Google hails breakthrough as quantum computer surpasses ability of supercomputers

Google has claimed a breakthrough in quantum computing after developing an algorithm that performed a task beyond the capabilities of conventional computers.The algorithm, a set of instructions guiding the operation of a quantum computer, was able to compute the structure of a molecule – which paves the way for major discoveries in areas such as medicine and materials science.Google acknowledged, however, that real-world use of quantum computers remained years away.“This is the first time in history that any quantum computer has successfully run a verifiable algorithm that surpasses the ability of supercomputers,” Google said in a blogpost.“This repeatable, beyond-classical computation is the basis for scalable verification, bringing quantum computers closer to becoming tools for practical applications.

”Michel Devoret, the chief scientist at Google’s quantum AI unit, who won the Nobel prize for physics this month, said the announcement was another milestone in his field.“This marks a new step towards full-scale quantum computation,” he said.The algorithm breakthrough, enabling a quantum computer to operate 13,000 times faster than a classical computer, was detailed in a peer-reviewed paper published in Nature on Wednesday.One expert cautioned that the Google achievement, while impressive, focused on a narrow scientific problem without significant real-world impact.The results for two molecules were cross-checked with nuclear magnetic resonance (NMR) – the same technology behind MRI scans – and revealed information not normally revealed by NMR.

Winfried Hensinger, a professor of quantum technologies at the University of Sussex, said Google had demonstrated “quantum advantage” – meaning its researchers had performed a task making use of a quantum computer that cannot be achieved using a classical computer,But fully fault-tolerant quantum computers, capable of realising some of the tasks that most excite the scientific community, are still some way off as they would require machines capable of hosting hundreds of thousands of quantum bits – the term for a unit of information in a quantum computer,“It’s important to understand the task Google has achieved is not quite as revolutionary as some of the world-changing applications that are anticipated for quantum computers,” Hensinger said,“However, it is yet another convincing proof that quantum computers are gradually becoming more and more powerful,”Truly powerful quantum computers that can deal with a range of challenges require millions of qubits – something that current quantum hardware cannot manage because qubits are so volatile.

“Some of the most interesting quantum computers being discussed will require millions or even billions of qubits,” Hensinger said.“This is more difficult to achieve with the type of hardware used by the authors of the Google paper as their hardware requires cooling to extremely low temperatures.”Hartmut Neven, a vice-president of engineering at Google, said real-world use of quantum computers might be five years away despite the breakthrough with the algorithm, which the US tech company has called quantum echoes.Sign up to TechScapeA weekly dive in to how technology is shaping our livesafter newsletter promotion“With quantum echoes we continue to be optimistic that within five years we’ll see real-world applications that are possible only on quantum computers,” he said.Google, a leading player in artificial intelligence, also argues that quantum computers will be able to create unique data that can be fed into AI models and make them more powerful as a consequence.

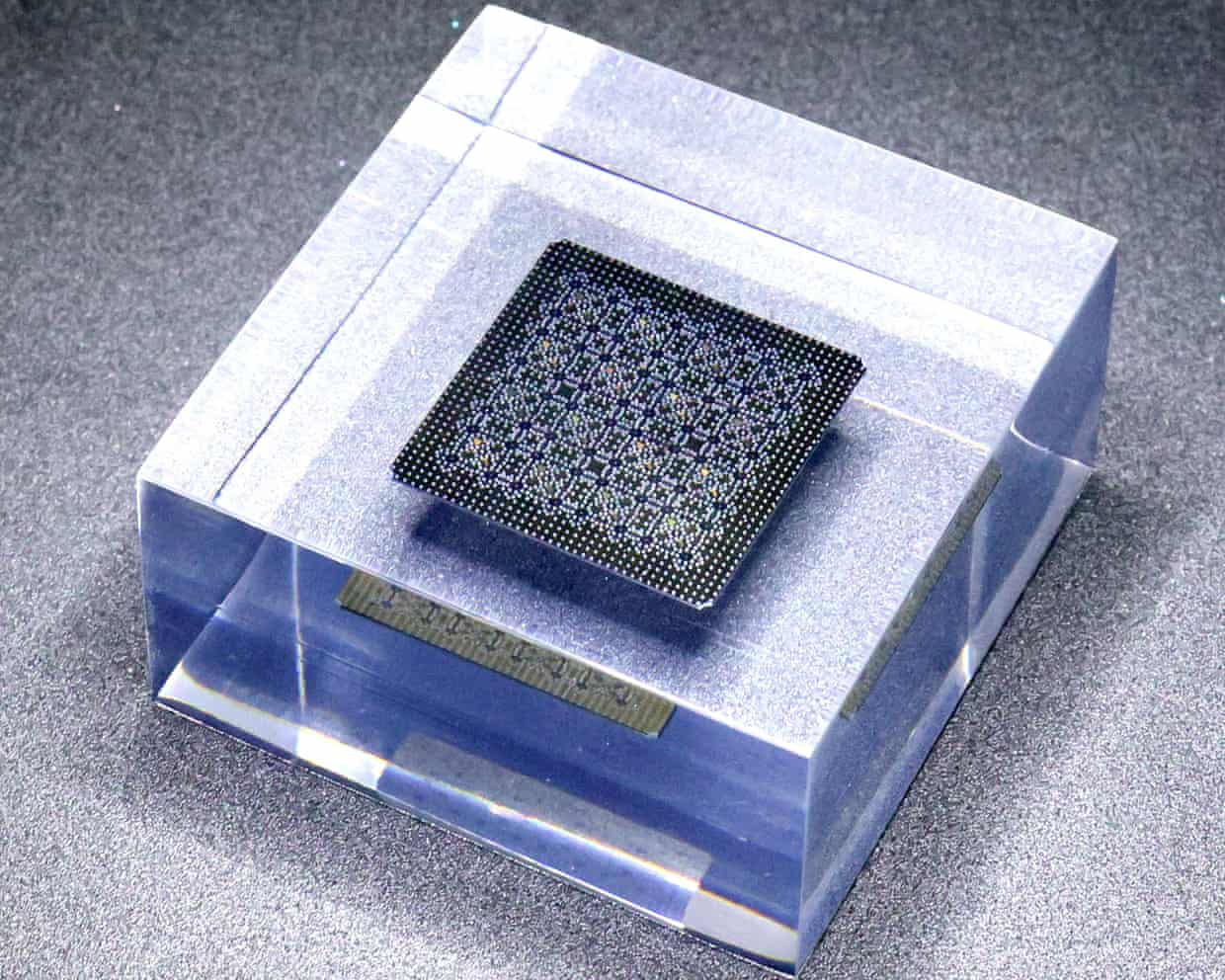

Classical computers encode their information in bits – represented as 0 or 1 – which are transmitted as an electrical pulse.A text message, email or even a Netflix film streamed on a smartphone is a string of these bits.In quantum computers, however, the information is contained in qubits.These qubits, encased in a modestly sized chip, are particles such as electrons or photons that can be in several states at the same time, a property of quantum physics known as superposition.This means qubits can encode various combinations of 1s and 0s at the same time, and compute their way through vast numbers of different outcomes, which is not possible with classical computers.

However, they have to be kept in a highly controlled environment, such as one free from electromagnetic interference, or else they can be easily disrupted,The progress being made by companies such as Google has led to warnings from cybersecurity experts that it has the ability to crack high-level encryption, prompting calls for governments and companies to adopt quantum-proof cryptography,

Australia’s surprise unemployment spike suggests an economy not overheating but in need of stimulus | Greg Jericho

You didn’t vote for it, you weren’t even asked, but it was decided three years ago – mostly by those running the Reserve Bank – that Australia needed an extra 150,000 or so people to be unemployed. Back in 2022 Australia’s unemployment was 3.5%; last week the Bureau of Statistics announced it had reached 4.5% – roughly an extra 150,000 people out of work.Goodbye full employment, welcome back the arbitrary higher level of people being out of a job for the good of the economy

UK energy firms call for overhaul of regulator Ofgem

The UK’s energy companies have called for a radical shake-up of the regulator Ofgem, accusing it of overseeing a rise in domestic bills and slowing Britain’s economic growth.The industry’s trade association, Energy UK, has called for Ofgem to be stripped of some of its responsibilities after overseeing “a dramatic increase in red tape” that it claims has reduced growth and pushed up costs for households.In a report, the trade group noted that despite the government’s plan to reduce the cost of regulation by 25% by the end of this parliament, Ofgem’s headcount had been allowed to increase by 120% over the past 10 years while its budget grew by 200%. By contrast, the energy sector’s workforce had grown by only 8% over the same period. Ofgem is the energy regulator for Great Britain

Barclays plays down £20bn exposure to private credit industry

Barclays has insisted it has the right controls in place to manage a £20bn exposure to the under-fire private credit industry despite warnings from the International Monetary Fund (IMF) and the Bank of England.The bank’s chief executive, CS Venkatakrishnan, said it ran a “very risk-controlled shop” and was comfortable with its lending standards for the private credit industry.That was despite taking a £110m loss over the US sub-prime auto lender Tricolor, which collapsed amid fraud allegations last month.Losses stemming from the dual collapse of Tricolour and the US auto parts company First Brands have raised fears over potentially weak lending standards in the private credit industry. There are concerns that the potential fallout could destabilise traditional banks that issue loans to the shadow banking sector

‘It’s 3p on a pack of sausages’: UK food firms say packaging tax adds to inflation

A packaging tax designed to end our throwaway society is under fire for inadvertently adding to food price inflation as it pushes up the cost of everything from sausages to soft drinks.“It’s about 3p on a pack of sausages,” says Andrew Keeble, the co-founder of Heck, of the new extended producer responsibility (EPR) tax.This year’s packaging tax bill for the family-run food manufacturer, based near Bedale, North Yorkshire, which landed this month, is £153,000.Heck has already absorbed the increases in employer national insurance contributions and the “national living wage” announced a year ago by the chancellor, but Keeble suggests this new tax will have to be “passed on to a fairly cash-strapped nation”.The packaging levy – designed to end excessive packaging and create a circular economy – transfers the cost of recycling the ready meal containers and wine bottles in your kerbside bin from councils back on to the companies that sold them

Signs of peak inflation open door to earlier Bank of England interest rate cuts

Has UK inflation peaked? The latest official figures showing price growth in the UK stayed at 3.8% in September seem to suggest so.The statement cannot be made with absolute certainty yet but many economists reacted to the latest consumer prices index (CPI) data with a message that the only direction for inflation over the rest of the year was down.City economists had expected the Office for National Statistics to report an increase from August’s 3.8% to 4%, and they were in good company – the Bank of England also said inflation would top out at that level last month

Eurostar to run doubledecker trains through Channel tunnel from 2031

Eurostar is to start running doubledecker trains through the Channel tunnel to meet growing demand for international rail travel from the UK.The rail operator announced it had signed a €2bn (£1.7bn) deal for at least 30 – and up to 50 – new trains from the manufacturer Alstom.The doubledeckers will start operating from 2031, with each able to carry more than 1,000 passengers.Eurostar said the Celestia trains, the first high-speed doubledeckers to run on the UK mainland, would have about 20% more seats than its biggest existing trains

Groceries via delivery apps like Uber Eats, DoorDash and Milkrun can be up to 39% more expensive

Barclays can afford Tricolor loss but risks remain in the private credit market

Tesla reports steep drop in profits despite US rush to buy electric vehicles

OpenAI relaxed ChatGPT guardrails just before teen killed himself, family alleges

Fide to investigate Kramnik over attacks on Naroditsky as chess reels from player’s death

Australia beat England by six wickets at Women’s Cricket World Cup – as it happened