How to turn excess nuts and seeds into a barnstoming festive pudding – recipe | Waste not

Last Christmas we visited my in-laws in Cape Town, where, at over 30C, a traditional Christmas pudding just didn’t feel quite right,But my mother-in-law and her friend created the most delicious feast: a South African braai (barbecue) followed by an incredible ice-cream Christmas pudding made by mashing vanilla ice-cream with a mix of tutti frutti, candied peel, raisins and cherries,This semifreddo is a take on that dessert: a light frozen custard that still carries all the festive flavours,Tutti frutti semifreddo Christmas puddingWe stopped using clingfilm in our kitchen 15 years ago now, because it’s not easily recycled and because of health concerns about the possible transfer of microplastics into our food,Most semifreddo recipes tell you to line the freezer container with clingfilm, but I suggest using no liner at all, or silicone-free, unbleached baking paper instead.

If, like me, you don’t love traditional Christmas pudding, then this ice-cream alternative might be just the ticket.It’s easy to make in advance, a little decadent and delivers festive cheer.Anna Jones is one of the best food writers of our generation – her recipes are wholesome, adventurous and always easy to cook – and this recipe is adapted from her original, but tweaked to incorporate the flavours of Christmas pudding.I like how she skips the usual ribboning process, when you’d normally whisk the yolks and sugar over a bain-marie, simply by adding creme fraiche or mascarpone.I’ve slightly increased the amount of creme fraiche to use up a whole pot and made the ingredients flexible, so you can use up whatever nuts, candied peel or spices you have in your cupboard.

Serves 8200g mixed candied peel, stem ginger and/or dried fruit (eg, glacé cherries, raisins or chopped apricots); even a few crushed biscuits are tastyFinely grated zest and juice of ¼ lemon or orange2 tbsp brandy, whisky, rum or marsala1 tsp ground mixed spices (eg, cinnamon, ginger, cardamom or allspice)3 large eggs, separated120g icing sugar300ml double cream 200g creme fraiche, or 200ml extra double cream100g mixed nuts (eg, almonds, pistachios or hazelnuts), roughly chopped, plus extra to finish50g dark chocolate, finely chopped (optional), plus extra to finishLine a large pudding basin or loaf tin with baking paper.In a small bowl, macerate the mixed candied peel, stem ginger and/or dried fruit with the citrus zest and juice, the alcohol and your chosen spices.Separate the eggs into two clean bowls.Whisk the whites until firm.To the yolks, add the icing sugar, whisk until thick and pale, then beat in the macerated fruit.

In another bowl, whip the double cream to soft peaks, then whisk in the creme fraiche (or more double cream) until just combined.Gently fold this through the egg yolk mixture, then gently fold in the egg whites – use a large metal spoon to keep the mix airy.Finally, stir in the roughly chopped mixed nuts and finely chopped dark chocolate, if using.Spoon into the lined basin, cover with a plate or baking paper, and freeze for at least six hours or overnight.For the best results, move the semifreddo to the fridge about 30 minutes before you want to serve.

Turn out on to a plate, top with extra nuts and grated chocolate, then slice and serve.

HSBC has a new chair but the succession process should have been slicker

It turns out that Sir Mark Tucker, 67, retired as chair of HSBC in September to make way for an older man. Say hello to Brendan Nelson, 76, a former KPMG partner, who has been doing the job on an interim basis for a couple of months but was regarded as a rank outsider to get the gig permanently.Just how permanent remains to be seen because the HSBC chief executive, Georges Elhedery, clearly unaware that Nelson had thrown his hat into the ring, appeared to rule him out when speaking at an FT conference only on Monday. He said Nelson didn’t wish to do a full term of six to nine years, a remark that didn’t feel controversial at the time. After all, while US presidents may go on into their 80s these days, chairs of globally important banks tend not to

UK using more wood to make electricity than ever, Drax figures show

Britain’s reliance on burning wood to generate electricity has reached record highs, even as the government moves to curb the controversial use of biomass power.The latest figures supplied by the owner of the huge Drax biomass plant in North Yorkshire have revealed that power generated from burning biomass wood pellets provided 9% of the UK’s electricity in July, its largest ever monthly share.Weeks later, biomass provided almost a fifth (17%) of the UK’s electricity for the first time during one morning in September when renewable energy resources were particularly low.Britain’s record reliance on biomass generation has reached new heights as the government set out its plans to dramatically reduce the controversial energy source under a new subsidy agreement with the FTSE 250 owner of the Drax power plant.Under the deal, Drax will continue to earn more than £1m a day from energy bills in exchange for burning wood pellets at its power plant

Thames Water profits surge on higher bills; Prada buys Versace for $1.4bn – as it happened

Time to wrap up…Thames Water reported its first half earnings this morning, warning that crisis talks to secure its future with lenders are taking “longer than expected” and will drag into 2026 as it faces the prospect of a collapse into government control.Britain’s biggest water company on Wednesday said it had swung to a profit of £414m for the six months to September helped by bills rising by nearly a third, after losing £149m in the same period in 2024.Despite the jump in reported profits, the company said there was “material uncertainty which may cast significant doubt” on its status as a going concern. A collapse into government control under a special administration regime (SAR) – a form of temporary nationalisation – “could occur in the very near term” if it is unable to agree the terms of a formal takeover by its controlling lenders.HSBC has appointed the former KPMG partner Brendan Nelson as its chair after a prolonged search process that left one of the world’s biggest banks without a permanent executive in the top role for months

Design boss behind new Jaguar leaves JLR weeks after change of CEO

The Jaguar Land Rover design boss behind the Range Rover and the polarising Jaguar relaunch has abruptly departed the business just four months after its new chief executive took charge.Gerry McGovern left the role of chief creative officer on Monday after 20 years at the business in which he oversaw the design of some of the company’s most successful cars as well as the launch of a new-look, pink electric Jaguar that drew the ire of Donald Trump.Britain’s largest carmaker appointed PB Balaji as chief executive in August. Balaji, an Indian national, was previously the chief financial officer of Tata Motors, the Indian owner of JLR.Balaji was due to take over the reins of a business that was performing well, generating nearly three years of consecutive quarterly profits

HSBC appoints interim chair Brendan Nelson to permanent role

HSBC has appointed the former KPMG partner Brendan Nelson as its chair after a prolonged search process that left one of the world’s biggest banks without a permanent executive in the top role for months.The decision to appoint Nelson, who has been serving as interim chair, came as a surprise, after a protracted hunt for a permanent successor for Mark Tucker which involved courting external candidates including the former chancellor George Osborne and the head of Goldman Sachs’s Asia-Pacific division, Kevin Sneader.HSBC failed to find a permanent chair before Tucker left at the end of September, raising questions about the succession planning and the board’s effectiveness, with Tucker having first announced his decision to leave in May.Tucker, a former trainee professional footballer, left after eight years, outlasting three chief executives, to join the Hong Kong-based insurer AIA. The role of HSBC chair has become increasingly politicised, with Tucker navigating simmering tensions between the west and Beijing

Thames Water faces collapse as crisis talks take ‘longer than expected’

Thames Water has said crisis talks to secure its future with lenders are taking “longer than expected” and will drag into 2026 as it faces the prospect of a collapse into government control.Britain’s biggest water company on Wednesday said it had swung to a profit of £414m for the six months to September helped by bills rising by nearly a third, after losing £149m in the same period in 2024.Despite the jump in reported profits, the company said there was “material uncertainty which may cast significant doubt” on its status as a going concern. A collapse into government control under a special administration regime (SAR) – a form of temporary nationalisation – “could occur in the very near term” if it is unable to agree the terms of a formal takeover by its controlling lenders.Those creditors have asked the regulator, Ofwat, and the government for Thames to be let off future fines for pollution, arguing the prospect of hundreds of millions of pounds of extra costs is making a turnaround impossible

Tesla privately warned UK that weakening EV rules would hit sales

Australia’s eSafety commissioner rejects US Republican’s assertion she is a ‘zealot for global takedowns’

Sam Altman issues ‘code red’ at OpenAI as ChatGPT contends with rivals

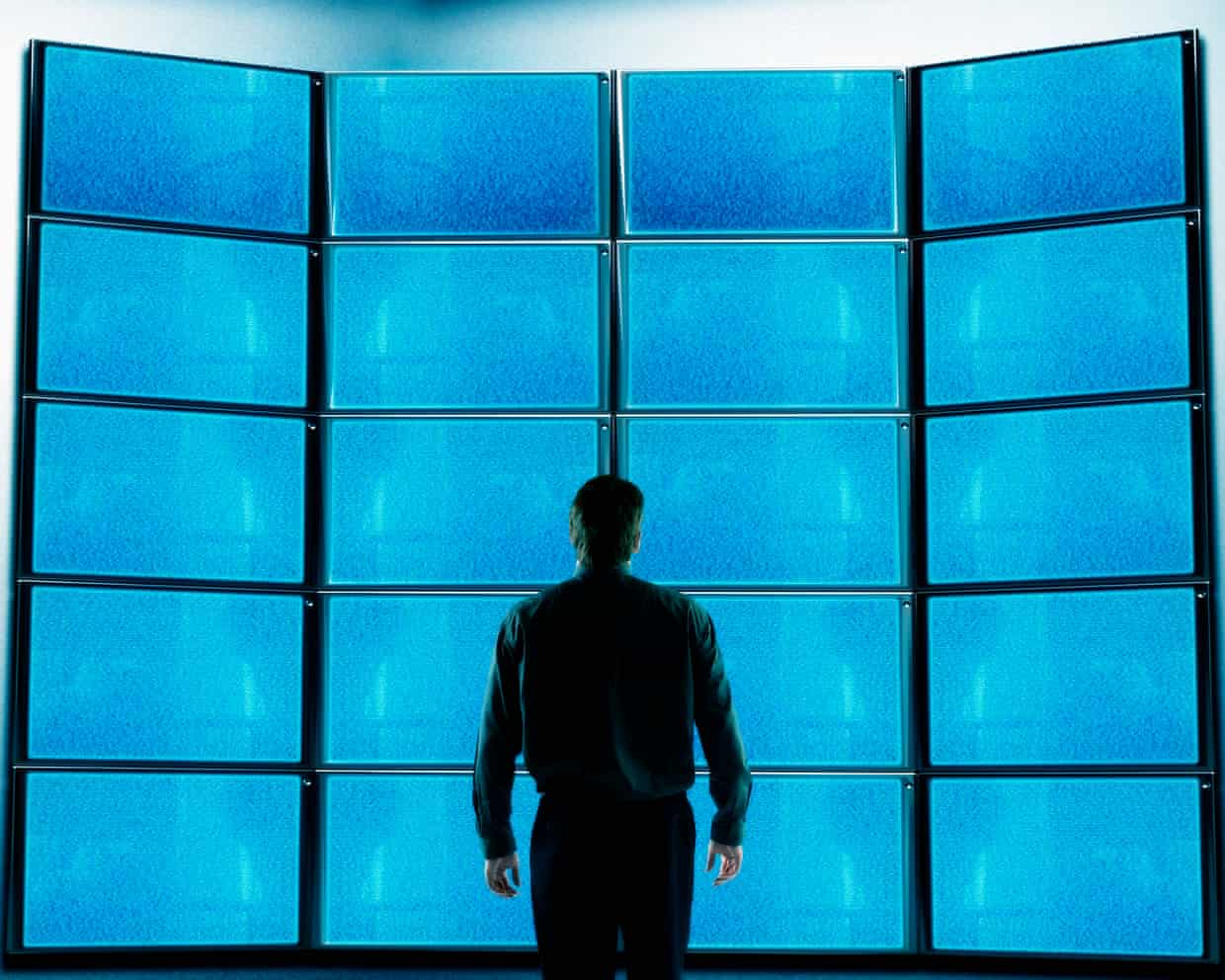

The fight to see clearly through big tech’s echo chambers

‘The biggest decision yet’: Jared Kaplan on allowing AI to train itself

Charlie Kirk tops Wikipedia’s list of most-read articles in 2025