Ratcliffe says immigrants cost too much, while Ineos lobbies for state funding

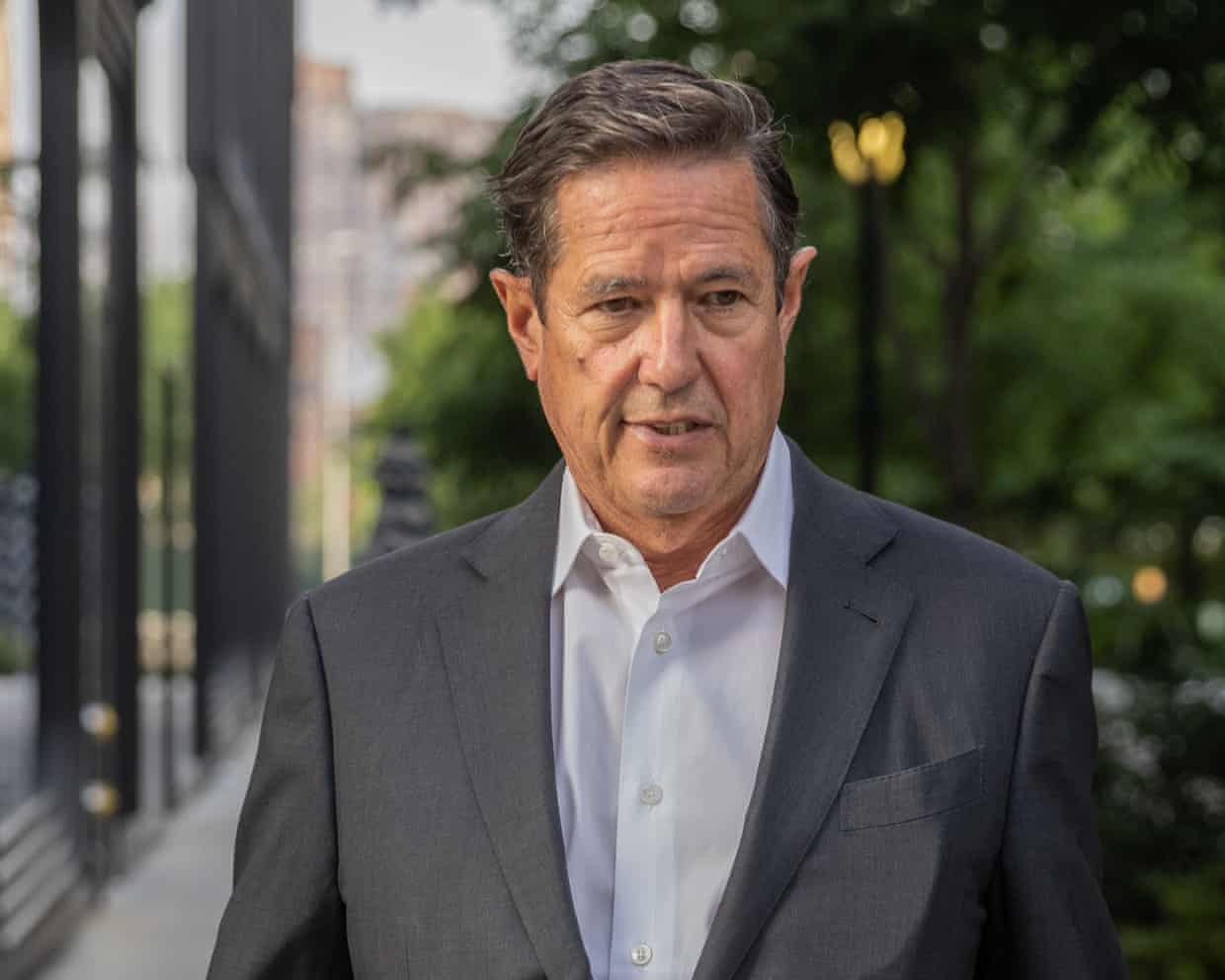

The backlash against Sir Jim Ratcliffe’s comments about immigrants to the UK “costing too much” for the state comes at an awkward time for his loss-making Ineos business.The billionaire industrialist’s sprawling empire, which ranges from chemicals to car making, has sought government financial support worth hundreds of millions of pounds and is lobbying for further state aid from the UK and EU to stay afloat.Britain’s seventh-richest man provoked outrage by accusing immigrants of “colonising” Britain and implying that people on benefits were an unaffordable drain on public funds.But Ratcliffe, who has also described carbon taxes as “the most idiotic tax in the world”, has in recent years laid claim to state support through grants and loan guarantees worth about €800m from UK and EU governments to help his refineries and chemicals plants during an extended downturn for the industry.Ratcliffe told Sky News: “You can’t have an economy with 9 million people on benefits and huge levels of immigrants coming in.

I mean, the UK has been colonised.It’s costing too much money.” He has subsequently apologised for his “choice of language”.The billionaire, who shifted his tax residency to Monaco in 2020 and who is worth an estimated £17bn, made the comments less than two months after he secured £120m of UK government support to ensure the future of the Grangemouth petrochemical site.The oil refinery complex, located on the Firth of Forth, had already received up to £70m in UK state aid in the four years prior to the December 2025 announcement.

The government also backed a £75m loan guarantee, while Ineos will invest £30m of its own money.Ratcliffe, who settled in Monaco months after receiving a knighthood in 2018, is also seeking support from the UK government worth hundreds of millions of pounds in public funds to build the “world’s greatest stadium” for Manchester United football club, in which he owns a minority stake.His move to Monaco is estimated to have cost the UK Treasury between £440m and £4bn in lost tax revenue.Ineos has also secured support from the French government for its Lavera site in southern France, launching a €250m investment to secure the site’s future with funds partially guaranteed by French government agencies.Support from state finances has become increasingly important to the sprawling and heavily indebted Ineos petrochemical empire amid a long-term downturn for the sector.

The rising cost of energy in Europe and steep competition from chemicals makers in the Middle East and Asia – which face fewer green costs and taxes – has forced many of the roughly 30 distinct companies that form the Ineos group to plunge to a loss,Ratcliffe has been a vocal critic of Europe’s “extreme carbon taxes” and in the past has blamed the continent’s high energy costs for “the deindustrialisation of Europe”,This week, Ratcliffe warned that the impact may be “unsurvivable”,“Rising carbon costs and weak trade defence are driving investment away,These conditions are unsurvivable for Europe’s chemical industry.

Plants are not closing through lack of commitment; they are closing because the economics no longer work,” he said.Credit ratings agencies, which provide financial health checks for most big companies, have sounded warnings over the outlook for Ineos that could make it more difficult and costly for it to borrow from major lenders.The two largest companies – Ineos Group Holdings and Ineos Quattro Holdings – together had more than £18bn of borrowings combined at the end of last year, an increase of nearly £3bn from the year before.One industry veteran said that Ratcliffe was likely to be in discussions with the companies’ creditors to restructure their complex debt arrangements to include covenant “holidays” or extensions to help Ineos avoid defaulting on its repayments.“There is a lot of debt.

It’s all tucked into a series of entities, all with their own debt levels and maturities,” the source said.Meanwhile, several of his companies have made job cuts, including at a plant in East Yorkshire and across its automotive arm late last year.Last year, Fitch Ratings warned that, for Ineos Group Holdings alone, the debt pile was expected to climb to almost €12bn (£10bn), or more than five times its earnings.The agency said there was “uncertainty” over the plan to repay related-party loans of £800m to other parts of the Ineos business empire.The company’s hopes of a recovery rest heavily on its floundering bid to build Europe’s largest petrochemical complex in Belgium.

Ratcliffe is calling for compensation from the Belgium state worth potentially hundreds of millions of euros for “lost time and resources” due to permit delays for its Ineos’ Project One petrochemical plant in Antwerp.The Flemish government told the Financial Times, which first reported the call for compensation, that it has formally rejected the “unjustified” and “fundamentally impossible” claim.Ratcliffe chose to construct the giant petrochemical complex at the port of Antwerp in 2019, after years of vocal backing for the UK’s Brexit campaign, in a blow to the UK’s hopes of hosting the mega-complex in Scotland.Still, the company’s €3.5bn financing for the project included a €700m guarantee from the UK’s credit agency, Export Finance.

Whether Ratcliffe’s apology for his comments about UK immigrants – which came after Keir Starmer called for an apology – is enough to secure the future goodwill of the UK government remains unclear.An Ineos spokesperson said: “The reality is that Ineos invests billions of euros of private capital into large industrial projects that support national economies, jobs and energy security.“As with most major infrastructure and manufacturing investments, these projects can be eligible for standard, transparent government support schemes that are open to all companies and designed to keep critical industry competitive.“Ineos continues to invest at scale despite a very challenging environment for European industry, and our focus remains on sustaining manufacturing, jobs and supply chains for the long term.”

Ratcliffe says immigrants cost too much, while Ineos lobbies for state funding

The backlash against Sir Jim Ratcliffe’s comments about immigrants to the UK “costing too much” for the state comes at an awkward time for his loss-making Ineos business.The billionaire industrialist’s sprawling empire, which ranges from chemicals to car making, has sought government financial support worth hundreds of millions of pounds and is lobbying for further state aid from the UK and EU to stay afloat.Britain’s seventh-richest man provoked outrage by accusing immigrants of “colonising” Britain and implying that people on benefits were an unaffordable drain on public funds.But Ratcliffe, who has also described carbon taxes as “the most idiotic tax in the world”, has in recent years laid claim to state support through grants and loan guarantees worth about €800m from UK and EU governments to help his refineries and chemicals plants during an extended downturn for the industry.Ratcliffe told Sky News: “You can’t have an economy with 9 million people on benefits and huge levels of immigrants coming in

Ex-Barclays boss Jes Staley was trustee of Jeffrey Epstein’s estate until 2015, files say

The former Barclays boss Jes Staley was named as a trustee of Jeffrey Epstein’s estate until at least May 2015, according to documents that appear to contradict court testimony given by the banker.This month the Guardian revealed that US prosecutors had reviewed allegations of rape and bodily harm against Staley, who denies any wrongdoing. He has never been charged with a crime related to the allegations.On Thursday, documents emerged that raised questions over whether Staley gave inaccurate evidence in court last year about the nature of his ties to the late convicted sex offender Epstein.Staley’s signature appears on a copy of the Jeffrey E Epstein 2014 Trust, dated November 2014, where he is named as one of three trustees

Schroders agrees £9.9bn takeover by US investor, ending 200 years of family ownership

Schroders has agreed a £9.9bn takeover by a US investor, ending two centuries of family ownership of the historic British asset management group.Chicago-based Nuveen will buy the City firm, it said on Thursday, in a deal that will create one of the world’s biggest fund managers, controlling about $2.5tn (£1.8tn) of assets

UK economy limps along at 0.1% growth – but there are reasons for optimism in 2026

Rachel Reeves has suggested 2026 is the year Labour can start to deliver on its economic promises; but 0.1% GDP growth in the final quarter of last year is hardly the springboard she was hoping for.In the supportive message on X she sent on Monday as Keir Starmer’s future appeared under threat, the chancellor claimed “the conditions for the economy to grow are there”.But the latest data, published by the Office for National Statistics (ONS), suggests that despite six interest rate cuts from the Bank of England since mid-2024, consumers and businesses are not yet taking the hint.Output from the key services sector was flat over the final quarter of the year, the ONS said, with construction – crucial to Labour’s ambitious housebuilding targets – declining by 2

UK economy grows by only 0.1% amid falling business investment

The UK economy expanded by only 0.1% in the final three months of last year, according to official data, as falling business investment and weak consumer spending led to little momentum going into 2026.Figures from the Office for National Statistics (ONS) show that the economy grew at the same rate of 0.1% as the previous three months. This was less than a 0

Housing market in England and Wales ‘showing tentative signs of recovery’

There are “tentative signs” that the housing market in England and Wales is recovering from a months-long slowdown after uncertainty around the autumn budget and economic pressures, estate agents and surveyors have reported.The Royal Institution of Chartered Surveyors (Rics) said its members were feeling more optimistic about the year ahead than at any time since December 2024, as inquiries from new buyers, agreed sales and house prices became less negative in January.A monthly survey of chartered surveyors in England and Wales showed a net balance of 35% of Rics members expect an increase in house sales over the next 12 months. The index measures the difference between the share of agents reporting rising and falling optimism.Demand from new buyers was still down, however, with a net balance of -15% of respondents saying they had seen a further decrease in inquiries in January, but Rics said this figure showed “diminished negativity”, after a reading of -21% in December and -29% in November

Jeane Freeman obituary

‘Jellyfish’ and ‘doormat’: why is Keir Starmer so deeply unpopular?

Vetting process for Mandelson needed more awkward questions, expert says

Former top civil servant warns ‘more due diligence’ to be done over replacement of Chris Wormald

Labour bill would stop ‘dodgy front companies’ making political donations

Aide linked to sex offender ‘did not give full account’ before he was given peerage, PM says