‘It’s soul-crushing’: young people battle to find any work in bleak jobs market

On any given day, Poppy Blackman is engaged in the “soul-crushing” process of applying for a new job, and rarely ever hearing anything back.The 22-year-old has been unemployed since January 2025 and says she applies to an average of 50 roles a month, using one of four different CVs she has written for different types of jobs and sectors.“I can’t be picky with what I want to apply for,” says Blackman, who lives in London.She studied fashion and art design at North Kent College but has given up on only applying within this sector.“Not a day goes by when I don’t apply for at least a few jobs,” she says.

“It does get pretty miserable after a certain amount of time, always doing the same thing, looking on the same websites, applying for similar jobs.It does get a little bit soul-crushing.”Blackman’s story is an increasingly common one.Official figures show youth unemployment among 18 to 24-year-olds rose to a five-year high in the final three months of 2025.Strip out the Covid spike in 2020 and youth unemployment has hit an 11-year-high.

On a wider net of 16 to 24-year-olds, youth unemployment is now higher than the EU average for the first time, rising to 16.1%, the highest level including the pandemic since 2014, when the jobs market was still recovering from the financial crisis.The EU average was 14.9% in the final quarter of 2025.The youth unemployment rate compares with an overall UK unemployment level of 5.

2%.Former MP and minister Alan Milburn, chair of the government’s Young People and Work review, which is due to report in the summer, said the rise in youth unemployment posed an “existential” risk for the UK and could put “a generation on the scrapheap”.“This is not a short-term phenomenon, it’s a long-term one,” he told the BBC.“We’re seeing something dramatic changing in the labour markets.“Forty-five per cent of 24-year-olds who are not in education, employment or training have never had a job.

If you haven’t had a job by 24, that entails a long-term scarring effect and you’re probably then stuck in a lifetime on benefits.”Ashwin Prasad, who runs the UK arm of Tesco, recently warned that the UK was “sleepwalking into a quiet epidemic” of joblessness, with millions of people out of work and on benefits.Some of this rise in joblessness is due to businesses looking to shore up costs in tougher times.Martin Beck, chief economist at WPI Strategy, said: “The economy has been sluggish for a long time and that tends to hit younger people first, because if you’re an employer and your demand is weak, you’re probably going to freeze recruitment.You’re not going to open up as many entry-level roles.

”Economists say that while there are a number of issues contributing to the rise in young people being out of work, one big factor has been rising costs for employers.In her first budget after Labour returned to power in 2024, the chancellor, Rachel Reeves, increased the rate of employers’ national insurance contributions (NICs) from 13.8% to 15% from last April.The threshold for NICs being levied was also cut from £9,100 to £5,000 a year.The national minimum wage has also risen every year since 2019, rising by 6.

7% in 2025 and by 4.1% in April 2026.From April, the combined cost of employing someone age 21 and over will have risen by 15% since 2024, according to the Centre for Policy Studies, or £3,414.For 18 to 20-year-olds, the increase is 26%, or £4,095.The Employment Rights Act has also added to costs for employers, with significant new rights for workers on sick pay, parental leave and zero-hours contracts.

Simon French, chief economist at Panmure Liberum, an investment bank, said: “The ‘national living wage’ is probably the most significant factor over the last decade in terms of its impact on youth unemployment,“But if you then layer on top of that the employer national insurance changes, plus the Employment Rights Act, on top of pensions auto-enrolment – that is a lot to absorb,“We’ve had these incremental costs being burdened on employers as if it is just a free lunch,Well, I think we’re finding, it’s not a free lunch,”It has all left young people facing a brutal jobs market.

Jack, 21, lives in London and graduated from Oxford University last summer with a first in history.He has since applied for more than 100 jobs, graduate schemes and internships and – despite landing his first internship, which started in January and runs for three months – he is now on the job hunt again.He says the application process is gruelling, made harder because of the prevalent use of technology in hiring.“You hear back from maybe 10% of applications and usually it’s automated, so you don’t even know what you’re doing wrong,” he says.“I’ve spoken to one human out of all those applications.

I’ve even been interviewed by chatbots.”He feels trapped in what he describes as a catch-22.“Entry-level roles want you to already have a foot in the door.The roles in which you begin your career require you to have already been in roles in which you begin your career.It’s a classic case of the chicken and the egg,” he says.

“I feel pretty drained and fed up.”Many graduates also say they are worried about companies using artificial intelligence to replace jobs.However, Jake Finney, senior economist at PwC, said its youth employment index for 2025 found AI was not a big factor.“We didn’t really find much of an impact at the economy-wide level, because ultimately, young people are concentrated in industries like retail and hospitality and these are not the sectors that have been hit by AI so far.“But if you look at the IT sector, which is obviously the sector that’s been most impacted by AI and automation so far, we’ve found that adult employment has been relatively stable, whereas youth employment has dropped by around a fifth.

”Jonathan Townsend, UK chief executive of The King’s Trust, which helps young people find work, said: “More young people are coming to us eager to work but feeling locked out of opportunities.“This generation has faced a uniquely difficult start to working life.Many had their education and early work experiences disrupted by the pandemic, leaving gaps in skills, confidence and networks that are crucial for getting a first job.”Saalim Elhaj, 23, has decided to learn new skills to find a job.He graduated with an architecture degree in Manchester in June 2025.

He moved to Southampton to be with his girlfriend and has mostly been unemployed apart from days labouring on construction sites.He no longer sees himself pursuing a career in architecture.“Even before finishing my course, I was quite disillusioned by the whole profession, but mostly by the economy,” he says.“I could see it wasn’t going to get any better.There weren’t many jobs for recent graduates.

Even the year before I graduated, I could see it was stagnating.I was really confused about what I’m supposed to be doing in this economy.”After contacting some architecture companies and seeing how few jobs there were for recent graduates, he decided to expand his skillset and get experience in construction.He is now hoping he can do an apprenticeship in timber framing, a traditional method of building using heavy timber – if he can find someone to take him on.In the meantime, he regularly travels to London to volunteer with a timber framer so he can learn as much as he can.

“It’s really bizarre, doing a university degree and now thinking about an apprenticeship, but everything is very uncertain and I really want to learn a skill.”Julie Leonard, chief impact officer at Shaw Trust, a national employment charity, said: “This generation has had a raw deal.They’ve faced a pandemic during the time when vital skills for the workplace are gained, and are starting their working lives during unprecedented social and technological change.”

US and Japan unveil $36bn of oil, gas and critical minerals projects in challenge to China

Japan has drawn up plans for investments in US oil, gas and critical mineral projects worth about $36bn under the first wave of a deal with Donald Trump.The US president and Sanae Takaichi, Japan’s prime minister, announced a trio of projects including a power plant in Portsmouth, Ohio, billed by the Trump administration as the largest natural gas-fired generating facility in US history.As a diplomatic row between Japan and China over the security of Taiwan continues, testing the Japanese economy, Takaichi said the projects would strengthen her country’s ties with the US.While Takaichi did not directly mention China, she expressed hope in a statement that the investments would enhance Japanese and US economic security.“Our massive trade deal with Japan has just launched,” Trump declared in a social media post

The death of Heather Preen: how an eight-year-old lost her life amid sewage crisis

In 1999, Heather Preen contracted E coli on a Devon beach. Two weeks later she died. Now, as a new Channel 4 show dramatises the scandal, her mother, Julie Maughan, explains why she is still looking for someone to take responsibilityWhen Julie Maughan was invited to help with a factual drama that would focus on the illegal dumping of raw sewage by water companies, she had to think hard. In some ways, it felt 25 years too late. In 1999, Maughan’s eight-year-old daughter, Heather Preen, had contracted the pathogen E coli O157 on a Devon beach and died within a fortnight

Boost to British Steel as Turkey places high-speed rail order

British Steel has secured an order worth tens of millions of pounds to supply rail for a high-speed electric railway in Turkey, amid continuing uncertainty over the long-term future of the government-controlled steelworks in Scunthorpe.The site will supply 36,000 tonnes of rail to ERG International Group, the company announced, in what it called an “eight-figure agreement”.The rail is destined for a 599km railway line being built to connect the Turkish capital, Ankara, with the western port city of İzmir, which will reduce the travel time and cut carbon emissions.British Steel said securing the contract had allowed it to create 23 new roles at the north Lincolnshire site and to restart round-the-clock rail manufacturing for the first time in more than a decade.The deal, which was supported by UK Export Finance, is seen as a commercial boost for the loss-making manufacturer

Goldman Sachs to drop race, gender and LGBTQ+ criteria from board evaluations

Goldman Sachs is removing race, gender and other diversity-related considerations when evaluating prospective candidates for its executive board after pressure from an activist shareholder group to remove the criteria.The National Legal and Policy Center (NLPC), a small Goldman shareholder, quietly submitted a request to the company last September asking the bank to eliminate its diversity, equity and inclusion (DEI) board criteria.According to a Wall Street Journal report, Goldman recently informed the group that it plans to remove the DEI criteria, and the two parties signed an agreement under which the NLPC would withdraw its proposal.Goldman’s board is expected to approve the changes this month, people familiar with the matter told the Journal.Currently, the board’s governance committee evaluates qualified candidates based primarily on four factors

UK interest rate cut likely in March as unemployment rate rises; youth joblessness to ‘increase significantly’ in coming months – as it happened

The chances of a cut to UK interest rates next month have risen, following this morning’s data showing a rise in unemployment and a slowdown in wage growth.The City money markets now indicate there’s a near-75% chance that the Bank of England lowers interest rates to 3.5% at its next meeting, in March, up from 69% last night.Investors now fully expect two rate cuts by Christmas, which would bring Bank Rate down to 3.25%

Surging prediction markets face legal backlash in US: ‘Lines have been blurred’

State lawmakers and gaming regulators across the US are escalating their fight against prediction markets, arguing that the fast-growing platforms are “basically gambling but with another name”.At least 20 federal lawsuits have been filed nationwide, disputing whether companies such as Kalshi and Polymarket should be treated as federally regulated financial exchanges, as they maintain, or as gambling operations that should be regulated like state-licensed sportsbooks.The row escalated this week, when the chair of the US Commodity Futures Trading Commission (CFTC), which oversees these platforms, announced that it was filing a friend-of-the-court brief in defense of “its exclusive jurisdiction over these derivative markets’”.The legal battle comes as the sector surges. More than $1bn was traded on Kalshi alone during Super Bowl Sunday, and Bloomberg reported that Kalshi’s January trading volume reached nearly $10bn, most of it tied to sports

Nigel Farage unveils Reform UK frontbench team and warns over dissent

What made ministers think they could delay local elections in England?

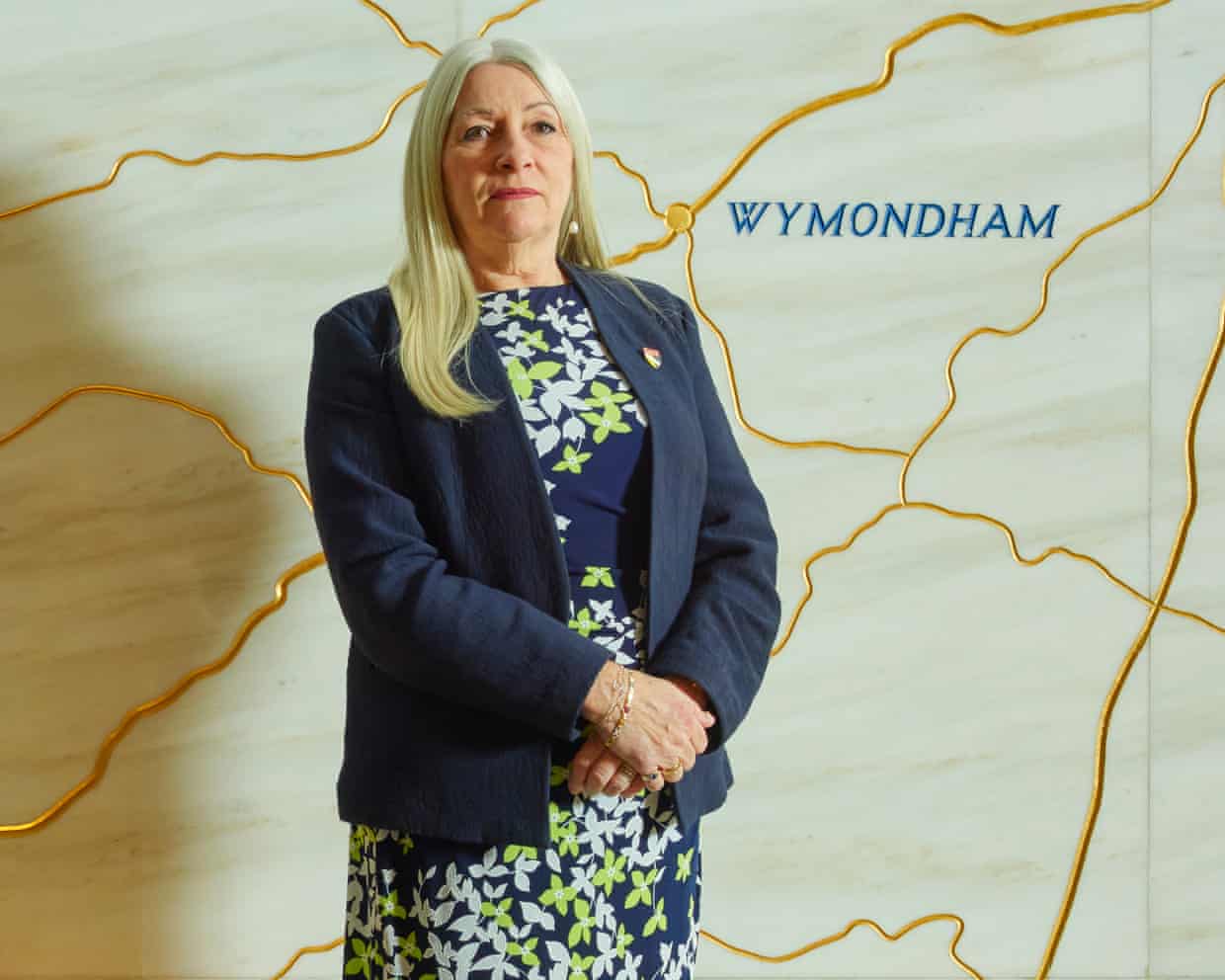

Norfolk council leader pulls out of long-awaited devolution deal over election U-turn

Keir Starmer buys personalised silver cufflinks given by Trump on state visit

UK politics: Farage insults female reporter as Braverman says Reform UK wants to scrap Equality Act – as it happened

Nigel Farage assumes Anne Robinson role in political remake of The Weakest Link