The easy thing for the RBA to do next week is raise rates. The smart move is to wait | Greg Jericho

There is a kind of sickness in Australia’s coverage and discussion about the economy – an obsession that interest rates need to do something.Go up, go down – anything! Unemployment fell, interest rates must do something (apparently fewer people being out of a job is bad and needs to be cured).Oh no, inflation went up in one month – we need interest rates to do something!!We see this as well with investors – or let’s be honest, speculators – who are determined that interest rates will go up next week.Even before the December CPI figures were released, investors were betting (and that is all it is) that there was a 58% chance the Reserve Bank of Australia would increase rates on 3 February:If the graph does not display click hereAfter the figures were released, showing inflation rose from 3.4% in November to 3.

8% in December, the market moved to price in the chances of a rate rise at closer to two chances in three,The Australian dollar also had a bit of a bump,This is because international investors who think rates will go up need to buy Australian dollars in order to buy Australian bonds and other financial instruments that will start getting higher interest returns,So, when more people want Australian dollars, the “price” (or exchange rate) goes up,Since the December unemployment figures showed a big drop in unemployment to 4.

1%, investors have been betting a rate rise is coming.If the graph does not display click hereThe December inflation figure of 3.8% would suggest this as well – especially as in December alone, inflation rose a pretty huge 1%:If the graph does not display click hereBut let’s look at that 1% jump.If you are thinking that seems a bit big – perhaps even bigger than you experienced – well, you are probably right.International holidays and travel accounted for 71% of all of the inflation in December, and domestic holidays accounted for another 26%.

If the graph does not display click hereSo large was the contribution of holiday prices, that if you removed those from the overall figures, inflation in December rose just 0.02%, and the annual growth of inflation would have remained steady:If the graph does not display click hereNow, that does not mean that the RBA will put its feet up and decide things are sweet.Even without holiday travel, inflation of 3.3% is higher than it would like.But it does suggest that the bank really should not get too excited about these figures.

Over the past year, the big driver of inflation was international holidays and also electricity,However, while electricity accounted for about 10% of all the increase in inflation in the past year, almost all of it was due to the removal of energy subsidies in Perth and Brisbane,If the graph does not display click hereElectricity prices in Brisbane in December 2025 were 456% higher than they were a year earlier – because in December 2024 the state energy subsidies were in place,Similarly, in Perth, apparently electricity prices rose 75%, whereas again it was just the impact of the state subsidies,Removing the big erratic items of holidays and electricity, annual inflation peaked in October at 3.

1% and in both November and December it steadied at 3,0%,Now obviously you can play around with the numbers to get whatever result you like, but it does show the danger for the RBA (and any speculators) being fixated on the overall number and not looking more closely,The Reserve Bank will examine the old quarterly figures as well,These showed CPI in the December quarter rise a modest 0.

6%, while the trimmed mean (or underlying) inflation rose 0,9%,The annual figures for both increased, but again this was due to electricity subsidies – as the old figures included them; the latest ones do not,So what will the RBA do next week? The easy thing is to raise rates,There are plenty of economic and financial chin scratchers around who love the idea of higher interest rates.

If they raise rates they will get little criticism – after all the market wants them to raise rates.But there is no sign that wages are taking off, even though unemployment is below 4.5%.Indeed, the latest job vacancy figures suggest that it is getting harder to find work, not easier – and that suggests wage growth will also keep slowing.If the graph does not display click hereThe easy thing for the RBA to do is raise rates, point to the overall inflation figures and hope no one looks any further.

The smart move is to look closer, and wait.Greg Jericho is a Guardian columnist and chief economist at the Australia Institute

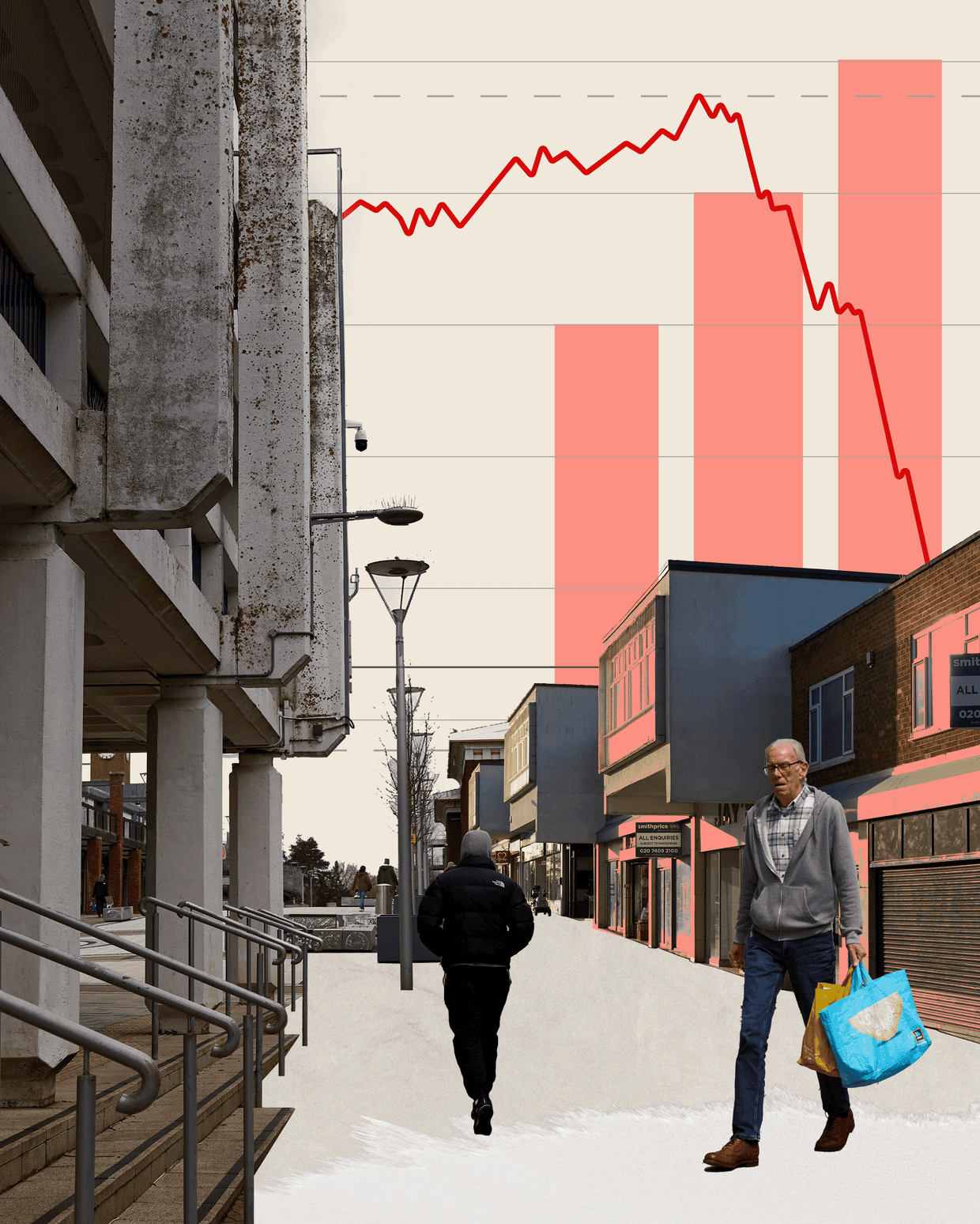

‘You’d be ashamed to bring someone here’: The struggling billionaire-owned high street that shows Reform’s road to No 10

Under blue skies and bunting, the whole of County Durham seemed to turn out for the young Queen Elizabeth II. They lined the streets in their thousands, waving flags and marvelling at the grand royal procession weaving past their newly built homes.It was 27 May 1960 and the recently crowned queen was officially opening the town of Newton Aycliffe on her first provincial tour after the birth of her third child, Andrew Mountbatten-Windsor, three months earlier. A 16-page commemorative pamphlet, priced at two shillings and sixpence, records the local Light Infantry buglers playing to the giddy crowd.The message was clear: Newton Aycliffe, a town built from scratch from the rubble of the second world war, heralded a new postwar Great Britain, a country that would give its people a modern, prosperous quality of life, free from the squalor of its bomb-scarred cities

Seven out of 10 UK mothers feel overloaded, research reveals

Seven out of 10 mothers in the UK feel overloaded and almost half have a mental health issue such as anxiety or depression, new research has revealed.The survey of mothers’ experiences in 12 European countries also found that most of those in Britain still do the majority of household tasks and caregiving work alone, and that the UK was among the worst for motherhood disadvantaging a woman’s career.The grim picture that emerged from the report, by the pan-European campaign group Make Mothers Matter, prompted calls for GPs and NHS maternity and health visiting services to routinely ask mothers about their mental wellbeing and provide much more help to those who need it.Make Mothers Matter surveyed 800 mothers in each of 12 European countries about the psychological impact of giving birth and dealing with the pressures of motherhood.It found that:71% of UK mothers feel overloaded – 4% more than the 67% European average47% of UK mothers suffer from mental health issues, including burnout, compared with 50% in Europe as a whole31% of UK respondents felt motherhood had a negative effect on their career, higher than the 27% average, with Ireland the highest on 36%However, it also found some measures by which mothers in the UK find it easier to balance work and caring

‘Keep slaying the dragon inside’: Simon Armitage pens poem for World Cancer Day

Cancer is a subject the poet laureate Simon Armitage has always shied away from. “I find it very daunting,” he said. “I’ve lost friends and family to cancer.”But when he was commissioned to write a poem to mark World Cancer Day, he was forced to confront the realities of the disease. “I think I saw part of my task as being slightly demystifying and maybe de-mythologising or de-demonising cancer a little bit to myself,” Armitage said

Pressure grows on ministers to end secrecy over UK medicines deal with Trump

Ministers are under growing pressure to end the “secrecy” around the UK’s deal with the US over the cost of medicines, which critics claim is “a Trump shakedown of the NHS”.MPs from Labour and several opposition parties want the government to publish its impact assessment of the agreement it reached last month with Donald Trump’s administration.Under the deal the UK will pay more for new medicines and let the NHS spend more on life-extending medicines in return for British pharmaceutical exports to the US avoiding tariffs.The deal has prompted concern among health experts that it could cost the UK government and the NHS billions extra a year to fulfil those pledges by the end of the deal in 2035.A cross-party group of Labour, Liberal Democrat, Green and SNP MPs is meeting on Wednesday evening to discuss how to compel Wes Streeting, the health secretary, and Peter Kyle, the business and trade secretary, to publish the government’s assessment of how the deal could affect the UK

Government row breaks out over plan to cut spending for PE in England’s schools

A row between government departments has broken out after the Department of Health and Social Care (DHSC) proposed cutting all its funding for physical education in schools.The DHSC is now intending to restore the funding despite insisting privately for weeks that it would end its contribution. Ministers are understood to have overruled the cuts, it emerged after the Guardian contacted the department.The Department for Education (DfE) is also planning cuts to PE from its own budget before changes in the next curriculum review. It is hoped that the changes – which will guarantee at least two hours of PE – will involve partnerships with sports bodies that will deliver some efficiencies

George Harrison’s old house has an interesting backstory | Letters

Peter Bradshaw missed out an important cultural feature of Letchmore Heath (‘The Village of the Damned was shot here – then George Harrison bought a house’: our UK town of culture nominations, 23 January). Before Piggott’s Manor was sold to George Harrison, it was the preliminary training school of St Bartholomew’s hospital in Smithfield, London, where 18-year-old would-be nurses spent three months before being let loose on real patients – learning how to bandage, give bed baths and change bed sheets with the “patient” still in it (practising on each other), give injections (into oranges), present food in an appetising way and – most importantly – to clean.Following this three-month period, we spent the next two-and-three-quarter years on the wards (as a form of apprenticeship) doing actual nursing work of greater complexity and responsibility. A far cry from the major cultural shift of today’s nurse training spent in universities and on placements.Dr Liz Rolls-FirthCheltenham, Gloucestershire

Even more energy suppliers are short of capital. Ofgem needs to toughen up

Federal Reserve holds interest rates as Trump piles on pressure

Artificial intelligence will cost jobs, admits Liz Kendall

US TikTok users: tell us how you feel about the app after the new US deal

ICE agents expected to be deployed for Super Bowl in California, officials say

Patrick Reed quits rebel LIV Golf tour in latest blow to Saudi-backed breakaway