Coles’ shameless ‘Down Down’ promotions have been exposed. So why aren’t they even trying to rebuild trust? | John Quiggin

Like millions of Australians, I shop at Coles.I’m not as careful as I should be, but I try to buy things advertised as being discounted, or on special.But after following a recent case before the federal court, I’ll be checking my old receipts before accepting such claims.In particular, I’ll be avoiding “Down Down” promotions.On the evidence before the court, such promotions are routinely used as a way of implementing price increases.

The facts of the case are simple and apparently uncontested.One example is particularly striking.Over a period of nearly a year, Coles offered a 1.2kg loaf of Nature’s Gift wet dog food for $4.Then, for seven days, the price rose by 50% to $6.

On the eighth day the price was set at $4.50, more than customers had been paying for all but seven of the previous 303 days, with Coles labelling the product “Down Down”.Sign up: AU Breaking News emailThe only unusual feature of this path to higher prices was the short duration of the large increase.According to Coles’ lawyers, the more common pattern was to raise the price for six to 12 weeks, then partially reverse the increase and advertise “Down Down”.As the evidence regarding deals with Arnott’s makes clear, this strategy is planned in advance as a way of raising prices without upsetting consumers.

In their defence, Coles claimed that Woolworths’ “Prices Dropped” program (the subject of a separate ACCC case) was even worse,More broadly the defence was that consumers were incapable of understanding the many complexities of pricing decisions,But most of us are capable of understanding the idea that taking prices two steps up then moving them one step down still leaves them higher,Whatever the outcome of the court case, it’s hard to believe that Coles will be able to get away with “Down, Down” promotions in future, even if they are genuinely reducing prices,In the long run, then, it seems as if this kind of sharp practice should be self-defeating.

The banks, for example, have spent years trying to shake off the bad reputation they built up for hidden fees and charges in the years leading up to the financial services royal commission.Woolworths and Coles are big companies that plan to stay around for a long time.Could not one or both of them commit to a policy of truthful advertising and stand by it long enough to establish a reputation that customers could trust?This hasn’t happened – with supermarkets, or telecoms, or banks or anywhere else, at least in the absence of comprehensive public shaming driven by government action.But why not?One explanation, apparent from the evidence in the Coles case, is that no one wants to be the first to move.Given the short-term pressure that decision-makers are under, it’s easy to imagine that any proposal of this kind will be put in the too-hard basket and left there.

Another possibility is that distrust is so widespread that no single company can break the pattern,The era of neoliberalism has certainly strengthened this distrust,There was a time when used car dealers were famously untrustworthy but financial institutions were pillars of probity,Today, when buying a second-hand car, the biggest risk is not that the speedo will be wound back but that you will be sold a loan with deceptively high interest,In this context, you just assume everyone is lying.

The final, gloomy, hypothesis is that Coles’ lawyers are right, and that we are proving the wisdom of HL Mencken’s observation that “No one in this world, so far as I know … has ever lost money by underestimating the intelligence of the great masses of the plain people” (put more succinctly by PT Barnum as “there’s a sucker born every minute”),Perhaps we are simply incapable of resisting an apparent bargain, even when we know there’s bound to be a catch,For years, we all fell for the illusion of items priced at $9,99 or similar, rather than the honest price of $10,Partly because of the digital economy, this particular trick seems to have faded away.

But the same digital economy has far nastier tricks in mind for us.The trickery of “Down Down” seems childish compared to the wonders of personalised pricing, where sellers set a price specifically aimed at being the maximum you are willing to pay, and precisely when you are primed to buy.The only solution, it appears, is to build your own AI agents, to trick the company algorithm into seeing you as a desirable customer.John Quiggin is a professor at the University of Queensland’s school of economics

Ketamine addiction making teenagers wet the bed, says UK’s first specialist clinic

Children are using incontinence pads and urinating in buckets next to their bed at night due to bladder problems caused by ketamine addiction, according to the first specialist NHS clinic dealing with the issue.Medics at Alder Hey children’s hospital in Liverpool have opened the first ketamine clinic for young people in the UK in response to a surge in urology problems linked to addiction of the drug.“Some of our patients start wetting the bed or find going to the bathroom at night is actually too hard, so they’ll either choose incontinence products or a bucket by the bed,” said Harriet Corbett, a consultant paediatric urologist at the clinic.“I hate to say it, but a lot of them get to the point where they’re not fussed about where they go, because the need to go overrides their desire to find somewhere private. And I suspect more of them are incontinent than are willing to tell us

Death tax? Property tax? Four ideas that could offset inheritance inequality in Australia

The $5.4tn intergenerational wealth transfer predicted to occur within the next two decades is a major challenge for Australian governments. Economists have warned it could entrench and exacerbate inequality, and make the economy less productive. So what can be done about it?“In the end, that comes down to tax,” says the former deputy reserve bank governor Guy Debelle. “Taxation is how you redistribute

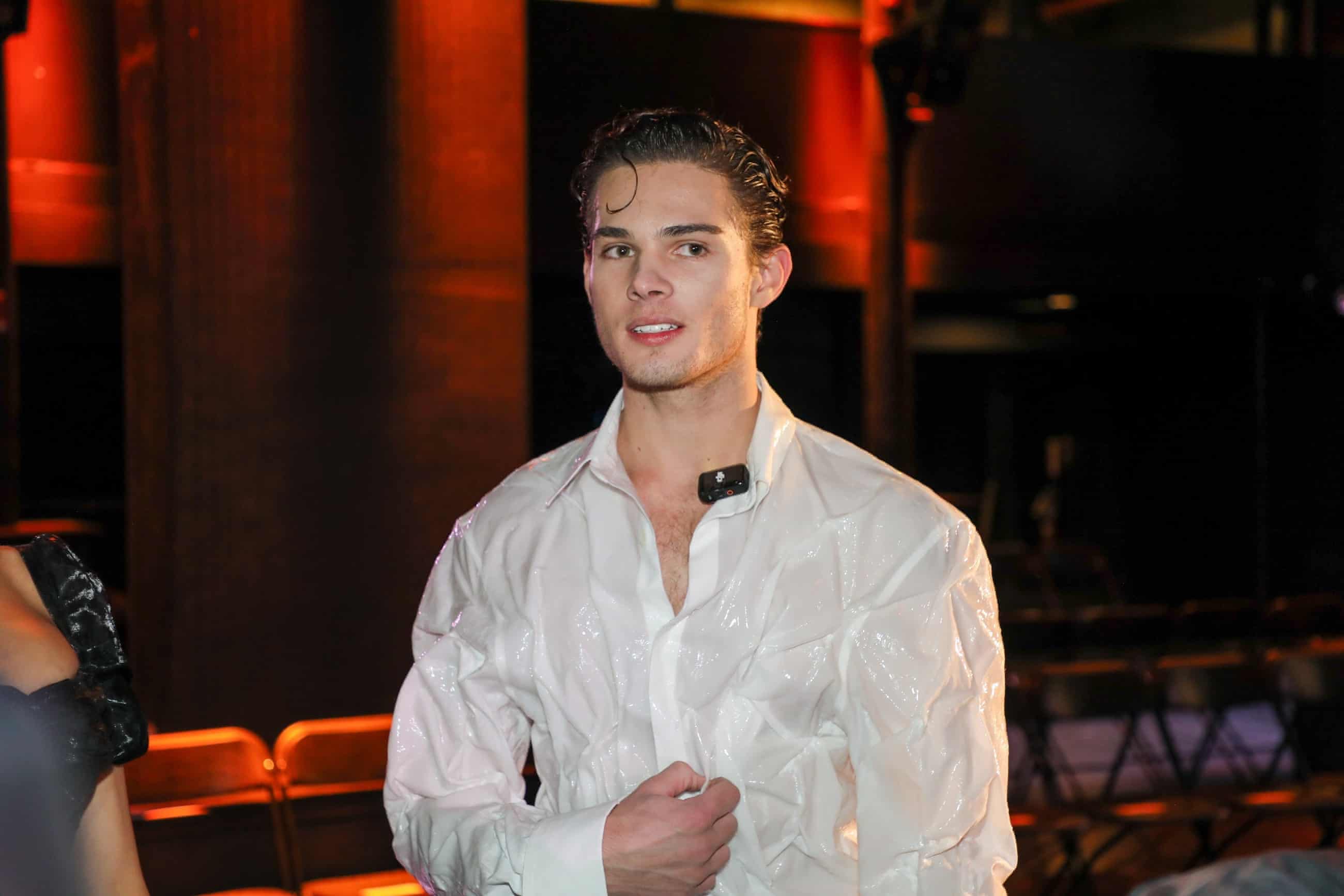

The disturbing rise of Clavicular: how a looksmaxxer turned his ‘horror story’ into fame

His gonzo argot of ‘mogging’ and ‘jestermaxxing’ masks a malign chauvinist philosophy, and his audience keeps growingHow’s your “jestermaxxing” game? Have you been “brutally frame-mogged” lately? If you’ve been finding this kind of online discourse even more impenetrable than usual, a 20-year-old content creator calling himself Clavicular is probably to blame.Born Braden Peters, Clavicular is a manosphere-adjacent influencer who has recently broken containment for a string of high-profile controversies, including livestreaming himself apparently running over a pedestrian with his Tesla Cybertruck and being filmed chanting the lyrics to Kanye West’s Heil Hitler in a nightclub with the self-styled “misogynist influencer” Andrew Tate and the white nationalist commentator Nick Fuentes.Before taking up with what some feel are among the worst men alive, Clavicular was known only as a “looksmaxxer”, a young man intent on optimising his physical attractiveness by frequently extreme measures (such as steroids, surgery and, er, taking a hammer to his jaw).Yet Clavicular’s gonzo live streams and absurd lingo have seen him escape his subcultural silo, landing him a modelling gig at New York fashion week and a profile in the New York Times.So where has he come from? And what does his rise mean for humanity?Peters came to prominence last year on the streaming platform Kick (like Twitch, but more laissez-faire with content moderation), where he now has nearly 180,000 followers

Ministers may slow youth minimum wage rise amid UK unemployment fears

Ministers are considering a slower rise in the minimum wage for younger workers, amid fears over rising youth unemployment.Labour had promised in its manifesto to equalise national minimum wage rates by the time of the next election, saying it was unfair younger workers were paid less. Government sources said equalisation remained the aim but the rise could come more slowly.At the current rates, those between 18 and 20 are paid a minimum of £10 an hour, rising to £12.21 an hour for those over 21

UK shoppers warned over spread of harmful and illegal skin lightening kits

Illegal skin lightening products are being sold in an increasingly wide range of UK outlets, including butchers, specialist food shops and small grocery stores, trading standards officers have warned.The Chartered Trading Standards Institute (CTSI) is warning that many of the products contain substances that are banned because of the serious risks they pose to health, including skin damage, infections and pregnancy complications.Officers say that, as well as online, they are finding them more frequently in Asian and Arab stores, plus specialist butchers and grocery stores for other diverse communities, whom the products are primarily targeted at.Tendy Lindsay, former chair of the CTSI, said: “As a Black woman and a longstanding advocate for equality, diversity and inclusion, I want to be absolutely clear: the sale of illegal skin lightening products is not only dangerous, it is unlawful.“Many of these products contain banned substances such as high levels of hydroquinone, mercury or potent corticosteroids

Brazilian butt lifts should be banned in UK amid ‘wild west’ industry, MPs say

Brazilian butt lifts should be banned in the UK, MPs have said, as a report found a lack of regulation had led to a “wild west” of cosmetic procedures being carried out in garden sheds, hotel rooms and public toilets.The women and equalities committee (WEC) said high risk procedures such as non-surgical buttock augmentation should be outlawed immediately, and a licensing system for lower risk treatments was urgently needed. People with no training can carry out potentially harmful procedures, putting the public at risk, the group of MPs added.A nine-month inquiry by the committee also found ministers were not moving quickly enough to tackle the risks posed to Britons and recommended they “accelerate regulatory action”. The lack of timely action was “fostering complacency in self-regulation” within the industry, they cautioned

British manufacturing continues to face low orders and upward price pressure, says CBI

Oil prices rise amid fears of US strikes on Iran – as it happened

Digital blackface flourishes under Trump and AI: ‘The state is bending reality’

The rise of AI is making the future of work look bleak – but it could be an opportunity

Winter Olympics 2026: speed skating, curling, ice hockey and more – live

Townsend calls for Kinghorn and Van der Merwe to show ‘huge determination’ against Wales