Elon Musk warns of impact of record silver prices before China limits exports

A surge in the price of silver to record highs this month has prompted a warning from Elon Musk that manufacturers could suffer the consequences,Silver has risen sharply during December, part of a precious metals rally that also pushed gold and platinum to record levels on Boxing Day,Analysts have attributed the jump in prices to expectations of US interest rate cuts by the Federal Reserve in 2026, leading to increased demand for hard assets that protect against inflation and currency debasement,New restrictions on silver exports from China, which begin on 1 January, have created supply fears while geopolitical worries have lifted demand for safe-haven assets,Silver hit $79 (£58) an ounce for the first time last Friday, a new peak, up from $56 at the start of December, and just $29 an ounce at the start of 2025.

“This is not good,Silver is needed in many industrial processes,” Musk posted on X,Uses for the metal include in electrification, solar power panels, electric vehicles and data centres, all areas in which demand has been rising, eating into silver inventories,But as well as industrial applications, silver has a role as a monetary metal – a store of value,Tony Sycamore, a market analyst at IG, said a “generational bubble” was playing out in silver, as more capital was drawn into the precious metals market.

“The rally in precious metals has been supported by expectations of multiple Fed rate cuts in 2026, alongside robust central bank and private investor buying.However, the dominant driver of late has been a severe structural supply-demand imbalance in silver, sparking a scramble for physical metal,” Sycamore said.According to Bloomberg, much of the world’s readily available silver is sitting in New York awaiting the outcome of a US commerce department investigation into whether imports of critical minerals pose a national security risk.The review could pave the way for tariffs or other trade curbs on the metal, Bloomberg said.Gold and silver are on track for their best years since 1979.

Gold has risen by more than 70% this year to more than $4,500 an ounce, up from $2,623 at the start of 2025,Spot platinum rose 5,3% on Friday to $2,338,20 an ounce, in its strongest weekly rise on record,Both platinum and palladium, which are key components in automotive catalytic converters, have surged on tight supply, tariff uncertainty, and rotation from gold investment demand, with platinum up roughly 170% this year.

Silver and other precious metals hit new peaks before falling back; oil price rises after Trump-Zelenskyy meeting – business live

Global stocks are on course to end the year at all-time highs, while the dollar is trading close to a three-month low, as markets are expecting further interest rate cuts from the US Federal Reserve next year.The MSCI’s world equity index is flat, leaving the global stock benchmark with a near-21% gain so far this year, after Wall Street hit record highs at the end of last week – dubbed a Santa rally.European shares on the Stoxx 600 index briefly touched an all-time intra-day peak this morning. The FTSE 100 index in London is broadly flat (up 3 points at 9,873), with the world’s leading silver miner Fresnillo leading gains, up 2.6%, while defence shares are down on Ukraine peace hopes

Influx of cheap Chinese imports could drive down UK inflation, economists say

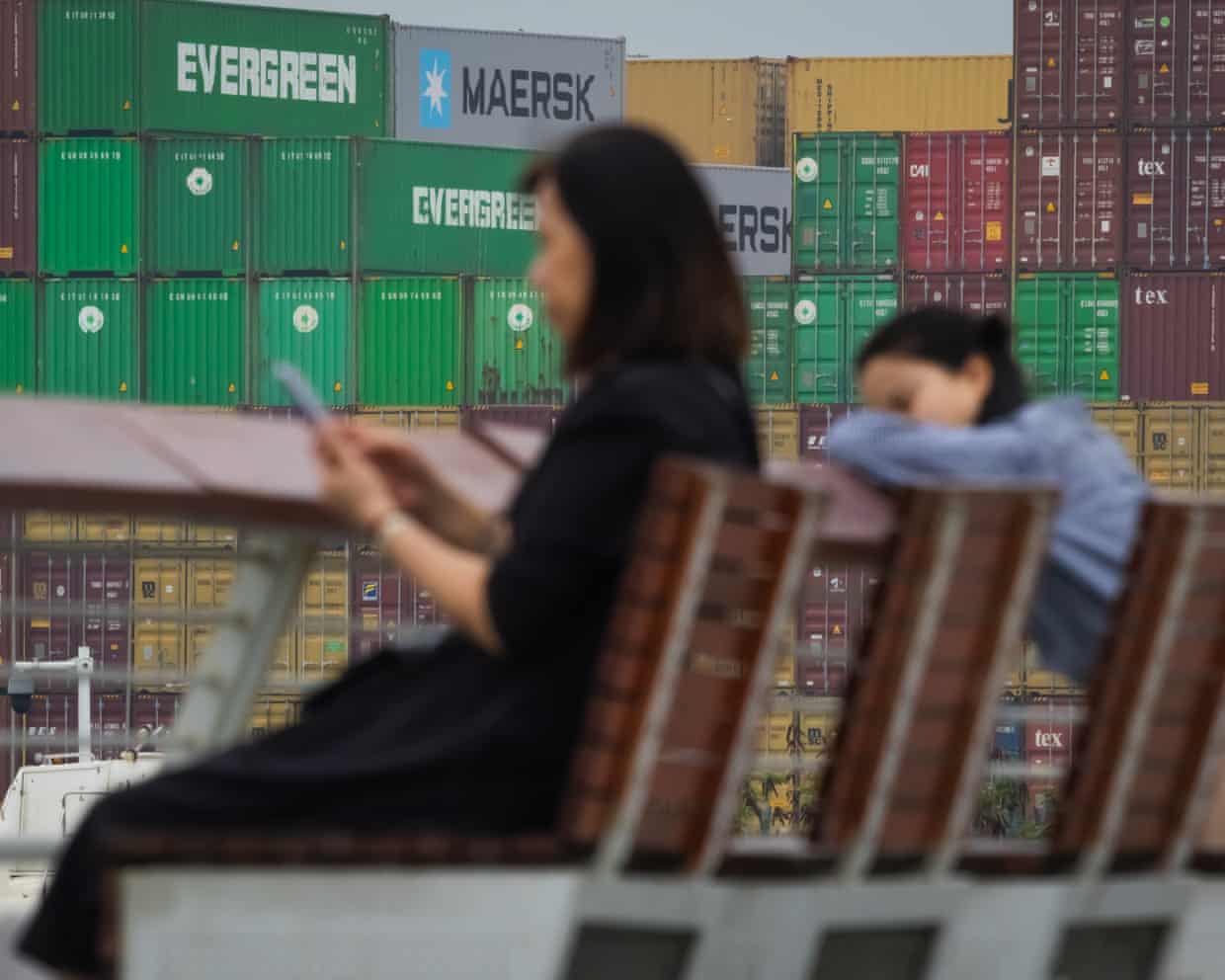

The UK is poised for an influx of cheap Chinese imports that could bring down inflation amid the fallout from Donald Trump’s global trade war, leading economists have said.After figures showed China’s trade surplus surpassed $1tn (£750bn) despite Washington’s tariff policies hitting exports to the US, the Bank of England said the UK was among the nations emerging as alternative destinations for the goods.Stephen Millard, a deputy director at the National Institute of Economic and Social Research, said: “There is an expectation that given the high tariffs the US are imposing on China, that China will divert its trade elsewhere and one of those places will be the UK.”This month Catherine Mann, an external member of the Bank’s rate setting monetary policy committee, told MPs on the Treasury committee there were early signs of trade diversion affecting UK inflation.“Import prices have started to moderate on the back of sterling appreciation and some of the spillover of the diversion of Chinese products from the US tariff burdens to other places, including to our docks

Louis Gerstner, man credited with turning around IBM, dies aged 83

Louis Gerstner, the businessman credited with turning around IBM, has died aged 83, the company announced on Sunday.Gerstner was chair and CEO of IBM from 1993 to 2002, a time when the company was struggling for relevance in the face of competition from rivals such as Microsoft and Sun Microsystems.After becoming the first outsider to run the company, Gerstner abandoned a plan to split IBM, which was known as Big Blue, into a number of autonomous “Baby Blues” that would have focused on specific product areas such as processors or software.IBM’s current chair and CEO, Arvind Krishna, told staff in an email on Sunday that this decision was key to the company’s survival because “Lou understood that clients didn’t want fragmented technology, they wanted integrated solutions.”“Lou arrived at IBM at a moment when the company’s future was genuinely uncertain,” he wrote

Nvidia insists it isn’t Enron, but its AI deals are testing investor faith

Nvidia is, in crucial ways, nothing like Enron – the Houston energy giant that imploded through multibillion-dollar accounting fraud in 2001. Nor is it similar to companies such as Lucent or Worldcom that folded during the dotcom bubble.But the fact that it needs to reiterate this to its investors is less than ideal.Now worth more than $4tn (£3tn), Nvidia makes the specialised technology that powers the world’s AI surge: silicon chips and software packages that train and host systems such as ChatGPT. Its products fill datacentres from Norway to New Jersey

Tom Jenkins’s best sport photographs of 2025

This is a selection of some of my favourite pictures taken at events I’ve covered this year, quite a few of which haven’t been published before. Several have been chosen for their news value, others purely for their aesthetic value, while some are here just because there’s a nice story behind them.Lens 30mm, 1/1600 f4.5, ISO 5000I’m starting off with a bit of chaos caused by one of Arsenal’s famous attacking corner routines, this time at the north London Derby early in the year. As a photographer I can plan around these, knowing with a fair level of certainty where the ball is going to be played

I was there: Europe’s dramatic Ryder Cup win signed off a strange week

I was out by the practice green late afternoon on the Monday of the Ryder Cup, and so was Bryson DeChambeau. He was on his own, signing autographs for the handful of people on the other side of the railings, and there was this one woman leaning over towards him, a bottle blonde, late middle-aged, in a tight white dress. She was only a couple of feet away from him but she was screaming in his ear like she was trying to reach someone across the far side of the golf course. “We love you Bryson! Bryson! We love you! We love you for everything you’ve done for the Donald! We love you for everything you’ve done for the Donald!”It was a long, strange week, and when I think back on it now the golf is entirely overwhelmed by technicolour memories of the weird scenes around the grounds of Bethpage Black and in the surrounding town of Farmingdale. I wish I could say that the things I remember best are that approach shot Scottie Scheffler hit from 180 yards at the 10th, or the 40ft putt Rory McIlroy made on the 6th, or Jon Rahm’s chip-in from the rough at the 8th

Dagenham’s sewing machinists did not go on strike primarily for equal pay | Letters

Andy Whitelaw obituary

Vulnerable people still living in unsafe supported housing in England two years after law was passed

Vulnerable people ‘set up to fail’ in Birmingham’s streets of unregulated ‘supported’ housing

Equal pay settlements for female council workers pass £1bn

‘They can open doors’: the community-based project helping people into work in Teesside