March cut to UK interest rates more likely after inflation drops to 10-month low; London house prices fall – as it happened

Many economists are predicting the Bank of England will cut interest rates in March, after seeing inflation fall to 3% this morning.The money markets now indicate there’s an 86% chance of a rate cut in March (taking Bank rate down from 3.75% to 3.5%), at next month’s meeting.That’s up from 77% last night, and 65% a week ago.

Yael Selfin, chief economist at KPMG UK, says the fall in inflation in January “paves the path for a March interest rate cut”.“Today’s inflation data will likely prompt the Bank of England to lower interest rates next month.The MPC will welcome the broad-based fall in inflation, with both headline and underlying measures of inflation easing.Given the favourable inflation outlook, the Bank is expected to cut interest rates three times this year, leaving interest rates at 3% by the end of 2026.“Headline inflation has gradually eased since last summer and is expected to fall further as food and energy prices drop.

The combined impact of the government’s energy bill package and the fall in wholesale gas prices could see household energy bills decrease by around 7% from April,Forward-looking data also points to food prices softening over the coming months, as recent declines in global food prices are passed on to households, with the recent adverse weather episodes across Europe not yet making their mark,Rob Morgan, chief investment analyst at wealth manager Charles Stanley, predicts at least two interest rate cuts this year:Another reduction as soon as the March meeting is now firmly on the table, and that’s unlikely to be the end of the matter with one or two further cuts likely as the year progresses,The Bank’s latest decision highlights just how close the committee already is to moving,The MPC voted 5-4 to hold Bank Rate at 3.

75%, far tighter than the widely expected 7–2 split.Notably, long‑time hawk Catherine Mann signalled her position is shifting, acknowledging that new analysis has “moved the appropriate time for a cut closer.” With Governor Bailey’s vote pivotal and Mann softening, the MPC’s balance is clearly tilting toward easing.The Bank’s updated projections reinforce that shift.It now expects CPI to fall to 2.

1% by the second quarter of 2026, down from 2.8% in the previous forecast, driven by lower energy costs and fiscal measures from the Autumn Budget.More strikingly, inflation is projected to dip below target to 1.7% next year and to remain subdued through 2028 – a sharp departure from earlier forecasts that had inflation above target into the 2030s.TUC general secretary Paul Nowak is urging the Bank to act fast:“Inflation easing is welcome news for working people.

“And it’s right that the government has reduced the pressure - cutting energy bills, freezing rail fares and prescription charges, and raising the minimum wage.“But after years of falling living standards millions of families are still struggling to make ends meet.“With households squeezed there’s less money being spent on the high street - holding back businesses and choking off growth.“The Bank of England must now act.“From next month we need a series of quick fire interest rate cuts.

“That would put money back into people’s pockets, give businesses the confidence to invest and help Britain finally move on from a cost-of-living crisis that has dragged on for far too long,”Time to wrap up…,City investors are betting on a cut to UK interest rates next month, after inflation fell to its lowest level in 10 months this morning,A March rate cut is now seen as an 80% chance by the money markets, after CPI inflation dropped to 3% in January,The slowdown was in line with a majority of City economists’ forecasts and marks the lowest level since March 2025.

The Office for National Statistics (ONS) said that falls in petrol prices, air fares and food had driven the drop,In a welcome boost for households’ shopping budgets, the rise in prices for food and non-alcoholic drinks slowed sharply to 3,6% in the year to January, down from 4,5% in December, and reaching a nine-month low,Petrol and diesel prices fell by 2.

2% over the year compared with a 0.9% rise last year.The average price of petrol fell by 3.1p a litre between December and January to stand at 133.2p a litre, while diesel fell by 3.

2p to stand at 142,5p a litre,Several economists predicted the fall in inflation, after a rise in unemployment yesterday, would nudge the Bank of England into cutting borrowing costs at its next meeting,Others, though, suspect the Bank may wait until April, with services inflation still looking sticky,Seperate data showed that house price inflation, and rising rents, have slowed, with property prices falling in London, particularly in inner districts of the capital.

Wall Street’s main share indexes have opened higher, supported by gains in technology stocks as the AI worries that hit the sector in recent sessions ease.The Dow Jones Industrial Average is up 123 points or 0.25% at 49,657.15 points in eary trading.The broader S&P 500 share index gained 0.

2% and the tech-focused Nasdaq Composite rose by 0.28%.The oil price has risen today, threatening to undermine some of the progress against inflation.Brent crude is up 2.6% at 69.

20 per barrel, hitting its highest level in almost a week.Oil rose as the talks in Geneve between Russia and Ukraine fail to yield any agreement, yet.The battle to get inflation in the UK sustainably down to the Bank of England’s 2% target may not be won for some time….Oxford Economics, the consultancy, have slightly raised their forecasts for UK inflation this year and in 2027.They do expect price pressures to ease this spring, but then see inflation picking up again.

As a result, they now expect the CPI measure of inflation to average 2,6% this year and next year, up from 2,3% and 2,5% previously forecast,Edward Allenby, senior UK economist at Oxford Economics, explains:Looking ahead, several factors should pull headline inflation materially lower in the near term.

We expect a combination of smaller once-a-year rises in index-linked and regulated prices, a substantial fall in the energy price cap, and the impact of policy measures from the 2025 Budget to drag inflation close to 2% in April.However, we think there’s a good chance that inflation edges higher again from H2 2026, with sticky pay growth likely to prevent services inflation from cooling significantly.The path for inflation this year is likely to be a little stronger than we previously forecast.This is partly due to us factoring in new regulatory price announcements over the past month, some of which have been slightly higher than anticipated.Meanwhile, the Office for National Statistics increased the weight assigned to services prices, which boosts headline inflation.

Incorporating these changes into our forecast means we now see CPI inflation averaging 2.6% this year and next, up from 2.3% and 2.5% previously.Back in the City, Vodafone’s shares have hit a three and a half-year high after it announced the sale of its stake in its Dutch joint venture.

Vodafone is selling its 50% stake in Dutch telecom company VodafoneZiggo to Liberty Global plc for €1.0bn.Vodafone is also getting a 10% stake in a new company, to be called '“Ziggo Group”, which will own both VodafoneZiggo and Liberty Global’s Belgian subsidiary, Telenet Group.Liberty Global plans to list Ziggo Group on the Euronext market in Amsterdam in 2027.Margherita Della Valle, chief executive of Vodafone Group, says:“We’re pleased to have agreed the sale of our 50% share in VodafoneZiggo at an attractive valuation.

This transaction delivers €1 billion in cash to Vodafone, and we have the potential for further value creation through our 10% stake in Ziggo Group, a business with greater scale,”Vodafone’s shares rose as high as 120p, the highest since August 2022, after the deal was announced, helping to keep the FTSE 100 at record levels today,Over in the US, orders for durable goods such as household appliances, automobiles and furniture, have dropped,New orders for manufactured durable goods decreased by 1,4%, the US Census Bureau has announced, due to a drop in orders for transportation equipment.

That follows a 5,4% increase in November,The US Census Bureau says:Excluding transportation, new orders increased 0,9%,Excluding defense, new orders decreased 2.

5%.Transportation equipment, also down two of the last three months, drove the decrease, $6.4 billion or 5.3% to $113.5 billion.

PA Media have written a handy explainer about today’s inflation report:Inflation is the term used to describe the rising price of goods and services,The inflation rate refers to how quickly prices are going up,January’s inflation rate of 3% means if an item cost £100 a year ago, it would now cost £103,It is lower than the 3,4% rate recorded in December, meaning that prices are still rising but at a slower rate than they had been before.

Official statisticians said the falling price of petrol and diesel was the biggest single downward drag on inflation in January.The average price of petrol fell by 3.1p per litre between December 2025 and January 2026 and the price of diesel slid 3.2p per litre, the ONS said.It also highlighted that a drop in airfares also helped bring inflation down.

The cost of air travel typically drops in January as airlines launch sales and discounts, but prices plunged by 26.5% in January compared with the previous month in a much sharper drop than usual.Food and non-alcoholic drink prices were also lower month-on-month, with bread and cereals among those dropping in price.Meanwhile, butter prices were up 1.4% for the month after a sharp slowdown from 8.

9% in December, while recent coffee price increases also slowed sharply.The decrease in broad inflation in January does not mean that price rises are slowing for all goods and services.Wednesday’s figures showed that hotels and other accommodation costs swung higher in January, rising by 0.4% in the month after declining in December.A number of other prices linked to leisure and hospitality also accelerated, amid recent warnings from the sector over high labour costs and impending tax rises

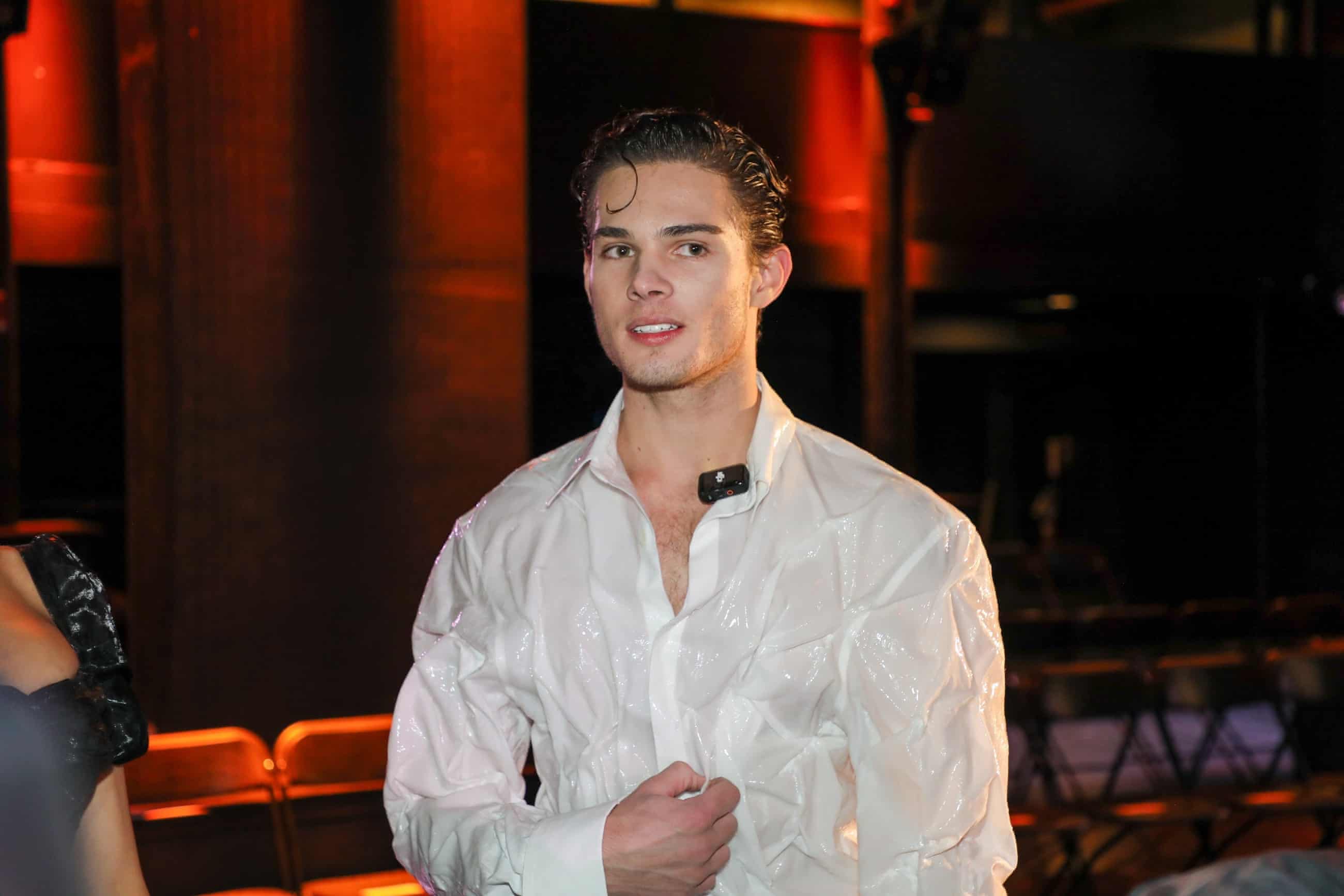

The disturbing rise of Clavicular: how a looksmaxxer turned his ‘horror story’ into fame

His gonzo argot of ‘mogging’ and ‘jestermaxxing’ masks a malign chauvinist philosophy, and his audience keeps growingHow’s your “jestermaxxing” game? Have you been “brutally frame-mogged” lately? If you’ve been finding this kind of online discourse even more impenetrable than usual, a 20-year-old content creator calling himself Clavicular is probably to blame.Born Braden Peters, Clavicular is a manosphere-adjacent influencer who has recently broken containment for a string of high-profile controversies, including livestreaming himself apparently running over a pedestrian with his Tesla Cybertruck and being filmed chanting the lyrics to Kanye West’s Heil Hitler in a nightclub with the self-styled “misogynist influencer” Andrew Tate and the white nationalist commentator Nick Fuentes.Before taking up with what some feel are among the worst men alive, Clavicular was known only as a “looksmaxxer”, a young man intent on optimising his physical attractiveness by frequently extreme measures (such as steroids, surgery and, er, taking a hammer to his jaw).Yet Clavicular’s gonzo live streams and absurd lingo have seen him escape his subcultural silo, landing him a modelling gig at New York fashion week and a profile in the New York Times.So where has he come from? And what does his rise mean for humanity?Peters came to prominence last year on the streaming platform Kick (like Twitch, but more laissez-faire with content moderation), where he now has nearly 180,000 followers

Ministers may slow youth minimum wage rise amid UK unemployment fears

Ministers are considering a slower rise in the minimum wage for younger workers, amid fears over rising youth unemployment.Labour had promised in its manifesto to equalise national minimum wage rates by the time of the next election, saying it was unfair younger workers were paid less. Government sources said equalisation remained the aim but the rise could come more slowly.At the current rates, those between 18 and 20 are paid a minimum of £10 an hour, rising to £12.21 an hour for those over 21

Brazilian butt lifts should be banned in UK amid ‘wild west’ industry, MPs say

Brazilian butt lifts should be banned in the UK, MPs have said, as a report found a lack of regulation had led to a “wild west” of cosmetic procedures being carried out in garden sheds, hotel rooms and public toilets.The women and equalities committee (WEC) said high risk procedures such as non-surgical buttock augmentation should be outlawed immediately, and a licensing system for lower risk treatments was urgently needed. People with no training can carry out potentially harmful procedures, putting the public at risk, the group of MPs added.A nine-month inquiry by the committee also found ministers were not moving quickly enough to tackle the risks posed to Britons and recommended they “accelerate regulatory action”. The lack of timely action was “fostering complacency in self-regulation” within the industry, they cautioned

UK shoppers warned over spread of harmful and illegal skin lightening kits

Illegal skin lightening products are being sold in an increasingly wide range of UK outlets, including butchers, specialist food shops and small grocery stores, trading standards officers have warned.The Chartered Trading Standards Institute (CTSI) is warning that many of the products contain substances that are banned because of the serious risks they pose to health, including skin damage, infections and pregnancy complications.Officers say that, as well as online, they are finding them more frequently in Asian and Arab stores, plus specialist butchers and grocery stores for other diverse communities, whom the products are primarily targeted at.Tendy Lindsay, former chair of the CTSI, said: “As a Black woman and a longstanding advocate for equality, diversity and inclusion, I want to be absolutely clear: the sale of illegal skin lightening products is not only dangerous, it is unlawful.“Many of these products contain banned substances such as high levels of hydroquinone, mercury or potent corticosteroids

‘It’s soul-crushing’: young people battle to find any work in bleak jobs market

On any given day, Poppy Blackman is engaged in the “soul-crushing” process of applying for a new job, and rarely ever hearing anything back.The 22-year-old has been unemployed since January 2025 and says she applies to an average of 50 roles a month, using one of four different CVs she has written for different types of jobs and sectors.“I can’t be picky with what I want to apply for,” says Blackman, who lives in London. She studied fashion and art design at North Kent College but has given up on only applying within this sector.“Not a day goes by when I don’t apply for at least a few jobs,” she says

Fostering target brings hope for thousands of children | Letter

Re your editorial (The Guardian view on fostering: reform is welcome, but excess profits must be tackled, 10 February), I’ll never forget the midnight feast that nobody ate. Four children sat shellshocked in my lounge, having just been removed from their home. They didn’t know or trust us. We tried our best to make them feel comfortable with cookies, doughnuts and crisps, but it would take several days before they were ready to tuck into treats.Fostering has been one of the biggest privileges for my wife and me over the past 20 years

‘By the end of the day we’re just knackered’: business booms for UK’s south Asian jewellers as gold prices soar

March cut to UK interest rates more likely after inflation drops to 10-month low; London house prices fall – as it happened

Zuckerberg grilled in landmark social media trial over teen mental health

Stone, parchment or laser-written glass? Scientists find new way to preserve data

Mikaela Shiffrin overcame grief, crashes and her own self-doubt to win slalom gold again

‘Princess Anne thought I was Joe Marler’: Heyes mixed up in case of mistaken identity