Oil firm Petrofac enters administration, putting 2,000 jobs at risk; Greencore-Bakkavor food giant deal faces UK competition concerns – business live

British retailers reported another fall in sales in October and blamed the late autumn budget for uncertainty around tax hikes, according to a survey,The CBI business lobby group said its gauge of retail sales volumes compared with a year earlier rose only slightly this month but remained deep in negative territory at -27, versus -29 in September,Its measure of expected sales for the month ahead slipped to -39 from -36,Martin Sartorius, the CBI’s principal economist, said the 13th consecutive month of falling sales volumes measured by the survey reflected weak consumer confidence, worsened by uncertainty around Rachel Reeves’ budget on 26 November, which is a month later than usual,Persistent uncertainty ahead of the autumn budget is deepening the strain on retailers and other distribution firms that are still grappling with the effects of last year’s fiscal decisions.

To help rebuild confidence and encourage growth, the chancellor should reaffirm her commitment to no further business tax hikes in November.Like other employers, retailers were hit by higher social security contributions in Reeves’ first budget last year.They are also nervous about planned employment rights legislation, which could put firms off hiring, Sartorius said.Official figures published on Friday showed a surprise increase in retail sales volumes in September to a three-year high, boosted by tech purchases amid the release of the new iPhone 17 as well as strong online demand for gold.The US government’s debt burden is on track to overtake those of Italy and Greece for the first time this century, according to forecasts from the International Monetary Fund.

Government gross debt in the US will rise by more than 20 percentage points from now to reach 143.4% of the country’s GDP by 2030, exceeding previous records set after the pandemic, the Financial Times reported, referring to IMF data published this month.The Washington-based fund estimates that the US budget deficit will hover above 7% of GDP every year until 2030, the highest of any rich nation tracked by the IMF.Italy and Greece have long struggled with rising public debt, and were at the heart of the eurozone sovereign debt crisis of 2010-2012, with Greece needing a bailout and restructuring overseen by the IMF and EU.But government debt burdens in both countries are projected to be on a downward trend at the end of the decade, as they have tightened their grip on budget deficits.

By contrast, the US debt-to-GDP ratio will still be rising in 2030, according to the IMF projections, with the Congressional Budget Office (CBO) expecting it to increase for decades thereafter.Mahmood Pradhan, head of global macro at the Amundi Investment Institute, told the FT:It is a symbolic moment, and according to the CBO the projections are for US debt to carry on rising — that is the impact of running perpetual deficits.But Italy has a weaker growth outlook than the US, so this should not be read as meaning Italy is out of the woods.Business confidence in Germany has risen unexpectedly, pointing to gradual improvement in Europe’s largest economy.The business climate index from the Munich-based Ifo institute rose to 88.

4 points in October, from 87.7 points in September, but is still below August’s level.This was driven by improved expectations for the coming months, rising to the highest level in more than three years, while the current business situation was assessed as slightly worse, for the third month in a row.Companies overall remain hopeful that the economy will pick up in the coming year.Expectations in the manufacturing sector improved, as the decline in new orders came to a halt, although companies were less satisfied with current business.

In the service sector, confidence improved significantly, led by tourism and IT services,In trade, optimism also rose, while companies were slightly more downbeat about the current situation,However, in construction, expectations were more pessimistic, amid a lack of orders,Leo Barincou, senior economist at Oxford Economics, said the improvement in business confidence adds to other signs of a slight upturn in economic growth between October and December,The German ifo index rebounded in October, making up for some of September’s losses.

After last week’s favourable PMI, today’s reading supports the prospect of a mild upturn in economic activity in Germany in the fourth quarter.However, we don’t think any kind of strong rebound is in on the cards as hard data remains very negative.However, any improvement in economic activity is likely to be gradual, given the contraction we expect in the third quarter based on the latest data releases.All hopes are still on fiscal stimulus, said Carsten Brzeski, global head of macro at ING.Let’s be clear: the scale of Germany’s announced fiscal stimulus – €500bn for infrastructure and a ‘whatever it takes’ stance on defence – remains significant.

This money will eventually reach the economy.However, recent fiscal manoeuvres have increased the risk that the stimulus will be less impactful and slower to materialise than initially hoped.Beyond the diluted impact of fiscal stimulus, the government is also struggling to agree on the far-reaching reforms needed to structurally enhance Germany’s competitiveness.Chancellor Friedrich Merz has promised a ‘Fall of Reforms’.So far, the government has not only failed to deliver but also appears stuck in a macroeconomic model rooted in the 20th century, lacking a clear plan to propel the German economy into the 21st century.

He cautioned that the confidence improvement is “not a turning point” for the German economy.On Thursday, the first estimate of German third-quarter growth will provide a better impression of the current state of the economy.After the contraction in the second quarter, chances of a rebound are lower than the chances of yet another contraction and, in turn, a technical recession.Today’s Ifo index suggests that German businesses still bank on the fiscal stimulus to save the economy, even if the economy is heading for a third consecutive year of stagnation.With all the headwinds from trade, the exchange rate and geopolitics, it is hard to believe that today’s Ifo index marks a turning point.

European shares have edged higher, as investors are willing to take more risk – cheered by comments from Donald Trump that he could reach a trade deal with China’s president in the coming days,The pan-European Stoxx 600 index edged up 0,1%, hitting an intra-day record high,However, the FTSE 100 index in London dipped by 6 points to 9,639, reversing a similar gain in early trading, after it closed at a record high on Friday,Germany’s Dax is 0.

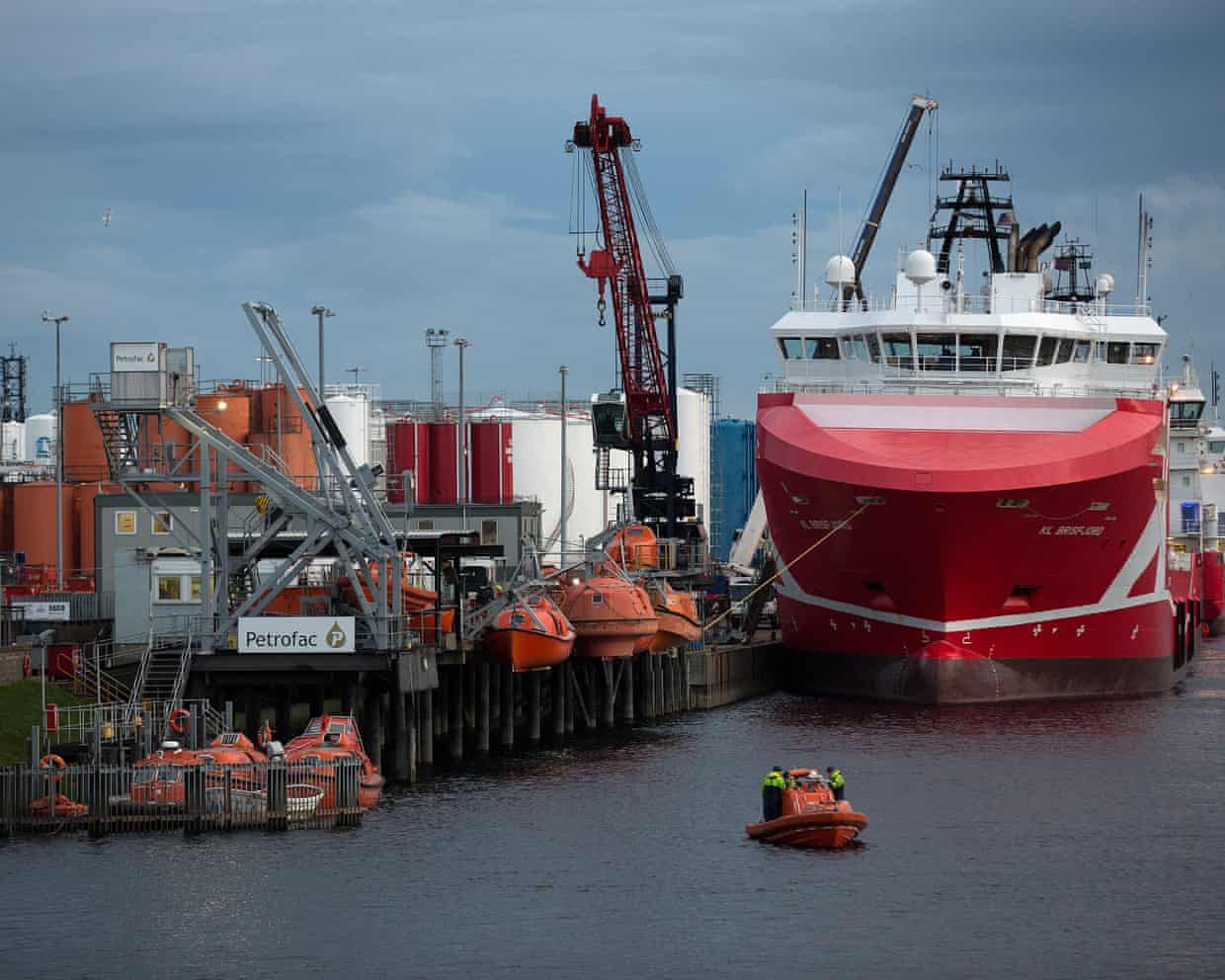

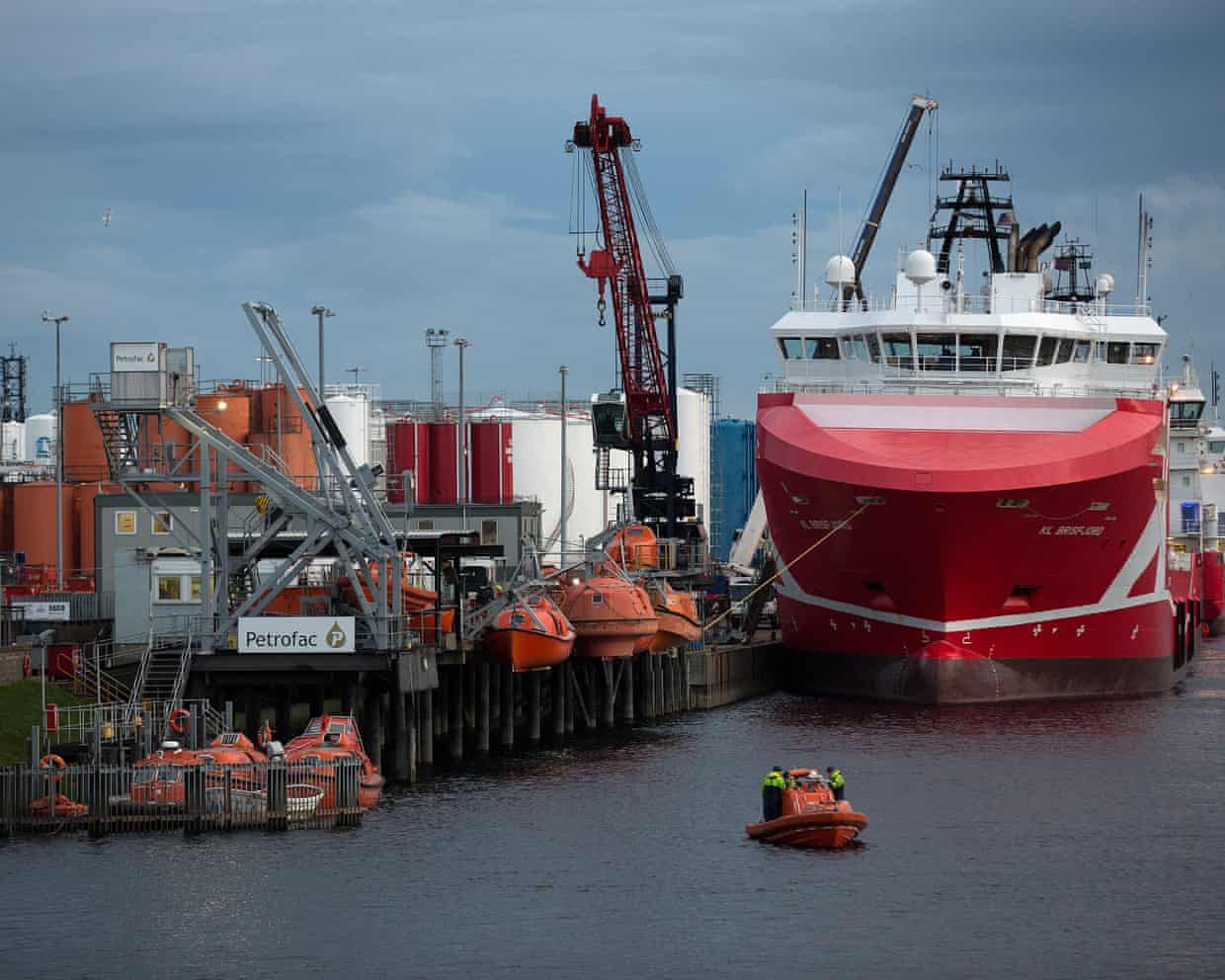

15% ahead while France’s CAC dipped by 0.1% and Italy’s FTSE MiB gained 0.6%.The oil and energy company Petrofac has filed for administration, putting 2,000 jobs in Scotland at risk.Petrofac said its holding company has applied to the High Court of England and Wales to appoint administrators – which will only affect the holding company.

This comes after the energy services firm lost a major offshore wind project in the Netherlands over its failure to meet contractual obligations,It stressed that its North Sea operations will continue to trade, and is exploring options for “alternative restructuring and M&A solutions” with its key creditors,According to Sky News, there are hopes that a buyer can be found quickly for its North Sea business, with one source close to the company suggesting that it could happen in the coming days,Petrofac’s collapse would be a serious setback for the British government, as it comes under increasing political pressure over plans to block new North Sea oil licences for exploration,Creditors include a group of noteholders, who are supporting the company with forbearance arrangements while alternative options are explored.

Petrofac said it retains the support of its lenders.It added:When appointed, administrators will work alongside executive management to preserve value, operational capability and ongoing delivery across the group’s operating and trading entities.Authors will come to rely on artificial intelligence to help them beat writer’s block, the boss of the book publisher Bloomsbury has said.Nigel Newton, the founder and chief executive of the publisher behind the Harry Potter series, said the technology could support almost all creative arts, although it would not fully replace prominent writers.He told the PA news agency:I think AI will probably help creativity, because it will enable the 8 billion people on the planet to get started on some creative area where they might have hesitated to take the first step.

AI gets them going and writes the first paragraph, or first chapter, and gets them back in the zone.And it can do similar things with painting and music composition and with almost all of the creative arts.Newton, who founded Bloomsbury in 1986 and signed JK Rowling in the 1990s, said there could be a “problem” if AI is used to write entire books.However, he said that readers ultimately look for books written by famous authors.We are programmed deep in our DNA to be comforted by the authority and the reliability of big brand names, and that applies more than ever to the names of big writers.

There will be some shoddy content out there so people will turn increasingly to sources of authority for reassurance.Bloomsbury sales have been increased by a roster of high-profile authors in recent years, including the fantasy author Sarah J Maas, whose popularity has risen on TikTok.Maas, the author behind the “romantasy” series A Court of Thorns and Roses, has sold more than 70m copies of her books in English across the world.All of the titles have been published by Bloomsbury.Last week the publisher, which is headquartered in London and employs about 1,000 people, experienced a share rise of as much as 10% in a single day after it reported a 20% jump in revenue in its academic and professional division in the first half of its financial year, largely thanks to an AI licensing agreement.

However, revenues in its consumer division fell by about 20%, largely due to the absence of a new title from Maas.While Newton argued that AI could help new writers, many prominent authors have clashed with AI companies in recent years.In September, the AI company Anthropic agreed to pay $1.5bn (£1.1bn) to settle a class action lawsuit in the US by book authors who argued the company took pirated copies of their works to train its chatbot.

Shares in Britain’s second-biggest drugmaker GSK rose by 1,3%, making it one of the top risers on the FTSE 100, after it struck a deal for a prostate cancer medication,The pharmaceutical firm acquired exclusive worldwide rights from the French biotech Syndivia to develop and sell a treatment for metastatic castration-resistant prostate cancer that it is in pre-clinical studies,GSK said the drug, will complement its pipeline for prostate cancer medicines,Around 1.

4 million men worldwide are diagnosed with prostate cancer each year and 10-20% develop advanced disease, castration resistance with metastases, within five years.Hesham Abdullah, senior vice-president and global head of oncology, R&D, at GSK said:Prostate cancer represents a significant health burden and an emerging area of growth for GSK, where targeted therapies are urgently needed in metastatic castration-resistant settings.The addition of this ADC builds on GSK’s growing portfolio and strengths in tumour-targeted technologies, including GSK’227, our B7-H3-targeting ADC.GSK is paying the Strasbourg-based biotech £268m for the medication.The TSE 100 index has nudged 6 points higher at the open, rising to 9,651 after Friday’s record close.

HSBC is among the biggest fallers on the blue-chip index, down by almost 2%.It said it will take a $1.1bn provision in its third-quarter results (out tomorrow), after losing part of an appeal in a lawsuit related to convicted fraudster Bernard Madoff’s Ponzi scheme.The London-based bank acted as a service provider to several funds that invested with Bernard L.Madoff Investment Securities.

Herald Fund sued HSBC’s Luxembourg division in 2009, seeking restitution of assets it said were lost in the fraud.Last Friday, the Luxembourg Court of Cassation rejected an appeal by HSBC’s unit over the restitution of securities claimed by Herald, but accepted its appeal on a separate cash restitution claim, the bank said.HSBC now plans to lodge a second appeal with the Luxembourg Court of Appeal and if is is unsuccessful, the bank said it would contest the amount to be paid.It added that “the eventual financial impact could be significantly different”.Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Asian stocks are rallying, after Donald Trump said the US and China are set to “come away with” a trade deal,The current trade truce is set to expire on 1 November, but hopes of an extension lifted stocks across Asia,US officials expect Beijing to postpone export controls on rare earths, following trade talks in Malaysia over the weekend,Treasury secretary Scott Bessent said on Sunday that US and Chinese officials had drawn up a “very substantial framework” for a trade deal,Japan’s Nikkei jumped by 2.

5% through the 50,000 mark for the first time, while South Korea’s Kospi climbed 2.6% to a record high.Hong Kong’s Hang Seng rose by 1% and mainland Chinese exchanges in Shanghai and Shenzhen gained 1.2% and 1.5% respectively.

Stock futures are pointing to a higher open in Europe and on Wall Street later,On Friday, the S&P 500 and the Nasdaq in New York, and the FTSE 100 in London, hit record highs after US inflation data fuelled hopes of interest rate cuts,Trump is due to meet Chinese president Xi Jinping later this week in South Korea during his Asia tour,The US president told reporters on Air Force One on the way to Japan from Malaysia:I’ve got a lot of respect for president Xi and I think we’re going to come away with a deal,We have China coming and its going to be very interesting.

He reiterated:I think we’re going to have a deal with China.We’re going to meet them later in China and we’re going to meet them in the US, either Washington or Mar-a-Lago.Trump added he might sign a final deal for TikTok on Thursday.Bessent claimed on Sunday that the US and China have finalised the details of a deal transferring TikTok’s US version to new owners.The price of gold fell by 1% to $4,069 an ounce, as demand for safe-haven assets weakened

Oil firm Petrofac enters administration, putting 2,000 jobs at risk; Greencore-Bakkavor food giant deal faces UK competition concerns – business live

British retailers reported another fall in sales in October and blamed the late autumn budget for uncertainty around tax hikes, according to a survey.The CBI business lobby group said its gauge of retail sales volumes compared with a year earlier rose only slightly this month but remained deep in negative territory at -27, versus -29 in September. Its measure of expected sales for the month ahead slipped to -39 from -36.Martin Sartorius, the CBI’s principal economist, said the 13th consecutive month of falling sales volumes measured by the survey reflected weak consumer confidence, worsened by uncertainty around Rachel Reeves’ budget on 26 November, which is a month later than usual.Persistent uncertainty ahead of the autumn budget is deepening the strain on retailers and other distribution firms that are still grappling with the effects of last year’s fiscal decisions

Oil and gas firm Petrofac files for administration, putting thousands of jobs at risk

Petrofac, one of the biggest North Sea oil and gas contractors, has filed for administration, putting more than 2,000 jobs in Scotland at risk.The energy services provider said it had applied to the high court of England and Wales to appoint administrators, after it lost a big offshore wind project over its failure to meet contractual obligations.Petrofac, which employs about 7,300 people globally, said the administration plans applied only to its ultimate holding company and that it would continue to trade during the process.Uncertainty over the company’s continued viability will pile political pressure on the government, as it faces a backlash over plans to tackle the climate crisis by blocking new North Sea oil licences for exploration.Energy secretary Ed Miliband’s department said on Monday it was leading efforts across “all parts of government” to support Petrofac’s UK arm, which it employs about 2,000 people at its North Sea hub in Aberdeen

Ultra-HD televisions not noticeably better for typical viewer, scientists say

Many modern living rooms are now dominated by a huge television, but researchers say there might be little point in plumping for an ultra-high-definition model.Scientists at the University of Cambridge and Meta, the company that owns Facebook, have found that for an average-sized living room a 4K or 8K screen offers no noticeable benefit over a similarly sized 2K screen of the sort often used in computer monitors and laptops. In other words, there is no tangible difference when it comes to how sharp an image appears to our eyes.“At a certain viewing distance, it doesn’t matter how many pixels you add. It’s just, I suppose, wasteful because your eye can’t really detect it,” said Dr Maliha Ashraf, the first author of the study from the University of Cambridge

Apple Watch Ultra 3 review: the biggest and best smartwatch for an iPhone

The biggest, baddest and boldest Apple Watch is back for its third generation, adding a bigger screen, longer battery life and satellite messaging for when lost in the wilderness.The Guardian’s journalism is independent. We will earn a commission if you buy something through an affiliate link. Learn more.The Ultra 3 is Apple’s answer to adventure watches such as Garmin’s Fenix 8 Pro while being a full smartwatch for the iPhone with all the trimmings

The old man and the mirror: Aaron Rodgers meets the quarterback he used to be

The four-time MVP faced his old team on Sunday night and put in a respectable performance. But it was Jordan Love who was able to control the gameIt all started so well. And then it fell apart.For two quarters, it looked like Aaron Rodgers might conjure one of those nights, the sort that ends with a smirk, a wink, and a reminder that he can match any of the league’s young pups. It was the first time in his career that he played against Green Bay, where he spent nearly two decades, won four MVPs and a lone Super Bowl

Crunch time nears for Australia as selectors try to fit Ashes batting puzzle pieces together | Martin Pegan

The Great Australian Bat Off has returned for a brand new season with fresh faces and forgotten favourites bidding to join the cast for the Ashes series opener. In a major subplot, captain Pat Cummins is officially out of the first Test and is all but certain to be replaced by understudy Scott Boland, while the final auditions to claim a spot in the squad will be staged across the Sheffield Shield matches that begin on Tuesday as much as the T20 series against India.The main storyline will be familiar to seasoned fans as the Australia selectors largely repeat last year’s search for an opener to partner Usman Khawaja. But the return to form of Marnus Labuschagne, and injury concerns for Cameron Green and Beau Webster, are plot twists that have thrown up more uncertainty over which six batters will be included for the Perth Test.Green was pulled from the ODI series against India due to side soreness in what chair of selectors George Bailey said was a “conservative” call, but doubts remain over his ability to bowl early in the Ashes

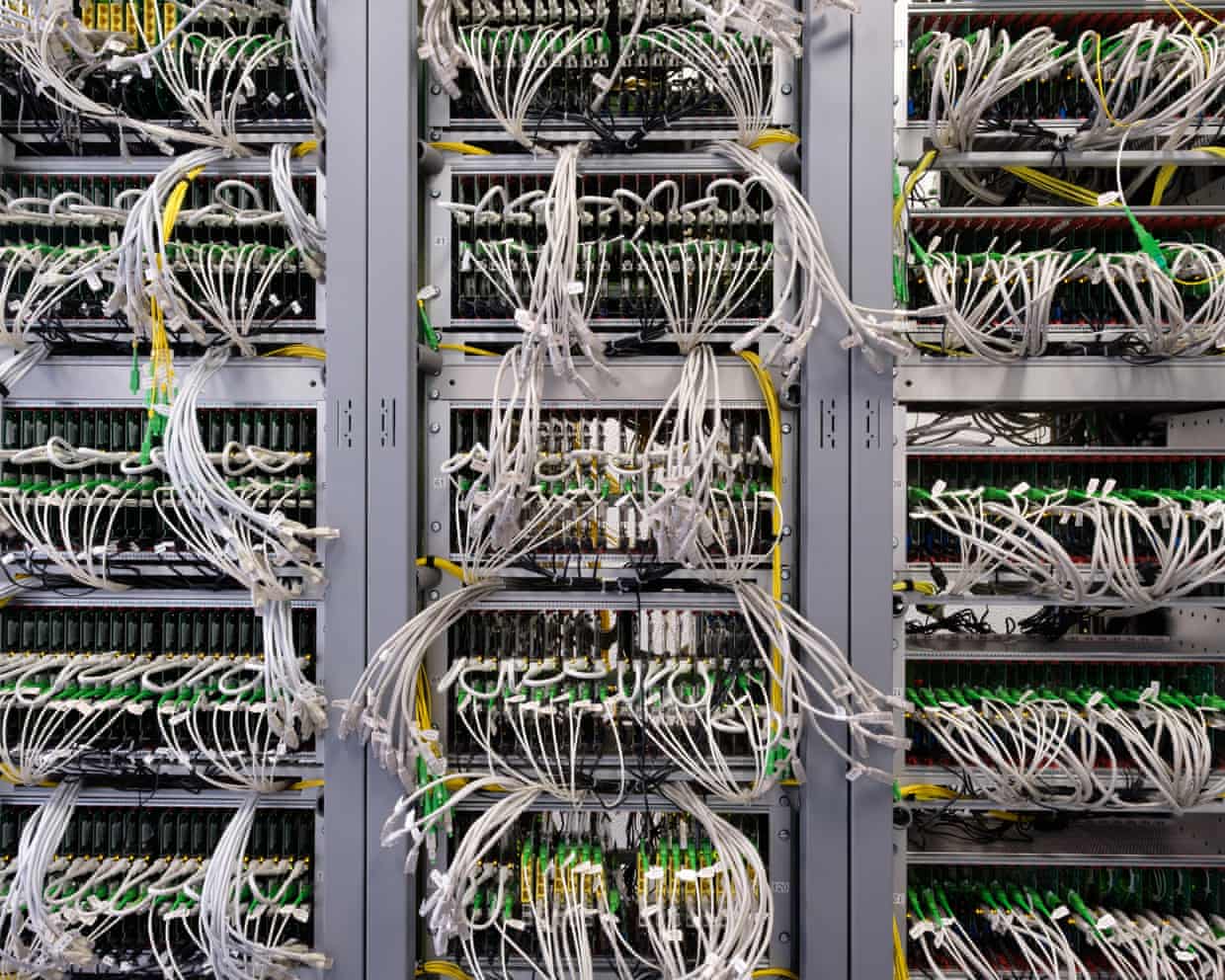

Could the internet go offline? Inside the fragile system holding the modern world together

Fare game: what the battle between taxis and Uber means for your airport trip in Sydney and Melbourne

Amazon strategised about keeping its datacentres’ full water use secret, leaked document shows

AI models may be developing their own ‘survival drive’, researchers say

‘He’s one of the few politicians who likes crypto’: my day with the UK tech bros hosting Nigel Farage

‘Sycophantic’ AI chatbots tell users what they want to hear, study shows