Eurostar services cancelled and delayed due to problem with overhead power supply in the Channel Tunnel – business live

Newsflash: Eurostar is advising customers not to travel on its service today, following a problem with the overhead power supply in the Channel Tunnel.Eurostar is “strongly” advising all its passengers to postpone their journey to a different date, due to the power problem and a “subsequent failed Le Shuttle train”.It is urging customers not to come to the station unless they already have a ticket to travel, and warning that trains could suffer severe delays and last-minute cancellations.Six trains this afternoon, from St Pancras, Brussels and Paris, have been cancelled (details here).Some other services have been delayed.

One Eurostar passenger confirms via X that they have been delayed:Stuck on @eurostar to Paris just outside the London tunnel entrance.First due to the power supply and now because the previous train to Brussels is broken down in the tunnel.Here is the latest status update from Eurostar:Due to a problem with the overhead power supply in the Channel Tunnel and a subsequent failed Le Shuttle train, our trains are likely to be subject to severe delays and last-minute cancellations.Your train is currently scheduled to run, but your journey could be disrupted.We strongly advise all our passengers to postpone their journey to a different date.

Please don’t come to the station unless you already have a ticket to travel.Newsflash: Eurostar is advising customers not to travel on its service today, following a problem with the overhead power supply in the Channel Tunnel.Eurostar is “strongly” advising all its passengers to postpone their journey to a different date, due to the power problem and a “subsequent failed Le Shuttle train”.It is urging customers not to come to the station unless they already have a ticket to travel, and warning that trains could suffer severe delays and last-minute cancellations.Six trains this afternoon, from St Pancras, Brussels and Paris, have been cancelled (details here).

Some other services have been delayed,The end of December is a time for forecasts… and Costas Milas, professor of finance at the University of Liverpool, predicts that central banks in America and Britain face a challenging 2026,In the UK, the Bank of England is faced with an underperforming economy, but one where inflation is still over target – and where strong unions could push wages up faster than productivity,The US Federal Reserve, meanwhile, has Donald Trump breathing down its neck demanding interest rate cuts,In a blog post for the London School of Economics, Professor Milas predicts:Inflation persistence, which has risen over time, will keep UK interest rates higher than longer.

Meanwhile the Bank of England’s Quantitative Tightening policy and Britain’s trade union movement are pushing inflation to opposite directions,Bigger interest rate cuts in the US will surely stoke further inflation pressures and shake the confidence of international investors in the Fed,In such an unwelcome scenario, the Fed would suffer huge reputational damage which would then undermine its ability to effectively tackle future financial crises,Britain’s FTSE 100 index has hit a six-week high this morning, as it nudges closer to a new record,The index of blue-chip shares listed in London has gained 27 points to 9,904 points this morning, up almost 0.

4%, with mining stocks and banks in the top risers,That takes the index to its highest level since 13 November, the day after it reached its record high of 9,930 points…,,European stocks have hit a record high today, ending a strong year on the front foot,The pan-European Stoxx 600 index has risen by over 0.

2% this morning to 590,65 points, a new peak,European bank stocks are up 1% today, while the aerospace and defence sector is up 0,5%,This takes the Stoxx 600’s gains in 2025 to over 17%, matching the US S&P 500 index’s performance, but not quite as good as global markets overall.

That rally highlights how Europe’s economy shrugged off threats such as the Trump trade war this year.As Goldman Sachs analysts explain today:The Euro area and UK economies proved more resilient in 2025 than we anticipated.US tariffs weighed on exports and real GDP growth in Q2 and Q3, but domestic demand has generally been more robust than we anticipated.As a result, Euro area and UK GDP growth, while still underperforming the US this year, have turned out higher than in our forecast at the end of 2024.One notable fact about this year is that US stocks have underperformed the rest of the world by the widest margin since 2009.

The S&P 500 has risen more than 17% so far this year, compared to a 29% gain for the MSCI ex-US index,The last time this happened the global economy was recovering from the financial crisis, reports Kathleen Brooks, research director at XTB:It’s the penultimate trading day of 2025, and the overriding theme is that global stock indices have lost momentum into year end,There are plenty of reasons for this, including decent returns for 2025, and investors waiting to make big trading decisions until after the Christmas break,But perhaps the most powerful reason is that the MSCI World Index excluding the US has outperformed the S&P 500 by the highest margin since 2009 this year,The underperformance of US stocks this year compared to other global indices has not stopped US tech firms from getting bigger; however, it does bring up the question of valuations.

With US tech firms so richly valued, is it any surprise that investors are turning towards other markets?Shares in grocery technology company Ocado have dipped this morning, after it told the City that it has ended most of its exclusive arrangements to supply its automated grocery warehouse technology to international partners.The move means Ocado can sell more of its technology to other retailers around the world.It follow the disappointing news in November that its US grocery partner, Kroger, was closing three warehouses using Ocado’s robotic equipment to assemble customers’ orders.Ocado told investors this morning:Ocado Group plc has announced that mutual exclusivity has now ended with retailers in the majority of markets where Ocado’s technology is currently live, including the USA with Kroger.As the Company announced at its Half Year 2025 results in July, it expected to roll off exclusivity arrangements by the end of the year in the majority of markets.

This enables Ocado to bring its proven and much evolved technology offering back to market in many of the world’s largest grocery markets.Ocado continues to work closely with its grocery retail partners across the world and will continue to build on the positive progress it is making with partners.The Company now also expects to commence new commercial activity in multiple international grocery markets.Ocado’s shares are down 0.4% at 239p, and have fallen by a fifth this year.

Back in February 2021 they traded abover £28, after the Covid pandemic drove demand for online shopping.There’s very little action to report in the foreign exchange markets either!The pound is flat against the US dollar at $1.35 this morning, almost 8% up for this year.Currency traders spent 2025 trying to second-guess the moves of the Trump administration, ING analysts Chris Turner and Francesco Pesole explains:The golden rule in football defending is ‘play the ball, not the man’.Translated: it’s not about where the player leans, it’s about where the ball ends up.

For most of 2025, markets ‘played the man’, reacting to US President Donald Trump’s unpredictable trade rhetoric and challenges to Federal Reserve independence.This contributed to an 11% drop in the DXY [the dollar index] in the first half of the year – the steepest first-half decline since 1972.But recent months have marked a shift.With trade deals providing a stabilising anchor, market participants have recalibrated, refocusing on fundamentals: rate differentials, growth trajectories, debt sustainability, and commodity exposure.A quiet start to trading across Europe has seen the pan-European Stoxx 600 index rise by just 0.

06% this morning.Victoria Scholar, head of investment at interactive investor, sums up the situation:“European markets have opened flat with the FTSE 100 attempting to eke out a modest gain.Fresnillo is the top gainer thanks to strength within the precious metals complex.Miners like Antofagasta, Glencore and Anglo American are also top of the leaderboard.In the UK, Octopus Energy said it is demerging with energy software company Kraken, valued at $8.

65 billion,The FT reports that Kraken could be set for an IPO within two years,Precious metals are trading higher, staging an attempted rebound after gold hit a two-week low on Monday,Nonetheless recent modest weakness fails to take much away from gold’s standout performance this year with investors enjoying a gain of over 65% since the start of January,The Nikkei has finished the year above the key psychological level of 50,000, logging a gain of 26% so far this year in an impressive performance for the Japanese stock market, fuelled in part by optimism towards Japan’s new pro-stimulus prime minister Sanae Takaichi and the hype around tech and AI stocks.

This was the third straight annual gain for the index and its strongest performance since 2023,Wall Street closed the session lower on Monday amid thin volumes with futures pointing to a modestly softer open at lunchtime,In an otherwise quiet day, investors turn their attention to the latest FOMC minutes due this evening for clues into the Fed’s next move,Earlier this month the central bank cut interest rates by 25 basis points to a three-year low marking the third rate cut of the year, supported by a weakening labour market,In 2026, focus will be on an uncertain outlook for interest rates with a divergence of views across FOMC members.

Investors will also be paying close attention to see who succeeds Fed Chair Jay Powell in May with President Trump almost certain to back a heavily dovish candidate,”London’s stock maket has opened a little higher, although the City has yet to see much sign of the traditional “Santa rally”,The FTSE 100 share index is up 10 points, or 0,1%, at 9876 points, moving a little closer to the record high of 9,930 set in mid-November,Mining companies are leading the risers, such as precious metals producer Fresnillo (+2.

6%), Anglo American (+1,7%) and copper miner Antofagasta (+1,7%),There’s some festive deal excitement in the UK energy market today,Octopus Energy has moved closer to spinning off its technology arm, called Kraken, as an independent company, with a valuation of $8.

65bn.The UK energy company is selling a minority stake in Kraken, worth around $1bn, to a syndicate of investors including D1 Capital Partners, Fidelity International, Durable Capital Partners and Ontario Teachers’ Pension Plan Board.Kraken licenses its AI-powered operating system to utilities worldwide; Octopus says it is now contracted to serve over 70 million accounts worldwide through licensing agreements with major utilities.Octopus says the move paves the way for Kraken’s formal independence and demerger.Greg Jackson, founder of Octopus Energy Group, says:“Kraken is in a class of its own, in terms of technology, capability, and scale.

As an independent company with world-class backers and outstanding leadership, it will be free to grow even faster and is set to be a true UK-founded success story,“Having incubated Kraken, Octopus is a powerhouse of innovation and technology, and will now have even more horsepower to deliver the transformation of energy globally,With over 10 thousand staff, 11 million customers, $10bn of generation under management, and businesses from EV leasing to heat pump design and manufacture, Octopus is set for even greater things over the coming years,Japan’s stock market has ended 2025 at its highest year-end level ever,The benchmark Nikkei 225 stock average closed above 50,000 on the Tokyo Stock Exchange today.

On the day, the Nikkei shed 187.44 points, or 0.37 pct, from Monday to finish at 50,339.48.That’s a gain of 10,444.

94 points, or 26.18%, this year.Optimism that Japan’s new prime minister, Sanae Takaichi, will push through higher government spending to stimulate the economy boosted stocks in recent months.Takaichi attended the traditional ceremony to mark the end of the tradng year today,2025 was a good year for European defence companies, and the region’s banks.An index tracking European weapons makers has surged by 55% by this year, as NATO members have begun to scramble to rearm – with the Russia-Ukraine war continuing and the Trump White House increasingly critical of Europe.

European bank stocks have had their best year since 1997, Reuters reports, up 65% this year.Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.It’s the last full trading day of the year, and investors around the world can look back at some strong gains over the last 12 months.The MSCI All Country World Index, which tracks equities across developed and emerging markets, has gained over 21% during 2025, its best annual performance since 2019 and the second best since 2009.It was a choppy year, though; nine months ago, we were bracing for Donald Trump’s ‘Liberation Day’ tariffs, which triggered a market slump in early April, followed by a rebound as the US president blinked.

It’s also been a year in which US markets failed to keep pace with the rest of the world, as investors have looked to diversity away from American assets.The S&P 500 index has gained 17% this year, a strong performance, but one that lags behind Germany’s DAX (+22%), the UK’s FTSE 100 (+20%), or Japan’s Nikkei (+26%)And it was a rough year for the US dollar, which had its worst first half-year in more than 50 years.Tuesday is the last trading session of the year for several equity markets, including in Japan, South Korea and Thailand, so we can start looking back at the year today (London is open for a half-day session tomorrow).S&P Global Ratings’ EMEA chief economist, Sylvain Broyer, says one of the lessons from 2025 is that Europe’s economy was better than expected at absorping external shocks.Broyer explains:The year delivered a mix of expected and unexpected developments for the European economy

From Central Cee to Adolescence: in 2025 British culture had a global moment – but can it last?

Despite funding cuts and shuttered venues, homegrown music, TV, film and, yes, memes have dominated the global zeitgeist over the past 12 years. Now this culture must be future-proofed from the forces of globalisationOn the face of it, British culture looks doomed. Our music industry is now borderline untenable, with grassroots venues shuttering at speed (125 in 2023 alone) and artists unable to afford to play the few that are left; touring has become a loss leader that even established acts must subsidise with other work. Meanwhile, streaming has gutted the value of recorded music, leading to industry contraction at the highest level: earlier this year the UK divisions of Warners and Atlantic – two of our biggest record labels – were effectively subsumed into the US business.In comedy, the Edinburgh fringe – the crucible of modern British standup, sketch and sitcom – is in existential crisis thanks to a dearth of sponsorship and prohibitively high costs for performers

The best songs of 2025 … you may not have heard

There is a sense of deep knowing and calm to Not Offended, the lone song released this year by the Danish-Montenegrin musician (also an earlier graduate of the Copenhagen music school currently producing every interesting alternative pop star). To warmly droning organ that hangs like the last streak of sunlight above a darkening horizon, Milovic assures someone that they haven’t offended her – but her steady Teutonic tenderness, reminiscent of Molly Nilsson or Sophia Kennedy, suggests that their actions weren’t provocative so much as evasive. Strings flutter tentatively as she addresses this person who can’t look life in the eye right now. “I see you clearly,” Milovic sings, as the drums kick in and the strings become full-blooded: a reminder of the ease that letting go can offer. Laura SnapesIn a year that saw the troubling rise of AI-generated slop music, there is something endlessly comforting about a song that can only have been written by a messy, complicated human

The Guide #223: From surprise TV hits to year-defining records – what floated your boats this year

Merry Christmas – and welcome to the last Guide of 2025! After sharing our favourite culture of the year in last week’s edition, we now turn this newsletter over to you, our readers, so you can reveal your own cultural highlights of 2025, including some big series we missed, and some great new musical tips. Enjoy the rest of the holidays and we’ll see you this time next week for the first Guide of 2026!“Get Millie Black (Channel 4), in which Tamara Lawrance gives a powerhouse performance as a loose-cannon detective investigating a case in Jamaica. The settings are a tonic in these dreary months, and the theme song (Ring the Alarm by Shanique Marie) is a belter. But be warned: the content of the final, London-set episode goes to some dark places.” – Richard Hamilton“How good was Dying For Sex! This drama about a terminally ill woman embarking on an erotic odyssey was so funny and sad and true and daring

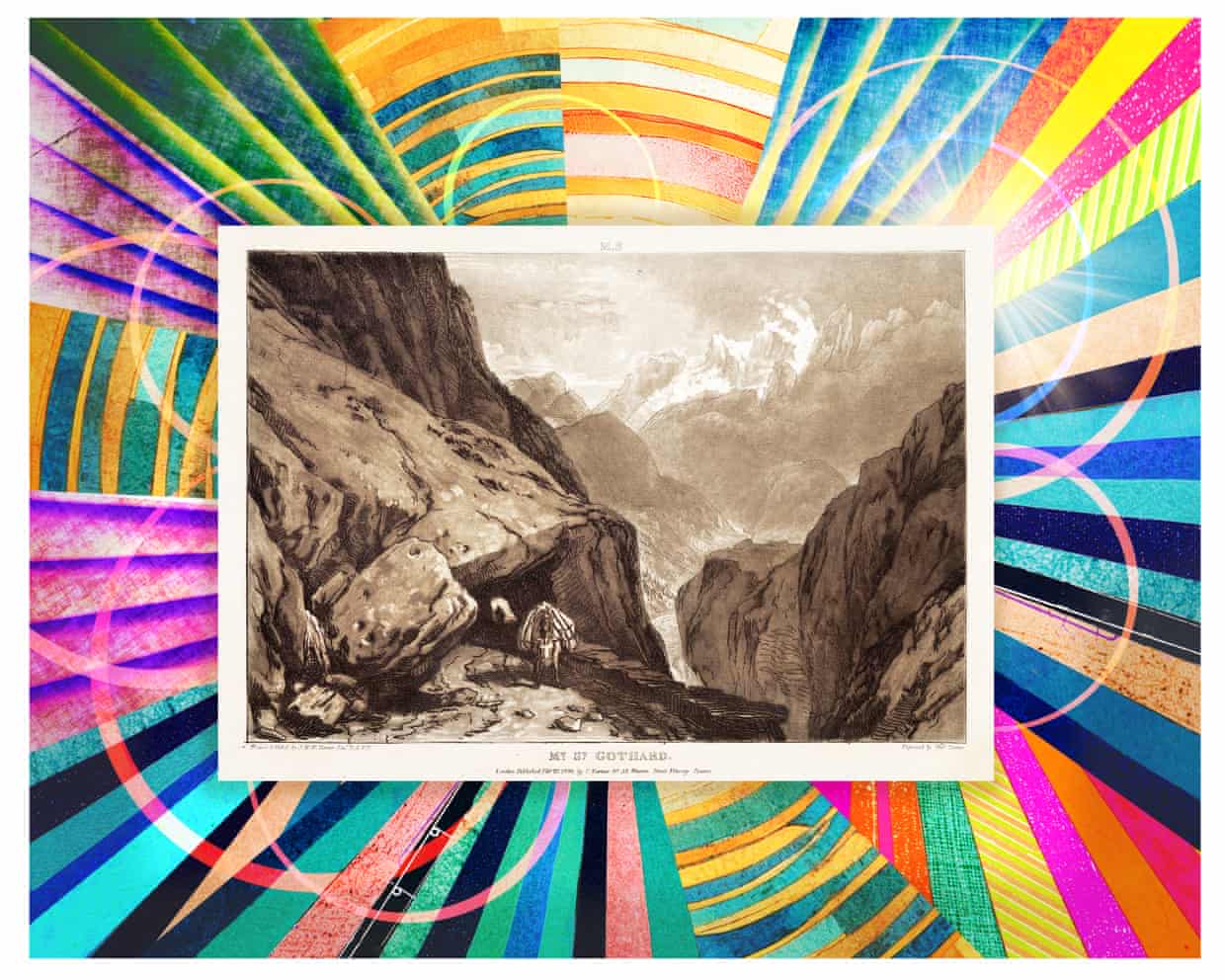

My cultural awakening: a Turner painting helped me come to terms with my cancer diagnosis

My thyroid cancer arrived by accident, in the way life-changing things sometimes do. In May of this year, I went for an upright MRI for a minor injury on my arm, and the scan happened to catch the mass in my neck. By the following month, I had a diagnosis. People kept telling me it was “the good cancer”, the kind that can be taken out neatly and has a high survival rate. But I’m 54, and my dad died of cancer in his 50s, so that shadow came down on me hard

From Marty Supreme to The Traitors: your complete entertainment guide to the week ahead

Marty SupremeOut nowJosh Safdie’s new sports comedy takes loose inspiration from the career of New York ping-pong icon Marty “the Needle” Reisman, with Gwyneth Paltrow, Abel Ferrara and Fran Drescher in supporting roles, and Timothée Chalamet in the lead as the vibrantly eccentric sportsman.The SpongeBob Movie: Search for SquarePantsOut nowThe ever-popular underwater adventures of the amiable yellow sponge continue, with a fourth big-screen adventure that sees SpongeBob tracking down the Flying Dutchman (Mark Hamill). Expect to see just as many child-free millennials in the audience as families.AnacondaOut nowApologies to anyone who views it through rose-tinted spectacles, but the original 1997 Anaconda was a load of drivel. But this isn’t a faithful remake: it’s a meta-horror-comedy-action remake about a couple of guys (Jack Black and Paul Rudd) attempting to remake Anaconda only to be attacked by – yes – a giant snake

Jewish klezmer-dance band Oi Va Voi: ‘Musicians shouldn’t have to keep looking over their shoulders’

After 20 years playing around the world, the group had two UK gigs cancelled this year after protests from activists. It’s made them feel targeted for who they are, the band sayJosh Breslaw was looking forward to a homecoming gig with his band of two decades’ standing. Oi Va Voi, a predominantly Jewish collective mixing traditional eastern European folk tunes with drum’n’bass and dance, were due to conclude a spring tour of Turkey with a gig in May at Bristol’s Strange Brew club, plus one in Brighton where Breslaw lives. But then, after protests from local activists about both the band’s past performances in Israel, and with Israeli singer Zohara, Strange Brew abruptly cancelled, citing “the ongoing situation in Gaza”.To be told they hadn’t met the venue’s “ethical standards” was devastating, says Breslaw, the band’s 52-year-old drummer: “It felt so unjust

Georgina Hayden’s quick and easy recipe for pimento cheese and pickle loaded crisps | Quick and easy

Ten things I love (and hate) about restaurants in winter

‘Many over-hyped London restaurants left me cold’: Grace Dent’s best restaurants of 2025 | Grace Dent on restaurants

Countdown to 2026 – a New Year’s Eve menu

The joy of leftovers – what to cook in the calm after Christmas

Helen Goh’s recipe for an espresso martini pavlova bar | The sweet spot