Bank of England says UK inflation has peaked after leaving rates at 4%; US job cuts jump as firms turn to AI – as it happened

Newsflash: The Bank of England believes the recent rise in UK inflation is over,Announcing today’s decision to leave interest rates on hold, the Bank declares “CPI inflation is judged to have peaked,”UK inflation has been recorded at 3,8% in July, August and September – and the Bank is expressing confidence that the process of ‘disinflation’ isn’t over,Its latest Monetary Policy Report, just released, predicts that inflation is likely to fall to close to 3% early next year before gradually returning towards to the 2% target over the subsequent year.

It says:Progress on underlying disinflation continues, supported by the still restrictive stance of monetary policy.This is reflected in an easing of pay growth and services price inflation.Underlying disinflation is being underpinned by subdued economic growth and building slack in the labour market.The Bank had previously forecast that inflation would peak at 4% in September.The Bank of England has opened the door to a December interest rate cut after signalling inflation has peaked as it kept borrowing costs unchanged before Rachel Reeves’s make-or-break budget.

With less than three weeks before the chancellor’s tax and spending statement, the Bank’s monetary policy committee (MPC) voted by a narrow five-four majority to keep borrowing costs unchanged for a second consecutive meeting.However, City economists said the knife-edge decision and the Bank’s latest predictions for a fall in inflation from the current rate of 3.8% would pave the way for Threadneedle Street to cut rates after the budget.Holding the casting vote, Andrew Bailey, the Bank’s governor, said he wanted to “wait and see” whether inflationary pressures would continue to fade and if Reeves’s budget would have an impact.“We held interest rates at 4% today.

We still think rates are on a gradual path downwards, but we need to be sure that inflation is on track to return to our 2% target before we cut them again,” he said.Investors were encouraged that the Bank predicted inflation has peaked, which may pave the way for rate cuts soon – depending on the economic impact of the budget…Another bout of selling is hitting the financial markets.The S&P 500 index of US-listed shares is now down 1%, with the Nasdaq index down 1.6%.The Dow Jones industrial average is down 0.

7%, led by Salesforce.com (-6.8%) and Amazon.com (-2.5%).

Stocks wobbled earlier this week amid worries that a boom in valuations of artificial intelligence (AI) companies could be rapidly cooling.John Wyn-Evans, head of market analysis at wealth manager Rathbones, has dubbed today’s decision a ‘dovish hold’, with the Bank of England playing second fiddle to Budget:“The hold was widely expected.However, unlike the US Federal Reserve’s recent ‘hawkish cut’, today’s decision could be described as a ‘dovish hold’.The vote split was just 5-4 in favour of no change vs the 6-3 average view of economists polled by Bloomberg.There was also a subtle change in the policy wording, with the path of future rate cuts being described as ‘gradual’ rather than ‘careful’.

“Inflation risks are seen as more balanced than previously, helped by recent more favourable data.But Governor Andrew Bailey (who casts the deciding vote to hold) highlighted the need to see more data.Even so, more rate cuts are on the way, barring a shock.In the UK telecoms world, BT has lost a wave of broadband customers to rivals in recent months amid a “competitive” market, and revealed another 5,000 jobs have gone under its cost-cutting drive.The telecoms giant said its Openreach broadband customers fell by 242,000 in the second quarter, also because of a weaker broadband market.

Chief executive Allison Kirkby explained that the market had ben flat to slightly down over the past year.She said some of this was “coming off the peaks of Covid, when people put second lines into their home so they could work from home,” and some of it was related to cost of living pressures.But, she added:“What we’re not seeing is the increased house building.That was meant to bring at least another 100,000 new homes into the market.That has not happened.

So once the government get the house building growing, this market will be back to growth again.”BT’s revenues declined by 3% year-on-year to £9.8bn in the six months to 30 September.This was driven by declines in its legacy landline service as well as a weaker mobile phone market as people are holding onto their devices for longer.Its pre-tax profit slid by 11% to £862m.

Kirkby said “people are just generally holding onto their devices for longer,” encouraged by financing schemes launched by BT and others, but also because handsets “are becoming ever more expensive, and there’s just not the same innovation in them”.“So whereas previously, people would maybe replace their handset every two years.The financing scheme that we launched 18 months ago meant that they hold on to them for three years.And actually the average handset cycle is more like four years.”BT did have a “very positive reaction” to the new Apple iPhone 17, and was pre-selling it ahead of other UK operators, Kirkby said.

BT has pushed ahead with a turnaround plan that involves slashing costs and sharpening its focus on the UK and newer business lines.It said it cut its total workforce by 6% in the first half of the year, to 111,000 people.The job cuts form part of a programme to cut costs by £3bn a year.So far it has achieved £1.2bn over the first 18 months.

Sterling has gained half a cent against the US dollar today, after the Bank of England narrowly failed to cut interest rates today,The pound is trading around $1,31 today, a cent higher than the seven-month low hit earlier this week,UK borrowing costs have dipped today,The prices of government bonds (gilts) have risen, which pushes down the yield (interest rate) on the debt, as investors have anticipated interest rate cuts as soon as December.

Hussain Mehdi, director of investment strategy at HSBC Asset Management believes gilts still look attractive at current levels, saying:“There were just too many unknowns for the BoE to cut today.Despite a raft of recent data likely to push the MPC in a more dovish direction – including soft GDP prints over the summer, and weaker wage and CPI inflation – there seems to be a call for these trends to be more sustained before committing to another cut.In addition, this month’s budget could have some material economic impacts which the BoE may need to factor in.December remains a live meeting in our view, and we see rates settling around the 3.5% level.

”“For investors, we believe UK gilts still look attractive given a starting point of high yields amid backdrop of rate cuts and falling inflation.UK stocks could also continue to perform amid rate cuts, helping to unlock value in many parts of the FTSE 100.”Janet Mui, head of market analysis at wealth manager RBC Brewin Dolphin, agrees that governor Andrew Bailey’s vote will be ‘crucial’ in deciding whether the Bank of England cuts interest rates in December:With widespread expectation of potential tax hikes in the Autumn Budget, there is a plausible case for even weaker demand hence pushing inflation lower from 2026.The difficulty is that the BoE cannot consider hypothetical impact in its assessment prior to knowing the exact measures in the Budget.We will, therefore, only get more clarity post Budget and Governor Bailey’s vote will be crucial.

Overall, markets believe the BoE has opened the door for a rate cut in December and has priced in that happening.”Reaction to today’s UK interest rate decision (no change) has been pouring in.Paul Dales, chief UK economist at Capital Economics, believes today’s decision to hold rates at 4% is a pause in the downward trend in interest rates rather than the end.Dales says:With a tightening in fiscal policy in the Budget on 26th November on the cards, the Bank will probably resume cutting rates in the coming months.We still think rates will be cut to 3.

00% next year rather than to the 3.50% priced into the financial markets.Kathleen Brooks, research director at XTB, says UK borrowers could get an early Christmas present from the Bank of England in December:The Bank of England voted to keep rates on hold today, but there could be rate cuts coming as soon as next month.The most interesting part of this meeting was the vote split, which was 5-4 in favour of remaining on hold.Also, for the first time we got detailed reasons why each member voted as they did.

The immediate market reaction to the decision was a rush to reprice December rate cut expectations, and, surprisingly, the pound is higher vs.the USD and the EUR.The interest rate swaps market is now pricing in a 65% chance of a rate cut next month, this is up from 29% at the start of this week, there is also a 52% chance of a cut in February.James Smith, ING’s developed markets economist for the UK, is more convinced that a rate cut is coming in December, adding:Everything hinges on Governor Andrew Bailey’s vote – and his comments make it abundantly clear that he is siding with the doves.Matt Swannell, chief economic advisor to the EY ITEM Club, says the MPC was “unusually divided”, leading to the narrow 5-4 vote, adding:Today’s decision clearly opens the door to a December cut, but that remains contingent on the incoming data.

If there are further signs of falling inflationary pressures in the coming months and if the bulk of the tax rises expected at the Autumn Budget are introduced almost immediately, then there might be a slim majority on the Committee in favour of a Christmas cut.Any future cuts are likely to come at a relatively gradual pace as the Committee continues to remain wary of lingering inflationary pressures.”Away from the Bank of England’s interest rate decision, we have new signs that artificial intelligence is hitting the jobs market.U.S.

-based employers announced 153,074 job cuts in October, up 175% from the 55,597 cuts announced in October 2024, outplacement firm Challenger, Gray & Christmas has reported.That’s the highest for the month since October 2003.Andy Challenger, chief revenue officer for Challenger, Gray & Christmas, says some companies are reducing headcount after adding staff during the Covid-19 pandemic, while others are halting hiring as they adopt AI.Challenger explains:“October’s pace of job cutting was much higher than average for the month.Some industries are correcting after the hiring boom of the pandemic, but this comes as AI adoption, softening consumer and corporate spending, and rising costs drive belt-tightening and hiring freezes.

Those laid off now are finding it harder to quickly secure new roles, which could further loosen the labor market.So far this year, US employers have announced 1,099,500 job cuts, an increase of 65% from the 664,839 announced in the first ten months of last year.That’s the highest level since 2020.John-Paul Ford Rojas of the Daily Mail says people are worried that income tax will go up in the budget – would that give the Bank any impetus to cutting interest rates in December?Andrew Bailey sticks to his guns, repeating that the Bank will assess the budget measures when they are announced, rather than speculating about fiscal policy.Szu Ping Chan of the Telegraph asks whether government action in the last year has helped, or hindered, the fight against inflation.

Andrew Bailey resists any temptation to criticise the Treasury.He points out that the government has many public policy objectives.For example, that can mean allowing water bills to rise to fund the clean-up of the water industry – it’s not for the Bank to oppose that (but it can point out the impact on inflation).My colleague Phillip Inman looks forward, asking why the Bank doesn’t expect to cut rates more quickly in 2026.The Bank’s scenarios show growth slowing and unempoyment rising in 2026, so why does they show restrictive interest rates?Andrew Bailey replies that the degree of restrictiveness is easing, and the Bank will continue to assess how restrictive the cost of borrowing is.

Joel Hills of ITV News asks why the Bank doesn’t support strong pay growth.Andrew Bailey replies that pay growth is an important determinent of inflation, while inflation expectations help to determine wage negotiations.We have been though a period where pay settlements were well above where our models suggested they would be.Pay settlements are coming down, he adds, and they will be an “important part of our considerations”.Phil Aldrick of Bloomberg asks if the Bank would welcome action by Rachel Reeves to slow increases in regulated prices.

Deputy governor Clare Lombardelli says that the Bank thinks around 0,4% of the current 3,8% inflation rate is due to those administered prices,

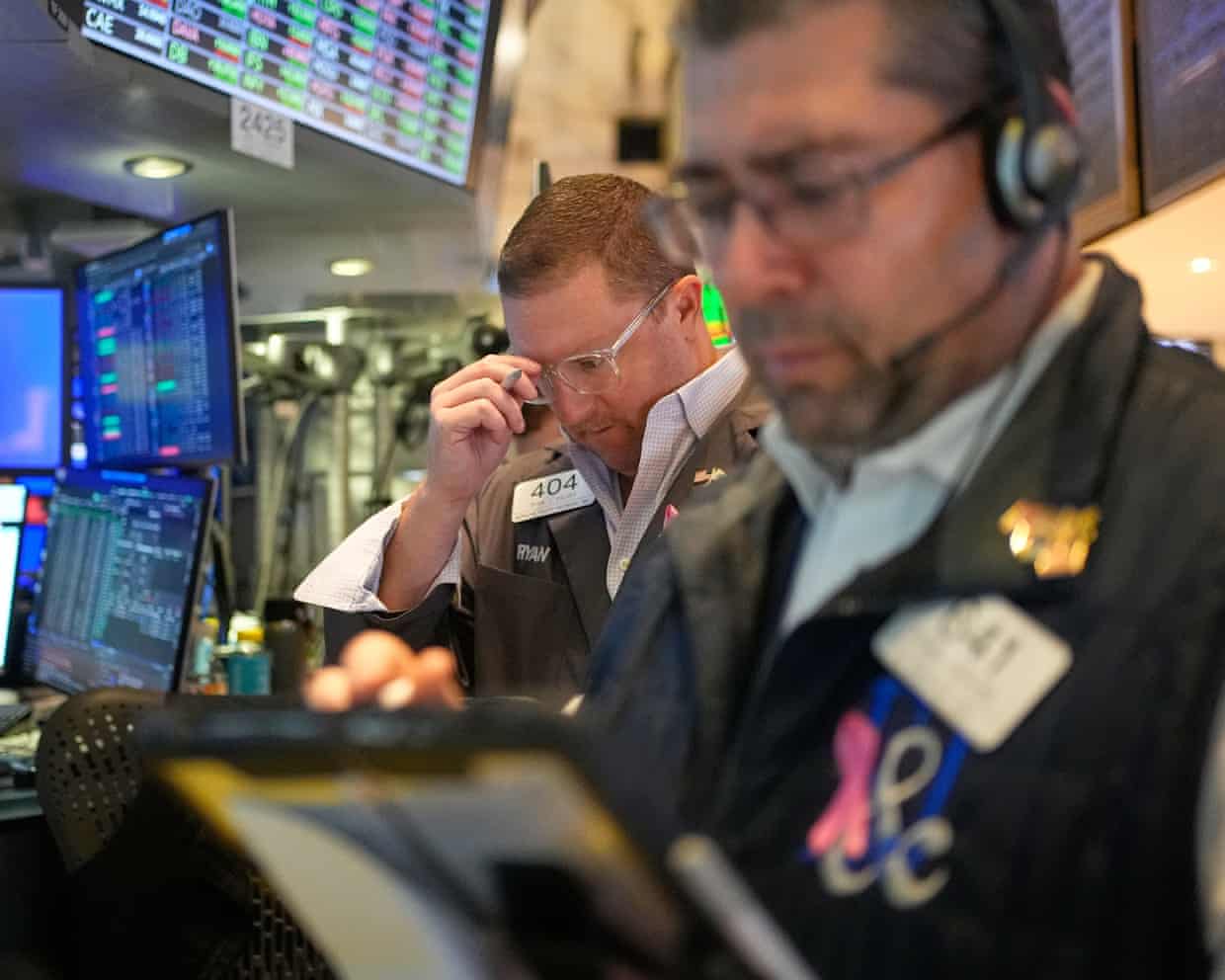

US stock market values tumble amid reports of high layoffs and hiring freezes

Fears that the US economy is slowing, with firms shedding jobs and imposing hiring freezes, sent Wall Street tumbling on Thursday.The S&P 500 index of leading firms was down 1% as investors also highlighted concerns about the potential for a slump in the value of businesses that have benefited from huge investments in artificial intelligence. The tech-heavy Nasdaq Composite fell 1.5%.A report showed that last month was the worst October for US layoffs since 2003, which grabbed the attention of investors in the absence of official data delayed by the federal government shutdown

British Airways to offer free fast onboard wifi to all after Starlink deal

Passengers on British Airways flights will be able to access fast wifi onboard at no cost after the airline’s parent company signed a deal with Elon Musk’s satellite company.The carrier said the free “reliable and lightning-fast” wifi from Starlink would be available to customers flying in economy, business or first class from next month.BA’s owner, International Airlines Group (IAG), said it had reached agreement with Starlink to provide internet connectivity on more than 500 aircraft across its carriers, which also include Aer Lingus, Iberia and Vueling.BA said the rollout of the technology was part of a £7bn “transformation” and would provide lag-free internet access to passengers from boarding to landing, even when they are flying over oceans or remote regions. Passengers will be able to connect multiple devices and they will not need a special login

How Tesla shareholders could make Elon Musk the world’s first trillionaire

If Elon Musk can grow Tesla to over $8tn in value for stockholders over the next decade, he will be well on his way to becoming the world’s first trillionaire.That is if stockholders approve the company’s latest proposed compensation plan for the “Superstar CEO”, as a judge once called him, at this week’s annual shareholders meeting in Austin, Texas, set for Thursday afternoon.“If Elon achieves all the performance milestones under this principle-based 2025 CEO Performance Award, his leadership will propel Tesla to become the most valuable company in history,” the company’s annual proxy statement boasts.Forward-looking measures on Musk’s compensation of $1tn are not the only issues on the ballot. Shareholders will also consider an alternate avenue to pay Musk the estimated $56bn the company says he is still due from a 2018 compensation plan

Amazon sues AI startup over browser’s automated shopping and buying feature

Amazon sued a prominent artificial intelligence startup on Tuesday over a shopping feature in the company’s browser, which can automate placing orders for users. Amazon accused Perplexity AI of covertly accessing customer accounts and disguising AI activity as human browsing.“Perplexity’s misconduct must end,” Amazon’s lawyers wrote. “Perplexity is not allowed to go where it has been expressly told it cannot; that Perplexity’s trespass involves code rather than a lockpick makes it no less unlawful.”Perplexity, which has grown rapidly amid the boom in AI assistants, has previously rejected the US shopping company’s claims, accusing Amazon of using its market dominance to stifle competition

‘The goal is to win all the final races’: Norris raises bar before São Paulo GP

Lando Norris has acknowledged that he needs to be at the very top of his game to try to secure his first world championship, as the British driver heads into this weekend’s São Paulo Grand Prix with a narrow one-point lead over his McLaren teammate, Oscar Piastri.Norris had trailed Piastri by 34 points after the Dutch GP but with a series of strong results including a dominant win from pole to flag at the last round in Mexico, Norris has edged ahead in the title race for the first time since the Saudi Arabian GP in April.Red Bull’s Max Verstappen has also made a late charge to reignite his title defence, recovering from a 104-point deficit to Piastri after Zandvoort to advance to being within 36 points of Norris.Four meetings remain, including two sprint races with one this weekend in Brazil, and with 116 points still available, Norris confirmed his aim was to simply keep winning.“Nothing is completed, nothing is done,” he said

Marcus Smith urged to kickstart England attack against Fiji after setbacks

Steve Borthwick has acknowledged the challenges presented by managing Marcus Smith’s diminished role for England but has urged the recalled playmaker to kickstart his side’s attack against Fiji on Saturday.Borthwick revealed that he met with Smith before England’s autumn campaign to offer support to the Harlequins No 10, who was first-choice fly-half 12 months ago before being moved to full-back and then to the role of super sub.After a patchy start to the season with Harlequins, Smith was absent from England’s 25-7 victory over Australia last weekend but with Freddie Steward nursing a hand injury, he comes back into the side at full-back while Fin Smith replaces George Ford at fly-half.In total, Borthwick has made seven personnel changes with Luke Cowan-Dickie, Ellis Genge, Alex Coles, Ollie Lawrence and Chandler Cunningham-South starting against Fiji, who were victorious on their most recent visit to Twickenham in 2023.Genge will captain the side from the start with Maro Itoje, who has been struggling with a lower leg injury, named on the bench for the first time since 2017

Elon Musk’s $1tn Tesla pay deal to be rejected by huge Norway wealth fund

Apple Watch SE 3 review: the bargain smartwatch for iPhone

Experts find flaws in hundreds of tests that check AI safety and effectiveness

OpenAI signs $38bn cloud computing deal with Amazon

Oakley Meta Vanguard review: fantastic AI running glasses linked to Garmin

‘History won’t forgive us’ if UK falls behind in quantum computing race, says Tony Blair