Bank of England opens door to December rate cut as it signals inflation has peaked

The Bank of England has opened the door to a December interest rate cut after signalling that inflation had peaked, as it kept borrowing costs unchanged before Rachel Reeves’s make-or-break budget.With less than three weeks before the chancellor’s tax and spending statement, the Bank’s monetary policy committee (MPC) voted by a narrow five-four majority to keep borrowing costs unchanged for a second consecutive meeting.However, City economists said the knife-edge decision and the Bank’s latest predictions for a fall in inflation from 3.8% would pave the way for the Bank to cut rates after the budget.Holding the casting vote, Andrew Bailey, the Bank’s governor, said he wanted to “wait and see” whether inflationary pressures would continue to fade and if Reeves’s budget would have an impact.

“We held interest rates at 4% today.We still think rates are on a gradual path downwards, but we need to be sure that inflation is on track to return to our 2% target before we cut them again,” he said.Borrowing costs have been cut five times since Labour came to power in July 2024, easing pressure on households and businesses, with the last reduction made in August.Meanwhile, inflation is running at 3.8% – almost twice the Bank’s 2% target.

In her 26 November fiscal statement the chancellor is expected to increase taxes, potentially slowing the economy, alongside measures taking action against the rising cost of living,Reeves welcomed the Bank’s updated forecast showing inflation falling back at a faster-than-anticipated rate,“At the budget later this month I will take the fair choices that are necessary to build the strong foundations for our economy so we can continue to cut waiting lists, cut the national debt and cut the cost of living,” she said,After the vote to hold, which was closer than the City expected, Bailey suggested the MPC would have an “opportunity to consider the budget” before its 18 December meeting,Financial markets shifted after the vote to indicate an almost 60% chance of a quarter-point reduction in rates next month.

Economists said tax increases could encourage Threadneedle Street to take action.“There is a plausible case for even weaker demand, hence pushing inflation lower from 2026,” said Janet Mui, the head of market analysis at the wealth manager RBC Brewin Dolphin.“[We will] only get more clarity post-budget, and governor Bailey’s vote will be crucial.Overall, markets believe the BoE has opened the door for a rate cut in December and has priced in that happening.”Five members of the MPC voted to keep rates unchanged at 4%, including Bailey, while a minority of four pushed for a quarter-point reduction.

Expressing growing concern over the strength of the economy, the Bank said unemployment was poised to climb to a higher peak above 5% early next year – from 4.8% now – amid subdued hiring demand.Sign up to Business TodayGet set for the working day – we'll point you to all the business news and analysis you need every morningafter newsletter promotionIt said inflation was likely to have already peaked at 3.8%, below its previous prediction for a peak of 4% this autumn.It forecast the rate would fall back to about 2.

5% next year, before returning to its 2% target over the course of 2027.In the minutes of its decision the MPC said that speculation over Reeves’s budget had probably contributed to weakness in the economy in recent months, while households had kept a lid on spending amid heightened pressures on living costs.It also found weaker exports to the US and disruption to Britain’s manufacturing base linked to the Jaguar Land Rover cyber-attack had pulled down output in the third quarter, forecasting a weaker growth rate of 0.2%.The Bank forecast GDP growth would slow from 1.

5% this year to 1.2% in 2026, before picking up to 1.6% in 2027 and 1.8% in 2028.However, policymakers warned that inflationary pressures could continue to weigh on households and businesses.

Huw Pill, the Bank’s chief economist, said there were signs that the UK could be suffering from “intrinsic inflation persistence” because workers and businesses were responding to current rates of inflation by demanding higher pay settlements and raising their prices.But Bailey said the risk of inflation becoming entrenched at high levels was diminishing as a risk, and signalled “if disinflation becomes more clearly established in the period ahead” he would vote for a cut.

Bank of England opens door to December rate cut as it signals inflation has peaked

The Bank of England has opened the door to a December interest rate cut after signalling that inflation had peaked, as it kept borrowing costs unchanged before Rachel Reeves’s make-or-break budget.With less than three weeks before the chancellor’s tax and spending statement, the Bank’s monetary policy committee (MPC) voted by a narrow five-four majority to keep borrowing costs unchanged for a second consecutive meeting.However, City economists said the knife-edge decision and the Bank’s latest predictions for a fall in inflation from 3.8% would pave the way for the Bank to cut rates after the budget.Holding the casting vote, Andrew Bailey, the Bank’s governor, said he wanted to “wait and see” whether inflationary pressures would continue to fade and if Reeves’s budget would have an impact

Bank of England says UK inflation has peaked after leaving rates at 4%; US job cuts jump as firms turn to AI – as it happened

Newsflash: The Bank of England believes the recent rise in UK inflation is over.Announcing today’s decision to leave interest rates on hold, the Bank declares “CPI inflation is judged to have peaked.”UK inflation has been recorded at 3.8% in July, August and September – and the Bank is expressing confidence that the process of ‘disinflation’ isn’t over.Its latest Monetary Policy Report, just released, predicts that inflation is likely to fall to close to 3% early next year before gradually returning towards to the 2% target over the subsequent year

Sainsbury’s says shoppers are delaying spending in run-up to budget

The boss of Sainsbury’s has urged Rachel Reeves not to fuel inflation with tax rises on retailers and their suppliers and says shoppers are delaying spending in the lead-up to her budget later this month.Simon Roberts, the chief executive of the UK’s second biggest supermarket, which also owns Argos and Habitat, said his customers were “going to be cautious on discretionary spending, not least because of uncertainty out there and [household] budgets are tight”.He said Argos had launched its deals for the Black Friday promotional event earlier than last year to try to tempt out shoppers as it was seeing “some delayed spend” while households waited to see if they would have to pay more tax.Roberts said it was not clear if food price inflation had peaked, adding: “The inflationary pressures on cost base have been significant this year … What we don’t want to see [in the budget] is further impacts that may cause further inflation.“No one wants to see inflation go any higher

Bank of England’s decision to keep interest rates at 4% is not all doom and gloom

There were reasons to be cheerful contained within the Bank of England’s latest verdict on the outlook for the UK economy, released alongside its decision to leave interest rates unchanged at 4%.Inflation, it said, had peaked at 3.8% and was expected to fall steadily back to the Bank’s 2% target sometime in 2027. That is an improvement on its thinking in August (the last time it published forecasts), when inflation was expected to peak at 4%.As inflation falls, economic growth picks up from 1

NHS won’t get cutting-edge drugs unless it pays more, says AstraZeneca boss

The boss of AstraZeneca has said that unless the UK ramps up spending on new drugs, it could be on a trajectory to only being able to afford cheap, generic medicines rather than cutting-edge treatments.Pascal Soriot made the remarks amid an acrimonious standoff between the pharmaceutical industry and the government over drug pricing, which has been blamed for drugmakers pausing or ditching nearly £2bn of investments in the UK this year.Britain has been heavily criticised by pharma executives, as well as high-profile scientists such as Sir John Bell, for not spending more on medicines, putting it out of line with other countries.“To say that countries will only be able to afford generics [drugs] is only an extreme case,” Soriot said on Thursday, emphasising that “it’s not the case today of course, but if things continue to deteriorate the way they do … it is actually possible that it happens over time, if the ongoing trend that has been in place for 15-20 years doesn’t change.”Soriot noted that the National Institute for Health and Care Excellence (Nice) cost-effectiveness thresholds for new drugs had not changed for two decades, “and we’ve had a lot of inflation in the last five years”

Banks poised to escape tax rises in Rachel Reeves’s budget

The chancellor has decided against increasing taxes on banks in this month’s budget, according to reports, which sent UK bank shares higher on Thursday.Shares in the high street banks NatWest and Lloyds rose by about 2%, putting them among the top risers on London’s FTSE 100.Despite speculation in the run-up to the 26 November budget, Rachel Reeves has reportedly told colleagues that she does not intend to impose further taxes on the UK banking sector, as she wants it to remain competitive to help support economic growth, according to the Financial Times.Banks currently pay a corporation tax rate of 28%, which includes a 3% surcharge on top of the standard corporation tax rate of 25%.Fresh calls for a new tax raid on lenders were raised in August in a paper by the Institute for Public Policy Research thinktank, which calculated such a move could raise as much as £8bn

Young people in the UK: share your experiences of living in a coastal town

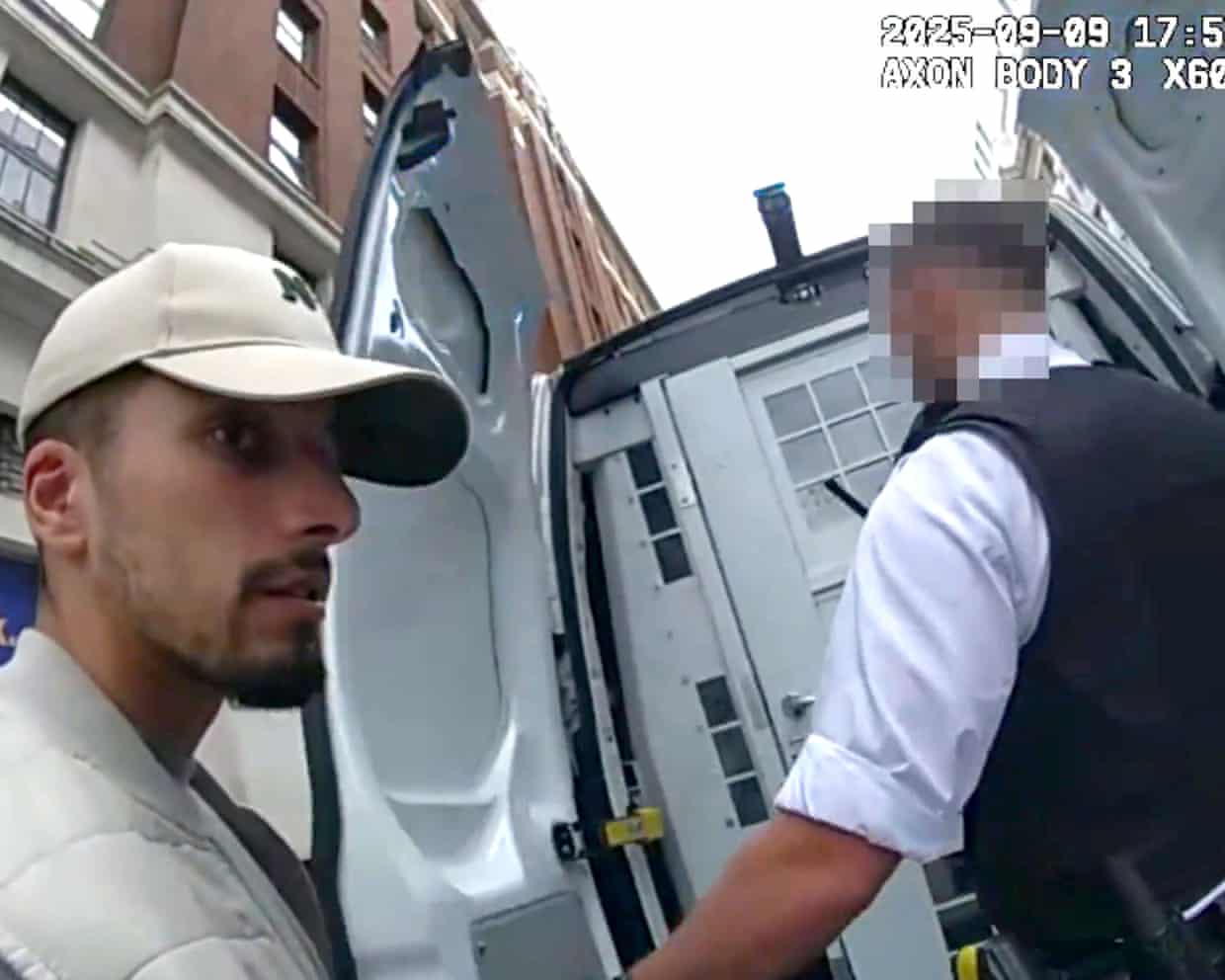

Mistakenly released prisoner Billy Smith turns himself in

Overcrowding, understaffing and old IT: chaotic context to prison release errors

Woman with stage 4 cancer has welfare benefit stopped after falling ill abroad

England prison chiefs summoned to urgent meeting with ministers over wrongful releases

Latest mistaken releases expose deep cracks in England’s prison system