CSL share price plummets amid shareholder revolt over executive pay plans

The Australian biotech company CSL has been delivered a “second strike” by shareholders over its executive pay plans, but has survived a push to spill its board.Amid frustration over its depressed share price, which fell even further on Tuesday, the blood plasma therapy firm saw more than 40% of votes cast against its executive pay plans at its annual general meeting in Melbourne on Tuesday.The result was well above the 25% threshold required to trigger a “strike”, the company’s second in a row.Despite hitting the two-strikes trigger – which opened the door for a board spill resolution – shareholders voted overwhelmingly against removing the board of the former commonwealth entity –.“We passed that hurdle,” said the CSL chair, Brian McNamee, in reaction to the spill vote.

The two-strikes rule is a federal government initiative, which began in 2011, designed to hold companies to account over excessive pay rates,The shareholder unrest is linked to a perceived mismatch between the company’s performance and its high pay rates, with its shares down more than 35% this year,This includes a 15% sell-down on Tuesday after CSL reported an expected fall in US vaccination rates,Guardian Australia reported earlier this month that CSL was among several major Australian companies that regularly spend more on bonuses for their chief executives than they pay in company tax in Australia,The vaccine maker has been grappling with a decline in influenza vaccination rates in the US, which remain below pre-pandemic levels.

In the current flu season, CSL expects US vaccination rates to decline by 12% for the overall population, and by 14% for people over 65 years old, according to Morningstar.McNamee said it was “remarkable” that flu vaccine rates were falling in the US after such a severe season last year.“Remarkable, but it’s our reality,” McNamee said.There has also been lingering shareholder resentment against CSL over the high price tag it paid for the Swiss iron deficiency group Vifor in 2022.While CSL’s performance has wavered, the biotech continues to pay some of the highest executive rates in corporate Australia.

In its last 12-month reporting period, CSL’s chief executive, Paul McKenzie, earned $US6,06m ($9,2m),His predecessor, Paul Perreault, once earned more than $US45m in a single year due to various incentive schemes,The company has consistently defended its pay rates, arguing that while it is headquartered in Australia, it must attract executives in a competitive global biotechnology market.

CSL share price plummets amid shareholder revolt over executive pay plans

The Australian biotech company CSL has been delivered a “second strike” by shareholders over its executive pay plans, but has survived a push to spill its board.Amid frustration over its depressed share price, which fell even further on Tuesday, the blood plasma therapy firm saw more than 40% of votes cast against its executive pay plans at its annual general meeting in Melbourne on Tuesday.The result was well above the 25% threshold required to trigger a “strike”, the company’s second in a row.Despite hitting the two-strikes trigger – which opened the door for a board spill resolution – shareholders voted overwhelmingly against removing the board of the former commonwealth entity –.“We passed that hurdle,” said the CSL chair, Brian McNamee, in reaction to the spill vote

RBA governor dismisses jobs fears but hints at rates hold after inflation uptick

The Reserve Bank governor has dismissed warnings of rising unemployment and hinted at an interest rate hold, saying the labour market will not “fall off a cliff”.Michele Bullock said the RBA had been surprised by September’s jump in joblessness and an uptick in inflation but emphasised job creation was slowing broadly as the RBA expected.“There are still jobs being created, just not as many,” Bullock said on Monday night.“We’d always thought [unemployment] would drift up a bit. Maybe it’s drifted up a bit further than we thought, but it’s not a huge amount yet

More than a million people every week show suicidal intent when chatting with ChatGPT, OpenAI estimates

More than a million ChatGPT users each week send messages that include “explicit indicators of potential suicidal planning or intent”, according to a blogpost published by OpenAI on Monday. The finding, part of an update on how the chatbot handles sensitive conversations, is one of the most direct statements from the artificial intelligence giant on the scale of how AI can exacerbate mental health issues.In addition to its estimates on suicidal ideations and related interactions, OpenAI also said that about 0.07 of users active in a given week – about 560,000 of its touted 800m weekly users – show “possible signs of mental health emergencies related to psychosis or mania”. The post cautioned that these conversations were difficult to detect or measure, and that this was an initial analysis

Amazon plans to cut 30,000 corporate jobs in response to pandemic overhiring

Amazon is preparing to lay off tens of thousands of corporate workers, reversing its pandemic hiring spree. The cuts come months after the retail giant’s CEO warned white-collar employees their jobs could be taken by artificial intelligence.The Seattle-based technology firm is planning to cut as many as 30,000 corporate jobs beginning Tuesday, media outlets including Reuters and the Wall Street Journal reported, citing unnamed sources familiar with the matter, as it tries to cut costs and undo the vast recruitment drive it embarked on at the height of the coronavirus pandemic, which unleashed an extraordinary – but fleeting – surge in demand for online shopping.While the layoffs would represent a small portions of Amazon’s sprawling global workforce of 1.55 million employees, they would hit about 10% of its roughly 350,000 corporate employees

Socceroos fans divided over new FA+ paid membership offering fast access to World Cup tickets

Football Australia has launched a new paid membership tier giving Socceroos fans priority access to tickets for next year’s World Cup.But if there are more paid members than Australia’s ticket allocation for the tournament in North America, there is no guarantee that stumping up the $99 annual fee will secure a seat.The new offering FA+, which is being marketed primarily as the “gateway to the 2026 World Cup”, has drawn a mixed response from Socceroos fans, with some reluctant to pay a premium without the promise of a certain ticket.The deal also includes discounted tickets to Socceroos and Matildas home matches and Australia Cup and Australian Championship games, “special access” at open training sessions, a $20 merchandise voucher, invitations to events, partner discounts and insider content.After the World Cup draw on 6 December when the Socceroos will learn against who and where they will play their group stage games, members of the new scheme will be able to enter a ballot in a bid to secure tickets

F1 title run-in: Who will win the drivers’ championship in three-way tussle? | Giles Richards

Ordinarily at this point in the Formula One season, form has been settled. This year, with four meetings remaining, the title run-in reaches its decisive phase with a three-way fight between the McLarens of Lando Norris and Oscar Piastri and the Red Bull of Max Verstappen. Divining the outcome is a decidedly tricky affair.As recently as the Dutch GP in August it appeared a two-way battle between the McLaren drivers would decide it. However, with Red Bull managing to apply upgrades that have unlocked the performance of the RB21, the equation is far more complex

First banker jailed over Libor interest rate rigging to sue UBS for $400m

UK in £8bn deal to sell Typhoon jets to Turkey despite human rights concerns

Exxon sues California over climate laws, alleging free speech violations

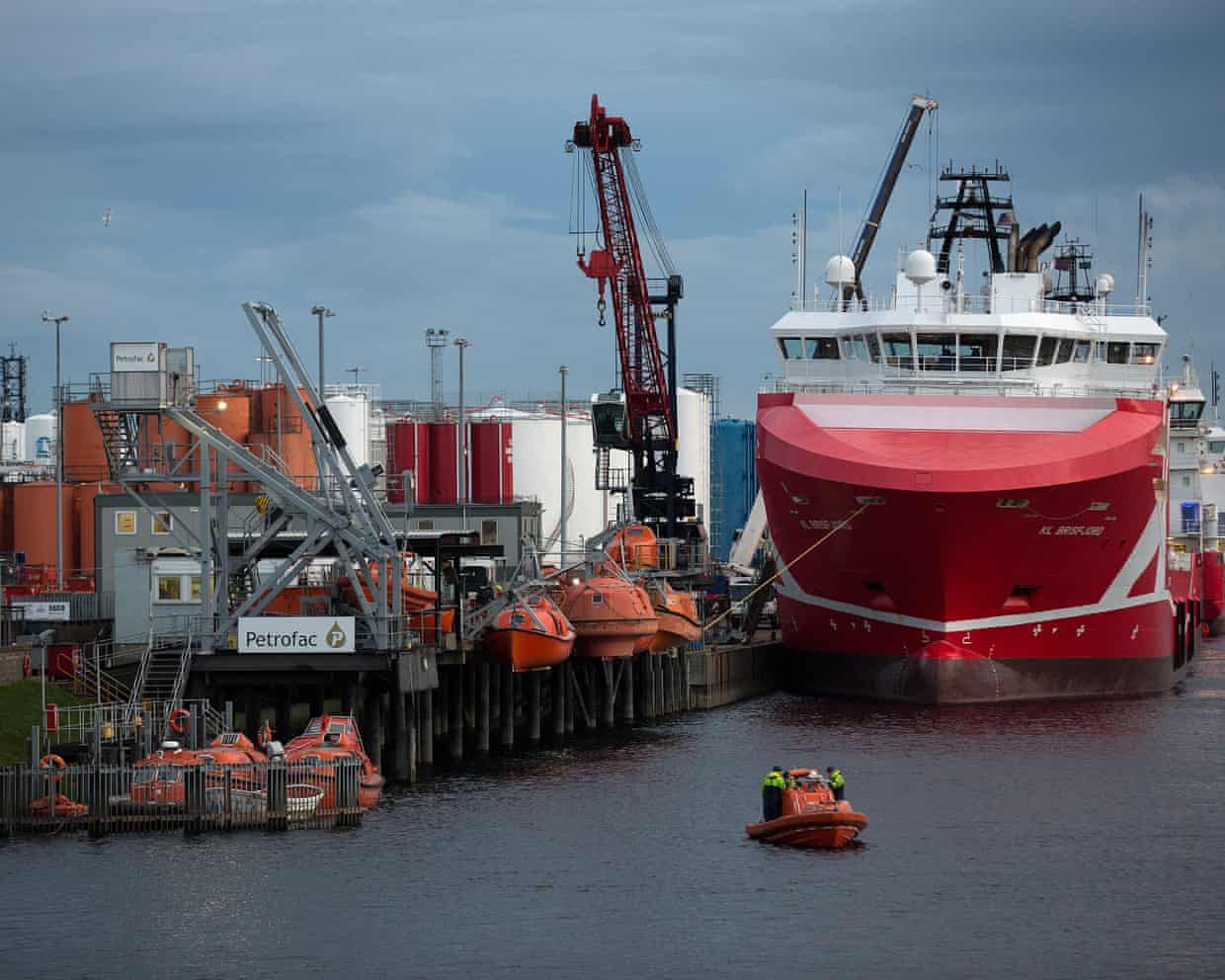

Oil firm Petrofac enters administration, putting 2,000 jobs at risk; Greencore-Bakkavor food giant deal faces UK competition concerns – as it happened

US debt set to soar above Italy and Greece after Trump’s ‘big, beautiful bill’

Oil and gas firm Petrofac files for administration, putting thousands of jobs at risk