Lloyds investigating after using staff’s bank account data in pay talks

The boss of Lloyds Banking Group has told staff that it is investigating a controversial decision to use employee bank account data during pay talks with unions last year.In a town hall meeting open to the bank’s 64,000 staff at the start of February, Charlie Nunn conceded that the move “obviously has created some concern” but tried to assure workers that “we definitely have listened to it”.“We haven’t yet fully worked out what we will do differently going forward, although I think we should just do the investigation fully,” Nunn said, in comments first reported by the Times.Nunn was responding to a staff question over the debacle, in which the bank used aggregated salary, spending and savings data from 30,000 staff accounts as part of a presentation to staff union representatives late last year.That data was used to suggest its lowest-paid staff had been in a better financial position than the wider population in recent years.

The banking group’s staff are strongly urged to hold their personal account with Lloyds, meaning the lender could access financial information without permission.The Guardian revealed last month that the Information Commissioners’ Office has started making “inquiries” with Lloyds over whether it might have breached data privacy rules as a result.An ICO spokesperson said at the time: “We are aware of this incident and are making inquiries with Lloyds Banking Group.”Lloyds, which had been locked in pay negotiations with staff unions, ultimately agreed to a two-year deal that would deliver a 7%-9% pay rise for staff.Nunn told staff at the town hall meeting that it had been a “legal use case of using aggregated data for a relevant business outcome” and that the lender’s “two recognised unions were very comfortable” with its use.

“But we clearly need to look at the lessons learned from that and you’ll see what that means going forward.So I recognise the feeling.”However, one of the recognised unions, Accord, said in a member newsletter in December that it reserved the right to sue the banking group if the ICO found it had breached data rules.A spokesperson for Lloyds – which owns the Halifax and Bank of Scotland brands – said Nunn’s comments did not mean there would be a “formal investigation” by the bank but there would be further review of the matter internally.In a statement, Lloyds said it was “committed to fair and progressive pay that provides certainty and support for all colleagues, and in this case more junior colleagues.

“We have worked hard with our unions, using aggregated data and direct colleague input and we are pleased that members of our recognised unions have voted to support our competitive multi-year pay proposal for 2026 and 2027 by a significant majority,”

No swiping involved: the AI dating apps promising to find your soulmate

Dating apps exploit you, dating profiles lie to you, and sex is basically something old people used to do. You might as well consider it: can AI help you find love?For a handful of tech entrepreneurs and a few brave Londoners, the answer is “maybe”.No, this is not a story about humans falling in love with sexy computer voices – and strictly speaking, AI dating of some variety has been around for a while. Most big platforms have integrated machine learning and some AI features into their offerings over the past few years.But dreams of a robot-powered future – or perhaps just general dating malaise and a mounting loneliness crisis – have fuelled a new crop of startups that aim to use the possibilities of the technology differently

The problem with doorbell cams: Nancy Guthrie case and Ring Super Bowl ad reawaken surveillance fears

What happens to the data that smart home cameras collect? Can law enforcement access this information – even when users aren’t aware officers may be viewing their footage? Two recent events have put these concerns in the spotlight.The Guardian’s journalism is independent. We will earn a commission if you buy something through an affiliate link. Learn more.A Super Bowl ad by the doorbell-camera company Ring and the FBI’s pursuit of the kidnapper of Nancy Guthrie, the mother of Today show host Savannah Guthrie, have resurfaced longstanding concerns about surveillance against a backdrop of the Trump administration’s immigration crackdown

US military used Anthropic’s AI model Claude in Venezuela raid, report says

Claude, the AI model developed by Anthropic, was used by the US military during its operation to kidnap Nicolás Maduro from Venezuela, the Wall Street Journal revealed on Saturday, a high-profile example of how the US defence department is using artificial intelligence in its operations.The US raid on Venezuela involved bombing across the capital, Caracas, and the killing of 83 people, according to Venezuela’s defence ministry. Anthropic’s terms of use prohibit the use of Claude for violent ends, for the development of weapons or for conducting surveillance.Anthropic was the first AI developer known to be used in a classified operation by the US department of defence. It was unclear how the tool, which has capabilities ranging from processing PDFs to piloting autonomous drones, was deployed

Elon Musk’s xAI faces second lawsuit over toxic pollutants from datacenter

Elon Musk’s artificial intelligence company xAI is facing a second lawsuit alleging it is illegally emitting toxic pollutants from its enormous datacenters, which house its supercomputers and run the chatbot Grok.The new pending suit alleges xAI is violating the Clean Air Act and was filed Friday by the storied civil rights group the NAACP. The group’s 40-page notice of intent to sue alleges xAI has been polluting Black communities near its facility in Southaven, Mississippi. The pollution comes from more than a dozen portable methane gas generators that xAI set up without permits, the notice alleges.The NAACP’s first notice of intent to sue was filed last June and involves similar allegations regarding the company’s datacenter in Memphis, Tennessee

AI is indeed coming – but there is also evidence to allay investor fears

The message from investors to the software, wealth management, legal services and logistics industries this month has been clear: AI is coming for your business.The release of new, ever more powerful AI tools has coincided with a stock market slide, which has swept up sectors as diverse as drug distribution, commercial property and price comparison sites. Advances in the technology are giving increasing credibility to predictions that it could render millions of white-collar jobs obsolete – or, at least, eat into the profits of established companies.Carl Benedikt Frey, the author of How Progress Ends and an associate professor of AI and work at the University of Oxford, says investors are reassessing the value of companies that rely heavily on selling software or specialist knowledge.“AI turns once-scarce expertise into output that’s cheaper, faster, and increasingly comparable, which compresses margins long before whole jobs disappear

Anthropic raises $30bn in latest round, valuing Claude bot maker at $380bn

Anthropic, the US AI startup behind the Claude chatbot, has raised $30bn (£22bn) in a funding round that more than doubled its valuation to $380bn.The company’s previous funding round in September achieved a value of $183bn, with further improvements in the technology since then spurring even greater investor interest.The fundraising was announced amid a series of stock market moves against industries that face disruption from the latest models, including software, trucking and logistics, wealth management and commercial property services.The funding round, led by the Singapore sovereign wealth fund GIC and the hedge fund Coatue Management, is among the largest private fundraising deals on record.“Anthropic is the clear category leader in enterprise AI,” said Choo Yong Cheen, the chief investment officer of private equity at GIC

A new diagnosis of ‘profound autism’ is under consideration. Here’s what parents need to know

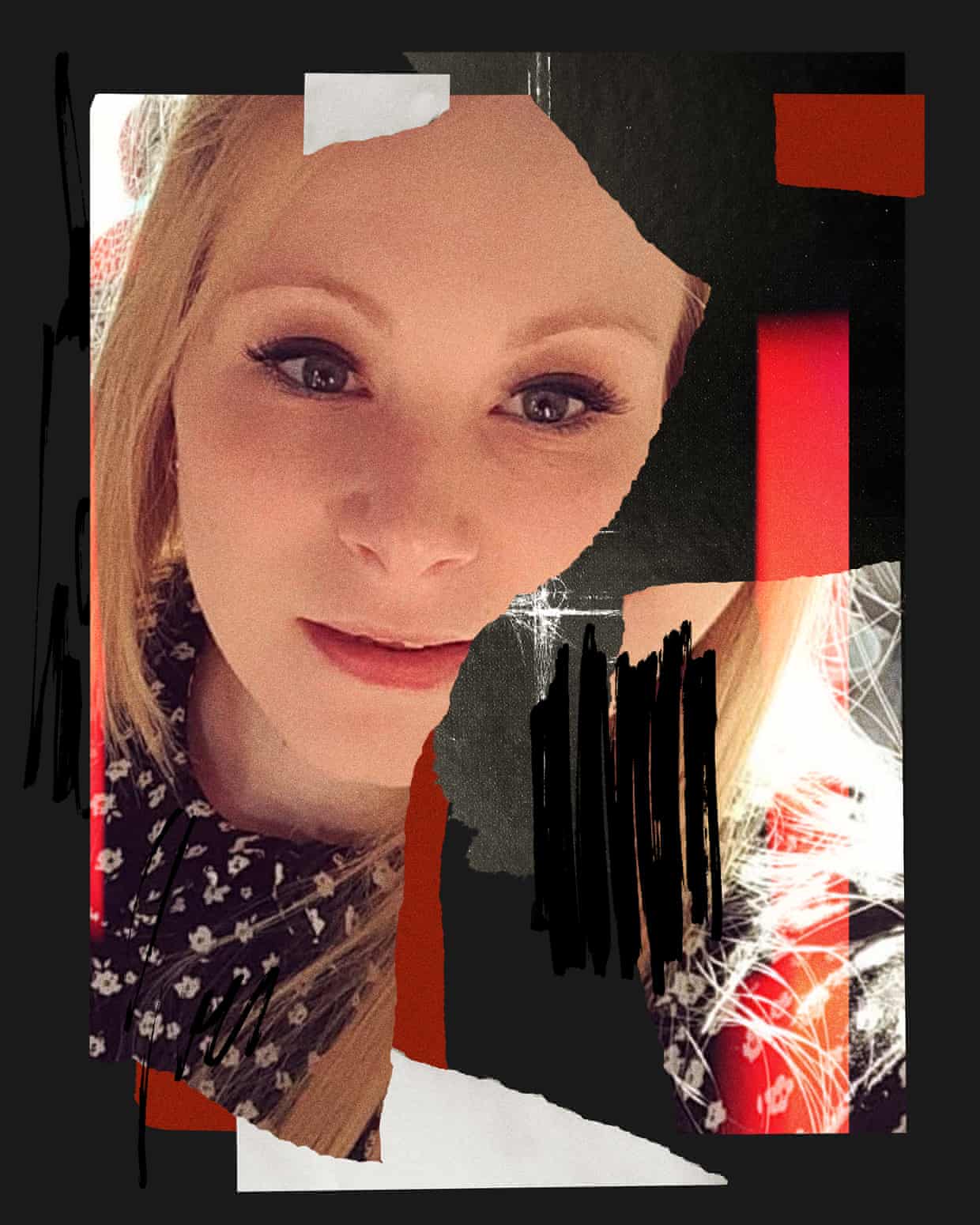

Katie’s story: her abusive ex-partner said ‘kill yourself’. When she did, police dropped domestic violence inquiry

Revealed: The true toll of female suicides with domestic abuse at their core

Fast-spreading measles outbreak takes hold among under-10s in north London

Jess Phillips calls for Epstein files to be catalyst for long-term legislative change

‘We almost lost you in the night’ - the life-threatening rise of measles in the UK