UK using more wood to make electricity than ever, Drax figures show

Britain’s reliance on burning wood to generate electricity has reached record highs, even as the government moves to curb the controversial use of biomass power,The latest figures supplied by the owner of the huge Drax biomass plant in North Yorkshire have revealed that power generated from burning biomass wood pellets provided 9% of the UK’s electricity in July, its largest ever monthly share,Weeks later, biomass provided almost a fifth (17%) of the UK’s electricity for the first time during one morning in September when renewable energy resources were particularly low,Britain’s record reliance on biomass generation has reached new heights as the government set out its plans to dramatically reduce the controversial energy source under a new subsidy agreement with the FTSE 250 owner of the Drax power plant,Under the deal, Drax will continue to earn more than £1m a day from energy bills in exchange for burning wood pellets at its power plant.

However, it will only be supported to run just over a quarter of the time, down sharply from almost two-thirds of the time currently.When the deal was agreed in February, the energy minister, Michael Shanks, said the company’s subsidies had been cut because it “simply did not deliver a good enough deal for billpayers and enabled Drax to make unacceptably large profits”.Drax has also faced a backlash from green groups amid criticism of the company’s claims that it sources wood only from “well‐managed, sustainable forests” to manufacture the pellets burned at its power plant.The power plant’s support payments were originally due to end in 2026 but it is now in line to earn £458.6m a year between 2027 and 2031 after the government agreed to extend its subsidies beyond 2026, according to analysts at Ember.

Frankie Mayo, an analyst at the climate thinktank, said: “Britain remains too reliant on polluting fuels, including biomass.While this will wind down as wind and solar grow, we’re not fully there yet: the use of imported fuels for power jumped in July 2025, though fell in subsequent months.“Halving public subsidies for biomass power at Drax from 2027 will mean reduced reliance on this expensive and polluting fuel, but clean power development can help Britain cut imports faster.”The government was approached for comment.The Guardian revealed last month that Drax continued to burn 250-year-old trees sourced from some of Canada’s oldest forests as recently as this summer, according to a new report from forestry experts at Stand.

earth, a Canadian environmental non-profit,The report’s findings suggest that the Drax power plant was burning “irreplaceable” trees even as its owners lobbied the UK government for the additional green energy subsidies,Drax said the pellets were typically made of “low-grade” wood rejected by commercial sawmills and either sold to the biomass industry as waste wood or burned to prevent wildfires,Responding to the Stand,earth report, a Drax spokesperson for Drax said: “Our sourcing policy means Drax does not source biomass from designated areas of old growth and only sources woody biomass from well-managed, sustainable forests.

”These designated areas of old growth amount to less than half of the total old-growth forest areas in British Columbia.Dr Iain Staffell, a professor at Imperial College London, and the lead author of the report, said: “Power demand is rising at its fastest rate for 10 years as we swap petrol and diesel cars for electric vehicles and new data centres power more of our lives online.Bridging the gaps in supply when the wind is not blowing or the sun is not shining is the ultimate test for our electricity system.”

HSBC has a new chair but the succession process should have been slicker

It turns out that Sir Mark Tucker, 67, retired as chair of HSBC in September to make way for an older man. Say hello to Brendan Nelson, 76, a former KPMG partner, who has been doing the job on an interim basis for a couple of months but was regarded as a rank outsider to get the gig permanently.Just how permanent remains to be seen because the HSBC chief executive, Georges Elhedery, clearly unaware that Nelson had thrown his hat into the ring, appeared to rule him out when speaking at an FT conference only on Monday. He said Nelson didn’t wish to do a full term of six to nine years, a remark that didn’t feel controversial at the time. After all, while US presidents may go on into their 80s these days, chairs of globally important banks tend not to

UK using more wood to make electricity than ever, Drax figures show

Britain’s reliance on burning wood to generate electricity has reached record highs, even as the government moves to curb the controversial use of biomass power.The latest figures supplied by the owner of the huge Drax biomass plant in North Yorkshire have revealed that power generated from burning biomass wood pellets provided 9% of the UK’s electricity in July, its largest ever monthly share.Weeks later, biomass provided almost a fifth (17%) of the UK’s electricity for the first time during one morning in September when renewable energy resources were particularly low.Britain’s record reliance on biomass generation has reached new heights as the government set out its plans to dramatically reduce the controversial energy source under a new subsidy agreement with the FTSE 250 owner of the Drax power plant.Under the deal, Drax will continue to earn more than £1m a day from energy bills in exchange for burning wood pellets at its power plant

Thames Water profits surge on higher bills; Prada buys Versace for $1.4bn – as it happened

Time to wrap up…Thames Water reported its first half earnings this morning, warning that crisis talks to secure its future with lenders are taking “longer than expected” and will drag into 2026 as it faces the prospect of a collapse into government control.Britain’s biggest water company on Wednesday said it had swung to a profit of £414m for the six months to September helped by bills rising by nearly a third, after losing £149m in the same period in 2024.Despite the jump in reported profits, the company said there was “material uncertainty which may cast significant doubt” on its status as a going concern. A collapse into government control under a special administration regime (SAR) – a form of temporary nationalisation – “could occur in the very near term” if it is unable to agree the terms of a formal takeover by its controlling lenders.HSBC has appointed the former KPMG partner Brendan Nelson as its chair after a prolonged search process that left one of the world’s biggest banks without a permanent executive in the top role for months

Design boss behind new Jaguar leaves JLR weeks after change of CEO

The Jaguar Land Rover design boss behind the Range Rover and the polarising Jaguar relaunch has abruptly departed the business just four months after its new chief executive took charge.Gerry McGovern left the role of chief creative officer on Monday after 20 years at the business in which he oversaw the design of some of the company’s most successful cars as well as the launch of a new-look, pink electric Jaguar that drew the ire of Donald Trump.Britain’s largest carmaker appointed PB Balaji as chief executive in August. Balaji, an Indian national, was previously the chief financial officer of Tata Motors, the Indian owner of JLR.Balaji was due to take over the reins of a business that was performing well, generating nearly three years of consecutive quarterly profits

HSBC appoints interim chair Brendan Nelson to permanent role

HSBC has appointed the former KPMG partner Brendan Nelson as its chair after a prolonged search process that left one of the world’s biggest banks without a permanent executive in the top role for months.The decision to appoint Nelson, who has been serving as interim chair, came as a surprise, after a protracted hunt for a permanent successor for Mark Tucker which involved courting external candidates including the former chancellor George Osborne and the head of Goldman Sachs’s Asia-Pacific division, Kevin Sneader.HSBC failed to find a permanent chair before Tucker left at the end of September, raising questions about the succession planning and the board’s effectiveness, with Tucker having first announced his decision to leave in May.Tucker, a former trainee professional footballer, left after eight years, outlasting three chief executives, to join the Hong Kong-based insurer AIA. The role of HSBC chair has become increasingly politicised, with Tucker navigating simmering tensions between the west and Beijing

Thames Water faces collapse as crisis talks take ‘longer than expected’

Thames Water has said crisis talks to secure its future with lenders are taking “longer than expected” and will drag into 2026 as it faces the prospect of a collapse into government control.Britain’s biggest water company on Wednesday said it had swung to a profit of £414m for the six months to September helped by bills rising by nearly a third, after losing £149m in the same period in 2024.Despite the jump in reported profits, the company said there was “material uncertainty which may cast significant doubt” on its status as a going concern. A collapse into government control under a special administration regime (SAR) – a form of temporary nationalisation – “could occur in the very near term” if it is unable to agree the terms of a formal takeover by its controlling lenders.Those creditors have asked the regulator, Ofwat, and the government for Thames to be let off future fines for pollution, arguing the prospect of hundreds of millions of pounds of extra costs is making a turnaround impossible

‘Failed former Tory MPs’ who join Reform unlikely to be selected as candidates, Zia Yusuf says – as it happened

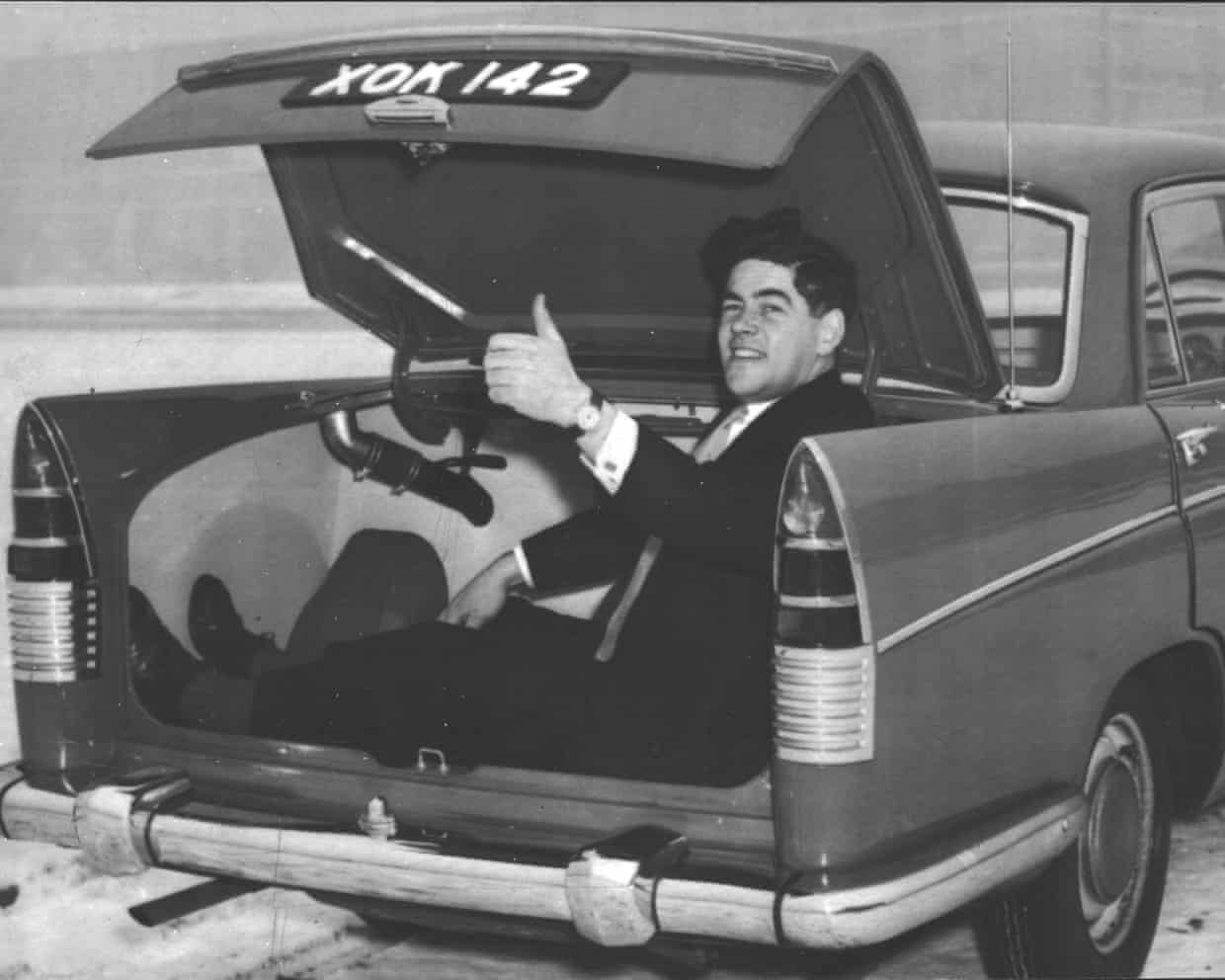

Keith McDowall obituary

Who will lose out when Labour cuts red tape? | Brief letters

Spoilt for choice, Conspiracy Kemi grabs wrong end of every stick | John Crace

Mark Fisher obituary

Foreign Office lost ‘opportunities to influence’ US after Harry Dunn death, review finds