Trump nominates Kevin Warsh as next Fed chair; eurozone economy keeps growing – business live

The identity of the next person to run America’s central bank – and face firm pressure from Donald Trump to cut interest rates – could be revealed today.President Trump told reporters last night that he would announce a successor to Federal Reserve Chair Jerome Powell on Friday morningTrump hinted that it would be “somebody that could have been there a few years ago...I think it’s going to be a very good choice.

I hope so.”A source later told Reuters that Trump had met with former Fed Governor Kevin Warsh at the White House on Thursday.Warsh, who interviewed for the job in 2017, is a critic of the Fed, which he says needs “regime change” to regain lost credibility.Whoever Trump picks will needs to be confirmed by a Senate majority.Newsflash: Donald Trump has decided to nominated Kevin Warsh as the next head of America’s central bank, the Federal Reserve.

In a post on Truth Social, the US president says he has “no doubt” that Warsh will be “one of the GREAT Fed Chairmen, maybe the best”,That’s not a surprise, given the president’s hints last night that he would choose “somebody that could have been there a few years ago” (Warsh lost out in 2017),But as we’ve been blogging this morning, while Warsh now favours lower interest rates he’s seen as less likely to push for aggressive cuts than some other candidates,Trump says:I am pleased to announce that I am nominating Kevin Warsh to be the CHAIRMAN OF THE BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM,Kevin currently serves as the Shepard Family Distinguished Visiting Fellow in Economics at the Hoover Institution, and Lecturer at the Stanford Graduate School of Business.

He is a Partner of Stanley Druckenmiller at Duquesne Family Office LLC.Kevin received his A.B.from Stanford University, and J.D.

from Harvard Law School.He has conducted extensive research in the field of Economics and Finance.Kevin issued an Independent Report to the Bank of England proposing reforms in the conduct of Monetary Policy in the United Kingdom.Parliament adopted the Report’s recommendations.Kevin Warsh became the youngest Fed Governor, ever, at 35, and served as a Member of the Board of Governors of the Federal Reserve System from 2006 until 2011, as the Federal Reserve’s Representative to the Group of Twenty (G-20), and as the Board’s Emissary to the Emerging and Advanced Economies in Asia.

In addition, he was Administrative Governor, managing and overseeing the Board’s operations, personnel, and financial performance.Prior to his appointment to the Board, from 2002 until 2006, Kevin served as Special Assistant to the President for Economic Policy, and Executive Secretary of the White House National Economic Council.Previously, Kevin was a member of the Mergers & Acquisitions Department at Morgan Stanley & Co., in New York, serving as Vice President and Executive Director.I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best.

On top of everything else, he is “central casting,” and he will never let you down.Congratulations Kevin! PRESIDENT DONALD J.TRUMPShould Kevin Warsh, as seems likely, get the Federal Reserve chair nomination, investors may expect him to push to shrink the central bank’s balance sheet.That’s because Warsh resigned from the Fed in 2011, after questioning the expansion of its record monetary stimulus programme, quantitative easing (QE).But Dario Perkins of City firm TS Lombard isn’t convinced this will happen, telling clients today: Is Warsh going to shrink the Fed’s balance sheet? I’ve heard Mr Anti QE talk about this many times, and his views are intellectually intractable.

He says shrinking the balance sheet will reduce interest rates and “crowd in the private sector”.But wasn’t QE supposed to SUPRESS long-term rates?The only way I can make sense of Warsh’s thinking is that he is implicitly calling for a big fiscal contraction.Well GLWT, because this administration has shown no inclination to cut the deficit.The silver price is slumping alarmingly today, at the end of a month of astonishing gains.Spot silver is curently down 13% at $101 an ounce, just a day after hitting a record high of $121.

64.That still leaves it up 40% since the start of 2025.Daniela Hathorn, senior analyst at Capital.com, says:“Markets have seen a busy and volatile 24 hours, with price action increasingly resembling a classic correction environment rather than outright panic.Volatility has picked up across asset classes as investors head into the weekend with geopolitics firmly in focus, particularly amid growing expectations that the US could escalate its stance toward Iran.

That backdrop has encouraged a degree of portfolio de-risking, reinforcing the risk-averse tone seen late in the week,In commodities, the move has been most visible in precious metals,Gold and silver had been trading in an increasingly speculative environment, with gold up nearly 20% and silver more than 30% over the past ten days,Against that backdrop, the near-10% pullback in gold overnight, while sharp, looks consistent with a long-overdue correction after a period of uninterrupted upside,Importantly, this does not undermine the longer-term appeal of precious metals, which continue to benefit from central bank buying and their role as hedges against political and fiscal uncertainty.

Rather, it reflects some concern that prices had moved too far, too fast, without a meaningful test of momentum,Lithuania was the fastest growing member of the eurozone in the last quarter, according to this morning’s data,Lithuania’s GDP rose by 1,7% in October-December, eurostat reports, followed by Spain and Portugal which both grew by 0,8%.

At the bottom of the growth league table was Ireland, whose GDP shrank by 0.6% in Q4 – making it the only member state that recorded a decrease compared to the previous quarter.Estonia, whose GDP was unchanged, was the only other member not to grow in Q4.US stock index futures have dropped, as New York investors react to speculation that Donald Trump has chosen Kevin Warsh as his pick to be the next Federal Reserve chair.Reuters has the details:At 04:51 am [EST], Dow E-minis were down 456 points, or 0.

93%, S&P 500 E-minis were down 72.5 points, or 1.04% and Nasdaq 100 E-minis were down 339.75 points, or 1.31%.

That reflects the idea that Warsh is less likely to launch aggressive monetary easing – despite his backing for lower interest rates – which would have weakened the dollar and fuelled inflation,The eurozone economy ended 2025 with “decent economic growth despite large uncertainty and economic tension,” says Bert Colijn, ING’s chief economist for the Netherlands,Colijn explains:GDP growth in the eurozone held steady at 0,3% quarter-on-quarter in 4Q 2025,This was slightly better than expected, as sentiment data had been more downbeat towards the end of the year.

But accelerating growth in Germany, Spain and Italy, to a lesser extent, made up for slow growth in France.But the eurozone economy seems set to show accelerated growth over the coming quarters, and if the European Commission’s economic sentiment indicator is anything to go by, we could already see this happening quite soon.January sentiment was buoyant and reached the highest level in three years, which was a broad-based improvement between countries and large sectors.Also, industry seems to have started a bit of a production revival at the end of last year, which is expected to increase in strength as this year sees more defence investment and German infrastructure spending coming through.The eurozone economy kept growing at the end of last year, despite the impact of Donald Trump’s trade wars.

Eurozone GDP increased by 0.3% on a seasonally adjusted basis in the fourth quarter of 2025, matching its growth rate in the third quarter, and slightly higher than the 0.2% forecast by economists.Eurostat also estimates that eurozone GDP increased by 1.5% during 2025,Euro area #GDP up by 0.

3% in Q4 2025, +1.3% compared with Q4 2024: preliminary flash estimate from #Eurostat https://t.co/Md95s79FCH pic.twitter.com/Kz0V6KpfpaMark Dowding, CIO of BlueBay Asset Management.

says:With Trump set to announce Kevin Warsh as the new Chair of the Federal Reserve, the presumption is that he will seek to justify a dovish stance, advancing the notion that AI productivity gains will ensure inflation is held in check.The UK property market ended 2025 on a slightly weak note, new data shows.The Bank of England has reported that in December, net mortgage approvals for house purchase fell by around 3,100 to 61,013, the lowest since June 2024.Net borrowing of mortgage debt by individuals remained unchanged when compared to November at £4.6bn.

HMRC data shows that the number of UK residential transactions in December 2025 was “marginally lower” than November at 100,440, which was 5% higher than December 2024.Italy’s economy matched Germany, by growing by 0.3% in the final quarter of last year.Italian national statistics bureau ISTAT says:The quarter on quarter change is the result of an increase of value added in agriculture, forestry and fishing, in industry and, less pronounced, in services.From the demand side, there is a positive contribution of the domestic component (gross of change in inventories) and a negative contribution of the net export component.

Germany’s economy has escaped stagnation.Europe’s largest economy expanded by 0.3% in October-December, the Federal Statistical Office (Destatis) has reported this morning.That follows no growth in July-September, and a 0.2% contraction in April-June.

Destatis says:In particular, household and government final consumption expenditure increased,The German economy thus ended 2025 in positive territory after a turbulent year, particularly for foreign trade,However, the German economy only grew by 0,3% in 2025 as a whole,Kevin Warsh does have an interesting connection to Donald Trump too.

He’s married to Jane Lauder, the businesswoman and billionaire heiress to the Estée Lauder fortune,Jane’s father, Ronald Lauder, is the son of Estée Lauder who founded the eponymous cosmetics company, and is also a long-time friend of Trump,When Trump won the presidency in 2016, Ronald Lauder donated $100,000 to the Trump Victory fundraising committee,Ronald Lauder is also reportedly the businessman who suggested to Trump that the US buy Greenland, planting a seed that rocked the Nato alliance this year,Bitcoin is heading for its worst streak of monthly losses since 2018, Bloomberg has spotted.

Bitcoin has fallen 6% during January, putting it on course for a fourth straight month of losses.It’s down 2.2% today at $82,528, as a deepening risk-off mood grips the markets.Chris Beauchamp, chief market analyst UK at IG, says Iran attack fears are prompting a “risk rout”:“Investors are bracing themselves for the strong likelihood that the weekend will see a US strike on Iran, now that all the pieces appear to be in place.Reports suggest that it may not be like the last time, a single strike, and instead mark a sustained campaign to topple the Tehran regime.

That opens the door to a host of other possible complications, not least an attempt to close the Straits of Hormuz.Amidst this drama, Kevin Warsh’s appointment pales by comparison, but at least it marks the end of this particular chapter of the Trump-Fed saga.”Back in the eurozone economy, growth has picked up in Spain.The Spanish economy expanded 0.8% in the fourth quarter from the 0

UK unlikely to join a US attack on Iran – but may help Gulf states if Tehran retaliates

Britain is unlikely to assist the US in an attack on Iran but a deployment of RAF Typhoons to Qatar last week signals a willingness to help regional allies if Tehran tries to widen the conflict in retaliation.A first strike on Iran is unlikely be in line with the UK’s interpretation of international law, but British forces could become involved if there is a need to help Qatar or other regional allies in self-defence.Last week, the RAF’s 12 Squadron, a joint Typhoon unit with the Qatari air force, moved from Lincolnshire to the Gulf state, while the US built up a substantial military presence for a possible attack against the Iranian regime.British sources said the squadron’s forward deployment was “at the request of the Qataris” – to help protect the country, home to the largest US airbase in the region, from any drone and missile counterattack.Earlier this month, Iran warned that US bases in the region, often also home to small numbers of British personnel, would be targeted in retaliation if Donald Trump bombed the country in support of Iranians protesting against the regime

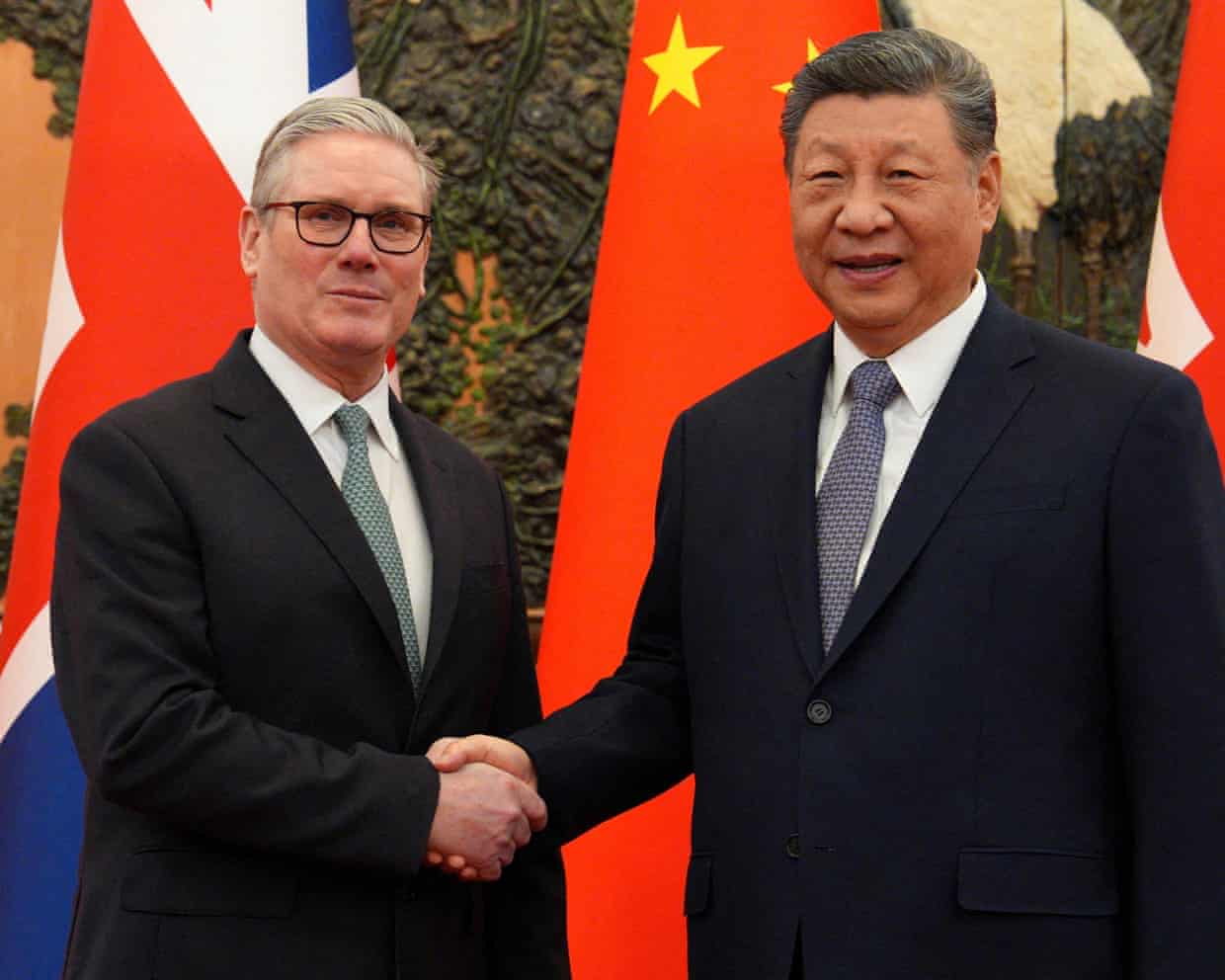

What agreements have been made during Starmer’s trip to China?

Keir Starmer will be pleased that he has secured several agreements to mark his visit to Beijing and by the warm tone of President Xi Jinping’s remarks about his government. However, No 10’s announcements do not put a figure on the value of the deals, and there does not appear to be a big bundle of investments worth billions by Chinese or British firms, which prime ministers have usually tended to hold up as a sign of success. These are the agreements secured by the UK so far.This is probably the biggest coup from the trip. Visa-free travel for Britons to visit China for under 30 days will allow holidays and business trips to take place without the usual bureaucracy

Xi didn’t really see a point to Kier’s visit – but hey, let a hundred flowers bloom | John Crace

Let’s face it, this was never going to be a meeting of equals. Keir Starmer had been desperate to squeeze in a trip to China for some time. Another country to tick off his list and he always feels a lot better about himself when he’s abroad. Less noise from his unhappy MPs. Plus he loved the pomp and ceremony that came with it

Starmer announces visa-free travel to China after talks with Xi in Beijing – UK politics live

Keir Starmer has secured a deal on visa-free travel to China for UK citizens during his visit to Beijing, PA Media reports. PA says:Those visiting the country for less than 30 days will no longer need a visa under the agreement, Downing Street has announced.It will apply to those travelling to China for business and as tourists and brings the rules for UK visitors in line with those from 50 other countries including France and Germany.The change will not come into effect immediately, but Beijing is understood to have committed to unilateral visa-free entry for UK citizens with a start date to be confirmed.British passport-holders currently need a visa to enter mainland China

Shamima Begum is a blot on Sajid Javid’s copybook | Brief letters

Reading your interview with Sajid Javid, with its account of juvenile theft from slot machines, the beatings he received from his father (which Javid himself now recognises as abuse) and the official leniency that he says changed his life, it’s hard to believe that this is the man who, on spurious national security grounds, took away Shamima Begum’s British citizenship for choices she made, or pressures she was put under, as a child.Mark de BrunnerBurn Bridge, North Yorkshire Re Adrian Chiles’s item (Is the wayward apostrophe in WALE’S LARGEST VAPE SHOP a sign of the times?, 29 January), while on holiday in Northumberland last year I visited a delightful cafe that sold various local crafts including handmade “Christma’s card’s”.Jane MarshLondon My mother regarded duvets (Letters, 28 January) as a “continental affectation”. For her, bed-making was all about the neatness of the hospital corners.Sue WallaceThame, Oxfordshire Why not have the World Cup in the US (A World Cup boycott over Trump? Football’s hypotheticals cannot be dismissed any more, 22 January)? They had the 1936 Olympics in Berlin and Fifa has already given a prize to our dictator!Kay KellerSchenectady, New York, US Sincere thanks for making my day last Friday

Nigel Farage meets UAE ministers and drums up donations on Dubai trip

Nigel Farage has paid a visit to Dubai to build diplomatic relations with United Arab Emirates ministers and drum up donations for Reform UK from wealthy expats.The two-night trip was his second visit to the Gulf state in two months, after a £10,000 trip hosted by Abu Dhabi to attend the Formula One grand prix.Farage’s ability to secure an audience with foreign government ministers is a new development, as his diplomatic ties have previously been largely with Donald Trump’s US administration.Speaking at a GB News event, Farage said he had had a “very good interview” with an unnamed UAE minister on Wednesday.One of those present at the event was the UAE industry minister, Sultan Al Jaber, who is also the chief executive of the state oil company Adnoc and a former chair of the UAE’s national media council

Great Ormond Street surgeon harmed 94 children, review finds

Dr Saboor Mir obituary

Tell us: do you live in a multigenerational house share?

Farage attack on high street Turkish barber shops is dog-whistle racism, minister says

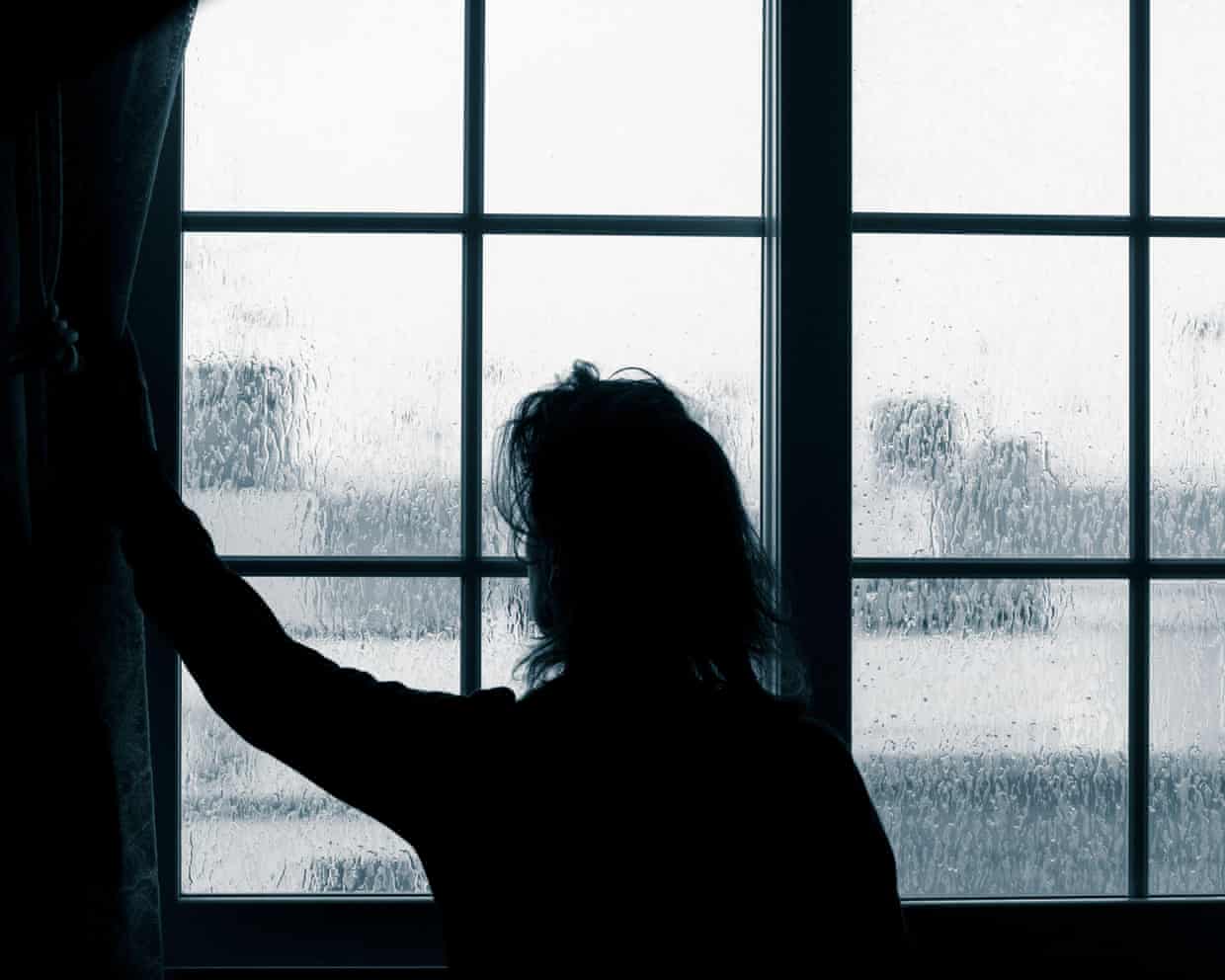

Survey of over-50s women finds almost two in three struggle with mental health

Record number of offenders being recalled to prison in England and Wales