Strong UK pay growth could limit interest rate cuts, Bank policymaker warns

The Bank of England may not be able to lower interest rates as much as expected this year, due to strong UK pay growth and expected rate cuts in the US, one of its top policymakers has said.Megan Greene, a member of the Bank’s monetary policy committee (MPC), which sets interest rates in the UK, said she was concerned that wages appeared to be growing strongly again this year and this could stop inflation from easing.In a speech in London at the Resolution Foundation, a leading thinktank, Greene said a decline in wage growth “may have run its course”, pointing to recent Bank of England surveys that suggest employers are planning to hand out pay rises of 3.5% or more this year.The latest official figures showed wage growth, excluding bonuses, weakened slightly to 4.

5% between September and November, from 4.6% in the previous three months.The MPC has a target for inflation of 2%, but figures released this week showed it reached 3.4% in December, up from 3.2% in November.

Consistent wage growth tends to push up inflation if there is not a corresponding rise in productivity growth, and Greene said she was “certainly sceptical” that productivity would rebound this year,Greene said the MPC’s decision on when next to lower borrowing costs would also be affected by whether the US Federal Reserve lowered rates, as this could cause inflation in the UK to rise,“If the Fed were to cut rates more aggressively than the Bank this year, this should cause US demand for UK exports to rebound, providing upward pressure on UK inflation,” she said,Greene’s warning comes as a separate report from the Bank concluded that it had consistently underestimated the full effects of inflation that came after the energy price shock of 2022 due to Russia’s full-scale invasion of Ukraine,“After 2022, the Bank’s medium-term inflation and wage growth forecasts proved repeatedly too low,” the central bank said in its first ever forecast evaluation report.

The report found that the Bank’s models had not anticipated the extent to which higher inflation in 2022 then led to households and businesses having higher inflation expectations, leading them to push for higher wages, which in turn added to further inflation pressure.The Bank said it would try to improve its “modelling and understanding of key economic mechanisms, including the labour market, wage-price interactions and inflation expectations” to better understand the recent “inflation persistence”.A separate, closely watched survey of activity among UK businesses showed that companies were reporting a sharp rise in costs in January, with the overall pace of inflation unchanged from December’s seven-month high.The purchasing managers’ index, from S&P Global, showed businesses in manufacturing and services sectors were “overwhelmingly” linking rising costs to “elevated wage pressures”, alongside rising transport bills and raw material prices from suppliers.These cost pressures had led firms to make the greatest increase to their own prices in more than a year, it said.

The survey also showed a “steep loss” of jobs among many of its respondents, especially in the hospitality sector.Many companies attributed the job cuts to the government’s introduction of higher national insurance contributions and increases to the “national living wage”.The survey has led City economists to reduce their expectations of the MPC making two interest rate cuts this year, with the first quarter-rate cut now not expected until June.The current base rate is 3.75%, after four cuts by the MPC in 2025.

However, the survey showed a reading of 53,9 in January, up from 51,4 in December at a 21-month high,A score over 50 indicates growth,

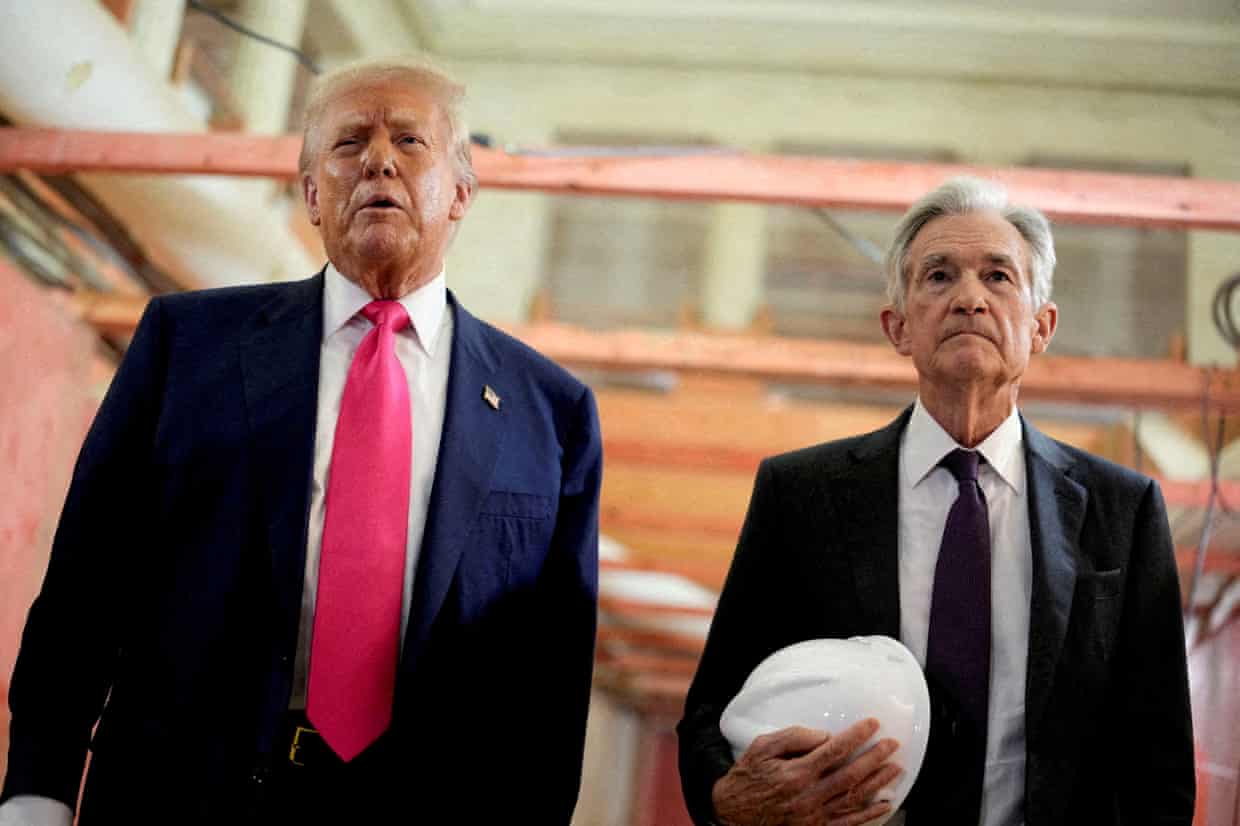

Is the supreme court ready to stand up to Trump over Federal Reserve attack?

Donald Trump has tried his usual tactics when it comes to getting the US Federal Reserve to lower interest rates: bully when persuasion doesn’t work, and then fire when bullying doesn’t work.In an unprecedented assault on the central bank, the president has called the Fed chair, Jerome Powell, “stupid” and threatened to fire him for not cutting interest rates as quickly as Trump would like. Most recently, the justice department instigated a criminal investigation against Powell for testimony he gave about renovations at the Fed’s headquarters. Even so, the Fed has not budged.Tactically, Trump’s assault on the Fed appears to be no different than his overhaul of the entire federal government

Customer complaints over water bills surge by 50% in England and Wales

Complaints about water companies in England and Wales to an independent monitor surged by more than 50% last year, as customers bristled at steep bill increases.More than 16,000 complaints were lodged in 2025 with the Consumer Council for Water (CCW), a government-sponsored body that represents customers’ interests.That was up from 10,600 in 2024, with the flow of objections well above the level of the prior year in every month from March onwards.Water companies have faced huge public anger in recent years over the amount of sewage flowing into Britain’s rivers and seas. However, the extent of the outrage increased sharply last year when water companies were allowed to increase bills to pay for upgrades after decades of underinvestment

Latest ChatGPT model uses Elon Musk’s Grokipedia as source, tests reveal

The latest model of ChatGPT has begun to cite Elon Musk’s Grokipedia as a source on a wide range of queries, including on Iranian conglomerates and Holocaust deniers, raising concerns about misinformation on the platform.In tests done by the Guardian, GPT-5.2 cited Grokipedia nine times in response to more than a dozen different questions. These included queries on political structures in Iran, such as salaries of the Basij paramilitary force and the ownership of the Mostazafan Foundation, and questions on the biography of Sir Richard Evans, a British historian and expert witness against Holocaust denier David Irving in his libel trial.Grokipedia, launched in October, is an AI-generated online encyclopedia that aims to compete with Wikipedia, and which has been criticised for propagating rightwing narratives on topics including gay marriage and the 6 January insurrection in the US

Young will suffer most when AI ‘tsunami’ hits jobs, says head of IMF

Artificial intelligence will be a “tsunami hitting the labour market”, with young people worst affected, the head of the International Monetary Fund warned the World Economic Forum on Friday.Kristalina Georgieva told delegates in Davos that the IMF’s own research suggested there would be a big transformation of demand for skills, as the technology becomes increasingly widespread.“We expect over the next years, in advanced economies, 60% of jobs to be affected by AI, either enhanced or eliminated or transformed – 40% globally,” she said. “This is like a tsunami hitting the labour market.”She suggested that in advanced economies, one in 10 jobs had already been “enhanced” by AI, tending to boost these workers’ pay, with knock-on benefits for the local economy

‘I feel like I’ll never be cold again’: How tennis stars coped with Melbourne heat | Tumaini Carayol

Even before the first set and first hour of his match elapsed, Tomas Machac had asked the umpire for the tournament doctor, trainer and pickle juice, the drink du jour for tackling cramps. Those preventive measures taken in the intense early stages of his third-round tussle with Lorenzo Musetti proved to be sensible, for the pair would spend a brutal four hours, 25 minutes on court.Four hours of that took place inside an open John Cain Arena, a furnace in suffocating heat. “We knew today was going to be really, really hot,” Musetti said. “I think I managed well to finish the match without cramping

Heward earns win for Bristol against Exeter with rain stopping open play

So much rain has been falling out west this week that Bristol could almost have floated down to Devon in canoes. Add in more heavy downpours, a tricky wind and a horribly slippery ball and there was never any chance of a free-flowing, fast-paced spectacle between two of the league’s more fluent attacking sides. This was a sodden slog, pure and simple, with only a rainbow or two to add a splash of colour.Not that the Bears will care much about the trench warfare nature of a victory that consolidates them in third position and above their opponents in the playoff race going into the Prem’s two-month hiatus. On an afternoon demanding character, perseverance and effort the visitors displayed all three, a first-half try from the appropriately named Noah Heward ultimately edging an old-school wrestling match

TikTok announces it has finalized deal to establish US entity, sidestepping ban

Campaigner launches £1.5bn legal action in UK against Apple over wallet’s ‘hidden fees’

Former FTX crypto executive Caroline Ellison released from federal custody

Experts warn of threat to democracy from ‘AI bot swarms’ infesting social media

Grok AI generated about 3m sexualised images in 11 days, study finds

Scarlett Johansson and Cate Blanchett back campaign accusing AI firms of theft