‘We’ve future-proofed’: how UK’s biggest car factory upgraded for EV revolution

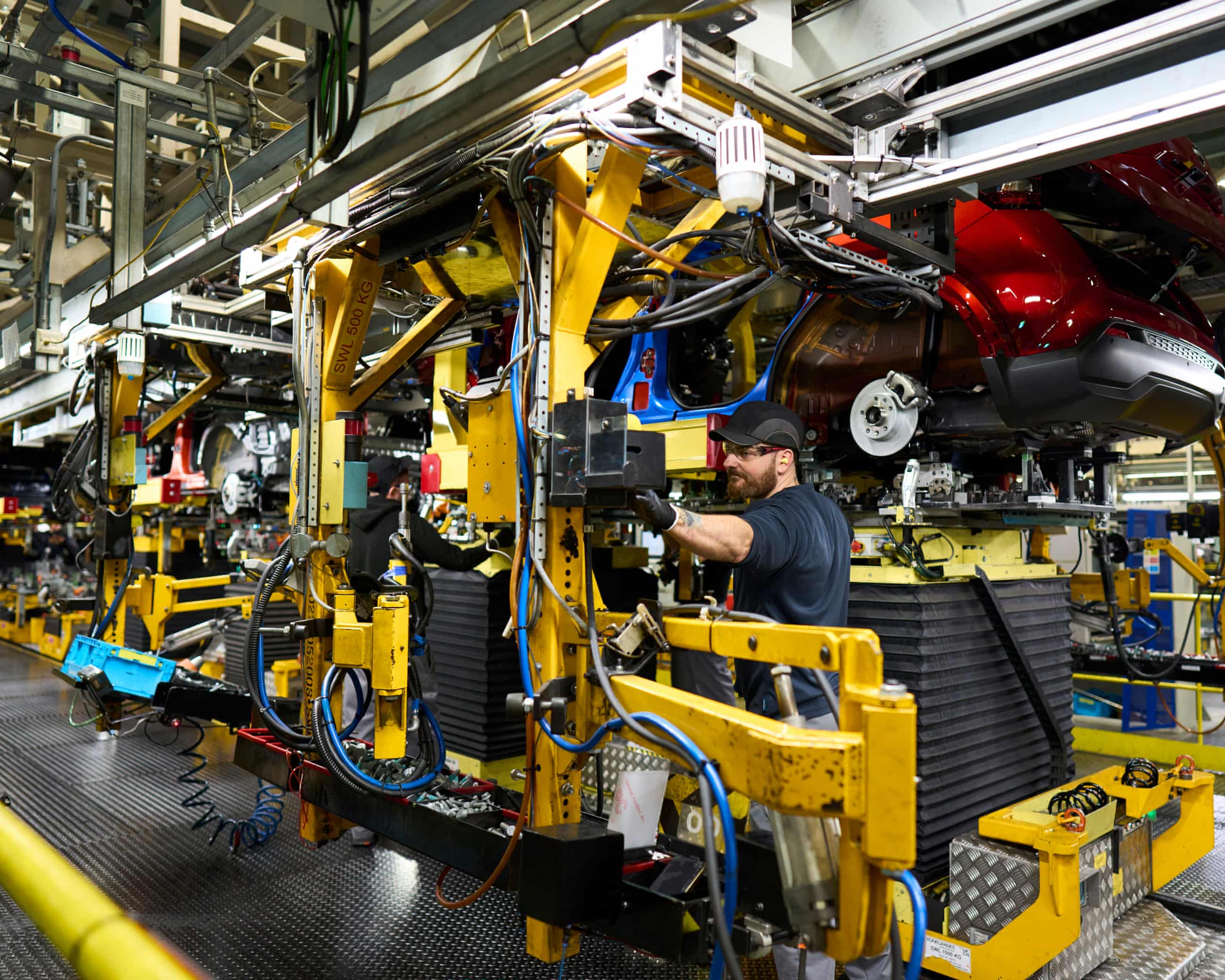

Nissan builds in capability to go fully electric at Sunderland plant amid scaling back of transition targets across EuropeCar bodies suspended from overhead rails move through Nissan’s factory in Sunderland, with workers stepping in to fit parts at different stations.At the newly installed battery “marriage station”, lifting machines push the most crucial component up into the body.Robots fit and tighten 16 bolts in under a minute – quick enough to ensure the constant flow of vehicles around Britain’s biggest car factory.The electric cars in question are the third generation of Nissan’s Leaf, after the Japanese carmaker this week launched production following £450m of upgrades.Beside the brightly lit final-inspection line, the industry minister Chris McDonald hailed the investment as an important part of the UK industry’s transition to electric vehicles.

The Leaf remains – for now – the only electric car to be built in large volumes in Britain.However, the launch does not come at an auspicious moment for electric cars.Carmakers around the world have delayed models, complaining that sales have not grown as fast as expected.On the same day as the Leaf’s launch, the EU announced it would water down a 2035 ban on petrol and diesel cars, proposing instead to allow 10% of European car sales to have internal combustion engines after that point.Nissan has joined the retreat.

Just two years ago it had pledged to sell only electric cars in Europe by 2030.However, Nissan’s boss in Europe, Massimiliano Messina, said in Sunderland that he was unwilling to commit to a date for the transition to be completed.“If I might give a number, it will be wrong,” he said, when asked when Nissan would be all-electric in Europe.“I cannot give you a date by when.But I’m more confident that we talk about 2050.

”The EU, a key market for the cars from Sunderland, was the last domino to fall in a global move to slow the transition, after a global barrage of lobbying by the politically powerful car industry.The UK weakened its zero-emission vehicle (ZEV) mandate in April – and will examine further changes.Canada paused its EV sales mandate in September.Meanwhile, Donald Trump has torn up any policy with a hint of support for electric vehicles – despite his short-lived alliance with Tesla’s boss, Elon Musk.That has cost US carmakers including Ford and General Motors billions of dollars in abandoned investments and lost sales.

European and British manufacturers will still have to switch to electric sales, but carmakers including Volkswagen have expressed relief at the EU’s changes,That will give them greater leeway to sell more hybrids, which combine a smaller battery with a polluting petrol engine,Electric-focused carmakers have strongly opposed the changes, and some in the EV industry have argued that it will just leave the way clear for manufacturers from China, the rising EV manufacturing superpower,Part of the Sunderland investment was to make sure it could sell more hybrids if needed,The new Leaf cars are now being manufactured on the same kilometre-long line that builds hybrid Qashqai and Juke models.

“We’ve future-proofed for the transition to fully electric vehicles – when the time comes,” said Guy Reid, the engineering general manager at Sunderland, on a platform overlooking the battery conveyor belt.“When we introduce more electric vehicles, we don’t have to modify this facility again.”Each station completes 60 jobs an hour in order to be able to make up to 600,000 cars a year.However, in 2024 the plant made only 282,000 cars, down 14% from the year before.The batteries themselves are manufactured next door, in a new plant built by the Chinese-owned, Japanese-headquartered company AESC.

As the new Leaf was launched, high-precision robotic arms stamped and trimmed battery cells to be assembled into packs, although only one out of four lines was operational as it waited for demand from Nissan to increase.AESC has also had to scale back its ambitions for Sunderland.Initial plans were for an annual manufacturing capacity of 38 gigawatt hours (GWh), but the finished plant is capable of making 15.8GWh of batteries a year, enough for about 300,000 electric cars with 50kWh batteries.Nissan’s change in direction is not just following the global automotive mood.

It is in the middle of a third turnaround plan after years of leadership turmoil.The company’s former chief executive Carlos Ghosn tried to make an alliance of France’s Renault, Nissan and Japan’s Mitsubishi into the world’s biggest carmaker.However, he was arrested in 2018.He dramatically fled house arrest, leaving behind years of leadership chaos at Nissan, and an abandonment of world-spanning ambitions.Nevertheless, in 2023 Makoto Uchida, one of Ghosn’s successors, had enough confidence to pledge only electric sales in Europe by 2030.

He said: “Nissan will make the switch to full electric by 2030 in Europe – we believe it is the right thing to do for our business, our customers and for the planet,”Sunderland was a key part of that plan,Nissan also said that year it was considering three electric models: a new Leaf hatchback, plus replacements for the Juke and Qashqai crossover SUVs (although the latter has yet to be confirmed),Securing the new electric models in Sunderland was seen as a huge priority for the previous Conservative government – partly to avoid a rerun of 2016, when the plant became a symbol of the potential economic harms of Brexit,The government secretly agreed to give state aid worth £61m.

Brexit is no longer the main concern of the car industry, but carmakers are still able to win significant support.State aid disclosures show that Boris Johnson’s government in 2022 gave Nissan £101m towards the plant in direct grants for a “new all-electric vehicle”, one of the largest subsidies given to a manufacturer since the UK’s departure from the EU.Nissan said it had invested £450m itself in upgrading the plant.Johnson’s government said the grant was justified because it “secures a strategically important internationally mobile investment”.Carmakers often play different governments off against each other when seeking support for factories.

The support may have helped Sunderland avoid the axe when Uchida was forced out earlier this year.In May, Nissan’s current chief executive, Ivan Espinosa, announced the closure of seven factories, with the loss of 20,000 jobs – but spared the UK.Yet Nissan still faces questions over whether it can fill the plant again.One suggestion aired by Espinosa was to build cars for Dongfeng, a Chinese manufacturer and partner in a joint venture with Nissan in Wuhan, China.Messina said Nissan was still looking at “opportunities”, but added that there was “nothing concrete”.

He insisted the company’s main focus would be on winning back market share with new models, starting with the Leaf.“For the time being, we are looking at ourselves because we want to make sure we secure our own footprint with our vehicles,” he said.

Was 2025 the year that business retreated from net zero?

Almost a year since Donald Trump returned to the White House with a rallying cry to the fossil fuel industry to “drill baby, drill”, a backlash against net zero appears to be gathering momentum.More companies have retreated from, or watered down, their pledges to cut carbon emissions, instead prioritising shareholder returns over climate action.In the UK, the rise of Nigel Farage’s Reform UK has helped fracture the political consensus that had helped make Britain the first big economy to enshrine a commitment to cutting carbon emissions into law, in 2019. Earlier this year, the Conservative party leader, Kemi Badenoch, officially ditched net zero by 2050 as a Tory policy. Labour was even forced to defend its net zero policy after an attack by its former leader, Tony Blair

Why is Truth Social owner Trump Media merging with a fusion energy firm?

Trump Media & Technology Group, owner of Donald Trump’s social media platform, Truth Social, announced a merger on Wednesday with a company developing fusion energy technology.TAE Technologies, an energy company founded in 1998, will join with Trump Media via a $6bn merger that it promises will propel it to build “the world’s first utility-scale fusion power plant” next year.The move signals that the president and his family continue to look for profit-seeking ventures outside of Truth Social, which remains tiny compared with rival platforms such as Facebook, Instagram and X (formerly Twitter).Here is what we know about the deal so far.The media company, which has dabbled in financial services, is engineering a huge pivot and diving headfirst into nuclear energy

FTSE 100 closes near record high as Santa Rally builds, despite weak retail sales – as it happened

British retailers have suffered a slump in sales in the run-up to Christmas, and are gloomier about their prospects for the start of 2026, a new survey shows.In another sign that the UK economy is struggling, the Confederation of British Industry has reported that retail sales volumes fell at an accelerated rate in the year to December.This pulled the CBI’s gauge of how retail sales compared with a year earlier worsened to -44 in December from -32 in November.The new year is expected to start on a gloomy note for the retail sector. Retailers anticipate that annual sales will fall sharply next month, with expectations at their weakest since March 2021

Independent businesses: have your online sales been affected by the rise of AI?

We’d like to find out more about how your business has been affected by changes to online searches amid the rise of AI.Independent businesses have traditionally relied on online advertising for increased visibility and sales, even if they are based on the high street. However, with the introduction of AI mode and AI Overview summaries on Google, and the proliferation of LLMs such as ChatGPT or Google Gemini, people are altering their search habits, which may affect the online visibility of small businesses.With this in mind, we want to find out if there have been any changes to organic traffic to your business site or online sales in recent months. Are customers still able to discover your company online? Have you found new opportunities or have there been significant challenges? How is your business innovating to get seen online? Are you changing strategy?We’d also like to hear from customers – have you found it harder to track down independent retailers, or find relevant products online?You can tell us by using the form below or by messaging us

Former Yodel owner probably forged mother’s signature in takeover bid, judge rules

The former owner of Yodel probably forged his mother’s signature in an attempt to seize back control of the parcel delivery company, according to an “extraordinary” ruling issued on Friday by a high court judge.Jacob Corlett, a 31-year-old logistics entrepreneur, launched a takeover of Yodel in January 2024, buying the financially distressed company for £1 as part of a plan to merge it with his own parcels company, Shift.Within six months, Yodel was unable to pay its debts to HM Revenue and Customs and commercial partners, forcing Corlett to sell the business – also for £1 – to another company called Judge Logistics Ltd (JLL) in June 2024.Earlier this year, the Polish parcel locker company InPost bought JLL in a £106m deal.After a suit brought against him by Yodel, including for breach of fiduciary duty during his time as a director, Corlett launched an unsuccessful counterclaim intended to regain control of Yodel

WH Smith tries to recover bonuses from ex-bosses as watchdog investigates accounting error

WH Smith will try to take back as much as £7m in bonuses from former executives after revealing the UK’s financial watchdog has launched a formal investigation into a devastating accounting error linked to its US business.Almost £600m was wiped off the books to paperclips retailer’s stock market value overnight in August after it identified errors with accounting for supplier income and provision for lost stock going back to 2023 in its North American arm.Last month its chief executive, Carl Cowling, stepped down in the wake of the scandal. The company is searching for a permanent replacement.On Friday the company said it would be “applying malus and clawback to recover overpaid bonuses” from Cowling, and its former finance director Robert Moorhead, after the restatement of profits in its 2023 and 2024 financial year

UK Foreign Office victim of cyber-attack in October, says Chris Bryant

Society of Editors decries Starmer’s plan to reduce media scrutiny of No 10

Reform-run Kent council accused of blocking scrutiny of claim it saved £40m

Reform candidate who told Lammy to ‘go home’ questioned other MPs’ loyalty to UK

Lib Dems call for inquiry into hostile foreign state interference to include US

Farage avoids police investigation over alleged electoral law breach