OBR chief’s exit may ease pressure on Rachel Reeves but the battle isn’t over

Had Richard Hughes not resigned as boss of the Office for Budget Responsibility (OBR) on Monday amid the indignation over the accidental publication of Rachel Reeves’s budget, the Treasury might now be under pressure over the tsunami of leaks that preceded it.The OBR’s David Miles told MPs on Tuesday the leaks had been so widespread and misleading that the watchdog feared its reputation was at stake.Alongside briefings about the potential direction of OBR forecasts, there were public comments too, including from Reeves herself, about the frustrating timing of the watchdog’s productivity rethink; and its refusal to “score” pro-growth policies.Arguing for an ambitious “youth experience scheme” in September, for example – details of which are still to be negotiated – the chancellor told the Times, “we want the OBR to score it.They scored it when we left the European Union.

They should score both the improved trade relationships that we’ve negotiated and this youth experience scheme.”Reeves’s allies have made no secret about the lack of rapport between her and Hughes – a blunt former IMF and Treasury official, whose past career involved advising the Zimbabwean government about hyperinflation.Longtime observers of the relationship between the Treasury and OBR point out that last year marked the first time Labour has had to tangle with the watchdog since it was created by George Osborne.A former Tory adviser joked: “Osborne’s trap laid in 2011 paid dividends.”Unable to respond to the “leakfest” publicly before the budget, the OBR chair and his colleagues had raised concerns privately with Treasury officials, Miles revealed.

With the search now on for a replacement, some senior economists said any credible successor would probably seek reassurances that the institution would not face a similar onslaught in future.Jonathan Portes, a former government adviser now at the thinktank UK in a Changing Europe, said Hughes’s departure was “not good for the UK in fiscal governance terms” and the government should have encouraged him to stay.“I don’t think his resignation is good for the government’s fiscal credibility”.The Bank of England governor, Andrew Bailey, underlined the importance of the OBR’s independence on Tuesday, telling journalists: “Attacks on the OBR: in terms of the principle, I would say ‘no, can we please remember why it was done and the principles underlying it’.”Hughes’s unprecedented letter last Friday, setting out the evolution of the OBR’s forecasts, reflected weeks of pent-up frustration within the concrete headquarters it shares with the Department of Justice.

He had intended to send it earlier – mentioning it in the OBR’s budget document, the Economic and Fiscal Outlook – but as Hughes’s colleague Miles confirmed on Tuesday, it was delayed by the chaos surrounding the budget’s accidental publication.The letter was read by some at Westminster – including the shadow chancellor, Mel Stride, and some journalists – as impugning Reeves’s honesty, revealing as it did that even before her gloomy 4 November speech, the OBR was assuming she would just meet her fiscal rules.Miles, who oversees the OBR’s forecasts and represented the watchdog at the Treasury select committee on Tuesday, scotched that idea firmly, however.The chancellor was right to point to the shaky state of the public finances, he said.Her “headroom” by the end of the five-year forecast was “wafer thin” – and indeed, as Miles and his colleague Tom Josephs made clear, while Reeves plans to raise taxes and cut spending to expand it, there are significant questions about whether that is realistic.

Without aiming its fire directly at Reeves, however, the OBR did want to highlight the contradiction between the evolution of its forecasts – which were broadly complete by 30 October – and the excitable government briefing on 14 November.That was the day bond markets reacted badly to news Reeves and Starmer had dropped the idea of raising income tax rates.Scrambling to calm City nerves, Treasury sources told some journalists that the change of heart resulted from improved OBR forecasts.Miles told MPs this improvement simply “didn’t exist”.To the extent the forecasts had got better, it had happened a couple of weeks earlier, before 31 October; and there was concern inside the watchdog that all this briefing made it look as though its forecasts were “wildly fluctuating”, making the budget process “chaotic” – which, of course, it was, but not for that reason.

As the dust settles on the budget, Reeves is now looking both for a chief economic adviser – after the scaling back of John Van Reenen’s role – and a new OBR chair, at a time when she and her policies are under intense political pressure.Plausible candidates to succeed Hughes include Bailey’s deputy, Clare Lombardelli, who has known Reeves for many years; Carl Emmerson, until recently of the Institute for Fiscal Studies; or if they prefer a consummate Treasury insider, director of public spending, Conrad Smewing.Senior government economist Nick Joicey, now at the Blavatnik school of government, might also be a solid candidate, were he not married to the chancellor.Whoever takes on the role may take some convincing that they will be given the freedom to do their job without being publicly – and privately – second-guessed by government insiders.And investors in bond markets, which were unmoved by the leak farrago, will be watching closely to ensure whoever is appointed has the credibility and independence needed for such an impossible job.

Chop and change: pork is ‘new beef’ for money-saving Britons, report finds

Pork is the “new beef”, with Britons increasingly making the money-saving meat swap for dishes such as spaghetti bolognese or T-bone steak, according to a new report.With the latest official figures showing beef price inflation running at 27%, customers are looking to buy pork cuts that you would typically associate with beef. That list runs to free-range fillets and short ribs as well as T-bone and rib-eye steaks, Waitrose says in its annual food and drink report.Recipe searches for “lasagne with pork mince” have doubled on its website, while searches for “pulled pork nachos” are up 45%. Its sales of pork mince are up 16% on last year, as home cooks adapt favourite recipes

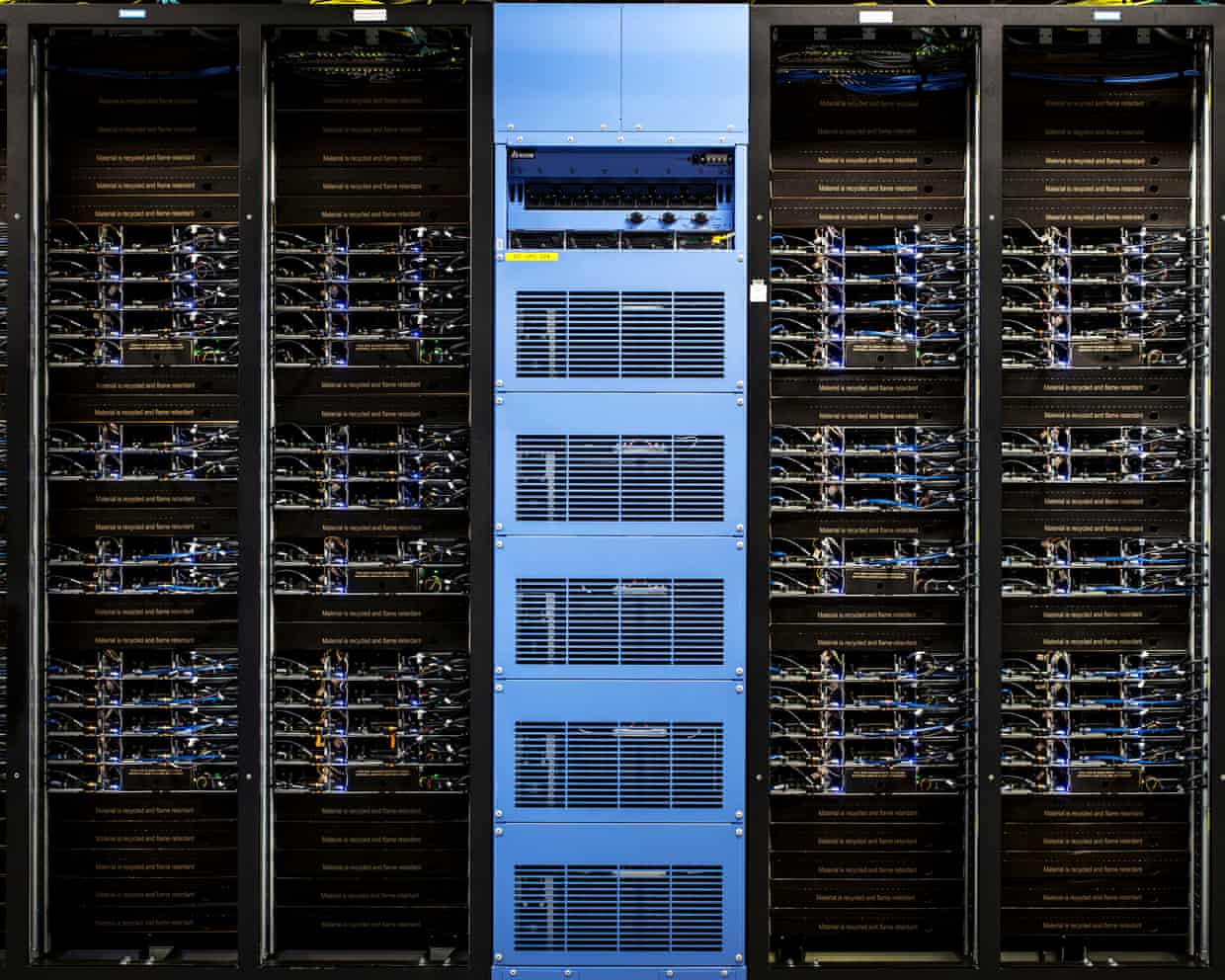

Australian economy crawls back into growth mode thanks to datacentre boom and household spending uptick

Surging investment in datacentres to fuel the AI tech boom and rising household spending on essentials like electricity and rents buoyed economic growth through the three months to September.National accounts figures showed real GDP expanded by 2.1% in the year, accelerating from 2% in June.Despite positive signs that the private sector is starting to drive economic activity after a period of strong government support, the quarterly pace of growth was a disappointing 0.4% – well shy of the predicted 0

Production of French-German fighter jet threatened by rivalries, chief executive says

The leaders of France and Germany have a “strong willingness” to build a new fighter jet together despite bitter internal rivalries, according to the chief executive of engine manufacturer Safran.A row over who should lead between French aerospace company Dassault and the German unit of Airbus has threatened to break apart the countries’ efforts to make a next-generation fighter jet.France’s Safran, one of the world’s biggest engine-makers, is due to co-produce turbines for the aircraft. Its chief executive, Olivier Andriès, told reporters in London on Tuesday that relations were “very strained” between the lead partners on the Future Combat Air System (known as Scaf in France)However, he added that the offices of the French president, Emmanuel Macron, and the German chancellor, Friedrich Merz, wanted a solution. “Obviously the relationship between Airbus and Dassault is extremely difficult,” Andriès said

Tunbridge Wells water cut likely to last after treatment problem reoccurs

Water shortages in Tunbridge Wells that have forced schools and businesses to close look likely to continue for at least another day after the local water company said the problem with its plant had reoccurred.The Drinking Water Inspectorate (DWI) has said it will investigate.Thousands of homes in the Kent town have been without water since the weekend after South East Water accidentally added the wrong chemicals to the tap water supply.Schools across the area have been shut, and residents have been filling buckets with rainwater to flush toilets. Cats, dogs and guinea pigs have been given bottled mineral water to drink as the people of Tunbridge Wells wait for their water to be switched back on

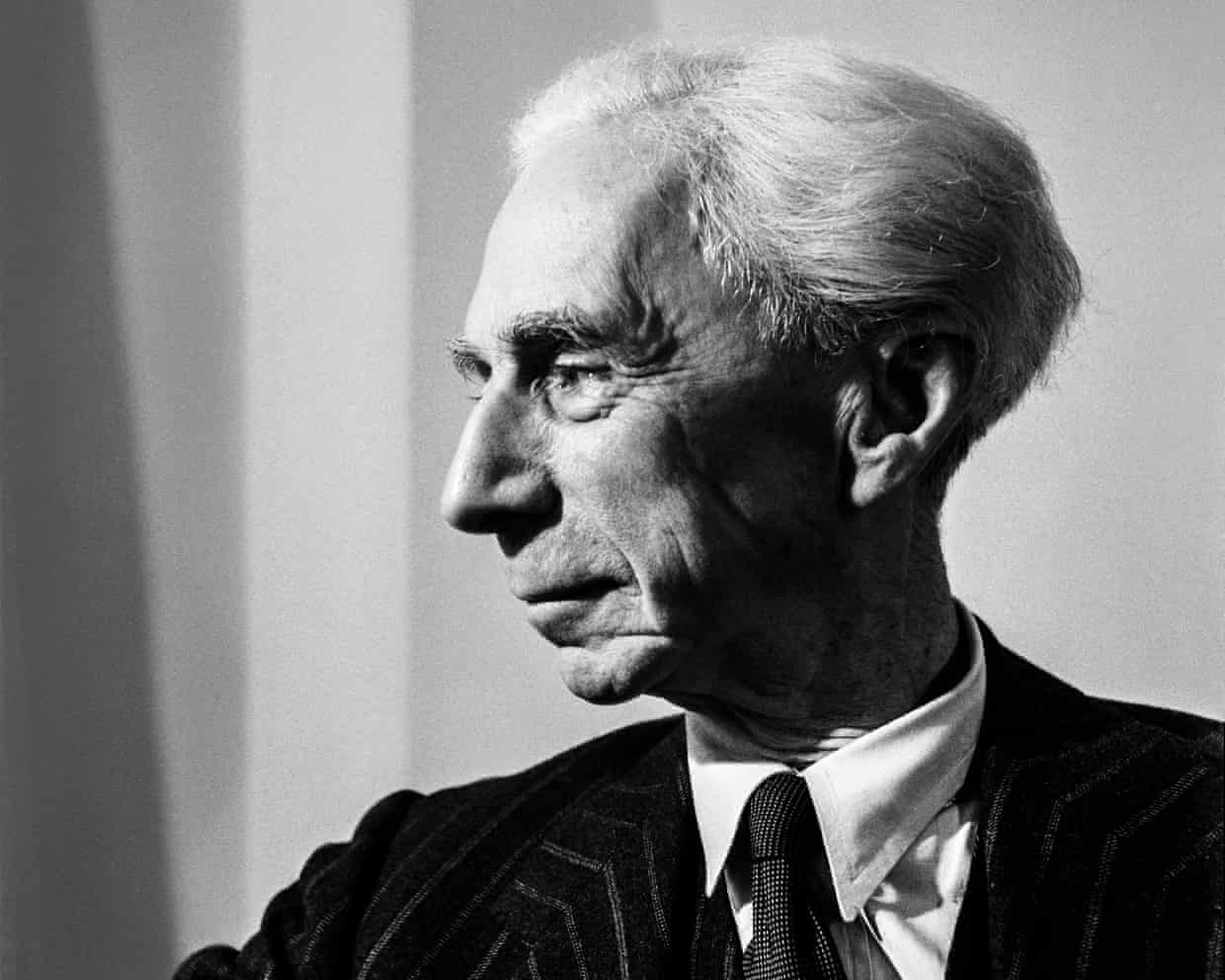

Fiscal headroom is a matter of guesswork | Brief letters

Your editorial (The Guardian view on OBR v the Treasury: ministers have embraced the theatre of errors, 1 December) correctly flags the huge uncertainty in trying to come up with a five-year forecast of the difference between taxes and spending. Although markets like big fiscal headroom numbers, they seem to ignore the wise words of Bertrand Russell, who defined mathematics as “the subject in which we never know what we are talking about, nor whether what we are saying is true”. This also applies to the concept of the medium-term fiscal headroom that economists and politicians alike are obsessed with.Prof Costas MilasUniversity of Liverpool The scrapping of the two-child benefit limit certainly seems to have polarised opinion. One camp reckons it should not have been scrapped at all, and the other reckons it should have been done a year ago

OBR chief’s exit may ease pressure on Rachel Reeves but the battle isn’t over

Had Richard Hughes not resigned as boss of the Office for Budget Responsibility (OBR) on Monday amid the indignation over the accidental publication of Rachel Reeves’s budget, the Treasury might now be under pressure over the tsunami of leaks that preceded it.The OBR’s David Miles told MPs on Tuesday the leaks had been so widespread and misleading that the watchdog feared its reputation was at stake.Alongside briefings about the potential direction of OBR forecasts, there were public comments too, including from Reeves herself, about the frustrating timing of the watchdog’s productivity rethink; and its refusal to “score” pro-growth policies.Arguing for an ambitious “youth experience scheme” in September, for example – details of which are still to be negotiated – the chancellor told the Times, “we want the OBR to score it. They scored it when we left the European Union

My cultural awakening: Thelma & Louise made me realise I was stuck in an unhappy marriage

The Guide #219: Don’t panic! Revisiting the millennium’s wildest cultural predictions

From Christy to Neil Young: your complete entertainment guide to the week ahead

Susan Loppert obituary

Oh yes he is! Kiefer Sutherland dives into the world of panto

O come out ye faithful: a joyful roundup of UK culture this Christmas