Socceroos fans divided over new FA+ paid membership offering fast access to World Cup tickets

Football Australia has launched a new paid membership tier giving Socceroos fans priority access to tickets for next year’s World Cup.But if there are more paid members than Australia’s ticket allocation for the tournament in North America, there is no guarantee that stumping up the $99 annual fee will secure a seat.The new offering FA+, which is being marketed primarily as the “gateway to the 2026 World Cup”, has drawn a mixed response from Socceroos fans, with some reluctant to pay a premium without the promise of a certain ticket.The deal also includes discounted tickets to Socceroos and Matildas home matches and Australia Cup and Australian Championship games, “special access” at open training sessions, a $20 merchandise voucher, invitations to events, partner discounts and insider content.After the World Cup draw on 6 December when the Socceroos will learn against who and where they will play their group stage games, members of the new scheme will be able to enter a ballot in a bid to secure tickets.

“Access will be based on supply and demand, and all eligible FA+ members will have an equal opportunity to participate,” according to FA.The new tier has received a mixed response from fans.The most popular comment on the Socceroos’ Instagram post announcing the scheme was: “Nobody wants this lol.”Others questioned the attractiveness of discounted national teams tickets if there were few home matches in the coming year, or they weren’t held in certain cities.Some were even more negative, describing the move on social media as a “cash grab”.

One stated: “Nope,Not paying a premium just for early bird access,”To pre-empt possible disappointment, FA is promoting the membership’s other features,“Even if you miss out on tickets, your FA+ membership still delivers value through to 31 October 2026,” it states, listing benefits such as discounted tickets, access to exclusive events, merchandise savings and “priority opportunities for future marquee matches”,Although the approach has drawn criticism from fans, some were always going to be left disappointed by the World Cup ticket allocation process.

Fifa has allocated FA 8% of sellable stadium capacity per match to sell to national team supporters, and there are more than 400,000 members on FA’s free membership tier,Sign up to Australia SportGet a daily roundup of the latest sports news, features and comment from our Australian sports deskafter newsletter promotionFA has also flagged more membership tiers are coming,“Football Australia is continuously reviewing feedback and demand, and additional membership tiers are being planned for future phases,” a frequently asked questions (FAQ) document provided by FA states,“These may include enhanced benefits or tailored packages to suit several types of fans,”The FAQ also states FA is “currently working on official travel packages” which “will be shared with FA+ members once confirmed”, though it notes “packages are not guaranteed and are subject to availability and third-party terms”.

The governing body recorded an $8,5m loss last financial year,

First banker jailed over Libor interest rate rigging to sue UBS for $400m

Tom Hayes, the first banker jailed over Libor interest rate rigging, is suing his former employer UBS for $400m (£300m), claiming he was a “hand-picked scapegoat” for the Swiss bank as it tried to avoid regulatory scrutiny.The claim, which was publicly filed in a US court in Connecticut on Monday, alleges that UBS misled US authorities and called him an “evil mastermind” behind the alleged Libor scandal, in order to protect senior executives and minimise fines.Hayes spent five and a half years of an 11-year term in prison after he was accused of being a ringleader in a vast conspiracy to fix the now defunct London Interbank Offered Rate (Libor), which was used to price trillions of pounds worth of financial products, between 2006 and 2010.The wider scandal, which erupted in 2012, led to fines of almost $10bn for a dozen banks and brokerages. Hayes maintained his innocence and claimed during his original trial that he was taking part in an “industry-wide” practice, accusing regulators of making him a scapegoat

UK in £8bn deal to sell Typhoon jets to Turkey despite human rights concerns

Britain has agreed to sell 20 Typhoon fighter jets to Turkey in an £8bn deal despite concerns about alleged human rights violations by its government.Keir Starmer signed the deal during a visit on Monday to Ankara to meet the country’s president, Recep Tayyip Erdoğan. The prime minister said the deal would boost the Nato alliance, despite criticism of Turkey’s increasingly authoritarian administration.The deal was signed as Erdoğan’s jailed chief political opponent, Ekrem İmamoğlu, faced fresh charges including alleged links to British intelligence.The jet, also known as the Eurofighter, is a joint project between the UK, Germany, Italy and Spain, and has been one of the Royal Air Force’s key aircraft for two decades, including in Iraq, and intercepting Russian planes since Moscow’s full-scale invasion of Ukraine

Exxon sues California over climate laws, alleging free speech violations

Exxon, an oil firm consistently ranked among the world’s top contributors to global carbon emissions, is suing the state of California over two climate-focused state laws, arguing that the rules infringe upon the corporation’s right to free speech.The 2023 laws, known collectively as the California Climate Accountability Package, will require large companies doing business in the state to disclose both their planet-heating carbon emissions and their climate-related financial risks, or face annual penalties.The laws would thereby force Exxon to “serve as a mouthpiece for ideas with which it disagrees”, says the lawsuit, filed in the US district court for the eastern district of California on Friday.Asked for comment, Exxon referred the Guardian to the lawsuit. The state of California was not immediately available for comment

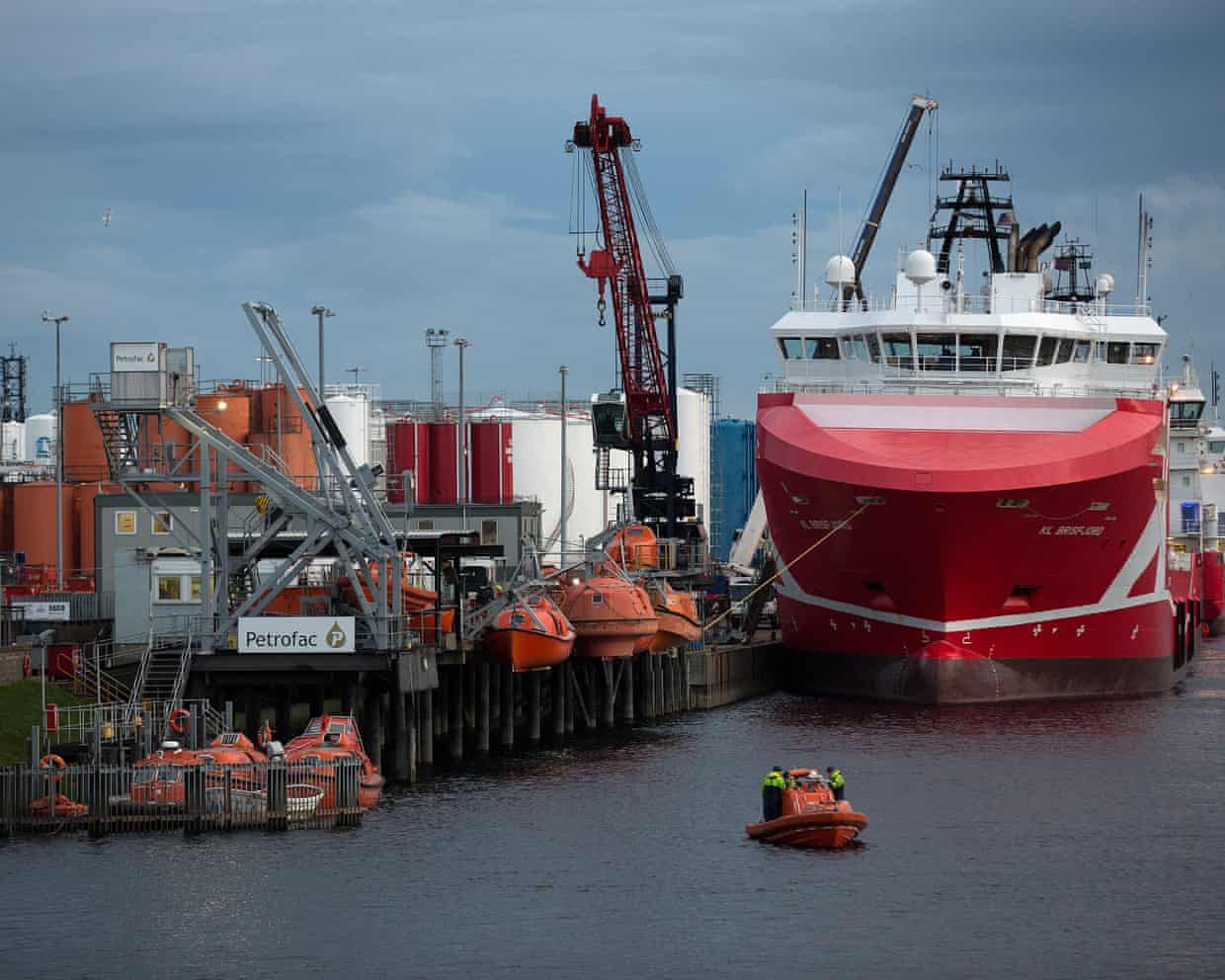

Oil firm Petrofac enters administration, putting 2,000 jobs at risk; Greencore-Bakkavor food giant deal faces UK competition concerns – as it happened

Time to wrap up.Wall Street shares have scaled new all-time highs, as rising expectations of a US-China trade deal encouraged risk-taking by investors, in a week dominated by Big Tech results and a widely-expected Federal Reserve interest rate cut on Wednesday.The tech-heavy Nasdaq rose by 1.6%, the Dow Jones gained 0.5% and the S&P 500 climbed by nearly 1%

US debt set to soar above Italy and Greece after Trump’s ‘big, beautiful bill’

Donald Trump is on course to push US debt levels above those of Italy and Greece by the end of the decade after wide-ranging tax cuts and increased defence spending, according to International Monetary Fund (IMF) forecasts.Illustrating the rising debt levels in Washington and efforts made by Rome and Athens to bring spending under control after the 2008 financial crash and Covid-19 pandemic, the IMF predicts the US will see its debts climb from 125% to 143% of annual income by 2030, while Italy’s will flatline at about 137%.Greece is on track to cut the ratio of debt to gross domestic product (GDP) from 146% to 130% over the same period. According to IMF data, Athens has tackled a budget overspend that raced to 210% as a proportion of GDP in 2020.Amid tax cuts for high earners, the US is expected to run annual budget deficits of more than 7% over the next five years, while Italy is due to cut its spending shortfall this year to 2

Oil and gas firm Petrofac files for administration, putting thousands of jobs at risk

Petrofac, one of the biggest North Sea oil and gas contractors, has filed for administration, putting more than 2,000 jobs in Scotland at risk.The energy services provider said it had applied to the high court of England and Wales to appoint administrators, after it lost a major offshore wind project over its failure to meet contractual obligations.Petrofac, which employs about 7,300 people globally, said the administration plans – likely to be carried out by the business services firm Teneo – applied only to its ultimate holding company and that it would continue to trade during the process.Nevertheless, any uncertainty over the company’s continued viability could add to political pressure on the UK government, as it faces a backlash over plans to tackle the climate crisis by blocking new North Sea oil licences for exploration.Energy secretary Ed Miliband’s department said on Monday it was leading efforts across “all parts of government” to support Petrofac’s UK arm, which it employs about 2,000 people at its North Sea hub in Aberdeen

Cheltenham festival switch to Saturday a gamble not worth taking

‘I’m making it work’: Lando Norris confident he is finally getting to grips with his McLaren

England look to dodge lightning strike after familiar crumble in opening ODI

The old man and the mirror: Aaron Rodgers meets the quarterback he used to be

Crunch time nears for Australia as selectors try to fit Ashes batting puzzle pieces together | Martin Pegan

‘I could have killed them’: Lawson’s fury after narrowly missing hitting marshals