Nigel Farage apologises for 17 breaches of MPs’ code of conduct

Nigel Farage has apologised for 17 breaches of the MPs’ code of conduct after failing to declare £380,000 of income on time, saying he is an “oddball” who does not do computers.The Reform UK leader and MP for Clacton said he had relied on a senior member of staff to submit his income to the register of interests and had been let down, but he took full responsibility for the error.He blamed “severe growing pains” as Reform UK had been overwhelmed by administration and emails since growing in size and gaining MPs at the 2024 election.The interests included his work as a broadcaster for GB News and payments for social media output on Google and X.Farage, who is the highest-earning MP, has previously admitted breaching parliamentary rules by failing to register a trip to Florida to appear at a fundraising event for Donald Trump.

The Reform UK leader was the main speaker at the $500-a-head Republican party dinner in Tallahassee in March last year,After the latest investigation, Farage told the standards commissioner: “Why have payments that have gone into my account been delayed? Well, gross, gross administrative error,And I’m a little bit shocked by [it], especially as some payments were put in months after I had [provided them],“You may say: why don’t I enter those things myself? Well, I don’t do computers,I can come and fill in a register for you, but I don’t do computers.

So I rely on other people to do those things for me.I’m not, I’m afraid, computer literate, which makes me yet more an oddball than perhaps I was before.”He said there had been no intention to deceive anyone and that he had nothing to gain by late declarations.Farage also said that he had never been in any trouble with tax authorities, did not claim expenses, and that he was not making money out of being an MP – but that his income was earned “because I am Nigel Farage”.In his decision, Daniel Greenberg, the standards commissioner, found there had been a high number of breaches and that it was of high value, but he accepted that this had been inadvertent.

In his apology, Farage said: “I’m sorry,I apologise,I fully accept that I’m in the wrong in every way, because if your staff mess up, ultimately you’re responsible and that’s what happens with rank in life, whether you’re, you know, running a business or a member of parliament,”A Labour party spokesperson said: “Nigel Farage is so distracted with tempting failed Tory politicians into his party that he can’t even get the basics right,He isn’t on the side of working people – he’s just lining his pockets when he should be standing up for his constituents.

“He boasts about making money ‘because I’m Nigel Farage’, raking in millions through various outside jobs.But he neglects to do the important work that hard-pressed taxpayers fork out for him to do.“Labour will tighten the rules on MPs’ second jobs to make sure the public get the attention they expect and deserve from their elected representatives.”Keir Starmer, the prime minister, has also previously been found by the standards commissioner to have declared his financial interests late, leading to eight minor and inadvertent breaches of the code.

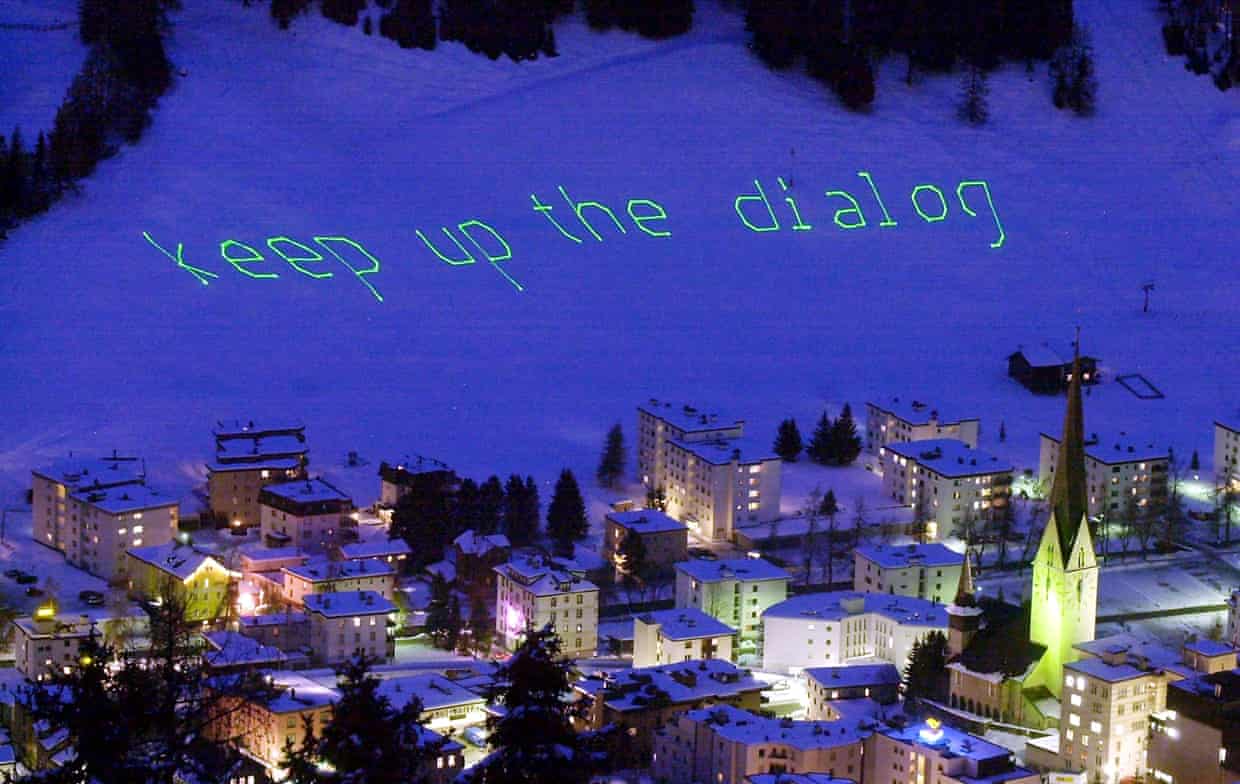

Archive: Davos – hot air in a cold climate

The Observer, 3 January 1971The cult of the management seminar is growing. So is the cost. Anyone with a finely developed sense of the ridiculous will welcome the news that in Davos, Switzerland, later this month 500 of Europe’s top businessmen will each pay about £700 to sit and learn at the feet of such mighty gurus as Herman Kahn and John Kenneth Galbraith.The first European Management Symposium, organised by the Geneva business school, Centre d’Etudes Industrielles, to celebrate its 25th anniversary, will cost each visitor £500 in registration fees, £100 for accommodation, plus travel (£53 fare from London). You can, of course, add a few pounds here and there for drinks and other sundries which businessmen require when they are away from home

JD Wetherspoon warns of lower profits as pubs hit by rising costs

JD Wetherspoon has warned of lower than expected half-year profits, as the pub chain revealed a £45m surge in costs driven by “higher than expected” bills for energy, wages, repairs and business rates.The bigger-than-forecast expenses in the 25 weeks to 18 January meant profits at Wetherspoons are now “likely to be lower” compared with the same period in 2024, said its chair, Tim Martin.Shares in the company dropped by more than 6% in early trading on Wednesday.The warning comes as pressure builds on British pubs, with a number of rising costs in recent years including higher employer national insurance contributions and increases in the minimum wage, energy costs and inflation.Higher bills meant one pub a day closed for good in England and Wales last year, according to analysis of government statistics by the tax specialist company Ryan

UK inflation rises for first time in five months to 3.4% in December

Inflation in the UK rose for the first time in five months to 3.4% in December, pushed up by higher air fares and tobacco prices.The Office for National Statistics (ONS) said the annual inflation rate increased from 3.2% in November after falling in October and flatlining in the previous three months. The figure overshot City economists’s forecasts of a modest rise to 3

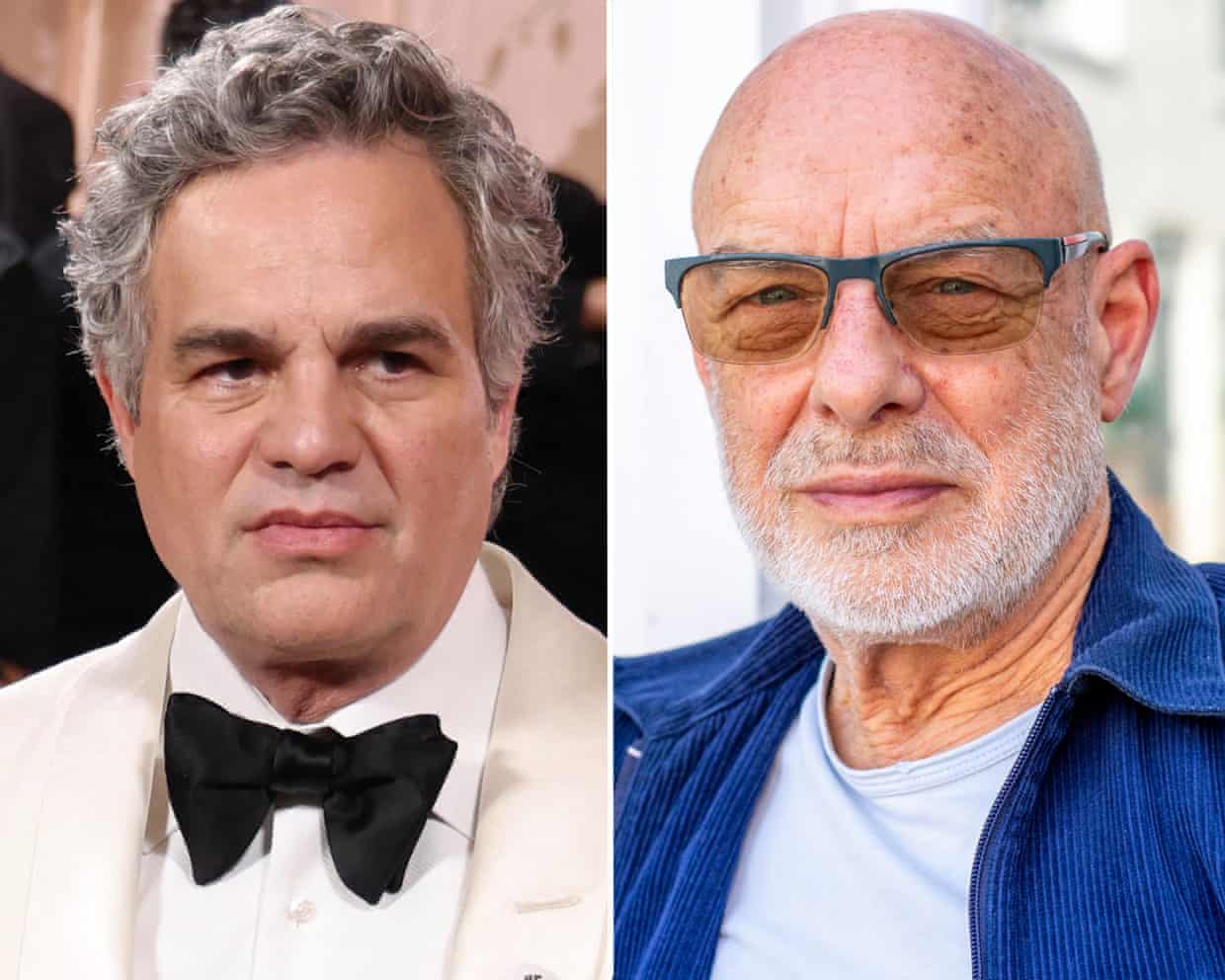

Nearly 400 millionaires and billionaires call for higher taxes on super-rich

Nearly 400 millionaires and billionaires from 24 countries are calling on global leaders to increase taxes on the super-rich, amid growing concern that the wealthiest in society are buying political influence.An open letter, released to coincide with the World Economic Forum in Davos, calls on global leaders attending this week’s conference to close the widening gap between the super-rich and everyone else.The letter, signed by luminaries including the actor and film-maker Mark Ruffalo, the musician Brian Eno and the film producer and philanthropist Abigail Disney, says extreme wealth is polluting politics, driving social exclusion and fuelling the climate emergency.“A handful of global oligarchs with extreme wealth have bought up our democracies; taken over our governments; gagged the freedom of our media; placed a stranglehold on technology and innovation; deepened poverty and social exclusion; and accelerated the breakdown of our planet,” it reads. “What we treasure, rich and poor alike, is being eaten away by those intent on growing the gulf between their vast power and everyone else

A stooge in the US Fed could blow out inflation in Australia – but Trump is unlikely to get his way

The Reserve Bank of Australia could lose some control over its ability to set interest rates independently if Donald Trump is successful in his bid to take control of the US central bank, experts warn.Ten days after the US Department of Justice announced a criminal investigation into the Federal Reserve’s chair, Jerome Powell, the supreme court on Wednesday will hear arguments in a legal case that will determine whether the president has the power to fire Lisa Cook, a member of the Fed’s board of governors.National Australia Bank’s chief economist, Sally Auld, said if the court upholds Trump’s efforts to sack Cook then that could spell the beginning of the end of the central bank’s independence.The consequences of Washington DC wresting control over monetary policy could be severe, and ultimately lead to higher inflation.It would likely trigger a crisis in confidence in the American currency and financial assets, such as stocks and bonds, Auld said, with ramifications for other central banks

Wall Street sees worst day since October after Trump tariff threats

Stock markets fell on both sides of the Atlantic on Tuesday, with Wall Street suffering its worst day since October, as investor concerns persisted over the fallout from Donald Trump’s push for US control of Greenland.The sell-off hit US stocks on the first day of trading in New York since Trump threatened new tariffs on eight European countries, after the market was closed for a public holiday on Monday. The S&P 500 closed down 2.1% while the Dow Jones finished down 1.8%

Nato chief urges ‘thoughtful diplomacy’ after US treasury secretary’s jibe at Denmark

Next buyout saves footwear brand Russell & Bromley but 400 jobs likely to be lost

Elon Musk floats idea of buying Ryanair after calling CEO ‘an idiot’

Tell us: has a chatbot helped you out of a difficult time in your life?

Australian Open 2026: De Minaur, Zverev, Tiafoe and Andreeva win, Raducanu out – as it happened

Mayfield claps back at former coach Stefanski and says Browns treated him like ‘garbage’