The year of the ‘hectocorn’: the $100bn tech companies that could float in 2026

You’ve probably heard of “unicorns” – technology startups valued at more than $1bn – but 2026 is shaping up to be the year of the “hectocorn”, with several US and European companies potentially floating on stock markets at valuations over $100bn (£75bn).OpenAI, Anthropic, SpaceX and Stripe are among the big names said to be considering an initial public offering (IPO) this year.The success of their flotations – whether the shares maintain their value, rise or fall – could shape concerns about the AI race and whether the resulting market mania is a bubble.Some may have had plans to float last year that were delayed or derailed by the US federal shutdown and sweeping government job cuts hitting the market watchdog.This year is shaping up to be similarly geopolitically choppy, with Trump’s latest tariff threats against European allies over Greenland casting a shadow over shares this week.

However, despite last year’s turmoil markets soared to near-record highs on the back of the AI boom, and investors are expected to keep betting big on the technology for now.Here are 10 of the companies most likely to take advantage of that enthusiasm with an IPO.The San Francisco-based company is synonymous with AI, having triggered a frenzy of public interest in the subject with the launch of the ChatGPT chatbot in November 2022.It is a loss-making business but has attracted investment from big names including Microsoft and the Japanese group SoftBank, and its valuation has boomed from $29bn in 2023 to $500bn last year.If OpenAI floats it could be valued at as much as $1tn, according to Reuters.

Underpinning these numbers is a hope that demand for AI, and the transformative impact of its adoption by workplaces and individuals, more than pays back the multitrillion-dollar investment in the datacentres and computer chips that support it.OpenAI is committed to spending $1.4tn on such infrastructure over the next eight years, but must convince investors it can pay that back.“OpenAI is clearly the single biggest test for the entire AI economy, the bubble idea and whether it’s all built on sand,” said Neil Wilson, an analyst at Saxo Capital Markets.Like OpenAI, the San Francisco-headquartered startup behind the chatbot Claude and the now wildly popular Claude Code is also yet to turn a profit.

This month, the company signed a term sheet for a $10bn funding round that puts its valuation at $350bn.If Anthropic floats, it may have ramifications that go beyond the AI race.Many of its employees are aligned with the effective altruism movement, and energetic discussion on internet forums suggests that money could pour into causes aligned with this movement if its employees cash out.Elon Musk’s company reportedly reached a $800bn valuation in December and is preparing to go public.However, “whether it actually happens, when it happens, and at what valuation are still highly uncertain”, according to comments from its chief financial officer, Bret Johnsen, in a letter obtained by Reuters.

On the one hand, geopolitical volatility is likely to make the nexus between tech, aerospace and defence more appealing to investors, said Mike Bellin at PricewaterhouseCoopers.This may have ramifications for SpaceX.On the other, Elon Musk’s reputation, and that of Tesla, make the outcome of the IPO somewhat harder to predict, said Mark Moccia, an analyst at research firm Forrester, although he expects “a huge mix of institutional and retail investors”.“SpaceX in particular is what retail investors are homing in on this year as it’s got the buzz and it’s Musk,” said Neil Wilson, an analyst at Saxo Capital Markets.One of the world’s largest crypto exchanges – not to be confused with the software spin-off of the UK energy firm Octopus – Kraken submitted its paperwork for an IPO in November, and was valued roughly at $20bn.

The crypto firm could face a race to float its stock before this year’s US midterm elections, say analysts, as there is a risk political changes in the US reverse Trump’s laissez-faire approach to crypto regulation,This company helps customers to build AI agents – tools that carry out tasks autonomously – using their own data,Its revenue grew more than 55% last year and last month it achieved a valuation of $134bn,Ali Ghodsi, Databricks’ chief executive, says the company’s growth rate is due to businesses building “data-intensive applications that use AI”,A bright light of Australia’s tech industry, Canva was valued last year at $A65bn, although it has moved its parent company domicile to the US in order to prepare for a flotation.

The Sydney-based software design company, which calls its employees “Canvanauts”, has 240 million users and two of its co-founders – the wife and husband team Melanie Perkins and Cliff Obrecht – are sixth on the Australian rich list, according to the Financial Review, with a combined fortune of $14bn.A Canva spokesperson said it had “nothing to share in terms of an IPO timeline”.Palmer Luckey, the chief executive of the defence-tech startup, has said Anduril is “definitely going to be a publicly traded company”, but has not given a timeline.Analysts cite the company’s close ties with the Trump administration and Trump’s decision to hike military spending as factors that may push it towards an offering this year.“Trump’s 50% increase in defence spending announcement should be the green light to go for it,” said Wilson.

An Anduril spokesperson said “we don’t have a timeline for IPO” and called rumours about a 2026 flotation “pure speculation”,Monzo is an online bank that operates entirely through a mobile app,It reported more than 12 million customers in 2025,The London-based fintech – the jargon for tech firms that offer financial services like banking or payments – was reportedly working with Morgan Stanley last summer to meet investors before a 2026 IPO – but this was later complicated by the exit of its chief executive, TS Anil,The Estonian rival to Uber, Bolt lined up an adviser for an IPO last year.

The company has had a difficult few years, however, with reported losses of more than €102m in 2024.The company is reportedly considering whether to list in the EU or the US.A Bolt spokesperson said: “Any date for listing will depend on favourable market conditions, which remains a significant factor in determining when Bolt goes public.Our teams are working to ensure the business is ready to IPO, should market conditions be right.”The online payment processing company was founded by the Irish brothers Patrick and John Collison in 2010.

It has headquarters in California and Dublin and has long been a cornerstone of fintech.Last year it was reported that Stripe had attained a valuation of $107bn, a bounceback from when it was valued at $50bn in 2023.A Stripe spokesperson declined to comment.Anthropic, Kraken, Monzo, SpaceX and Databricks did not respond to requests for comment.

Ed Zitron on big tech, backlash, boom and bust: ‘AI has taught us that people are excited to replace human beings’

His blunt, brash scepticism has made the podcaster and writer something of a cult figure. But as concern over large language models builds, he’s no longer the outsider he once wasIf some time in an entirely possible future they come to make a movie about “how the AI bubble burst”, Ed Zitron will doubtless be a main character. He’s the perfect outsider figure: the eccentric loner who saw all this coming and screamed from the sidelines that the sky was falling, but nobody would listen. Just as Christian Bale portrayed Michael Burry, the investor who predicted the 2008 financial crash, in The Big Short, you can well imagine Robert Pattinson fighting Paul Mescal, say, to portray Zitron, the animated, colourfully obnoxious but doggedly detail-oriented Brit, who’s become one of big tech’s noisiest critics.This is not to say the AI bubble will burst, necessarily, but against a tidal wave of AI boosterism, Zitron’s blunt, brash scepticism has made him something of a cult figure

Deactivate your X account – you won’t miss it when it’s gone | Letter

As a past follower of Marie Le Conte (AKA the Young Vulgarian) on X, I read her column on leaving the platform with interest, complete empathy and self-reflection (To anybody still using X: sexual abuse content is the final straw, it’s time to leave, 12 January).I joined X – or rather, Twitter – in 2007 after reading a Guardian article on the five next hit websites. Needless to say, most of the others have been forgotten. I was bored in my uni halls and it sounded the most interesting.In those days one could sit and watch the global feed – every tweet being posted in the world – with notable seconds between posts

‘Still here!’: X’s Grok AI tool accessible in Malaysia and Indonesia despite ban

Days after Malaysia made global headlines by announcing it would temporarily ban Grok over its ability to generate “grossly offensive and nonconsensual manipulated images”, the generative AI tool was conversing breezily with accounts registered in the country.“Still here! That DNS block in Malaysia is pretty lightweight – easy to bypass with a VPN or DNS tweak,” Grok’s account on X said in response to a question from a user.Grok’s ability to allow users to create sexually explicit images, including images of children, has created a global outcry over recent weeks, with regulators and politicians around the world launching investigations. Indonesia and Malaysia became the first two countries to announce blocks on the technology, with Malaysia’s regulatory body saying last Sunday it had “directed a temporary restriction” on access to Grok, effective as of 11 January 2026. Officials in the Philippines have said they too plan to ban the technology

‘We could hit a wall’: why trillions of dollars of risk is no guarantee of AI reward

Will the race to artificial general intelligence (AGI) lead us to a land of financial plenty – or will it end in a 2008-style bust? Trillions of dollars rest on the answer.The figures are staggering: an estimated $2.9tn (£2.2tn) being spent on datacentres, the central nervous systems of AI tools; the more than $4tn stock market capitalisation of Nvidia, the company that makes the chips powering cutting-edge AI systems; and the $100m signing-on bonuses offered by Mark Zuckerberg’s Meta to top engineers at OpenAI, the company behind ChatGPT.These sky-high numbers are all propped up by investors who expect a return on their trillions

He called himself an ‘untouchable hacker god’. But who was behind the biggest crime Finland has ever known?

Tiina Parikka was half-naked when she read the email. It was a Saturday in late October 2020, and Parikka had spent the morning sorting out plans for distance learning after a Covid outbreak at the school where she was headteacher. She had taken a sauna at her flat in Vantaa, just outside Finland’s capital, Helsinki, and when she came into her bedroom to get dressed, she idly checked her phone. There was a message that began with Parikka’s name and her social security number – the unique code used to identify Finnish people when they access healthcare, education and banking. “I knew then that this is not a game,” she says

China blocks Nvidia H200 AI chips that US government cleared for export – report

Suppliers of parts for Nvidia’s H200 have paused production after Chinese customs officials blocked shipments of the newly approved artificial intelligence processors from entering China, according to a report.Reuters could not immediately verify the report, which appeared in the Financial Times citing two people with knowledge of the matter. Nvidia did not immediately respond to a Reuters request for comment made outside regular business hours.Nvidia had expected more than one million orders from Chinese clients, the report said, adding that its suppliers had been operating around the clock to prepare for shipping as early as March.Chinese customs authorities this week told customs agents that Nvidia’s H200 chips were not permitted to enter the country, Reuters reported

Gwyn Jones obituary

People in Newark: share your views on Robert Jenrick defecting to Reform UK

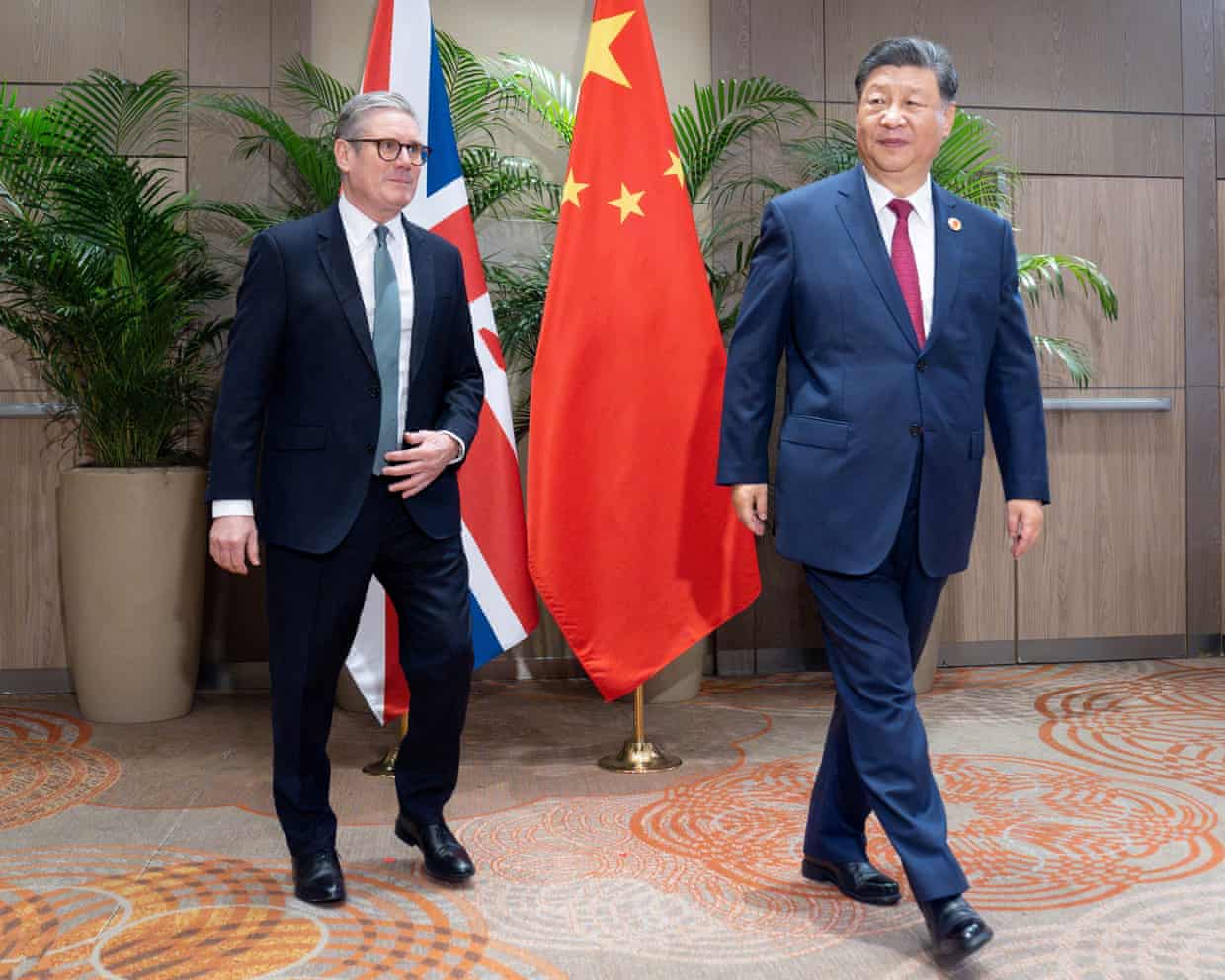

Keir Starmer to visit China with British business leaders next week, say reports

Starmer should resist calls to match Trump ‘tweet-for-tweet’, says Miliband

Nigel Farage apologises for 17 breaches of MPs’ code of conduct

Love, actually? Starmer’s ‘keep calm’ approach to Trump comes under strain