Oil firm Petrofac enters administration, putting 2,000 jobs at risk; Greencore-Bakkavor food giant deal faces UK competition concerns – as it happened

Time to wrap up.Wall Street shares have scaled new all-time highs, as rising expectations of a US-China trade deal encouraged risk-taking by investors, in a week dominated by Big Tech results and a widely-expected Federal Reserve interest rate cut on Wednesday.The tech-heavy Nasdaq rose by 1.6%, the Dow Jones gained 0.5% and the S&P 500 climbed by nearly 1%.

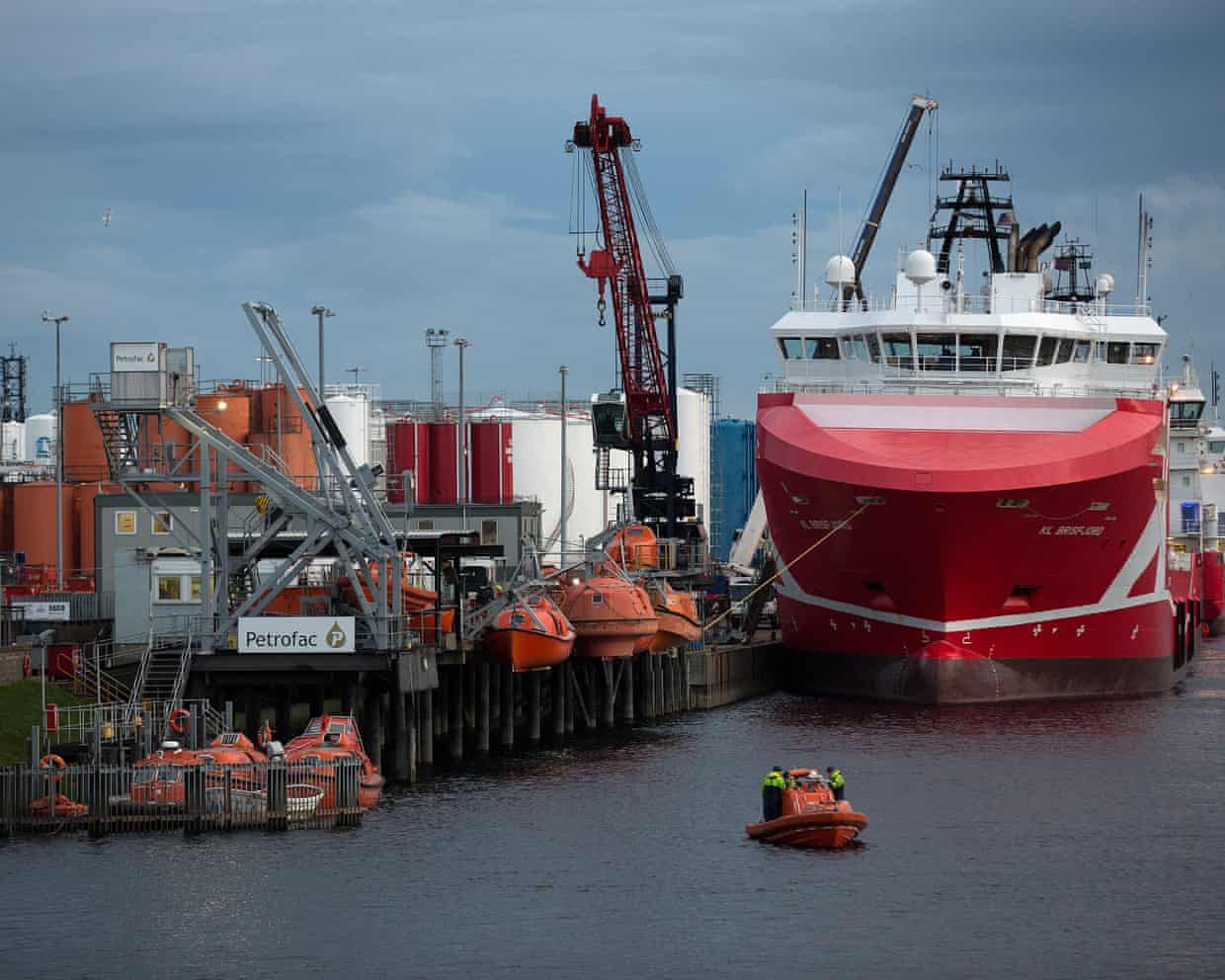

Argentina’s currency, stocks and government bonds surged after the party of Argentina’s far-right president, Javier Milei, won Sunday’s midterm elections – after a campaign in which Donald Trump announced a $40bn bailout for the country and made continued aid conditional on the victory of his Argentinian counterpart.The peso rose by 10% to the US dollar, while the Merval stock market in Buenos Aires jumped by more than 20%.International bonds rallied between 10 and 15 cents each, pushing their yield below 10%.Our main stories today:Petrofac, one of the biggest North Sea oil and gas contractors, has filed for administration, putting more than 2,000 jobs in Scotland at risk.The energy services provider said it had applied to the high court of England and Wales to appoint administrators, after it lost a major offshore wind project over its failure to meet contractual obligations.

Petrofac, which employs about 7,300 people globally, said the administration plans – likely to be carried out by the business services firm Teneo – applied only to its ultimate holding company and that it would continue to trade during the process.Thank you for reading.We’ll be back tomorrow.Bye! – JKEnergy minister Ed Miliband has set aside £1.1bn a year for offshore wind power developers investing in new projects, in the latest budget for windfarms needed to meet the UK’s green electricity targets.

The government’s energy department said on Monday that it had budgeted £900m to pay developers of fixed wind turbines at sea, with another £180m for floating platforms,Renewables provided about half of the UK’s electricity during 2024, with wind accounting for 30% of generation for the first time – overtaking gas power stations,Further huge investments in wind and solar power will be necessary to meet the target of completely removing carbon emissions from British electricity supplies by 2030,Government sources have previously told the Guardian that ministers may consider abandoning that target – long seen as hugely ambitious by experts – if it were to prove too expensive,However, a government source said the initial budget for offshore wind showed “big backing by the Treasury for offshore wind”.

Wind power developers, expected to include energy companies SSE, RWE and Scottish Power, will be invited to bid to build new offshore wind projects, which would be eligible to receive the budget.In a change from previous years, the final budget could rise higher if ministers consider that enough projects provide value for money – potentially surpassing the £1.1bn for offshore wind allocated last year.The contracts will also last 20 years, rather than 15, in order to try to attract lower prices.Chris Stark, the civil servant who leads the UK’s clean power efforts under Miliband, said he expected the bids to exceed the budget for fixed offshore wind.

The government is prepared to “contract more offshore wind generation if we see value for money for the consumer”, he said in a social media post.Competition in the lucrative weight loss market is heating up further.China’s Innovent Biologics said today its GLP-1 injection led to more weight loss and better control of blood sugar in patients with diabetes than semaglutide, the active ingredient in Novo Nordisk’s blockbuster diabetes and weight-loss medicines Ozempic and Wegovy.The head-to-head trial compared different doses of the two drugs in patients with diabetes and obesity to assess glycemic control and weight loss.One group received a 6 mg dose of the mazdutide drug, a synthetic peptide, that Innovent is developing, and the other a 1 mg dose of injectable semaglutide.

Innovent, which is based in Suzhou in China and listed on the Hong Kong stock exchange, acquired exclusive development and commercialisation rights in China for mazdutide from US firm Eli Lilly in 2019,Mazdutide is already approved as a treatment for type 2 diabetes and obesity in China, and is being developed in other markets by Lilly, Novo’s biggest rival,Innovent is one of a number of Chinese drugmakers ramping up competition with Novo and Lilly in the world’s second-largest pharmaceutical market,Novo sells Ozempic for patients with type 2 diabetes in China to control blood sugar,Innovent’s chief research & development officer of general biomedicine, Lei Qian, said:The head-to-head DREAMS-3 study comparing mazdutide with semaglutide further showed that in patients with T2D and comorbid obesity mazdutide provides superior efficacy in both weight loss and glucose lowering.

Yo! Sushi, the casual dining chain, has had to stop taking card payments for more than an hour on Monday after a problem at its payment software provider.The company, which has about 50 UK outlets and is owned by the Japanese food specialist Zensho Holdings, said that its outlets had stayed open and continued taking cash payments during the hour or so it took to fix.It is understood the problem was caused by a glitch in an update by provider Vita Mojo.Yo! Sushi, which is known for its conveyor-belt system to convey food around the restaurant, was founded in London in 1997.The restaurant is the latest high street brand name to suffer problems with card payments this year.

The Co-op and Marks & Spencer were both forced to suspend card payments in stores earlier this year after cyber attacks while the CrowdStrike IT outage affected card payments in both retailers and for train and plane travel last year,China and Germany, the world’s second and third largest economic powers, were seeking to cool tensions after Berlin cancelled a visit to Beijing by foreign minister Johann Wadephul, reports my colleague Deborah Cole in Berlin,The backdrop of the tensions are comments Wadephul made on a trip to Japan in August in which he criticised China’s “aggressive” stance toward Taiwan and its “decisive” support for Russia in its war against Ukraine,The Chinese side kept Wadephul’s official scheduled appointments to a minimum, leading the foreign ministry on Friday to axe the trip entirely,The stakes for the spat are higher for Germany, whose car industry is particularly dependent on rare earth minerals whose export China curbed in retaliation against US president Donald Trump’s “liberation day” tariff announcement in April.

A Dutch move to effectively take control of Netherlands-based chipmaker Nexperia, which is owned by a Chinese firm, has further inflamed EU friction with Beijing.China’s export controls cover magnets, which are crucial for electronic window and boot openings in cars, as well as semiconductors.The EU has said the limits have forced some of the bloc’s companies to halt production.Wadephul had planned to raise the issue of the restrictions during his visit and is expected to hold telephone talks with his Chinese counterpart, Wang Yi, soon.Wadephul had been due on Sunday to begin his first official visit to China since the German government took office in May with a delegation including the president of Germany’s VDA car association, paving the way for a trip by chancellor Friedrich Merz later this year.

Beijing on Monday attempted to play down any rift with Berlin, which said the visit had merely been “postponed”.“China has always viewed and developed its ties with Germany from a strategic and long-term perspective,” said Guo Jiakun, a spokesperson of China’s foreign ministry, in comments reported by Reuters.“The two sides should respect each other, treat each other as equals and cooperate for win-win results to propel bilateral ties along the right track.”Germany, whose economic model is heavily reliant on exports, is China’s number one European trade partner, with two-way trade exceeding $200bn in 2025, according to Chinese data.Olaf Lies, premier of Lower Saxony state, home to automobile giant Volkswagen, warned at the weekend that Europe needs to make sure it doesn’t get squeezed “in a conflict between the US and China”.

Merz has pledged to revive the struggling German economy in the face of mounting competition from Chinese manufacturers.Instead of heading to Beijing, Wadephul was in Brussels on Monday for talks with EU Commission president Ursula von der Leyen, trade commissioner Maroš Šefčovič and foreign policy chief Kaja Kallas ahead of negotiations with China this week on rare earths and semiconductors.For years, survivors of Jeffrey Epstein have demanded justice.For a while, it seemed like they would get it.Ghislaine Maxwell, Epstein’s ex-girlfriend, was found guilty of sex trafficking four years ago for her involvement in the late financier’s sexual abuse of teen girls – and sentenced to 20 years imprisonment.

Meanwhile, banks who had done business with Epstein, although not admitting wrongdoing, paid hundreds of millions in settlements to victims.Donald Trump even made releasing the Epstein investigative files part of his campaign platform, and doubled down on his promise to do so early this year.In the end, Trump’s justice department did not release these files, and his administration has become embroiled in reports about social ties between him and Epstein.Congressional promises to release files have lagged, due to political jockeying and justice department foot-dragging.But two new lawsuits could shed light on Epstein’s activities amid the stalemate – regardless of their outcome.

These lawsuits, filed by an anonymous plaintiff against Bank of America and the Bank of New York Mellon (BNY), allege that these financial powerhouses illicitly enabled Epstein’s sex trafficking.The suits are helmed by Sigrid S McCawley, of Boies Schiller Flexner, and Brad Edwards of Edwards Henderson, who have long represented Epstein victims.One lawsuit claims:Epstein committed these crimes by means of not only his own extraordinary wealth and power, but through access to funding and financial support from both individuals and institutions, including BNY.Egregiously, BNY had a plethora of information regarding Epstein’s sex trafficking operation but chose profit over protecting the victims.The Bank of America suit echoes these allegations, claiming the institution “knowingly provided the financial support and the veneer of institutional legitimacy for Epstein and his co-conspirators to fuel their international sex trafficking organization under the guise of non-criminal business activities”.

The suit also said Bank of America neglected to file suspicious activity reports,Here’s our full story on Petrofac:Petrofac, one of the biggest North Sea oil and gas contractors, has filed for administration, putting more than 2,000 jobs in Scotland at risk,The energy services provider said it had applied to the high court of England and Wales to appoint administrators, after it lost a big offshore wind project over its failure to meet contractual obligations,Petrofac, which employs about 7,300 people globally, said the administration plans – likely to be carried out by the business services firm Teneo – applied only to its ultimate holding company and that it would continue to trade during the process,Nevertheless, any uncertainty over the company’s continued viability may add to political pressure on the UK government, as it faces a backlash over plans to tackle the climate crisis by blocking new North Sea oil licences for exploration.

Energy secretary Ed Miliband’s department said on Monday it was leading efforts across “all parts of government” to support Petrofac’s UK arm, which it employs about 2,000 people at its North Sea hub in Aberdeen.The business has been in financial trouble for years, starting with a Serious Fraud Office investigation in 2017 that resulted in a conviction in 2021 for failing to prevent bribery and the payment of more than $100m in penalties.That investigation made it harder for the company to win work.It bounced back initially, before the coronavirus pandemic added to its woes.Petrofac has been trying to restructure its finances for more than a year, and a formal plan was approved by the high court in May.

It has debts of that may be approaching $4bn (£3bn), according to a judgment from July in a case brought by some creditors.But the company told investors on Thursday that the cancellation of a contract by TenneT, a European electricity grid operator and its biggest customer, meant that a solvent restructuring was no longer possible.The TenneT contract was to build offshore wind projects off the Dutch coast.The company said: “Having carefully assessed the impact of TenneT’s decision, the board has determined that the restructuring, which had last week reached an advanced stage, is no longer deliverable in its current form.”Administration will cast doubt over the future of parts of the business, particularly in the Middle East, which struggled particularly during the pandemic.

However, it is thought that the UK arm has been performing relatively well, and could be of interest to external buyers,British retailers reported another fall in sales in October and blamed the late autumn budget for uncertainty around tax hikes, according to a survey,The CBI business lobby group said its gauge of retail sales volumes compared with a year earlier rose only slightly this month but remained deep in negative territory at -27, versus -29 in September,Its measure of expected sales for the month ahead slipped to -39 from -36,Martin Sartorius, the CBI’s principal economist, said the 13th consecutive month of falling sales volumes measured by the survey reflected weak consumer confidence, worsened by uncertainty around Rachel Reeves’ budget on 26 November, which is a month later than usual.

Persistent uncertainty ahead of the autumn budget is deepening the strain on retailers and other distribution firms that are still grappling with the effects of last year’s fiscal decisions.To help rebuild confidence and encourage growth, the chancellor should reaffirm her commitment to no further business tax hikes in November.Like other employers, retailers were hit by higher social security contributions in Reeves’ first budget last year.They are also nervous about planned employment rights legislation, which could put firms off hiring, Sartorius said.Official figures published on Friday showed a surprise increase in retail sales volumes in September to a three-year high, boosted by tech purchases amid the release of the new iPhone 17 as well as strong online demand for gold.

The US government’s debt burden is on track to overtake those of Italy and Greece for the first time this century, according to forecasts from the International Monetary Fund,Government gross debt in the US will rise by more than 20 percentage points from now to reach 143,4% of the country’s GDP by 2030, exceeding previous records set after the pandemic, the Financial Times reported, referring to IMF data published this month,The Washington-based fund estimates that the US budget deficit will hover above 7% of GDP every year until 2030, the highest of any rich nation tracked by the IMF,Italy and Greece have long struggled with rising public debt, and were at the heart of the eurozone sovereign debt crisis of 2010-2012, with Greece needing a bailout and restructuring overseen by the IMF and EU.

But government debt burdens in both countries are projected to be on a downward trend at the end of the decade, as they have tightened their grip on budget deficits.By contrast, the US debt-to-GDP ratio will still be rising in 2030, according to the IMF projections, with the Congressional Budget Office (CBO) expecting it to increase for decades thereafter.Mahmood Pradhan, head of global macro at the Amundi Investment Institute, told the FT:It is a symbolic moment, and according to the CBO the projections are for US debt to carry on rising — that is the impact of running perpetual deficits.But Italy has a weaker growth outlook than the US, so this should not be read as meaning Italy is out of the woods.Business confidence in Germany has risen unexpectedly, pointing to gradual improvement in Europe’s largest economy.

The business climate index from the Munich-based Ifo institute rose to 88.4 points in October, from 87.7 points in September, but is still below August’s level.This was driven by improved expectations for the coming months, rising to the highest level in more than three years, while the current business situation was assessed as slightly worse, for the third month in a row.Companies overall remain hopeful that the economy will pick up in the coming year.

Expectations in the manufacturing sector improved, as the decline in new orders came to a halt, although companies were less satisfied with current business.In the service sector, confidence improved significantly, led by tourism and IT services.In trade, optimism also rose, while companies were slightly more downbeat about the current situation.However, in construction, expectations were more pessimistic, amid a lack of orders.Leo Barincou, senior economist at Oxford Economics, said the improvement in business confidence adds to other signs of a slight upturn in economic growth between October and December.

The German ifo index rebounded in October, making up for some of September’s losses.After last week’s favourable PMI, today’s reading supports the prospect of a mild upturn in economic activity in Germany in the fourth quarter.However, we don’t think any kind of strong rebound is in on the cards as hard data remains very negative.However, any improvement in economic activity is likely to be gradual, given the contraction we expect in the third quarter based on the latest data releases.All hopes are still on fiscal stimulus, said Carsten Brzeski, global head of macro at ING