs – as it happened

Britain’s main stock market index has just hit a new record high, lifted by shares in oil companies and miners.The FTSE 100 shares index has just touched a new peak of 12,259 points, two points above the previous record high hit nearly two weeks ago.Copper producer Antofagasta is leading the charge; it’s up 11% today, as the copper prices has hit new record levels over $14,000/tonne (see earlier post), and after reporting a 9% increase in quarterly copper production earlier today.The jump in the oil price today has lifted Shell (+2.1%) and BP (+1

Rate-rigging convictions of five bankers referred to UK appeals court

Five more former bankers convicted of rigging interest rates will be given a fresh chance to clear their names, after the supreme court overturned a decade-old ruling against the trader Tom Hayes last year.The Criminal Cases Review Commission (CCRC) said on Thursday that it had referred the ex-City traders’ convictions back to the court of appeal. The men were jailed between 2016 and 2019 on charges of manipulating the euro interbank offered rate, Euribor, or the now defunct London interbank offered rate, Libor.The Euribor and Libor rates affected the value of ordinary people’s pensions, mortgages and savings, as well as hundreds of trillions of pounds and euros worth of financial products around the world. Nine bankers accused of rigging the rates were given fraud convictions, including Hayes

UK unlikely to join a US attack on Iran – but may help Gulf states if Tehran retaliates

What agreements have been made during Starmer’s trip to China?

Xi didn’t really see a point to Kier’s visit – but hey, let a hundred flowers bloom | John Crace

Starmer announces visa-free travel to China after talks with Xi in Beijing – UK politics live

Shamima Begum is a blot on Sajid Javid’s copybook | Brief letters

Nigel Farage meets UAE ministers and drums up donations on Dubai trip