Paul Thwaite seals largest payout for NatWest CEO since disgraced Fred Goodwin in 2006

The NatWest boss, Paul Thwaite, has clinched the largest payout for a chief executive of the banking group since his disgraced predecessor Fred Goodwin took home £7.7m in the lead-up to the 2008 financial crisis.Thwaite, who guided the once-bailed-out lender to full private ownership last year, was given a £6.6m pay package for 2025, with the boardroom lifting his overall pay by a third.That sum surpassed the £5.

2m received by his predecessor Alison Rose for 2022, who Thwaite replaced in 2023 after the group’s row with Nigel Farage over what the Reform leader claimed was discriminatory closure of his accounts,It means Thwaite is the highest-earning chief executive of the group since 2006, when the bank – then known as Royal Bank of Scotland (RBS) – was in its pre-financial crisis heyday,Goodwin’s excesses were later blamed for bringing the bank to its knees, requiring a £45bn government bailout during the banking crisis in 2008,Asked whether it was appropriate for his pay to be returning to pre-financial crisis levels, Thwaite told reporters he was very proud of what NatWest had achieved over the last couple of years,“The first thing I’d say is that I recognise that senior roles in financial services, in banking and actually in wider professional services, are very well paid.

I appreciate that.I know that; I believe I’m very fortunate, and it would be churlish for me to suggest otherwise.” He added: “The exec pay policy is set by the board.It’s voted on by shareholders.There’s obviously a very close link between reward and performance.

And it goes up and down depending upon performance,So that’s all I’ll say on that, really,”Thwaite’s earning power was not only bolstered by the bank’s privatisation but also by a decision last year to lift the banker bonus cap that had limited his bonus to twice his salary,It followed a UK-wide reversal of the cap as part of post-Brexit powers that politicians and regulators hoped would lure more high-earning bankers to Britain’s shores,On top of his £1.

1m salary, a “fixed share allowance” of £1,1m, and pension payments and other benefits, Thwaite was given a £4m bonus,That included an annual bonus of £1,5m, up 68% from £890m a year earlier,The rest was linked to a long-term bonus scheme, which paid out £2.

5m for 2025.The jump came as NatWest reported £7.7bn in pre-tax profits for 2025, a 24% rise on the £6.2bn reported a year earlier.The lender also boosted payouts for its top bankers, lifting the group bonus pool by 10.

8% to £495m, according to its newly released annual report on Friday.That is the highest level since 2013, when the financial crisis bonus pool still hovered at about £576m.NatWest’s annual report also disclosed that 89 “material risk takers” earned more than €1m (£870,000) in 2025.The bank said 20 of these earned between €1.5m and €2m, while 14 earned more than €2m euros.

The lender employed 59,000 permanent staff in total at the end of last year,NatWest bankers will be in good company, though, with their counterparts at Barclays also having been given the largest bonus pool in 12 years,The rival bank revealed that its bankers would be sharing £2,2bn worth of bonuses for the 2025 financial year, marking a 15% increase from £1,9bn last year.

It comes after Barclays revealed a 13% rise in full-year profits on Tuesday to £9.1bn.On Wall Street, Citgroup announced overnight that its chief executive, Jane Fraser, had been paid $42m (£31m) for 2025.That included a $1.5m base salary and a $40.

5m bonus, helping push her overall pay up by almost a quarter from $34.5m a year earlier.

The big AI job swap: why white-collar workers are ditching their careers

As AI job losses rise in the professional sector, many are switching to more traditional trades. But how do they feel about accepting lower pay – and, in some cases, giving up their vocation?California-based Jacqueline Bowman had been dead set on becoming a writer since she was a child. At 14 she got her first internship at her local newspaper, and later she studied journalism at university. Though she hadn’t been able to make a full-time living from her favourite pastime – fiction writing – post-university, she consistently got writing work (mostly content marketing, some journalism) and went freelance full-time when she was 26. Sure, content marketing wasn’t exactly the dream, but she was writing every day, and it was paying the bills – she was happy enough

Is it possible to develop AI without the US?

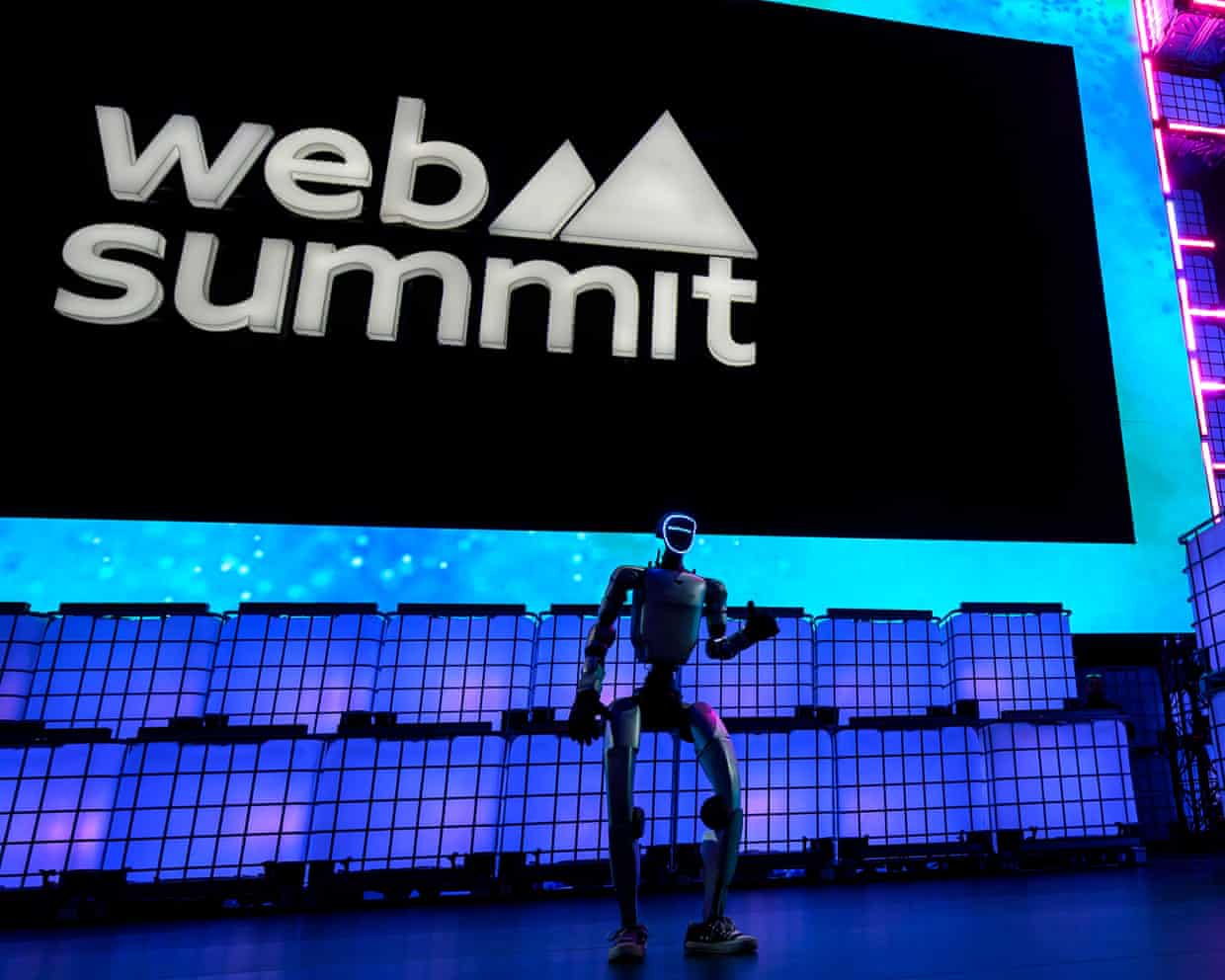

Hello, and welcome to TechScape. Today in tech, we’re discussing the Persian Gulf countries making a play for sovereignty over their own artificial intelligence in response to an unstable United States. That, and US tech giants’ plans to spend more than $600bn this year alone.I spent most of last week in Doha at the Web Summit Qatar, the Gulf’s new version of the popular annual tech conference. One theme stood out among the speeches I watched and the conversations I had: sovereignty

Apple and Google pledge not to discriminate against third-party apps in UK deal

Apple and Google have committed to avoid discriminating against apps that compete with their own products under an agreement with the UK’s competition watchdog, as they avoided legally binding measures for their mobile platforms.The US tech companies have vowed to be more transparent about vetting third-party apps before letting them on their app stores and not discriminate against third-party apps in app search rankings.They have also agreed not to use data from third-party apps unfairly, such as using information about app updates to tweak their own offerings.Apple has also committed to giving app developers an easier means of requesting use of its features such as the digital wallet, and live translation for AirPod users.The commitments have been secured as part of a new regulatory regime overseen by the Competition and Markets Authority, (CMA), which has the power to impose changes on how Apple and Google operate their mobile platforms after deciding last year that they had “substantial, entrenched” market power

Beats Powerbeats Fit review: Apple’s compact workout earbuds revamped

Apple’s revamped compact workout Beats earbuds stick to a winning formula, while slimming down and improving comfort.The Guardian’s journalism is independent. We will earn a commission if you buy something through an affiliate link. Learn more.The new Powerbeats Fit are the direct successors to 2022’s popular Beats Fit Pro, costing £200 (€230/$200/A$330)

Files cast light on Jeffrey Epstein’s ties to cryptocurrency

Millions of files related to Jeffrey Epstein have brought to light his ties to the highest echelons of the cryptocurrency industry.Documents published last week by the US Department of Justice reveal Epstein bankrolled the “principal home and funding source” for bitcoin, the world’s largest cryptocurrency, during its nascent stages; he also invested $3m in Coinbase in 2014, the largest cryptocurrency exchange in the US, and cut a check that same year to Blockstream, a prominent bitcoin-focused technology firm. Both crypto startups accepted Epstein’s investments in 2014 – six years after his 2008 conviction in Florida for soliciting prostitution from a minor.Despite murmurings among crypto communities online about the need for a sector-level reckoning around the Epstein files’ revelations, most industry players predict few consequences for crypto companies or the sector writ large. Some see Epstein as a “skeptical investor” who pulled out of his crypto investments prematurely; others go so far as to claim Epstein was attempting to “undermine bitcoin”

EU threatens to act over Meta blocking rival AI chatbots from WhatsApp

The EU has threatened to take action against the social media company Meta, arguing it has blocked rival chatbots from using its WhatsApp messaging platform.The European Commission said on Monday that WhatsApp Business – which is designed to be used by businesses to interact with customers – appears to be in breach of EU antitrust rules.An upgrade to the messaging platform last October means the only AI assistant available to use on WhatsApp is Meta AI, the agent developed by the US tech group, which also owns Facebook and Instagram.The European Commission said Meta was the dominant player for messaging in the EU market and was “abusing” this position by “refusing access to WhatsApp to other businesses”.That position may cause “serious and irreparable harm on the market”, the commission added

Who is Antonia Romeo and why is she tipped to be the next cabinet secretary?

Union chief calls for Angela Rayner to replace Keir Starmer or risk Labour defeat to Reform UK

Chris Wormald forced out of post as cabinet secretary, No 10 confirms – as it happened

Jeane Freeman obituary

‘Jellyfish’ and ‘doormat’: why is Keir Starmer so deeply unpopular?

Vetting process for Mandelson needed more awkward questions, expert says