Pound hits lowest since April as investors anticipate budget tax rises after Reeves speech – business live

The pound has now dropped to $1,3064, a new six-month low, as City traders anticipate tax rises in this month’s budget,Sterling has lost more than 0,5% today, or around three-quarters of a cent, with analysts pointing to Rachel Reeves’s promise of an “iron clad” commitment to her fiscal rules, and her failure to rule out tax rises,Fiona Cincotta, senior market analyst at City Index, says:In a rare pre-budget speech, Reeves reiterated her commitment to budget goals and what many are considering as weaves, paving the way for more tax hikes and tough decisions in the Budget that would come close to breaking the party’s manifesto pledges.

Reeves is increasingly expected to lift income tax by 2p at the same time as lowering National Insurance by 2p as part of the measures that she will take to plug a fiscal black hole of over £20 billion.This means that working people won’t be affected, but pensioners will.High spending, weak growth, and a productivity downgrade mean Reeves is now in a position where she has little choice but to hike taxes.As Saxo Market’s Neil Wilson flagged earlier (see 9.41am) tighter fiscal policy (eg higher taxes) should typically lead to looser monetary policy (lower interest rates), which leads to a weaker currencey.

UK bonds have lost some of their earlier zip, as investors digest Rachel Reeves’s speech.As flagged at 8.26am, bond yields (borrowing costs) fell after Reeves pledged an ‘iron clad’ commitment to sticking to the fiscal rules.But around half of that rally has faded, with 10-year and 30-year bond yields both down around 2 basis points (0.02 percentage points, a small move), after the chancellor didn’t confirm that taxes will definitely rise.

Matthew Amis, investment director for rates management at Aberdeen Investments, says:“Chancellor Reeves’s speech this morning provided the gilt market with all the right comforting words as we head towards the Autumn Budget.The Chancellor confirmed the fiscal rules are ironclad, that she intends to increase the fiscal headroom and the importance of inflation falling.She mentioned re-visiting welfare reform, and while admittedly there were more hints to tax rises than spending cuts, there were some hints to spending cuts nonetheless.Gilts yields fell throughout the speech, but pared gains as it became clear that even though tax hikes seem inevitable, they weren’t going to be announced today.“The question now is: can she deliver? UK chancellors have talked tough in the past, only to then fail on delivery or U-turn at the last moment.

If Chancellor Reeves is as bold as she was this morning at the Autumn Budget, then we believe gilts yields can continue to fall into year-end, outperforming peers.”This morning’s address by the chancellor was an “odd speech”, argues economist Paul Johnson, the former head of the Institute for Fiscal Studies thinktank.Johnson, now Provost of The Queen’s College, Oxford, posted on X:In one sense fair enough to blame last government for problems.But wrong to pretend all utterly unexpected and couldn’t possibly have been predicted at election or budget last year.We knew the risks when tax promises were made.

And so did she,Musa Sabo, director at tax advisors Andersen LLP, says people should brace for higher taxes:“Rachel Reeves’ speech this morning has done nothing to ease the fears surrounding the upcoming Budget, and such a speech would only be required ahead of breaking their manifesto pledge not to raise taxes on working people,“The message from the Chancellor is now clear - brace yourselves for an increase to income tax, national insurance or VAT at the Budget,”There are three principle takeaways from Rachel Reeves’s speech this morning, reports Michael Brown, senior research strategist at brokerage Pepperstone, namely:The Chancellor all-but-confirmed that the OBR will be downgrading its trend productivity growth forecastsReeves noted that she is seeking a greater degree of fiscal headroom (>£9,9bln that was left in the spring) to protect against future shocksReeves refused to repeat the manifesto promises not to raise income tax, national insurance, or VATHe reckons this means Reeves will deliver a larger fiscal tightening than had been expected, to address a black hola of perhaps £35bn, due to:£20bln from the OBR’s productivity downgrade£5bln from the failure to cut welfare spending£3bln from measures to cut consumer energy billsBetween £5bln - £10bln in seeking to build a buffer larger than the £9.

9bln in the ‘Spring Statement’That means an income tax hike is now “incredibly likely”, Brown suggests, in two ways:Firstly, the freeze on income tax thresholds, in place since 2022, and currently due to expire in 2028, looks set to be extended once more,This, over time, causes an effect known as ‘fiscal drag’, whereby an increasing number of employees are dragged into higher tax thresholds as earnings increase, but the thresholds remain unchanged,Freezing these thresholds is likely to raise around £10bln a year,Secondly, an outright increase in income tax rates is likely to be delivered,Increasing the higher rate of income tax, likely an easier ‘sell’ to Labour MPs and voters, would raise around £1.

5bln per annum, barely a ‘drop in the ocean’ in the grand scheme of things.Consequently, the balance of risks increasing tilts towards the Chancellor increasing the basic rate of income tax, where a 1p increase would raise between £6bln - £7bln a year.For context, no Chancellor has raised the basic income tax rate since all the way back in 1976*.That same year, the UK was forced to go ‘cap in hand’ to the IMF for a bailout, so here’s hoping history doesn’t repeat.* – I think 1975….

“Rachel Reeves’ unusual stance of giving a big speech on the eve of the Budget has left investors with more questions than answers, and done nothing to remove uncertainty around taxes,” says Dan Coatsworth, head of markets at AJ Bell.Coatsworth points out that the bond market would be happy if the chancellor raises taxes as it would help to improve public finances and make the UK less risky from an investment perspective.He adds that Reeves needs to be clearer about what she is planning:“The chancellor said the speech was about giving context to the challenges facing the government, but she batted away questions about taxes faster than an Olympic table tennis player.“Many people are fed up with this game.There are growing calls for the chancellor to be crystal clear in her plans and make bolder decisions.

No-one will be shocked at tax rises and many people believe it is better to sort the situation out once and for all, rather than keep tinkering at the edges.This feels like Reeves’ last chance to fix the house, otherwise her days could be numbered.”The pound has now dropped to $1.3064, a new six-month low, as City traders anticipate tax rises in this month’s budget.Sterling has lost more than 0.

5% today, or around three-quarters of a cent, with analysts pointing to Rachel Reeves’s promise of an “iron clad” commitment to her fiscal rules, and her failure to rule out tax rises.Fiona Cincotta, senior market analyst at City Index, says:In a rare pre-budget speech, Reeves reiterated her commitment to budget goals and what many are considering as weaves, paving the way for more tax hikes and tough decisions in the Budget that would come close to breaking the party’s manifesto pledges.Reeves is increasingly expected to lift income tax by 2p at the same time as lowering National Insurance by 2p as part of the measures that she will take to plug a fiscal black hole of over £20 billion.This means that working people won’t be affected, but pensioners will.High spending, weak growth, and a productivity downgrade mean Reeves is now in a position where she has little choice but to hike taxes.

As Saxo Market’s Neil Wilson flagged earlier (see 9,41am) tighter fiscal policy (eg higher taxes) should typically lead to looser monetary policy (lower interest rates), which leads to a weaker currencey,Rachel Reeves has refused to rule out tax rises in this month’s budget, insisting she must “deal with the world as I find it, not the world as I might wish it to be”,The chancellor foreshadowed an income tax increase, a breach of Labour’s manifesto commitment, as a result of the public finances being in a worse state than expected after “years of economic mismanagement”,In an early morning Downing Street press conference, she said that “each of us must do our bit” for the country’s future.

“If we have to build the future of Britain together, we will all have to contribute to that effort,” she said.“As chancellor, I have to face the world as it is, not the world that I want it to be.And when challenges come our way, the only question is the how to respond to them, not whether to respond, or not,” she told reporters.The market reaction to Reeves’s speech thus far is to sell sterling, reports Neil Wilson, UK investor strategist at Saxo Markets.He tells clients:GBPUSD dipped to retake the 1.

30 handle, hitting its weakest since April.It’s the pressure valve and Reeves wouldn’t like to see that kind of reaction coming directly from her speech.Wilson reckons that this morning’s speech suggests ‘panic’ in the Treasury, writing:Panic stations at Number 11 by the looks of it - offering a speech 3 weeks before the Budget that was only announced last night.The market is doubting credibility…He adds that the message from the speech is that tax hikes are coming, adding:This could well be a manifesto-breaking hike to income tax - she refused to say she would stick to the manifesto pledge to not raise income tax, NI or VAT.Lots of messaging around values and doing what’s right, not what’s popular.

Reeves is caught between various stools – the country (manifesto pledges), the party (spend more, protect the NHS), and the markets (gilts selling off just narrows the headroom).So, it’s a very tricky line to walk but ultimately, it’s the lack of political leadership from the top that is the making of this situation.However, a bold tax hike should lower gilt yields and could allow the BoE to go further with cuts.This will be a contractionary fiscal blow to the economy.But the bet is that you get the market onside, generate confidence from certainty, which gives you more flexibility later.

The risk is that you deal a big blow to confidence in the real economy and hit growth, which makes it all for nought.Either way, fiscal tighter, monetary looser suggests sterling remains on back foot.Lydia Prieg, chief economist at the New Economics Foundation, has responded to this morning’s speech from Rachel Reeves:“Rachel Reeves is right to say the economy isn’t working - but the challenges we face can’t just be solved by cutting regulation and making small tweaks to the tax system.We have a country that’s been ravaged by austerity, as well as an ageing population meaning spending on health and pensions is only set to increase.The scale of spending the country requires to get our public services and living standards up to scratch is significant.

Two things needs need to happen,Taxes will need to go up - and the chancellor should focus on those who are most able to contribute,To start with this government needs to equalise capital gains tax with income tax and get to grips with taxing land,Secondly, this government will need to invest more - to do this they need to reassess the fiscal rules and the OBR’s position in assessing them,This is how we will achieve long term stability.

”During her speech, Rachel Reeves pointed to the record highs seen on the London stock market last week as a sign of the UK’s positive economic performance,Unfortunately, the UK stock market has extended its earlier losses, with the FTSE 100 now down 97 points, or 1%, at 9604 points,Although that’s part of a wider global selloff today, there may also be concern about the impact of higher taxes on consumer spending,Daniela Hathorn, senior market analyst at capital,com, explains:Overall, her [Reeves’s] comments framed a pragmatic approach to rebuilding fiscal resilience while managing public expectations ahead of the next Budget.

The market reaction has been limited, with gilt yields dropping marginally as investors welcome the emphasis on prudence.However, the FTSE 100 has extended the losses into the European morning as Reeves’ comments highlight a difficult fiscal situation in the UK, which could have a negative effect consumers and business in tax increases are announced on November 26th.

Crispy chicken and pancetta with a nutty apple salad: Thomasina Miers’ Sunday best recipes

I recently invested in a beautifully wide, Shropshire-made pan that works on the hob and in the oven with equal ease, and without the chemical nonstick lining I keep reading about. It is a brilliant pan. As I turn on the heat to crisp the skin on my chicken thighs on the stove top, I can prep the vegetables I will then roast in the same pan. There is a soothing rhythm to this type of cooking, where most of the work is done in the oven. Here, I use jerusalem artichokes, the most delicious of autumn vegetables, parboiled in lemon juice to make them more digestible and then roasted with garlic and onions, until beautifully caramelised, and it’s a marvellous thing to put down on the kitchen table

From fritters to pizza, there’s more to pumpkin season than soups and carving

G’day! The last time I wrote to you was in the midst of our Australian winter, as the wind tippity-tapped tree-branch morse code on the windows and I tried to summon spring with the might of several tins of summer tomatoes and some inspiration from the Feast recipe archives.Well, allegedly, our spring has sprung, though you wouldn’t be able to tell, seeing as one of the challenges – or joys – of living in Melbourne is that this city’s concept of “seasons” is a little more fluid than most. Blustery winds have kept the trees dancing, wreaking havoc on the darling buds of May – sorry, October – and sending enthusiastically woven “cobwebs” and other Halloween paraphernalia flying.But I can guess which vegetable is going to be on your supermarket shelf, no matter which side of the international date line you are on: pumpkin! This is the time of year when European eaters are reaching for pumpkins to make soups and curries, while many across the Atlantic are mostly just carving them up. So, how to find more things to do with pumpkin than souping or sculpting? It helps to remember that pumpkin is also known as winter squash – and what’s summer squash? Courgettes or, as I say, zucchini

Benjamina Ebuehi’s recipe for ginger biscuit s’mores | The sweet spot

What’s Bonfire Night without some toasty, gooey marshmallows? And it’s only right to have them in a s’more, the American classic that’s also now part of the festivities over on this side of the pond. Digestive biscuits are typically the go-to, but I like to add extra flavour, depth and texture by using ginger oaty biscuits instead. These are quick to put together and don’t require any chilling. Ideally, the s’mores would be made over a real fire, but a blowtorch or hot grill will do the job, too.Prep 5 min Cook 30 min Makes 9100g unsalted butter 25g honey 130g plain flour 120g caster sugar 45g oats 2 tsp ground ginger ½ tsp bicarbonate of soda ½ tsp salt 9 squares dark chocolate 9 marshmallows Flaky sea saltHeat the oven to 190C (170C fan)/375F/gas 5 and line two oven trays with baking paper

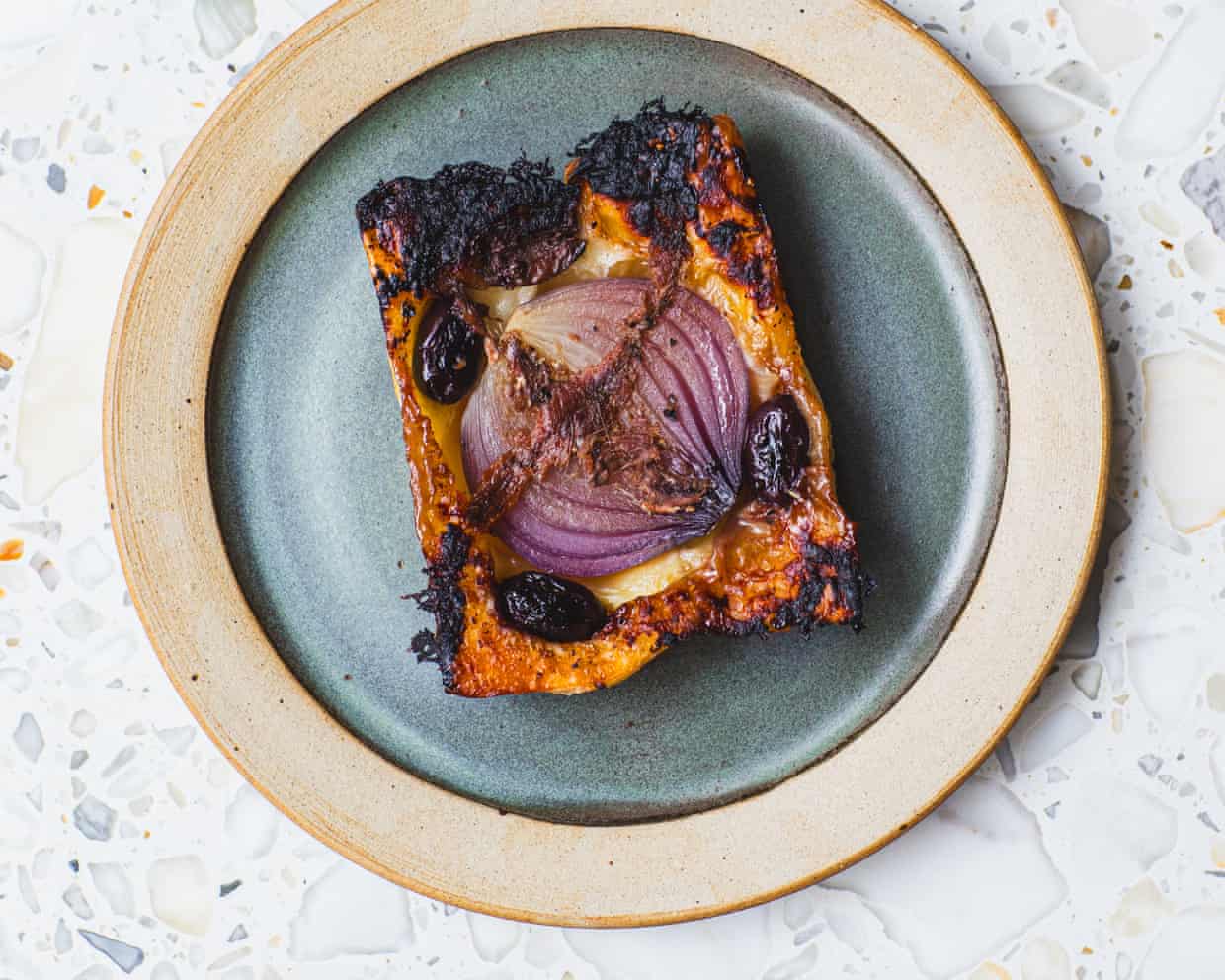

How to turn pastry scraps into a quick and tasty caramelised onion tart – recipe | Waste not

This is my quick version of pissaladière, and it transforms a small amount of leftover pastry scraps into a spontaneous treat. Keep and combine any trimmings into a ball and re-roll as and when required. Pastry keeps well in the freezer, and by skipping two time-consuming steps in the traditional recipe – that is, making the pastry and caramelising the onions – this one comes together about an hour faster. Instead, the onions are cooked upside down, steaming and caramelising beneath a blanket of pastry with anchovies and black olives for a fast, fun twist on a French classic. And if you have less pastry, you can always halve the recipe

Australian supermarket chocolate ice-cream taste test: ‘My scorecard read simply: “I’m going to buy it”’

Sweet memory lane or boulevard of broken creams? Nicholas Jordan and friends sample 23 tubs in search of nostalgia, glee and chocolate excessIf you value our independent journalism, we hope you’ll consider supporting us todayGet our weekend culture and lifestyle emailI grew up in a house barren of treats – there was no regular supply of chocolate, snakes, sour lollies or caramels. There was one exception: ice-cream, and I was mostly free to eat it whenever I wanted. That constant, childhood joy was the start of a storied love affair. Later, when I had money to buy my lunch in high school, I would get a one-litre tub, a pair of spoons, and my friend and I would eat the entire thing and nothing else. Sometimes, if we were particularly greedy, we’d split a two-litre tub

Sweet dreams? Healthy ways to put pudding back on the menu | Kitchen aide

I eat healthily, but my meals are never really complete without pudding. Yoghurt and stewed fruit aside, do you have any suggestions for what will hit the spot without verging too far into the unhealthy? Wendy, by emailThe truth is, you can’t often have your cake and eat it – or not a big piece, anyway. “My main piece of advice, which maybe isn’t all that welcome, is to keep to small portions,” says Brian Levy, author of Good & Sweet, in which his recipes contain no added sugar. “My grandma would keep mini chocolate bars and have just one, but that’s never really worked for me.”’Tis the season for stewed fruit, but have you tried Melissa Hemsley’s banana slices sandwiched together with peanut butter, half-dipped in melted chocolate and put in the freezer? (FYI the same tactic also works like a dream with dates

Cocktails and checkmates: the young Britons giving chess a new lease of life

Melbourne Cup 2025: Jamie Melham follows in Michelle Payne’s footsteps with win aboard Half Yours

The stats that show why England should be wary of resurgent Marnus Labuschagne

Commanders coach accepts blame for leaving Jayden Daniels in game before serious injury

WTA Finals: Rybakina downs Swiatek, Anisimova fights back to beat Keys – as it happened

Steward injury could offer Smith the chance to start for England against Fiji