How the FTSE 100 ‘dinosaur’ roared back to life | Nils Pratley

It was a bumper year for stock markets globally and the surprise, perhaps, is that the FTSE 100 index more than kept up,The London market has sometimes been derided as lacking dynamism – the hedge fund manager Paul Marshall called it the “Jurassic Park” of exchanges a few years ago – but its main index enjoyed its best 12 months since 2009,The Footsie didn’t quite make it to the round number of 10,000 but still improved by 21,5%, slightly outperforming the S&P 500 index in the US,How did that happen amid weakening UK growth, pre-budget chaos and general gloom? The short answer is that a stock market index reflects only its constituent parts.

It is not a symbol of national economic virility,That is especially true of the internationally flavoured Footsie, whose members make about three-quarters of their combined revenues overseas,The tale of 2025 was one of helpful breezes blowing through many of the most important sectors,Defence stocks enjoyed commitments by Nato’s western European members to spend more heavily on equipment,That assisted companies such as Rolls-Royce, whose remarkable run has taken the shares from sub-100p in 2022 to £11-plus today.

Banks have had near-perfect conditions of low defaults and falling interest rates.The bill (for some) from the car finance scandal was brushed off easily.Global mining companies, which are still a significant slice of the Footsie, enjoyed the gold-inspired rally in everything related to precious metals plus the demand for copper that comes with energy transition and electrification.The best-performing share in the index was Fresnillo, a Mexico-based silver miner, up almost fivefold.Over in pharmaceuticals, Donald Trump’s bark on tariffs and prices proved worse than his bite.

AstraZeneca, the most valuable component of a value-weighted index, rose almost 30%.Meanwhile, National Grid and SSE, two heavyweights in UK energy infrastructure, benefited from regulatory funding for the upgrade of the transmission network.Virtually the only “problem” stock at the top end of the index was Diageo, the Johnnie Walker and Smirnoff drinks maker, which was mired in the related issues of a weak global spirits market and boardroom upheaval.Sue Noffke, the head of UK equities at the fund manager Schroders, makes the point that the Footsie’s rise should not be viewed purely as a one-year phenomenon.Go back three years and the average investment return including dividends has been 14% a year for a cumulative return of 48%.

A cheap starting point is obviously one factor,Even as late as spring 2024, the Footsie was priced at just under 10 times its predicted earnings for the next year, extremely low by historical standards,Noffke also highlights corporate self-improvement – “companies doing it for themselves” – and the role of share buybacks,There is a long list of companies that can be seen as getting stricter in their capital allocation in pursuit of better returns, and being prodded by shareholders to do so,Unilever demerged its ice-cream division as Magnum in 2025, echoing GSK’s separation of its consumer products division as Haleon in 2022.

The industrial heavyweight Smiths Group is breaking itself up.BP, after years of flip-flopping, is “pivoting” away from its low-return renewables investments.Anglo American has engaged in a multiyear restructuring that ended in a well-received $50bn (£37bn) merger with the Canadian rival Teck Resources.AB Foods is contemplating splitting the discount retail chain Primark from its food and ingredients businesses.The buyback angle represents a shift in thinking in London.

In the old days, dividends were a priority, which was why a core part of Marshall’s dinosaur thesis was that London’s fund managers are obsessed with income rather than growth.Now buybacks, which offer more bang for the same buck when – critically – the shares are cheap, are a greater part of the mix.In any case, the idea that UK investors set the tone is probably out of date: US funds own more of the Footsie than the locals these days.Noffke calculates that 55% of larger UK companies have bought back at least 1% of their shares in the past 12 months, compared with 40% in the US.Shell has bought back more than 20% of its equity since 2020, for example.

“The UK stock market has moved on from being the dividend yield capital of the world,” she argues.“It’s still attractive on dividend income, but it’s not so standout.It has now moved to become the share buyback capital of the world.”Therein – maybe – lies a path for an image overhaul for the London stock market.The old complaints about the dearth of new arrivals and the lack of whizzy US-style tech and AI stocks are still heard.

But investors ultimately care about valuations and returns.Noffke puts the appeal of the UK market like this: “We have a different sectoral mix that is not dependent, or wholly dependent, on an AI thematic.We are cheap.We are cash rich.We’re buying a lot of shares back, and are quite shareholder friendly.

And we’re seeing a lot of companies that, through a combination of top-down from management and bottom-up from the investor base, are showing more grip and more ambition,”The Footsie still has to keep going in the same fashion,The concentration in its makeup at the top end could work against it if a few important sectors go into reverse; and the relative lack of tech stocks may eventually become a bigger problem,But 2025 continued a good run,The dinosaur isn’t extinct yet.

Nigel de Gruchy obituary

The trade union leader Nigel de Gruchy, who has died aged 82, always insisted on putting the interests of the teachers he was elected to represent ahead of those of the pupils in the classrooms where they taught. While this approach was both logical and defensible for a trade unionist, it was also one that inevitably provoked controversy.Such an outcome did not normally deter De Gruchy, who relished the prospect of a public ding-dong, recognising that the resultant publicity might quite possibly enhance his chances of success in whatever cause he was then pursuing. It did not make him popular in Westminster or Whitehall, but he won some important political and legal battles that would significantly improve the lives of school teachers.These included, shortly after De Gruchy became general secretary in 1990 of the amalgamated National Association of Schoolmasters/Union of Women Teachers (NASUWT), helping to persuade John Major’s government to establish a teachers’ pay review body

From Send to single-sex spaces: key tests facing Keir Starmer in 2026

Keir Starmer will begin his second full year in Downing Street as one of the least popular ever prime ministers – a spectacularly rapid reversal from his landslide election win of just 18 months ago.Yet Starmer believes this will be the year things start to improve for his beleaguered premiership and fractious Labour party.His chief of staff, Morgan McSweeney, recently told special advisers gathered in Downing Street that 2026 would be “the year of proof” when Labour begins to show voters that the change they voted for in 2024 is being delivered.Starmer will start the year with a speech on the cost of living, flagging recent interest rate cuts and the abolition of levies from energy bills as signs that life is becoming more affordable.But he faces a number of potential pitfalls in the year ahead that could end up defining his premiership

Badenoch under fire as Tory shadow attorney general acts for Roman Abramovich

Kemi Badenoch is under pressure to act on the revelations that her shadow attorney general is representing the Russian oligarch Roman Abramovich, despite UK sanctions against him.David Wolfson, a Tory peer, is part of the legal team representing Abramovich as he attempts to recover billions in frozen assets he owns in the Channel islands.Abramovich is caught up in a legal battle with the government of Jersey after it launched an investigation into the source of more than £5.3bn of assets linked to him and held there.Ministers have said that the case in Jersey is delaying the release of £2

‘We have to go’: longest-serving lord reflects on looming Labour eviction

At the age of 84, David Trefgarne is not the oldest active peer in the House of Lords. But now well into his 64th year in the upper house, he is very much the longest serving. And in the next few months, it will all end.The 2nd Baron Trefgarne, to use his formal title, is one of the few hereditary peers still helping to make UK law, the tail end of a legislative chain dating back to the 13th century and Magna Carta. When one of these laws, the House of Lords (hereditary peers) bill, receives royal assent some time in the spring, that will be that

Unite leader tells Labour to ‘stop being embarrassed’ to be voice of workers

Unite’s general secretary, Sharon Graham, has told the government it must do more for workers in 2026 or risk sowing the seeds of its own destruction.Graham accused Labour of being preoccupied with its “failing leadership” and described the debate about who might replace Keir Starmer as inevitable.Writing in the Times, she said: “For too long it has been everyday people, workers and communities who have paid the price for crisis after crisis not of their making. In 2026 this must stop. The government needs to decide what it stands for and who it stands for

‘Zack is a phenomenal leader’: Siân Berry on the Green party’s next steps as membership doubles

“Someone has to be out there making the narrative for social security. Someone has to fight the corrosive attitudes to people on benefits,” says Siân Berry, who has just finished her first year as a Green MP in the House of Commons.She is speaking to the Guardian in her Brighton constituency office, formerly occupied by the legendary Caroline Lucas who flew a lone flag as the only member of parliament for the Green party for 14 years.Now, however, there are four MPs including Berry, battling together, she says, to hold the space for the left at a moment when it feels the far right has hypnotised the entire political body. “Often Adrian [Ramsay, MP for Waveney Valley] is the only one bringing up animal welfare in Defra questions, or Carla [Denyer, MP for Bristol Central] will be the only person arguing for a refugee’s right to work to the Home Office

Huge rise in number of people in England’s A&Es for coughs or hiccups

‘Absolutely frightening’: surge in ketamine cases hits urology wards in England and Wales

Offenders in England and Wales to have alcohol levels tracked over new year period

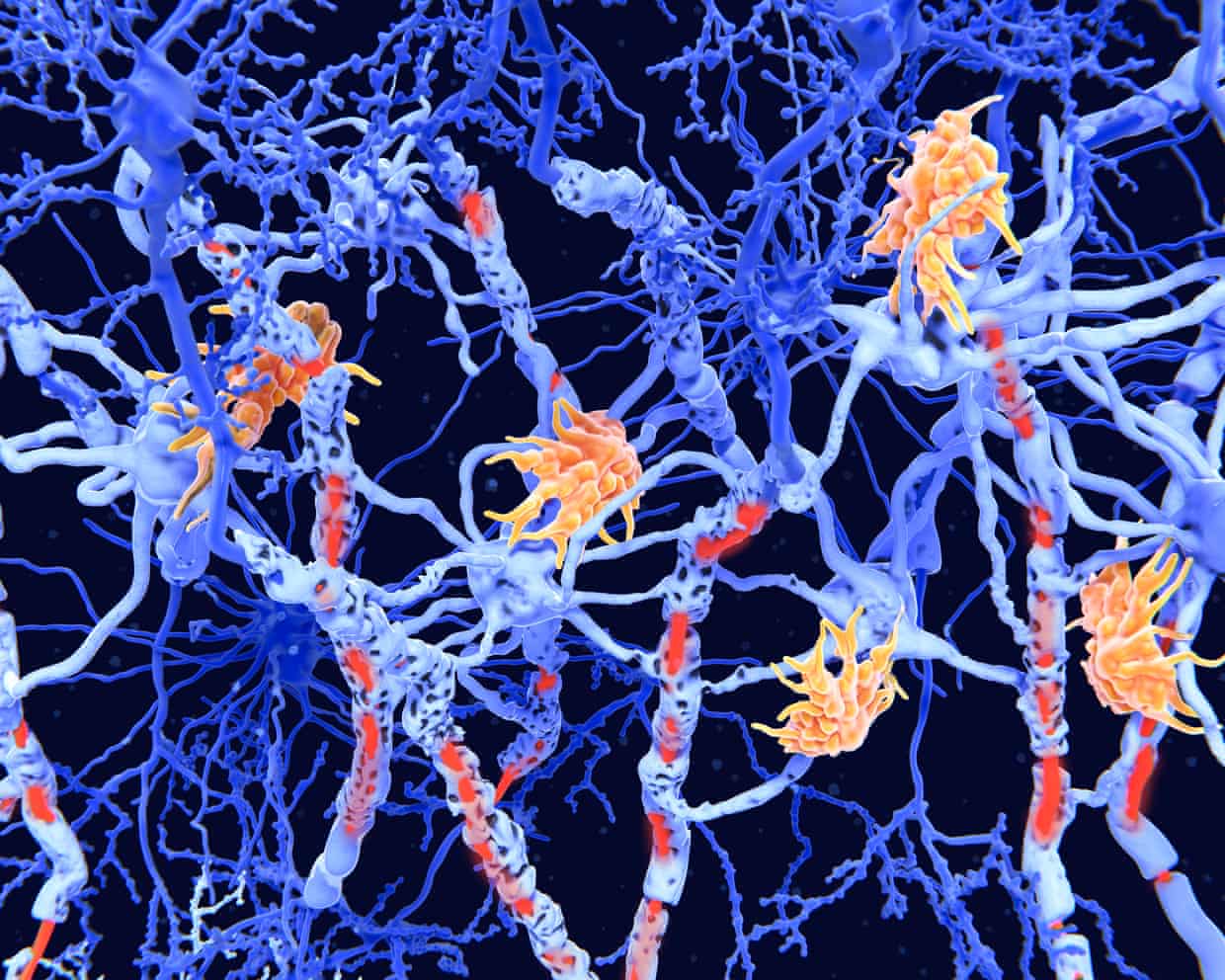

Two new subtypes of MS found in ‘exciting’ breakthrough

A&Es in ‘big trouble’ because of ‘normalised’ corridor care, says leading UK medic

From Adolescence to the manosphere: has 2025 been the year of the boy?