Tony Blair’s oil lobbying is a misleading rehash of fossil fuel industry spin

Ex-PM’s thinktank urges more drilling and fewer renewables, ignoring evidence that clean energy is cheaper and better for billsA thinktank with close ties to Saudi Arabia and substantial funding from a Donald Trump ally needs to present a particularly robust analysis to earn the right to be listened to on the climate crisis.On that measure, Tony Blair’s latest report fails on almost every point.The Tony Blair Institute for Global Change (TBI) received money from the Saudi government, has advised the United Arab Emirates petrostate, and counts as a main donor Larry Ellison, the founder of Oracle, friend of Trump and advocate of AI.The latest TBI report calls for an expansion of oil and gas production in the North Sea, despite the additional greenhouse gas emissions this would generate, and abandoning the UK government’s target to largely decarbonise the electricity sector by 2030, arguing that doing so is necessary to power AI datacentres.The report claims renewable energy is too expensive.

Yet this overlooks the fact that it is significantly cheaper than building the gas-fired power stations that would be needed instead.New onshore wind has been agreed at a price of £72/MWh and new solar at £65MWh – both less than half the £147/MWh cost of building and operating new gas power stations.New offshore wind, at £91/MWh, is about 40% cheaper than new gas.According to the analyst firm Aurora Energy Research, offshore wind priced below £94/MWh lowers consumer bills.By contrast, nuclear power – on which the TBI is keen – is likely to cost more than £133/MWh and would take many more years to build.

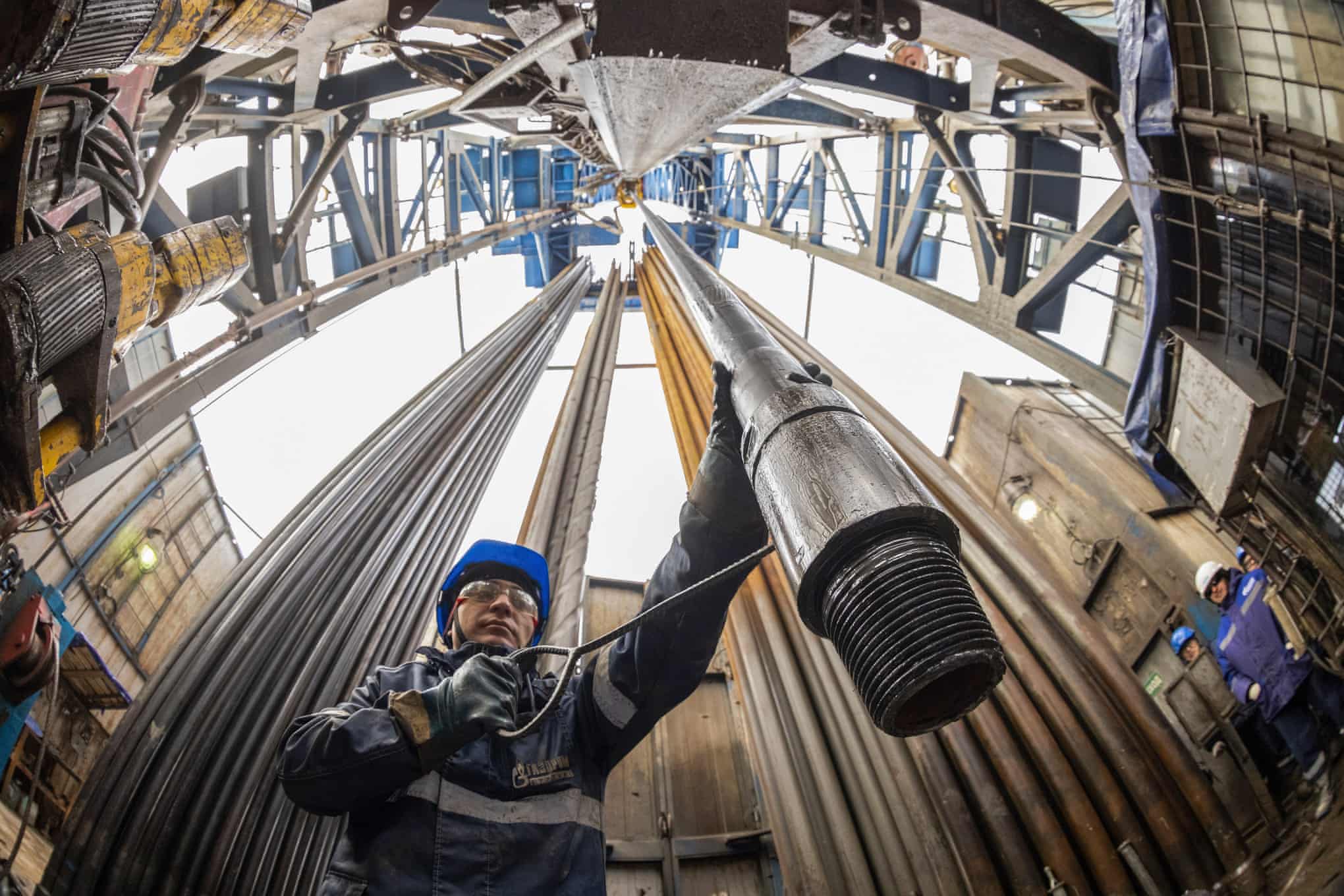

The report also cavils at the cost of electricity grid upgrades needed to support renewable energy, without acknowledging that grid improvements will be required in any scenario.It also ignores the conclusion of the network system operators, NESO, that a clean power system for the UK by 2030 is achievable “without increasing costs to consumers”.Draining the last drops of oil and gas from the North Sea lies at the heart of the TBI advice, projecting a £165bn industry as a result.Yet the North Sea is a rapidly declining basin where the remaining reserves are increasingly expensive to extract.Accordingly, says the TBI, oil and gas companies should receive substantial tax cuts.

Since 2020, the energy industry has made £125bn in profits in the UK, with oil and gas companies enjoying windfalls while vulnerable people struggled to heat their homes.Shell made $40bn in 2022 alone, BP $30bn the same year.Although profits have come down from their peaks, persistently high gas prices are keeping fossil fuel companies buoyant.Simon Francis, a coordinator at the End Fuel Poverty Coalition, said: “To call for the windfall tax to be scrapped, while energy giants post extraordinary profits and millions live in cold damp homes is staggering.“That tax exists because companies benefited from a crisis that devastated household finances.

Removing the windfall tax would reward profiteering and shift the burden back on to households that are still paying the price of Britain’s overreliance on gas.”Numerous analyses have shown that further North Sea production would make little difference to the UK’s energy security and would not reduce energy bills.Bob Ward, a policy director of the Grantham Research Institute at the London School of Economics and Political Science, said: “More North Sea production would have no significant impact on the wholesale price of electricity and would not reduce prices for British households and businesses.”Gas is traded on international markets, which determine the price.Even if the North Sea were drilled to exhaustion, the UK is likely to be reliant on imports for at least two-thirds of its gas within five years, and potentially all of it by 2050.

Mike Childs, the head of science at Friends of the Earth, said: “If we’re to bring down bills for good and protect people from future gas price volatility, then we must accelerate the development of renewable energy.”The report’s claim that renewable energy will be costly – despite price falls of 50-90% in recent years – also overlooks the fact that wind energy cut wholesale prices of electricity by about a third last year, with further reductions likely as new offshore windfarms come online.Shaun Spiers, the executive director of the Green Alliance thinktank, said: “We don’t need to rethink a clean power plan that’s working – the UK generated record-breaking amounts of renewable energy last year.”Consumers have yet to feel the full benefit, largely because the structure of the UK’s privatised energy market means electricity prices remain mostly dependent on the price of gas.The TBI report, Spiers added, “gives few suggestions for how to do this”.

Although TBI maintains that the UK’s target of reaching net zero greenhouse gas emissions by 2050 should remain, it does not explain how slowing the rollout of renewables is compatible with that goal.What matters to the climate is not emissions in 2050 but the accumulation of carbon dioxide in the atmosphere.Maintaining fossil fuel production, as TBI advocates, might still allow net zero to be reached by mid-century, but would result in higher emissions in the interim, undermining the purpose of the target.According to Angharad Hopkinson, a political campaigner for Greenpeace UK: “The assertion that abandoning strategies to reduce emissions will somehow reduce emissions, and choosing more expensive energy will somehow reduce costs, is ludicrous.”Elsewhere in the report, the TBI rehashes the argument that the UK is responsible for just 1% of global greenhouse gas emissions, implying that the actions of larger emitters such as China will make more of an impact.

While technically accurate, this fails to acknowledge that roughly a quarter of global greenhouse gas emissions come from countries that each account for about 1% of emissions.If all of them abandoned net zero efforts, global temperatures would rise far beyond the 1.5C limit of safe heating.

Reeves appoints higher pay advocate to fight skills shortages as chief economic adviser

Rachel Reeves has appointed a labour market expert who has repeatedly called for better pay and conditions in key sectors, such as social care, to reduce the UK’s reliance on migrant workers as her new chief economic adviser.Prof Brian Bell, who chairs the independent Migration Advisory Committee (MAC), which advises the government, has been announced as the new chief economic adviser in the Treasury – a senior civil service role.He will take up the post just as the UK economy is adjusting to a plunge in net migration, which fell by more than two-thirds, to 204,000, in the year to June 2025.Some economists have predicted a further decline, towards zero net migration – but Bell rejects that forecast, expecting it to bounce back towards 300,000 a year by the end of the decade.A professor of economics at Kings College London, Bell has used his role on the MAC to make the point that the “skills shortages” bemoaned by UK employers may often reflect the failure to offer good enough terms and conditions to domestic workers

Trump ‘plans to roll back’ some metal tariffs; US inflation weaker than expected in January - business live

Time to wrap up…US inflation moderated in January to 2.4%, an easing after Donald Trump’s tariffs triggered price fluctuations last year.Prices rose 0.2% from December to January, according to data released by the US Bureau of Labor Statistics on Friday measuring the consumer price index (CPI), which measures the price of a basket of goods and services. Core CPI, which strips out the volatile food and energy industries, went up 0

Anthropic raises $30bn in latest round, valuing Claude bot maker at $380bn

Anthropic, the US AI startup behind the Claude chatbot, has raised $30bn (£22bn) in a funding round that more than doubled its valuation to $380bn.The company’s previous funding round in September achieved a value of $183bn, with further improvements in the technology since then spurring even greater investor interest.The fundraising was announced amid a series of stock market moves against industries that face disruption from the latest models, including software, trucking and logistics, wealth management and commercial property services.The funding round, led by the Singapore sovereign wealth fund GIC and the hedge fund Coatue Management, is among the largest private fundraising deals on record.“Anthropic is the clear category leader in enterprise AI,” said Choo Yong Cheen, the chief investment officer of private equity at GIC

How to deal with the “Claude crash”: Relx should keep buying back shares, then buy more | Nils Pratley

As the FTSE 100 index bobs along close to all-time highs, it is easy to miss the quiet share price crash in one corner of the market. It’s got a name – the “Claude crash”, referencing the plug-in legal products added by the AI firm Anthropic to its Claude Cowork office assistant.This launch, or so you would think from the panicked stock market reaction in the past few weeks, marks the moment when the AI revolution rips chunks out of some of the UK’s biggest public companies – those in the dull but successful “data” game, including Relx, the London Stock Exchange Group, Experian, Sage and Informa.Relx, the former Reed Elsevier, whose brands include the Lancet and LexisNexis, is the most intriguing in that list. The company’s description of itself contains at least five words to provoke a yawn – “a global provider of information-based analytics and decision tools for professional and business customers” – but the pre-Claude share price was a thing of wonder

Winter Olympics 2026: Klæbo seals treble; Australian snowboarding gold; GB drought goes on – live

Klaebo is now the joint most decorated Winter Olympian in history! And there are three more chances of gold to come, in the men’s relay, men’s team sprint and 50k marathon.France’s Mathis wins silver, and Einar Hedegart bronze. Britain’s Andrew Musgrave finishes a fantastic sixth, bare arms and all.Speed skating: there’s a gold medal waiting for the fastest man to cover 10,000m of ice. It takes over 12 minutes to complete so a balm to those overstimulated by the scream of the sliding events

Itoje calls for ‘bulletproof’ England approach to slay their Murrayfield ghosts

Maro Itoje has called on his England side to be “bulletproof” as they seek to clinch a first win at Murrayfield in six years on Saturday. England can keep their grand slam pursuit alive by successfully defending the Calcutta Cup and Itoje has urged his side to create their own history despite their recent wretched form in Edinburgh.With England on a 12-match winning streak and Scotland suffering a shock defeat by Italy last week, Steve Borthwick’s side are clear favourites for victory. Their only victory at Murrayfield since Eddie Jones’ first game in charge came in miserable weather in 2020, however, with Scotland securing victories in 2022 and last time out in 2024.England have been regularly knocked from their stride on Scottish soil with a pre-match fracas in the tunnel preceding the 2018 defeat

Curling’s uncle: 54-year-old lawyer who called out ICE becomes oldest US Winter Olympian

‘It’s ridiculous’: Maro Itoje dismisses Sir Jim Ratcliffe’s ‘colonisation’ comments

Dolomites diary: lederhosen, late buses and the anatomy of an Olympic ski jumper

Love in a cold climate: Winter Olympic village runs out of condoms after three days

Hats off to Borthwick for swapping England’s hookers to weather early Scottish storm | Ugo Monye

Penisgate 2: Italian Olympic coverage takes Leonardo da Vinci’s genitals away