On Polymarket, ‘privileged’ users made millions betting on war strikes and diplomatic strategy. What did they know beforehand?

In the early hours of 13 June, more than 200 Israeli fighter jets began pummeling Iran with bombs, lighting up the Tehran skyline and initiating a 12-day war that would leave hundreds dead.But for one user of the prediction market Polymarket, it was their lucky day.In the 24 hours before the strike occurred, they had bet tens of thousands of dollars on “yes” on the market “Israel military action against Iran by Friday?” when the prospect still seemed unlikely and odds were hovering at about 10%.After the strike, Polymarket declared that military action had been taken, and paid the user $128,000 for their lucky wager.But was it just luck?Polymarket is an online platform where people can bet on just about anything, from what the most-streamed song on Spotify will be to how many times Donald Trump will say “terrible” that day.

Under Joe Biden, the unregulated site was banned in the United States, although it could be accessed with a VPN.Now, over $100m worth of bets are placed on Polymarket each day.The user who had placed the bet was new to Polymarket.Since then they have lodged five bets on similar markets like, “Israel announces end of military operations against Iran before July?” and “Israel strikes Iran by January 31, 2026?” All have been successful, making further profits of more than $28,000.The Guardian’s analysis of blockchain data traced the wallet to an X account with its location set to Beit Ha’shita, a kibbutz in northern Israel.

The user recently transferred their bets to two other accounts, data shows, potentially to avoid detection.There, they currently have 10 live bets relating to Israel’s military strategy.The X user behind the account could not be reached for comment but Israel Defense Forces and the Israel Security Agency have opened an investigation into the user, officials said last Thursday.Unlike sports betting sites like DraftKings, where users have to scan their IDs before they are able to place a bet, Polymarket is built on a blockchain.Accounts are linked to crypto wallets that can be publicly traced but are difficult to link back to an individual.

So, even though the company is headquartered in the US, its markets are global and the users anonymous.Online prediction markets found mainstream traction in 2024 by letting everyday Americans wager on the US presidential election.Americans were already becoming hooked on online gambling after the 2018 supreme court ruling that legalized sports betting.But that election supercharged the desire to bet: the twists and turns of the presidential race meant it already felt like a spectator sport.Polymarket’s virality was initially powered by manosphere influencers.

The Barstool Sports founder Dave Portnoy broadcast election odds to more than 200 million followers, right-leaning X accounts weaponized the markets, which were predicting a Trump victory, against mainstream polls, which showed a tight race.Crypto streamers pitched political betting as just another high-risk, high-reward trade.Since then, Polymarket and its rival Kalshi have gamified all corners of life – from tomorrow’s weather to Bad Bunny’s Super Bowl outfit – and in effect, turned reality itself into a casino.To bet on an outcome, users buy either a “yes” or “no” event contract.These are priced between $0 and $1, and like any market, their price fluctuates depending on demand.

If a “yes” contract is worth $0.80, the market thinks it’s 80% likely.If the “yes” thing happens – a team wins their game, a director wins their Oscar, a bomb drops on a city – the value of the correct contract shoots up to $1, while the wrong contract drops to $0.If you buy thousands of contracts for something that seems really unlikely, $0.10 for Israel striking Iran, say, then when that contract reaches $1 – you stand to make a huge profit.

For example, one account created in November has been solely dedicated to wagering that Trump will appoint Kevin Warsh as the next chair of the Federal Reserve, persisting even when the odds dropped to 7%.After Trump announced Warsh this morning, they will profit $142,000.Polymarket disciples reject the idea that they are merely gambling, they see the markets that result from the bets placed on the site as critical sources of information.The thinking is that Polymarket odds, based on the guesses of people willing to put their money where their mouth is, are a better method of predicting the future than flawed polls or biased commentators.They see Polymarket, primarily, as journalism.

“It’s the most accurate thing we have as mankind right now, until someone else creates some sort of super crystal ball,” Polymarket’s CEO, Shayne Coplan, told 60 Minutes in November, shortly after the 28-year-old was anointed the world’s youngest self-made billionaire, according to the Bloomberg Billionaires Index.Polymarket provides a “credible, lightning-fast news channel for hundreds of millions of people”, said the blockchain analyst Andrew 10 Gwei [he goes by his X username], who has been exposing insider activity within crypto startups since 2020 and has more recently turned his focus to Polymarket.“You gain access to critical information about key world events faster than everyone else.”Polymarket called the 2024 presidential race before the polls.The 2026 Golden Globes announced real-time Polymarket odds as the telecast headed into commercials, correctly predicting 26 out of 28 winners and taking a lot of the suspense out of the ceremony itself.

Media entities such as CNN and the Wall Street Journal have partnered with prediction markets and integrated their data into their reporting.But this is not the first time America has used prediction markets to hedge outcomes.A century ago, political betting was rampant on Wall Street.Bookmakers correctly predicted 11 out of 15 elections between 1884 and 1940.These odds would be splashed across newspapers each election cycle – “never wrong”, as some papers put it.

During some election years, the betting on political outcomes would exceed trading in stocks and bonds.However, election betting wouldn’t survive the Prohibition era’s moral clampdown on gambling.Critics warned these markets risked election tampering and information withholding.At the same time, the arrival of scientific polling provided an uncontroversial alternative to finding out the mood of the nation.After the success of Gallup in predicting the 1936 election, many newspapers scrubbed Wall Street odds from their pages.

But today’s gambling revival looks nothing like the past: betting is now borderless, anonymous and limited only by imagination.“We’re still trying to understand how these markets are going to affect our lives, but honestly, I think they’re affecting us more than we probably realize,” said Yesha Yadav, a professor at Vanderbilt law school.When Yadav asked her students recently if they bet on prediction markets, a sea of hands shot up.“It’s just becoming normal,” she said.Event contracts are considered derivatives, so online prediction markets fall under the jurisdiction of the US Commodity Futures Trading Commission (CFTC), who, under Biden, had fought hard to block them.

Election markets are “contrary to the public interest”, Rostin Behnam, former CFTC chair said in 2023, adding that regulating them would be both “impractical” and force the agency to act as “an election cop”.But under Trump, the CFTC has pulled back.It dropped its legal fight to ban Kalshi’s election markets, and permitted Polymarket to operate domestically under its jurisdiction.Business has been booming ever since: the total value of bets bought on the sites in just the month of December surpassed $8.3bn, up 1,300% from February, according to DefiLlama data.

That’s about the same as the monthly sales of Target.Yet, as the list of markets grows longer, so does the number of people sitting on valuable information.Concerns have been mounting about alleged insider trading.The world first caught on to the problem after the US capture of Venezuela’s leader, Nicolás Maduro, in January.Shortly after, reports circulated that a new Polymarket account had profited more than $400,000 by betting Maduro would be ousted by the end of January.

The wagers were placed in the days and hours running up to Trump revealing the capture on Truth Social.Yet, the profiteering may run deeper than this.The Guardian identified more than a dozen Polymarket accounts with the hallmarks of possible insider trading: large, accurate bets lodged shortly before the event, with little other activity – and are not hedging their bets across multiple accounts.Collectively, the accounts have profited about $2.17m.

The markets with suspicious activity cross many areas of life, some involve foreign diplomacy, others congressional votes.From big tech announcements to an international award.On 26 December, the Ukrainian president, Volodymyr Zelenskyy, posted on X that he and Trump would meet before the new year.A cluster of five new Polymarket users cashed in a collective $154,000 from the statement.The bets on “Will Trump meet with Zelenskyy by December 31?” were lodged within a few hours of one another, all one day before Zelenskyy’s statement.

Blockchain data suggests the accounts may be jointly owned.Three of the wallets funding these accounts have transactions between them, and four link to the same Binance wallet.The wallets frequently interact with a Ukrainian-founded cryptocurrency exchange and one features the Ukrainian flag with the bio “#standwithUkraine”.Earlier this month, Ukrainian regulators banned Polymarket for conducting an unlicensed gambling business.In October, Venezuelan opposition leader María Corina Machado Parisca won the Nobel peace prize.

Shortly after, major news outlets reported about a spike in Polymarket activity before the announcement, with one user having profited more than $65,000, prompting the Nobel Institute to launch an investigation.But the scale was far bigger than previously reported: the Guardian uncovered eight jointly owned, new accounts which collectively profited more than $161,000, with wagers placed 12 hours before the winner was revealed.Among them are politically charged usernames like “fmaduro”, “madurowilllose”, “trumpdeservesit” and “striketheboats”.One new account made $17,000 betting on the date of the US government shutdown, the bulk of which was made from a bet made the night before the House passed the government funding bill.Another made $25,000 predicting which shows would be Netflix’s first and second most-streamed shows that week – in the US and globally – with correct bets placed in 10 Netflix markets for two weeks in a row.

Three have bet exclusively on announcements from Strategy, a publicly traded bitcoin treasury company, profiting more than $143,000 since July.Twelve emerged in October to bet on the launch of OpenAI’s new browser, profiting $50,000, with all but one now lying inactive.Could it be that all of these accounts were just normal users who randomly placed life-changing amounts of money on niche markets, took the profits, and never gambled again? It’s conceivable – but seems almost impossible.The likelihood is that these bets were made by people with prior knowledge of the market’s outcome.The problem is proving it.

Because what constitutes insider knowledge is ambiguous.Take this macabre example: a new Polymarket account made $142,000 betting that Thailand would strike Cambodia just hours before the market resolved.Blockchain data links the wallet to a person based in Thailand.But reports suggest the bets occurred while the strikes had already begun.Seeing missiles, getting evacuated, or hearing local reports first does not make them an insider – they simply had the advantage of circumstance.

Whether insider trading should be illegal, even in more traditional markets, was for a long time a matter of debate.Up until the 1930s, this kind of activity was allowed on the stock market; corporate insiders could freely trade on non-public information.But after the 1929 Wall Street crash, in order to keep ordinary Americans trading, Congress needed to convince them the stock market was not a rigged casino.So, in 1934, it outlawed “any manipulative or deceptive device” in connection with trading securities.Regulators and courts have since interpreted that law to include trading on the basis of “material, non-public information”.

There’s been thousands of cases over the decades, including a lawyer sentenced to 12 years in prison for trading on information stolen from pre-eminent law firms.Kalshi, Polymarket’s main competitor, has rules prohibiting insider trading.A spokesperson said they freeze accounts that show suspicious behavior while they investigate trades by analyzing that user’s social connections and have already “disciplined a number of users”.Kalshi says that it is a financial crime for users that have “material, non-public information”, about a market to place a bet on that market.Polymarket is not centrally regulated and does not ban insider trading.

Instead, it falls to the users to comply with the law wherever they are based, a spokesperson said.However, after the CFTC allowed Polymarket to operate in the US in November, Polymarket rolled out a regulated, waitlist-only version of its app for US users.This app does require a government-issued ID and prohibits insider trading.It only has a limited selection of markets.But US users only need a VPN to access the unregulated version of the site and it’s presumed millions of Americans have placed hundreds of millions worth of bets in this way.

This violates Polymarket’s terms of use, but because Polymarket does not collect customers’ personal information, it can only verify their identity with an IP address, which can easily be altered with a VPN.“Of course there’s people who are working on it that know when it’s going to come.What’s cool about Polymarket is that it creates this financial incentive for people to go and divulge the information to the market and the market to change,” CEO Coplan told 60 Minutes.“Insider trading is a core feature of the system.It’s what makes them the fastest and most accurate news source in the world,” said Andrew 10 Gwei, who has been exposing insider activity within crypto startups since 2020 and has more recently turned his focus to Polymarket.

He estimates to have found dozens of these accounts over the past month or two, totalling millions of dollars in profits.X is inundated with self-proclaimed insider-hunters like Andrew who track suspicious activity and use this information to inform their own trades.Andrew lets people know when he thinks he has spotted an insider, so that laypeople can quickly copy their bets.“People are keen to learn how to track insider accounts, or at least get information about them, primarily to find financial opportunities.I doubt anyone following me considers insider trading on Polymarket wrong or harmful,” said Andrew

‘You can tell the mood has changed’: How Plaid Cymru led the Welsh fightback against Reform

Nigel Farage’s party was on the charge in Wales – but after the seismic Caerphilly byelection, progressives now believe they can come out on top in MayThe night after Plaid Cymru decisively beat Reform UK in the Caerphilly byelection last autumn, spraypaint reading “Now u can fuck off home” appeared on the shutters of the rightwing party’s offices on Cardiff Street.It was quickly cleaned off, but stickers bearing Welsh nationalist and anti-fascist slogans have popped up in its place, either scratched off or covered with duct tape. Reform is still there: the lights are on, and a shop owner next door said people go in and out every day, although no one answered the door when the Guardian rang the bell.The byelection was a golden opportunity for Nigel Farage’s party. Reform poured money and resources into its chance to break off a piece of the Labour heartland and boost its credibility by winning a first seat in the Senedd

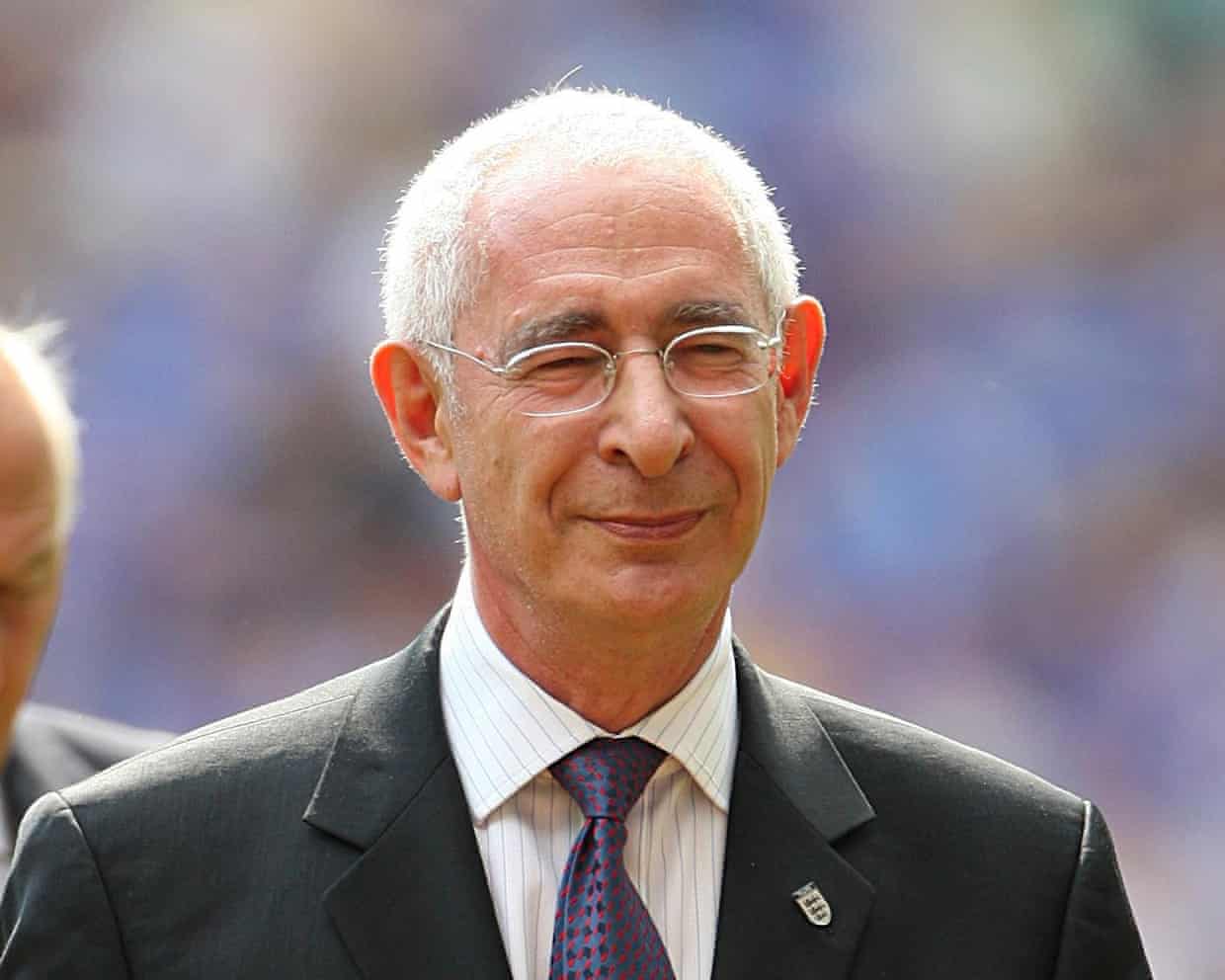

Lord Triesman, former Labour minister and FA chair, dies aged 82

Lord Triesman, a former Labour minister and chair of the Football Association, has died at the age of 82. The Labour party said the peer died on Friday night “peacefully and at home”.The former prime minister Tony Blair paid tribute to David Triesman as a “vital part of the New Labour movement”. Labour’s leader in the House of Lords, Angela Smith, described him as “respected and loved by his colleagues for his courtesy, kindness, wisdom, loyalty and generosity of spirit”.Triesman was the general secretary of the Association of University Teachers trade union and the general secretary of the Labour party before he joined Blair’s government in the House of Lords in 2004

Starmer says Gorton and Denton byelection a vote on ‘true patriotism’ as Labour picks local candidate

Keir Starmer has said the byelection in Gorton and Denton will be a referendum on “true patriotism” and that Labour is the only party that can defeat the “poisonous division” of Reform.The prime minister, during his visit to Japan, said he saw the vote as a two-way contest between Labour and Reform UK, as he criticised Nigel Farage’s party.Speaking on the same day that his party selected Angeliki Stogia, a Manchester city councillor, as its candidate in the byelection in the city, Starmer said: “It is very much and very clearly now a byelection between Labour and Reform on key principles.“I see that Tommy Robinson has just come out in support of Matt Goodwin, the Reform candidate. That tells you everything about the politics they intend to inject into this byelection, the politics of poisonous division, so we can see exactly where that’s going

UK and EU to explore renewed talks on defence cooperation

The UK and the EU are exploring the prospect of new talks on closer defence cooperation, as Keir Starmer stressed on Friday that he wanted to “go further” in the UK’s relationship with Brussels. Maroš Šefčovič, the EU’s trade commissioner, is due in London for talks next week, with trade, energy and fisheries on the agenda. But diplomatic sources said the UK is keen to discuss restarting negotiations on defence as soon as it can.Talks for the UK to join the EU’s €150bn (£130bn) Security Action for Europe (Safe) defence fund collapsed in November 2025 amid claims that the EU had set too high a price on entry to the programme.France has denied it was responsible for the breakdown in talks, but diplomatic sources say tension remains between Paris and other member states, particularly Germany, where sources have said they want the UK to be involved in Safe “as soon as possible”

Chalmers rejects opposition claims Labor is fuelling inflation, and says he is ‘impatient for reform’

Jim Chalmers says the May budget will help tackle inflation and strengthen the economy against shocks from Donald Trump’s policies, and has pushed back on opposition claims his government is intensifying cost-of-living pain. Days before another expected interest rate rise from the Reserve Bank of Australia, Chalmers labelled criticism of government spending from the Liberal and National parties as hypocritical, while also saying the government was “open” to big ideas on tax reform and would apply a laser-focus on intergenerational inequity in Labor’s second term. “The same people who say now that the budget is the sole or primary driver of inflation weren’t saying that last year when inflation was falling substantially and the bank cut rates three times,” he said.“We actually improved the budget in December in the update in any case, another $20bn in savings and the sort of responsibility and restraint unrecognisable to our predecessors.”Chalmers praised last week’s landmark speech by Canada’s prime minister, Mark Carney, but stopped short of endorsing Carney’s call for a coalition of middle powers and said Australia would navigate a path between China, as its biggest trading partner, and the United States as a vital defence ally

Jeffrey Epstein sent money to Mandelson’s husband after prison release, emails suggest

Jeffrey Epstein sent thousands of pounds in bank transfers after his release from prison in 2009 to Peter Mandelson’s husband, according to emails published by the US Department of Justice on Friday.The latest documents raise fresh questions about Epstein’s relationship with Mandelson, who was sacked as the UK’s ambassador to Washington when details of his support for the disgraced financier emerged in September.The latest dataset published on Friday shows that Mandelson’s husband, Reinaldo Avila da Silva, emailed Epstein on 7 September 2009, about two months after Epstein was released from prison. Epstein had served 13 months of an 18-month sentence for soliciting prostitution from a minor, for which he was registered as a sex offender. Mandelson was business secretary at the time and in a relationship with da Silva

The long-term cost of high student debt in the UK is not just for graduates | Heather Stewart

US, UK, EU, Australia and more to meet to discuss critical minerals alliance

Can French Connection make FCUK fashionable again?

Impose sanctions on refineries that buy Russian crude oil to end war, says Bill Browder

Urban Outfitters, Dreams and Royal Parks cafes criticised for use of gig economy app

‘Small mercies’: north London cafe evictions paused after legal challenge