UK borrowing exceeds forecasts in October as retail sales fall; energy price cap to rise in January – business live

Newsflash (yes, another one): The UK government borrowed more than forecast last month to balance the books, highlighting the fiscal challenge facing Rachel Reeves in next month’s budget.The Office for National Statistics has reported that the UK borrowed £17.4bn in October, to cover the shortfall between tax income and spending.City economists had expected borrowing to drop to £15bn, down from the £20bn borrowed in September.Significantly, this is £3bn more than the £14.

4bn forecast in March 2025 by the Office for Budget Responsibility.So far this year, the UK government has borrowed £116.8bn; £9.0bn more than in the same seven-month period of 2024.That’s the second-highest April to October borrowing (not adjusted for inflation) on record, after that of 2020.

Ofgem’s decision to raise the UK price cap slightly, as we enter the coldest months of the year, is a blow.Richard Neudegg, director of regulation at Uswitch.com, calls it a “tedious disappointment’:“Millions of homes will now have their heating on to cope with this week’s cold snap, so the stubbornly high energy price cap is a stark reminder of the need for households to take matters into their own hands.“Industry forecasts had been predicting a small fall in the cap, so this increase will be a tedious disappointment for the millions of standard tariff customers who are already paying over the odds for their energy.“Customers on a price-capped tariff can switch to a fixed deal now and start seeing average savings of £185 a year.

In doing so, they’ll also protect themselves from the predicted increase we might see in April.“Consumers should run a comparison for their usage levels and region.For households able to switch, fixing now at a cheaper rate is the best defence against high winter bills.“Two million households are planning to go without central heating this winter, which is a damning indictment of the state of energy affordability.All eyes are now on next week’s Budget and whether the Chancellor can deliver any more meaningful support on energy bills.

“Importantly, a mooted removal of VAT on energy bills would apply to all customers - so those choosing a fixed deal to beat the price cap would save twice.”This morning’s economic data paints “a pretty grim picture”, creating a bleak backdrop for the Budget, says Ruth Gregory, deputy chief UK economist at Capital Economics.On the public finances, Gregory explains:The £17.4bn of public sector net borrowing in October was once again higher than the consensus forecast of £15.1bn and the OBR’s forecast of £14.

4bn.This means that after seven months of the 2025/26 financial year, public sector net borrowing is a huge £9.9bn higher than the OBR forecast at the Spring Statement in March.The overshoot in the Chancellor’s chosen fiscal mandate of the current budget is even greater, at £15.1bn.

Higher local authority spending, which is particularly subject to revision, has been a key source of the overshoot.But the slow growth of tax receipts has played a part too, which has been surprising given that high inflation has boosted consumer spending in nominal terms.And on retail sales, the 1.1% month-on-month-fall in retail sales volumes in October “isn’t quite as bad as it looks”, and could be reversed in November if consumers were indeed holding back spending ahead of Black FridayBut, she adds:The risk is that the fourth quarter isn’t a golden one for retailers and that higher taxes in the Budget restrain retail spending over the crucial festive period and going into next year.Today’s borrowing figures compound the woes for Chancellor Rachel Reeves as she seeks to plug gaps in the public finances and find extra to rebuild her headroom for future shocks, says Richard Carter, head of fixed interest research at Quilter Cheviot: Carter points out that borrowing so far this financial year is £9bn higher than a year before, which he says highlights the extent to which the government has increased borrowing since coming to power last year.

“Markets and investors are craving some sort of fiscal responsibility from the UK government, but with next week expected to bring yet more tax rises and potential unintended consequences, one does begin to question how long this current approach can last.Without a shift in the fiscal rules again, the UK economy is bound between tax rises, spending cuts or a combination of the two.So far this government has preferred to use the lever of tax rises and found its backbenchers have jammed the spending cuts one.Economic growth is subsequently difficult to achieve and shows no sign of taking off again any time soon.“Gilt yields have been climbing higher once again in recent weeks, and the UK still has a risk premium attached to it compared to peers.

Ultimately, today’s borrowing figures suggest Reeves is running out of room, and potentially time, to kick start the economy and get it growing once again,While rate cuts will help, inflation remains sticky and as such the Bank of England may not act as aggressively as the government would like,The ball is in Reeves’ court, but her next move will prove crucial next week,”At £17,4bn, UK government borrowing in October was £1.

8bn less than October 2024 (a smaller fall than expected).This fall was due to taxes rising faster than spending.ONS chief economist Grant Fitzner explains:“Borrowing this October was down on the same month last year, although it was still the third-highest October figure on record in cash terms.“While spending on public services and benefits were both up on October last year, this was more than offset by increased receipts from taxes and National Insurance contributions.”Newsflash (yes, another one): The UK government borrowed more than forecast last month to balance the books, highlighting the fiscal challenge facing Rachel Reeves in next month’s budget.

The Office for National Statistics has reported that the UK borrowed £17.4bn in October, to cover the shortfall between tax income and spending.City economists had expected borrowing to drop to £15bn, down from the £20bn borrowed in September.Significantly, this is £3bn more than the £14.4bn forecast in March 2025 by the Office for Budget Responsibility.

So far this year, the UK government has borrowed £116.8bn; £9.0bn more than in the same seven-month period of 2024.That’s the second-highest April to October borrowing (not adjusted for inflation) on record, after that of 2020.Newsflash: Retail sales fell across Great Britain last month, for the first time since May.

The Office for National Statistics has reported that retail sales volumes are estimated to have fallen by 1.1% in October 2025.The ONS says:Supermarkets, clothing, and mail order retailers fell in October 2025, which some retailers attributed to consumers delaying their spending in the lead up to Black Friday.That follows a 0.7% rise in September (revised up from a 0.

5% rise) and a 0.5% increase in August (revised down from a 0.6% rise)Newsflash: Hopes for a small fall in energy bills across Great Britain have been dashed.Regulator Ofgem has just announced that from 1 January to 31 March 2026 there will be a small monthly increase of 28 pence on the price of energy for a typical household who use electricity and gas and pay by Direct Debit.The change means the average dual fuel energy bill will increase to £1,758 per year in January to March, up from £1755 in the current quarter, an increase of 0.

2%.As flagged in the introduction, forecasters had expected a 1% drop in the cap which would have saved a typical household £22 per year.Ofgem says:Compared to the level between January and March 2025, it is 1% or £20 lower.Year on year when adjusted for inflation the new cap is 2% or £37 lower than the same period in 2025.The annual cost for people who use electricity and gas and pay by Direct Debit would be £1,758 per year (0.

2%).There may be jitters in the European markets today, after losses on Wall Street last night.Fears of a growing bubble around the artificial intelligence frenzy resurfaced yesterday, less than 24 hours after strong results from chipmaker Nvidia sparked a rally.Wall Street initially rose after Nvidia, the world’s largest public company, reassured investors of strong demand for its advanced data center chips.But the relief dissipated, and technology stocks at the heart of the AI boom came under pressure.

The benchmark S&P 500 closed down 1.6%, and the Dow Jones industrial average closed down 0.8% in New York.The tech-focused Nasdaq Composite closed down 2.2%.

The futures market indicates we’ll see losses in London when trading begins at 8am.Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.We’re about to get the final healthcheck on the UK economy ahead of next week’s budget.The latest public finances are expected to show the UK borrowed around £15bn in October to cover the shortfall between tax receipts and spending.Economists will scrutinise the data to see whether the government has fallen further off course against the forecasts set in March.

New retail sales data is also due, and show whether consumers were hit by pre-budget caution.The City expects retail sales were flat month-on-month in October, but up 1.5% compared with a year ago.And in a flurry of early morning news, energy regulator Ofgem is about to set the latest price cap on bills across Great Britain.Households may get a little respite from rising costs – the cap is expected to drop by around 1% from January due to lower wholesale gas prices.

That would lower the average dual-fuel bill for a typical household to £1,733 a year, down £22, forecaster Cornwall Insight has said,7am GMT: UK public finances for October7am GMT: UK retail sales for October7am GMT: UK energy price cap for January-March 2026 to be set8am GMT: Eurozone flash PMI economic data9:30am GMT: UK flash PMI economic data3,40pm GMT: Bank of England chief economistHuw Pill panellist in Zurich on ‘the future of the world’s leading currencies’

Chiefs heir Gracie Hunt backs rival Super Bowl half-time show over Bad Bunny

Gracie Hunt, the daughter of Kansas City Chiefs owner Clark Hunt, is throwing her support behind Turning Point USA’s plan to stage an alternative Super Bowl half-time show, a direct counter to the NFL’s decision to feature Bad Bunny at Super Bowl LX.Hunt said in an appearance on Fox News Channel’s The Will Cain Show on Tuesday that she “most definitely” backs Turning Point’s counter-programming effort, spearheaded by Erika Kirk, the widow of Charlie Kirk. The NFL’s choice of Bad Bunny for the half-time show has attracted strong pushback from many on the right, who object to his criticism of Donald Trump and US immigration enforcement.“I really respect Erika for all that she’s done, especially with creating a half-time show for America,” she said. “You know, children are young, they’re impressionable

England’s wing commander Daly primed to take flight against Pumas

It’s funny how things have come full circle for Elliot Daly. The first time he played a Test against Argentina he lasted barely five minutes before being shown a red card for a misjudged tackle on a still airborne opponent. And now, nine years on, to whom have England turned to help discomfort the Pumas aerially? None other than wing commander Daly.Much has changed, however, since that distant sending off at Twickenham in November 2016 on what was only his third start for England. Daly is now a vastly experienced international with 73 caps and the game also looks significantly different courtesy of the crackdown on “escorts” protecting the catcher, which has put an even greater emphasis on high-ball expertise

‘I made mistakes on TV, he made his on a field’: Panesar strikes back at Smith’s Mastermind jibe

Steve Smith, Australia’s acting captain, has confirmed his team for Friday’s opening Ashes Test – but his team announcement was overshadowed by an extraordinary verbal attack on Monty Panesar after the former England spinner suggested Ben Stokes and his touring team should try to upset him by rehashing the infamous sandpaper ball-tampering controversy of 2018.Smith insisted the comments “didn’t really bother me”, but apparently demonstrated the opposite by raking over Panesar’s notoriously miserable appearance on the TV quiz Mastermind in 2019.Panesar later hit back at Smith, saying on BBC Radio 5 Live: “I’ve had some great moments for England and I’ve had shockers, and he’s had some great moments for Australia and he’s obviously had a very big shocker in South Africa. We’ve both made mistakes. I made mine on a quiz show, he made his on a cricket field

Carlton are riding high on an AFLW wave of momentum. Just don’t call it a fairytale | Sarah Guiney

Momentum is a dangerous thing in sport. It can’t be acquired with any real success; it simply decides to arrive, announced only by the inexplicable way it shifts the air around a team. And something has certainly shifted down at Princes Park.If there had been any lingering doubts, Carlton’s semi-final demolition of Hawthorn well and truly dispelled them. From the first whistle, the Blues burst forth with a single-minded fervour usually reserved for teams far more experienced

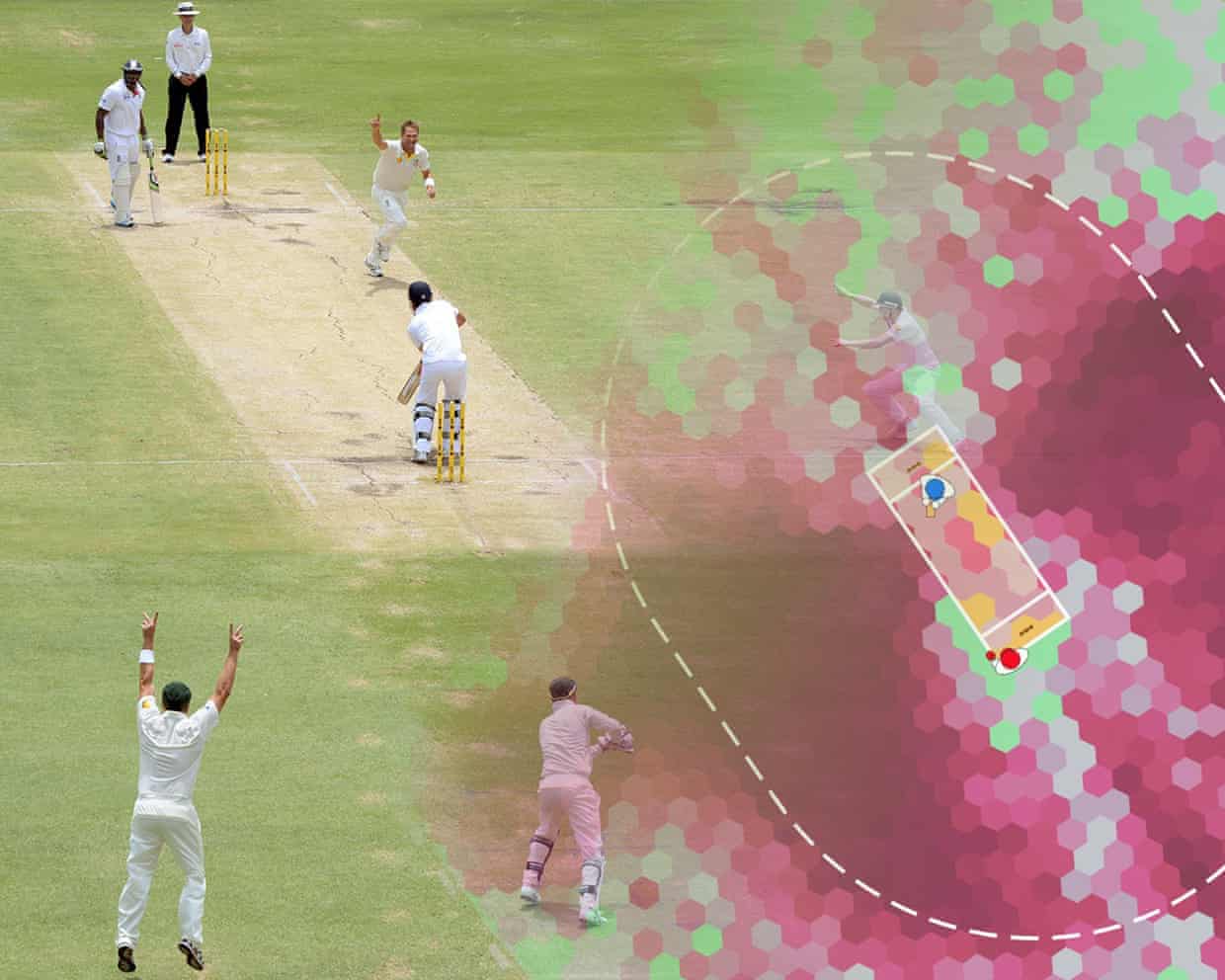

Silly point or square leg: how well do you know your way around a cricket field?

Cricket is full of jargon. Someone can be out for a duck, fooled by a doosra or fielding in the gully. If you are listening to a game on the radio, it can be difficult to interpret the vocabulary – silly, short, square etc – used to identify the positions of the fielders.Test how well you know cricket positions with the quiz below.For each question, place the fielder on the oval

Ashes 2025-26: key battles that could decide the urn’s next destination

Before Bazball, there was Travis Head. He was the one playing on fast-forward during the 2021-22 Ashes, sprinting to 152 at the Gabba in a career-shifting innings. The southpaw has since slashed tons in two finals against India, excelled in challenging Australian conditions, and can break out of a lean patch with a chainsaw-wielding knock. Never mind his three consecutive single-figure scores during Australia’s 3-1 win over India a year ago. He’d already hit consecutive hundreds to turn the direction of the series

UK retail sales drop unexpectedly as shoppers await Black Friday and budget

UK borrowing exceeds forecasts in October as retail sales fall; energy price cap to rise in January – business live

Elon Musk’s Grok AI tells users he is fitter than LeBron James and smarter than da Vinci

Xania Monet’s music is the stuff of nightmares. Thankfully her AI ‘clankers’ will be limited to this cultural moment | Van Badham

Chess outsiders triumph at World Cup in Goa and battle for Candidates spots

Australia v England: Ashes first Test, day one – live