Starmer warns of bigger impact on economy the longer Iran war continues - as it happened

Addressing the war in Iran, Keir Starmer acknowledged that the longer the conflict went on the greater the likely impact on the UK’s economy. The prime minister said:double quotation markThe job of government is obviously to get ahead, to look around the corner, to work with others, and the chancellor speaks to the governor of the Bank of England on a daily basis, with looking cross-departmental within government, assessing the risks, monitoring and talking to our international partners as well about what more we can do together to reduce the likely impact on people here and businesses here, of course.But it is important to acknowledge that that work is needed, because people will sense, you will sense I think, that the longer this goes on, the more likely the potential for an impact on our economy, impact into the lives and households of everybody and every business.And our job is to get ahead of that, to look around the corner, assess the risk, monitor the risks, and work with others in relation to that.The longer the US-Israel war with Iran continues, the more likely it is there will be economic damage in the UK, Keir Starmer warned as governments around the world braced for major disruption to energy supplies as a result of the escalating US-Israeli war with Iran

Lengthy US-Iran war would affect ‘lives and households of everybody’, says Starmer

Keir Starmer has said that a long-term US-Iran war would affect the “lives and households of everybody”, as the head of the AA advised motorists against making “non-essential” journeys.On Monday, oil prices surged past $100 (£75) a barrel for the first time since 2022, which will feed through to higher costs at petrol stations, and consumers will also be hit if energy costs push up inflation.Ministers are understood to be looking at ways to potentially mitigate the rising costs on energy bills – and are likely to come under pressure to cancel a planned 5p rise in fuel duty this autumn.Speaking as he launched the government’s community cohesion plan, Starmer said: “The job of government is obviously to get ahead, to look around the corner, to work with others, and the chancellor speaks to the governor of the Bank of England on a daily basis … assessing the risks, monitoring and talking to our international partners as well about what more we can do together to reduce the likely impact on people here and businesses here, of course.“But it is important to acknowledge that work is needed, because people will sense … that the longer this goes on, the more likely the potential for an impact on our economy, impact into the lives and households of everybody and every business

Nigel Farage invests £215,000 in Kwasi Kwarteng’s bitcoin firm

Nigel Farage has invested in Kwasi Kwarteng’s bitcoin reserves company, as the leader of Reform UK aligns himself closer with the cryptocurrency industry.The MP has invested £215,000 in Stack BTC, the crypto business that is chaired by the former Conservative chancellor.Farage, who has long courted the UK’s crypto sector, said he was delighted to have “become an investor in Stack” and “lend my support to the team”.“I have long been one of the UK’s few political advocates for bitcoin, recognising the role digital currencies will play in the future of business and finance,” he said in a statement. “I believe that we can and should be a major global hub for the crypto industry

Labour in ‘deep trouble’ with Black voters, Operation Black Vote chair warns

Labour is in “deep trouble” with Black voters, a former government adviser has warned, saying the party is at risk of being seen as “accepting the normalisation of racism”.David Weaver, who is the chair of Operation Black Vote (OBV), said the government’s plans to restrict juries would “heighten, normalise and embed” racial disproportionality in the justice system and that Black voters were saying: “We don’t know what Labour stands for any more.”In November, Keir Starmer vowed to “stand up to racism”. But the “moral panic” over migration and slow progress on tackling racial pay gaps and the Windrush scandal meant sentiment was low, Weaver said.“We’re not happy,” he added

Former Tory minister Zac Goldsmith to launch new sports radio station

The former Conservative minister Zac Goldsmith is launching a new sports radio station, trkradio, in the run-up to the men’s football World Cup this summer.The Track Radio Corporation is understood to have been granted a licence by Ofcom last week, with Goldsmith and his brother Ben, a financier and environmentalist, the major investors.Trkradio is due to go to air for the first time next month, with the station’s presenters and other financial backers to be confirmed over the next few weeks.Sources involved in the launch told the Guardian that the station will feature a mix of reflective conversation about all sports with ambitions to offer broader content than staple football phone-ins, as well as playing music.The day-to-day running of trkradio will be led by Iain Macintosh, formerly the head of UK audio at the Athletic, and the former LBC commercial director Jonathan Arendt

Alba party to wind up and not contest Scottish election

The Alba party has announced that it will wind up and not field any candidates for the 2026 Scottish parliament election.The pro-independence party was formed in 2021 by the late Alex Salmond as a “new political force” but has been suffering from a sharp fall in membership and a financial crisis.Police Scotland has been investigating alleged “irregularities” in the party’s finances since May.Kenny MacAskill, who defected from the Scottish National party and succeeded Salmond as Alba leader, said the decision taken by the party’s ruling national executive committee on Sunday had been made “with considerable regret”.The Electoral Commission advised the party that, given its financial situation, it should either voluntarily de-register or face statutory de-registration

We may not be running out of gas but we still need a serious strategic gas reserve | Nils Pratley

Golf club firm owned by Trump’s sons merges with drone manufacturer

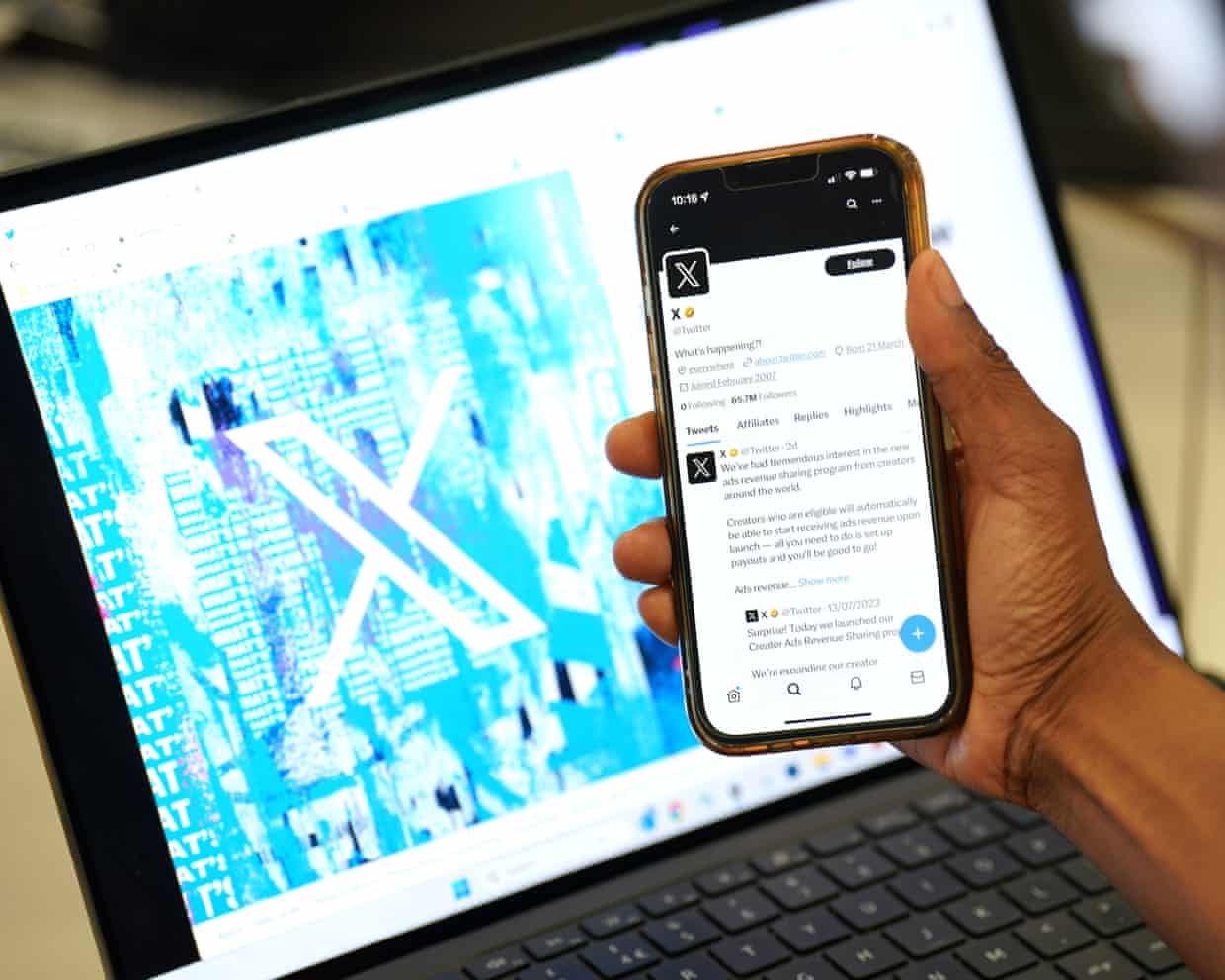

X suspends 800m accounts in one year amid ‘massive’ scale of manipulation attempts

AI firm Anthropic sues US defense department over blacklisting

‘We all believe in the plan,’ says England’s Ben Spencer

Dolphins take $99m hit on Tagovailoa and sign Willis; Tampa’s star WR Evans heads to 49ers