Barclays can afford Tricolor loss but risks remain in the private credit market

“I’m not an entomologist,” said CS Venkatakrishnan, the Barclays chief executive, dodging the question everybody is asking: how many cockroaches are about to crawl out of the woodwork in the private credit market?The good news – sort of – for Barclays is that it had only one insect to point to.A £110m loss from lending to Tricolor, the US sub-prime auto lender that has failed amid allegations of fraud, doesn’t look good but Venkatakrishnan could simultaneously trumpet that Barclays avoided that other rotten private credit beast First Brands.Barclays was asked to lend to the stricken autoparts supplier, but didn’t.JP Morgan, taking its own $170m (£127m) hit on Tricolor, said the same last week.One could regard these developments as mildly reassuring after a week in which both the International Monetary Fund and the Bank of England have warned about risks that may be emerging in the world of private credit, AKA the shadow banking sector.

Exposure to fraud – if that is what it turns out to be at Tricolor; the US justice department is investigating – is an everyday risk of doing business for a bank.Sometimes the risks materialise.One cannot assume on the basis of a single bad exposure that Barclays’ lending standards, which Venkatakrishnan defended stoutly, have slipped.Meanwhile, the group’s £20bn exposure to private credit – weighted to the US and out of a total loan book of £346bn – doesn’t feel wildly abnormal for a firm with an active investment bank in New York.Barclays, reporting quarterly pre-tax profits of £2.

08bn, is also plainly big enough to take a £110m hit on the chin.It’s got enough surplus capital to afford £500m-worth of share buybacks.The share price rose.Jolly good, so time to stop fretting about the whole private market? Well, no, obviously not.The governor of the Bank of England, Andrew Bailey, wasn’t going to downplay the risks in front of a Lords select committee this week (he is paid to worry, after all), but he made three obvious and related points.

First, there’s no way to tell at the time if collapses are “idiosyncratic cases” or an indicator of a broader crisis in the private credit market.The 2007-08 credit crisis also began with a low rumble that was deemed to be too far away from the financial centre to matter systemically.Second, there is some evidence of “slicing and dicing” of loan structures by private credit lenders, which is how risk was disguised last time.Third – and this is probably Bailey’s critical point – central bankers don’t have much visibility over what is happening in the shadows because private credit is largely unregulated.In other words, it is a world of known unknowns.

Sign up to Business TodayGet set for the working day – we'll point you to all the business news and analysis you need every morningafter newsletter promotionFinancial markets, after panicking for a couple of days about First Brands and Tricolor and possible spillovers to mainstream big banks, have gone back to relaxed mode.That’s understandable because the numbers aren’t yet big enough to indicate wider and deeper problems.But, as Bailey indicated, risky lending in an opaque, complex and leveraged part of the financial world is now ringing alarm bells.If more cockroaches appear in the next couple of months, sentiment will turn again.

Georgina Hayden’s recipe for parmesan and sage jacket potato gnocchi | Quick and easy

If I’m going to the effort of making jacket potatoes (and by effort I mean putting them in the oven for an hour), I will almost always pop in a few extra spuds to make gnocchi for a later meal. The difference between shop-bought and homemade gnocchi is vast, especially the vac-packed, long-life kind, which are dense and can be heavy. Freshly made gnocchi, with fluffy baked potatoes, however, are light as air, pillowy and silky. If that sounds intimidating, let me reassure you that this recipe is really forgiving, and much easier than making fresh sheet pasta. I love them served simply, as here, with a slightly nutty sage butter and lots of parmesan

How to make the perfect strata – recipe | Felicity Cloake's How to make the perfect…

Also known variously as “breakfast casserole” and “egg dish”, strata is an American brunch favourite that, according to the great US chef Sohla El-Waylly, is best described as “the love child of frittata and bread pudding”, while the dish’s name comes from the fact that it’s assembled in layers. Like all the best leftovers recipes, those layers are eminently flexible, but what all strata have in common are stale bread and eggs. The rest is largely up to you.The Guardian’s journalism is independent. We will earn a commission if you buy something through an affiliate link

Scottish hospitality coalition urges chancellor to protect whisky industry

A coalition of drinks, tourism and farming bodies has urged the chancellor to protect the Scottish whisky industry from a steeper sales slump and further job losses by freezing spirits duty in her budget next month.The grouping, which includes the Scottish arms of the National Farmers’ Union, the Institute of Directors and UKHospitality, has written to Rachel Reeves to argue that a freeze in duty would be a “strategic investment” that could increase tax revenues.They said recent rises in spirits duty had taken the overall tax paid on the average bottle of whisky to at least £12, or 70% of the retail price, contributing to about 1,000 redundancies in whisky production since last year’s budget, when spirits duty rose.“The current duty regime, combined with wider economic headwinds, is placing significant strain on both producers and venues,” the joint letter said. “Some businesses are halting investment or looking abroad, while others are being forced to cut jobs

‘I felt my soul leave my body’: 13 readers on the worst meal they ever cooked – from ‘ethanol risotto’ to gravy cake

There are lots of potential errors a home cook can make, whether mistaking a bulb of garlic for a clove or experimenting with a banana sauce for pork. Here are some culinary experiments to avoidI’m very fond of steamed vegetables with lemon and black pepper. When I was pregnant, my loving partner took it upon himself to cook for me. We didn’t have any lemons. We did have kiwis

670 Grams, Birmingham B9: ‘A cascade of small, meaningful bowls that just ooze flavour’ – restaurant review | Grace Dent on restaurants

Birmingham’s dining scene often leans towards the intense. I recall a hazy afternoon seven years back at the Digbeth Dining Club, a ramshackle food market inside an old factory with few seats, loud music, breakfast cocktails and baos; it was a thoroughly chaotic way to take on board calories. More recently, I loved the city’s Albatross Death Cult, which served 12 courses of scintillating, seafood-focused finickiness to a pounding, darkwave industrial-goth soundtrack.The Guardian’s journalism is independent. We will earn a commission if you buy something through an affiliate link

‘£30 for a ready meal?!’ Do Charlie Bigham’s new dishes really beat going to a restaurant?

Like Tesla cars and the ending of the Sopranos, Charlie Bigham ready meals seem to be rather divisive. On the one hand, people clearly love them: about 31m dishes were sold in the past year alone. On the other hand, they generate a heap of mockery. The critique seems to be that only a gullible idiot would shell out up to a tenner on an oven-ready fish pie, chilli con carne or – as one commentator once memorably labelled it – a tray of “Tory slop”.Those critics will be sharpening their kitchen knives because Bigham, who is a kind of Tim “Wetherspoons” Martin for centrist dads, has just announced the launch of his Brasserie range: deluxe versions of his meals with prices that fetch up to … wait for it … £30! Thirty whole English pounds!With a menu consisting of venison bourguignon, coq au vin, confit duck (all at £16

iPhone 17 review: the Apple smartphone to get this year

Harry and Meghan join AI pioneers in call for ban on superintelligent systems

‘I’m suddenly so angry!’ My strange, unnerving week with an AI ‘friend’

ChatGPT Atlas: OpenAI launches web browser centered around its chatbot

‘Significant exposure’: Amazon Web Services outage exposed UK state’s £1.7bn reliance on tech giant

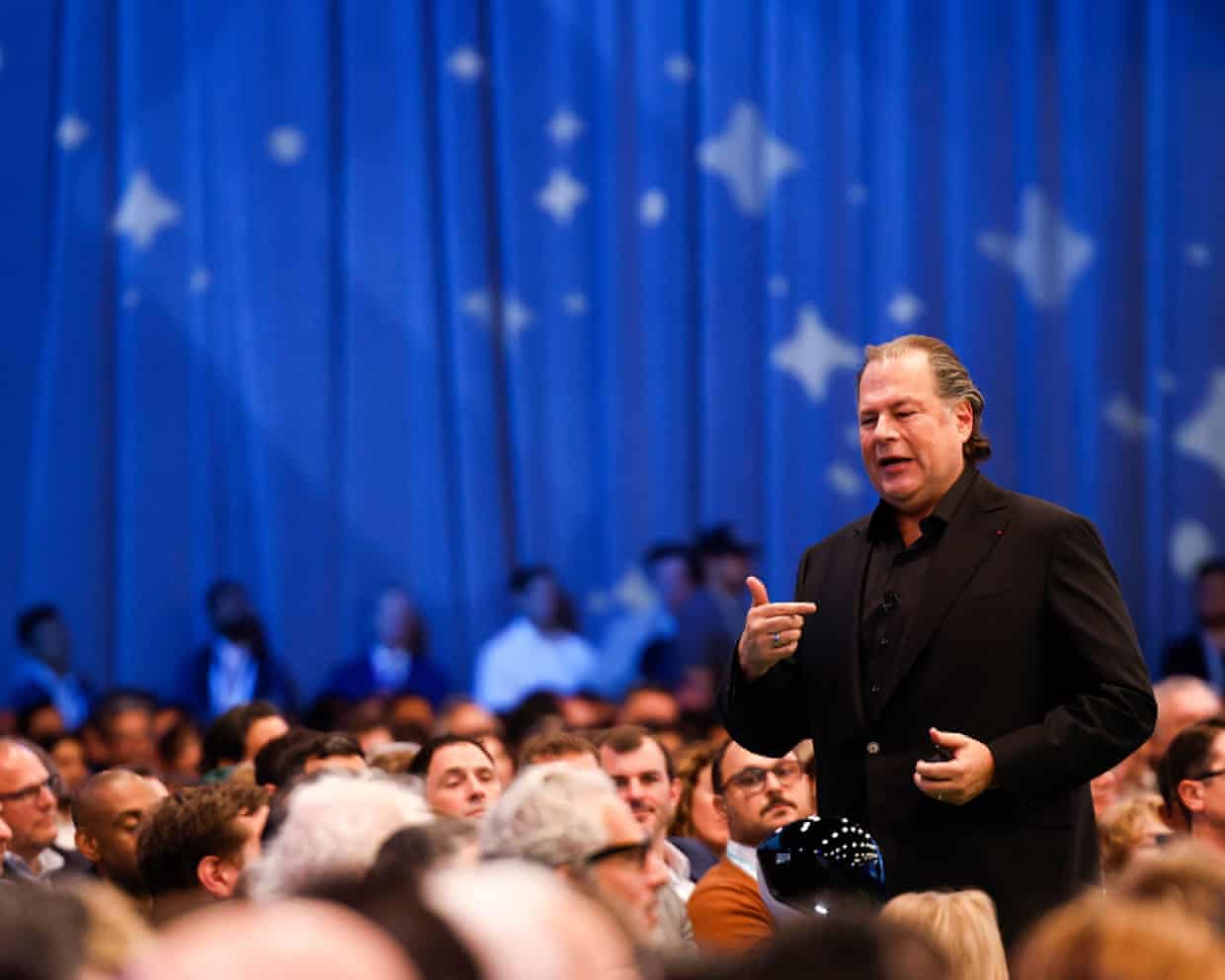

Salesforce’s CEO backtracks after saying Trump should send troops into San Francisco