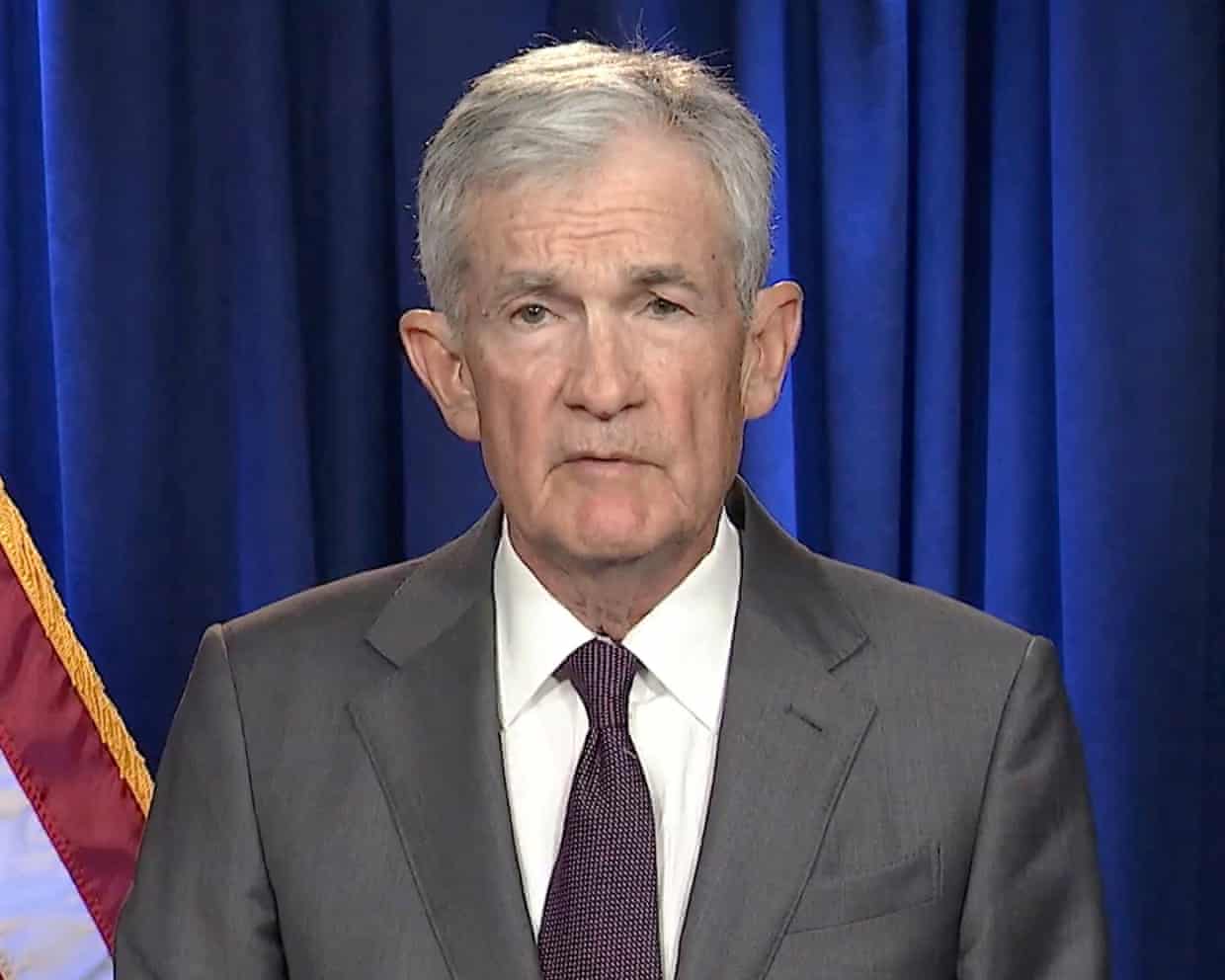

Criminal investigation into Fed chair Powell has ‘reinforced’ concerns over independence, Goldman Sachs warns – business live

Goldman Sachs’ chief economist Jan Hatzius has warned this morning that the criminal indictment threat facing Federal Reserve chairman Jerome Powell has reinforced worries that central bank independence is being undermined,Reuters reports that Hatzius told a 2026 Goldman Sachs Global Strategy Conference:“Obviously there are more concerns that Fed independence is going to be under the gun, with the latest news on the criminal investigation into Chair Powell really having reinforced those concerns,”Hatzius added, though, that he expected the Fed to continue to make decisions based on data:“I have no doubt that he (Powell) in his remaining term as chair is going to make decisions based on the economic data and not be influenced one way or the other, cutting more or refusing to cut on the back of data that could push in that direction,”Long-dated US government bond prices have dropped today, as investors react to the Fed situation,This has pushed up the yield, or interest rate, on 30-year US Treasury bonds by almost 5 basis points (0.

05 percentage points), to 4.861%.Ten-year Treasury bond yields are up too, by 3 basis points, to 4.2%.That may indicate that the markets are anticipating higher inflation in the long term, if the Federal Reserve cuts interest rates more swiftly than expeted.

JPMorgan Asset Management have flagged the risk of a steeper Treasury yield curve, meaning long-term rates would rise more than shorter ones, on expectations of more aggressive rate cuts,The US is to urge G7 countries to accelerate their efforts to mine their own rare earths in a bid to reduce China’s grip on the 17 soft metals vital for defence and modern life,Ahead of a meeting of in Washington to discuss the topic, US treasury secretary Scott Bessent will tell them they “need to move faster”,He has previously said the US is two years away from delivering its own rare earths with experts saying it can take as long as a decade to go from mine to factory floor, such is the difficulty in extracting the materials from ore,The EU is hoping to achieve a supply in Kiruna in Swedish arctic in the next five years, with the chief executive of the LKAB mine saying China’s position was built by the West’s decision to vacate the industry in the 1980s.

“Nobody saw any future in mining, then the super-cycle started and China started to consume enormous volumes of metals,” said Jan Moström, referring to the boom at the turn of the century when China drove huge demand for commodities on the back of urbanisation.Japan on Monday began a historic voyage to attempt to dig deep-sea rare earths at a depth of 6,000 metres to curb dependence on China with the scientific drilling boat, Chikyu leaving for the remote island of Minami Torishima in the Pacific, where surrounding waters are believed to contain a rich trove of valuable minerals.Ahead of the G7 meeting, a US official on Sunday night said:“Urgency is the theme of the day.It’s a very big undertaking.There’s a lot of different angles, a lot of different countries involved and we really just need to move faster.

”One intriguing question about the future of the Federal Reserve is whether Jerome Powell remains on its board after stepping down as chair, or departs.If he did leave, that would create a vacancy which Donald Trump could use to appoint his favoured successor onto the board, and then into the chair’s seat.Atakan Bakiskan, US economist at Berenberg, explains:Although Powell’s term as Fed Chair ends in May, he can remain on the Board as a Governor until January 2028.That said, most chairs in the past have left the Fed once their chair tenure expired.If Powell resigns from his Governor position in June, the resulting vacancy would allow President Trump to make a new appointment.

If he does not resign, someone else on the Board would need to step down for an outsider -- such as Kevin Warsh or Kevin Hassett -- to become Fed Chair.That person could be Governor Stephen Miran.Unless Trump re-nominates him and the Senate confirms, he would have to step down from his Governor role anyway, as he is completing Adriana Kugler’s term, which expires on January 30.If, however Powell resigns, and the Supreme Court allows Trump to remove Lisa Cook from her Governor role, both Kevins could join Miran on the Fed Board.This scenario would significantly increase the likelihood of a Fed willing to cut rates, even if economic data does not strongly support such a move.

The US dollar has continued to dip through morning trading in Europe; the dollar is now down 0,35% against a basket of other major currencies,Russ Mould, investment director at AJ Bell says the criminal investigation into Fed chair Jay Powell over a renovation of the central bank’s headquarters has “unnerved markets”, and raised questions about what might happen to the Fed once Powell steps down in May,Mould adds:There is a fear that Trump is meddling too much with policies that are meant to be set independently,“The Fed bases its monetary policy decisions on various data points, and a key purpose is to keep inflation in check.

“Trump wants to lower borrowing costs, so consumers and businesses spend more money and propel the economy.However, what’s worrying markets now over Trump’s implied intervention is that the loss of Fed independence could lead to inflation getting out of control.Goldman Sachs’ chief economist Jan Hatzius has warned this morning that the criminal indictment threat facing Federal Reserve chairman Jerome Powell has reinforced worries that central bank independence is being undermined.Reuters reports that Hatzius told a 2026 Goldman Sachs Global Strategy Conference:“Obviously there are more concerns that Fed independence is going to be under the gun, with the latest news on the criminal investigation into Chair Powell really having reinforced those concerns.”Hatzius added, though, that he expected the Fed to continue to make decisions based on data:“I have no doubt that he (Powell) in his remaining term as chair is going to make decisions based on the economic data and not be influenced one way or the other, cutting more or refusing to cut on the back of data that could push in that direction.

”Bloomberg are reporting that Federal Housing Finance Agency director Bill Pulte was “a driving force” behind the Trump administration’s decision to subpoena the Federal Reserve, according to people familiar with the matter.They say:The head of the typically staid FHFA has been a vocal force within the administration, pushing controversial housing policy ideas and investigating Trump’s foes for mortgage fraud.Pulte submitted a criminal referral to the DOJ about Fed Governor Lisa Cook that is at the root of Trump’s push to fire her.The Supreme Court is set to take up the Cook case later this month.A senior administration official said DOJ, not Pulte, is behind the subpoena which relates to Powell’s congressional testimony about Fed building renovations.

The investigation is being run by the US Attorney’s Office for the District of Columbia, according to people familiar with the matter,US Attorney for DC Jeanine Pirro signed off on the investigation into Powell, some of the people familiar with matter said,The battle to succeed Jerome Powell as chair of the Federal Reserve is a two-horse race, according to betting on predictions site Polymarket, with both horses called Kevin,Kevin Hassett, the director of Donald Trump’s National Economic Council, is leading the betting at 43% this morning,Close behind is Kevin Warsh, a former member of the Fed’s board of governors, at 41%.

Current board member Christopher Waller is running third, at 8%, followed by BlackRock executive Rick Rieder at 3%.Trump has suggested he could name his pick this month; Powell’s term ends in May.The news that Jerome Powell is facing a criminal investigation is “shocking”, professor Costas Milas of the University of Liverpool’s management school tells us.He explains:Jerome Powell will definitely regret he is not living in ancient Roman times where interest rates were remarkably stable as they were set at a fixed value to reflect the local system of numerical fractions.The criminal charges against Fed Chair Jerome Powell will most likely make financial markets realise that Fed independence is under huge pressure.

As I recently noted in a blog for LSE Business Review, if financial markets lose confidence in the Fed, Fed, in turn, will lose its ability to tackle future financial crises,Not a good economic start for 2026,,,The US stock market is set to open lower as investors react to the news that Federal Reserve Chair Jerome Powell said the Trump administration has threatened him with a criminal indictment.

A futures contract tracking the S&P 500 share index is down 0.75%, while Dow Jones Industrial Average futures are down 0.65%.Nasdaq 100 futures are down just over 1%.Chris Beauchamp, chief market analyst at IG, says:“The spat between Trump and Powell had been quiet of late, at least publicly, but the infighting has stepped up a gear following the DoJ’s investigation of the Fed.

Gold has surged to a new high on the news, while US futures are weaker,This certainly wasn’t on our bingo card for 2026, but it represents a major crisis for markets and has the potential to restart worries about the dollar and US monetary policy,Earnings season might knock this story off the front page for a while, but it will now rumble along in the background,”UK business secretary Peter Kyle has hinted the government will make an announcement for the hospitality industry “in the coming days”, amid growing pressure from pubs, restaurants, shops and hotels to reverse an impending rise in business rates,He told BBC Breakfast this morning:“We have been in listening mode for quite some time now.

..I’ve been up in Birmingham meeting the hospitality sector, I’ve been meeting people who are running pubs right the way through, as recently as just last week.And I think that we will be talking about this a bit more in the coming days.”He added he would be prepared to talk further on the challenges facing the hospitality industry “when we have spoken a bit more about what we will be doing in future to make sure we have a thriving pub and hospitality sector”.

It comes as chancellor Rachel Reeves faces pressure to U-turn on a Budget announcement to scale back business rate discounts over the next three years.Government sources confirmed last week that Reeves was preparing a support package that would include reductions to business rates for pubs.Shares in Dutch brewer Heineken have dropped by 2.4% in early trading after it announced the departure of its CEO.Dolf van den Brink will step down on 31 May; back in October, Heineken warned that profits this year will be lower than expected due to weaker growth in Europe and the Americas.

European stock markets have fallen at the start of trading, as investors ponder the criminal investigation into America’s top central banker.In London, the FTSE 100 share index is down 18 points, or almost 0.2%, at 10,106 points, having ended last week at a new closing high.France’s CAC is down 0.2%, while Germany’s DAX is flat.

Matt Britzman, senior equity analyst at Hargreaves Lansdown, says:“Global markets opened on the back foot this morning, with the FTSE 100 edging lower, alongside softer European markets and US futures pointing to a muted Wall Street open later today as investors grapple with fresh political turbulence and rising geopolitical risk,Sentiment has been shaken by news of a criminal probe into Fed Chair Jerome Powell and his claims of political pressure from the Trump administration, while unrest in Iran and talk of possible US intervention add another layer of concern,

Behind the Somali daycare panic is a mother-and-son duo angling to be top Maga influencers

YouTube influencer Nick Shirley, whose viral video alleging fraud by daycare centers servicing Minneapolis’s Somali American community came days ahead of the Trump administration’s declaration of a national funding freeze, has for years published conspiracy-minded takes on hot-button rightwing issues.The Guardian’s journalism is independent. We will earn a commission if you buy something through an affiliate link. Learn more.He also has close ties to the White House, Republicans, and to representatives of an earlier generation of rightwing partisan “ambush journalists” such as James O’Keefe

Elon Musk’s X threatened with UK ban over wave of indecent AI images

Elon Musk’s X has been ordered by the UK government to tackle a wave of indecent AI images or face a de facto ban, as an expert said the platform was no longer a “safe space” for women.The media watchdog, Ofcom, confirmed it would accelerate an investigation into X as a backlash grew against the site, which has hosted a deluge of images depicting partially stripped women and children.X announced a restriction on creating images via the Grok AI tool on Friday morning in response to the global outcry. A post on the platform said the ability to generate and edit images would now be “limited to paying subscribers”. Those who pay have to provide personal details, meaning they could be identified if the function was misused

Robots that can do laundry and more, plus unrolling laptops: the standout tech from CES 2026

This year will be filled with robots that can fold your laundry, pick up objects and climb stairs, fridges that you can command to open by voice, laptops with screens that can follow you around the room on motorised hinges and the reimagining of the BlackBerry phone.Those are the predictions from the annual CES tech show in Las Vegas that took place this week. The sprawling event aims to showcase cutting-edge technology developed by startups and big brands.Many of these fancy developments will be available to actually buy, moving from outlandish concepts to production devices, although some are still limited to costly prototypes.The rise of the humanoid robot continues, with the show floor filled with myriad prototypes, some of which operated autonomously rather than being remotely controlled or performing set routines this year

No 10 condemns ‘insulting’ move by X to restrict Grok AI image tool

Downing Street has condemned the move by X to restrict its AI image creation tool to paying subscribers as insulting, saying it simply made the ability to generate explicit and unlawful images a premium service.There has been widespread anger after the image tool for Grok, the AI element of X, was used to manipulate thousands of images of women and sometimes children to remove their clothing or put them in sexual positions.Grok announced in a post on X, which is owned by Elon Musk, that the ability to generate and edit images would be “limited to paying subscribers”. Those who pay have to provide personal details, meaning they could be identified if the function was misused.Asked about the change, a Downing Street spokesperson said it was unacceptable

X UK revenues drop nearly 60% in a year as content concerns spook advertisers

UK revenues at Elon Musk’s X fell by almost 60% in a year as advertisers pulled their spending over concerns about the social media platform’s content.News of the plummeting financial performance comes after X switched off the image creation function on its AI tool Grok for the vast majority of users after a widespread outcry about its use to create sexually explicit and violent imagery.In the UK, the social media site recorded a 58.3% fall in revenues from £69.1m in 2023 to £28

Spotify no longer running ICE recruitment ads, after US government campaign ends

Spotify is no long running advertisements for the US Immigration and Customs Enforcement (ICE), the streaming service has confirmed, after the Trump administration campaign ended in late 2025.“There are currently no ICE ads running on Spotify,” the Swedish company said in a statement. “The advertisements mentioned were part of a US government recruitment campaign that ran across all major media and platforms.”Since April, the government ads have also run on Amazon, YouTube, Hulu and Max among other streaming companies, with the aim of recruiting more than 10,000 deportation officers by the end of 2025.Previously, Spotify said that the ads, which encouraged US listeners to “fulfil your mission to protect America” and offered $50,000 in signing bonuses, did not “violate our advertising policies”

Lending to small businesses and low-income areas must expand, say Labour backbenchers

Justice department opens investigation into Jerome Powell as Trump ramps up campaign against Federal Reserve

‘Dangerous and alarming’: Google removes some of its AI summaries after users’ health put at risk

Elon Musk says UK wants to suppress free speech as X faces possible ban

Tom Willis wins family affair to help Saracens topple Toulouse in Champions Cup

David hat-trick dismantles Stormers to send Harlequins into Champions Cup last 16