Cryptocurrency slump erases 2025 financial gains and Trump-inspired optimism

As 2025 comes to a close, Donald Trump’s favorable approach to cryptocurrency has not proven to be enough to sustain the industry’s gains, once the source of market-wide optimism and enthusiasm.The last few months of the year have seen $1tn in value wiped from the digital asset market, despite bitcoin hitting an all-time-high price of $126,000 on 6 October.The October price peak was short-lived.Bitcoin’s price tumbled just days later after Trump’s announcement of 100% tariffs on China sent shockwaves across the market on 12 October.The crypto market saw $19bn liquidated in 24 hours – the largest liquidation event on record.

Ethereum, the second-largest cryptocurrency, saw a 40% drop in price over the next month,Eric Trump’s own crypto company endured a similar drop in its value in December,In Donald Trump, the crypto industry was delivered the pro-bitcoin president they were promised during his campaign,Within days of taking office for the second time, he issued an executive order that repealed restrictions on cryptocurrency and introduced new favorable regulations as well as a presidential working group on digital assets,“The digital asset industry plays a crucial role in innovation and economic development in the United States, as well as our Nation’s international leadership,” the order read.

He placed cryptocurrency front and center in American policy.Again in March, Trump announced a new strategic cryptocurrency reserve that fueled a 62% rally in the market prices of three out of five of the coins named to the reserve.Bitcoin, the world’s most valuable cryptocurrency, went up 10% to $94,164 in the hours after the reserve was announced.Cryptocurrency is sensitive to both narratives and confidence in global markets, said Rachael Lucas, the head of marketing and communications at BTC Markets, Australia’s largest cryptocurrency exchange.It’s what is called a risk-on asset, an investment that does better when investors are feeling confident about the economy and are willing to take on more risk, Lucas said.

“The Trump administration may be pro-crypto, but tariffs and tight monetary policy outweigh positive vibes,” said Lucas.“And it’s also just a reminder, especially for people in crypto, that macro forces really matter more than political stances.”In November, bitcoin suffered its biggest drop in price since 2021, bringing the coin’s value to less than $81,000.While bitcoin regained some of that value in the weeks after, the digital token started December with another slump, dropping 6% after Strategy, the biggest holder of bitcoin, cut its earnings forecast because of the slide in crypto prices.Bitcoin’s price now hovers near $90,000, up from years past but significantly lower than its peak.

In the first few days of December 2025, Eric Trump’s crypto firm, American Bitcoin Corp, saw 40% of its value – roughly $1bn – wiped out,The Trump family scion put on a bullish face and declared he would ride out the decline,“I’m holding all my @ABTC shares - I’m 100% committed to leading the industry,” Eric Trump said on X at the time,Some experts fear the industry is entering a so-called crypto winter, a prolonged period of stagnation or losses,The last time, crypto winter lasted from the end of 2021 through 2023, when the FTX mogul Sam Bankman-Fried was tried and convicted.

Those years saw bitcoin slump 70% in price.Despite the optimism fueled by Trump’s win, the current market downturn shows the crypto-friendly administration wasn’t enough to usher in a return to the “retail mania” of 2021, when there was a huge upswing in individual stock trading, said Christian Catalini, the founder of the MIT Cryptoeconomics Lab.“The recent crash isn’t a change in sentiment, but a collision of three structural factors: the aftershocks of a $19bn leverage washout in October; a risk-off rotation driven by US-China tariff tensions; and, crucially, the potential unraveling of the corporate treasury trade,” Catalini said.Another potential factor that may have shaken the crypto market is the downturn in share prices of AI stocks like Nvidia, said Lucas.“One of the reasons why bitcoin is tied to the AI cycle is because a lot of the bitcoin miners actually started leveraging their energy towards new datacenters,” she said.

“Not only is crypto a technical asset, we have the miners actually tied into AI devices going up,That negative sentiment tends to sneak into crypto,”Despite concerns over a crypto winter, notable players in the crypto space Larry Fink, the CEO of investment management firm BlackRock, and Brian Armstrong, the co-founder of Coinbase, the largest crypto exchange in the US, expressed optimism about the long-term value of the currency at a recent New York Times conference,Armstrong said “there was no chance” the price of bitcoin would go to zero and in fact 2025 would be seen as the year “when crypto went from gray market to a well-lit establishment”,Fink, for his part, said his firm had observed “legitimate long owners investing in the currency”, including sovereign wealth funds.

Lucas said that this downturn in crypto prices was not inconsistent with past four-year bitcoin cycles and that she was not worried about entering a much more sustained crypto winter.“If I was looking at it from a traditional bitcoin cycle, we are actually technically in a bear market,” said Lucas.“But as you can see, even with all of these macros that are affecting the market, bitcoin has still managed to set a price above $80,000.”

DIY shops enjoy bumper year as UK property market slows

Retailers of home improvement products are having a glittering year on the London stock market, as cash-strapped UK consumers turn to DIY projects after being priced out of moving home or undertaking expensive renovations.Publicly listed retailers including the B&Q owner, Kingfisher, as well as Topps Tiles, Wickes and the sofa seller DFS are on track for double-digit percentage share price increases of as much as 56% this year.Kingfisher and Topps Tiles have posted share price increases of 26.5% and 13% respectively, their best annual gains since the pandemic, while a 23% year-to-date rise at DFS is its strongest year since 2019.Kingfisher, which also operates in France and Poland, has issued two profit upgrades since September on the back of the company’s strong performance in the UK

Copper price on track for biggest rise in 15 years amid global shortage fears

Copper, the metal that underpins the fast-growing renewable energy industry, is on course for its biggest annual price rise in more than 15 years as traders react to fears of global shortages.As one of the main beneficiaries of the “electrification of everything”, copper has soared by more than 35% in value this year, spurred by US tariff uncertainty and concerns about mining disasters that could restrict supply.Analysts said copper had also joined silver and gold as a safe haven asset for investors wanting to hedge against the falling value of the dollar.Silver reached a record high on Monday, pushing the value of the Mexican mining company Fresnillo, which is listed on the London stock market, to a record high this month. The price of gold has jumped above $4,400 (£3,263) an ounce, up more than 70% since the beginning of January

Nearly half of Americans believe their financial security is getting worse, poll finds

Twice as many Americans believe their financial security is getting worse than better, according to an exclusive new poll conducted for the Guardian, and they are increasingly blaming the White House.The poll, conducted by Harris, will be a further blow to Donald Trump’s efforts to fight off criticism of his handling of the economy and contains some worrying findings for the president.Nearly half (45%) of Americans said their financial security is getting worse compared to 20% who said it’s getting better.57% of Americans said the US economy is undergoing a recession, up 11% from a similar poll that was conducted in February.The US is not experiencing a recession, which is typically defined as two quarters of negative growth

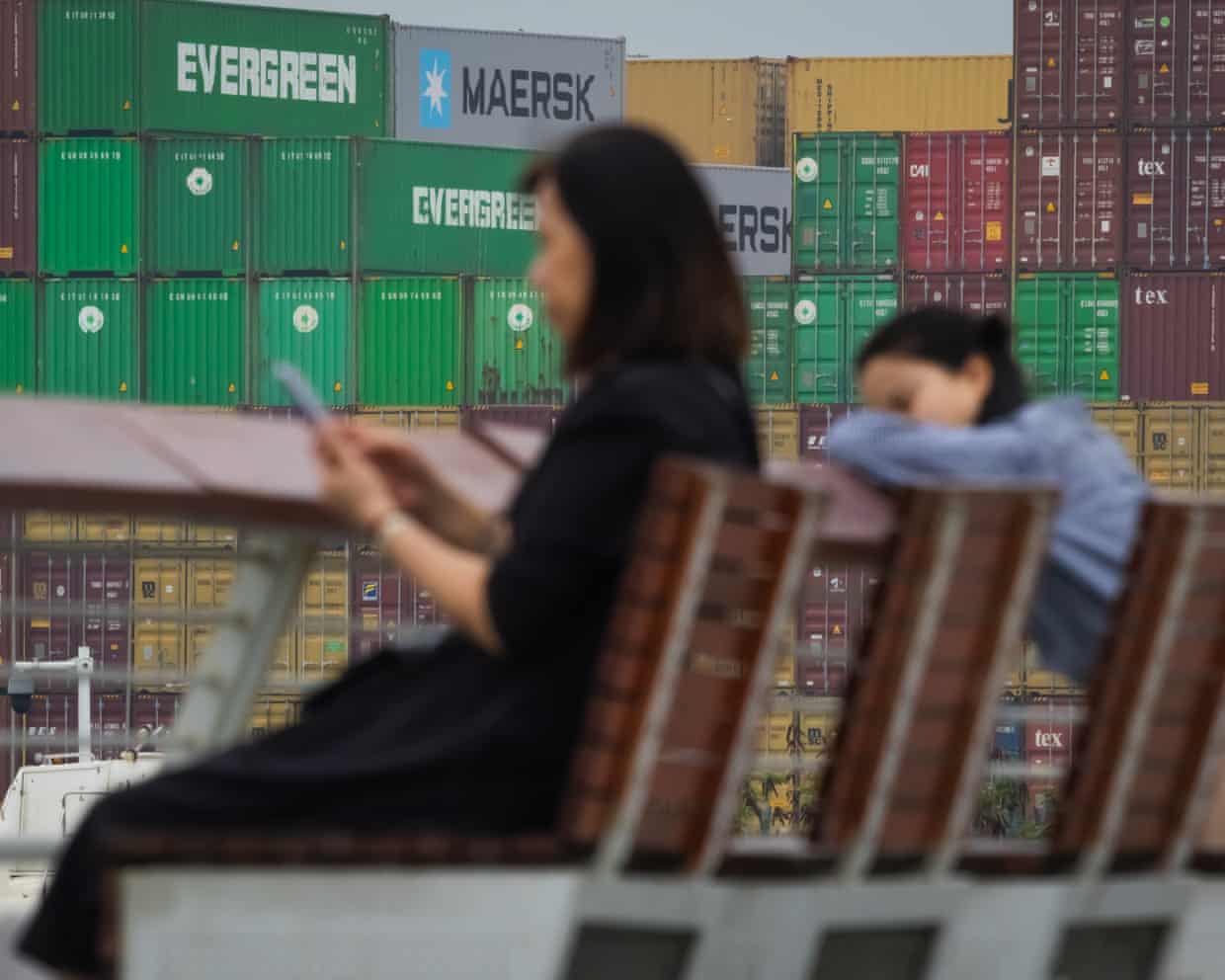

Influx of cheap Chinese imports could drive down UK inflation, economists say

The UK is poised for an influx of cheap Chinese imports that could bring down inflation amid the fallout from Donald Trump’s global trade war, leading economists have said.After figures showed China’s trade surplus surpassed $1tn (£750bn) despite Washington’s tariff policies hitting exports to the US, the Bank of England said the UK was among the nations emerging as alternative destinations for the goods.Stephen Millard, a deputy director at the National Institute of Economic and Social Research, said: “There is an expectation that given the high tariffs the US are imposing on China, that China will divert its trade elsewhere and one of those places will be the UK.”This month Catherine Mann, an external member of the Bank’s rate setting monetary policy committee, told MPs on the Treasury committee there were early signs of trade diversion affecting UK inflation.“Import prices have started to moderate on the back of sterling appreciation and some of the spillover of the diversion of Chinese products from the US tariff burdens to other places, including to our docks

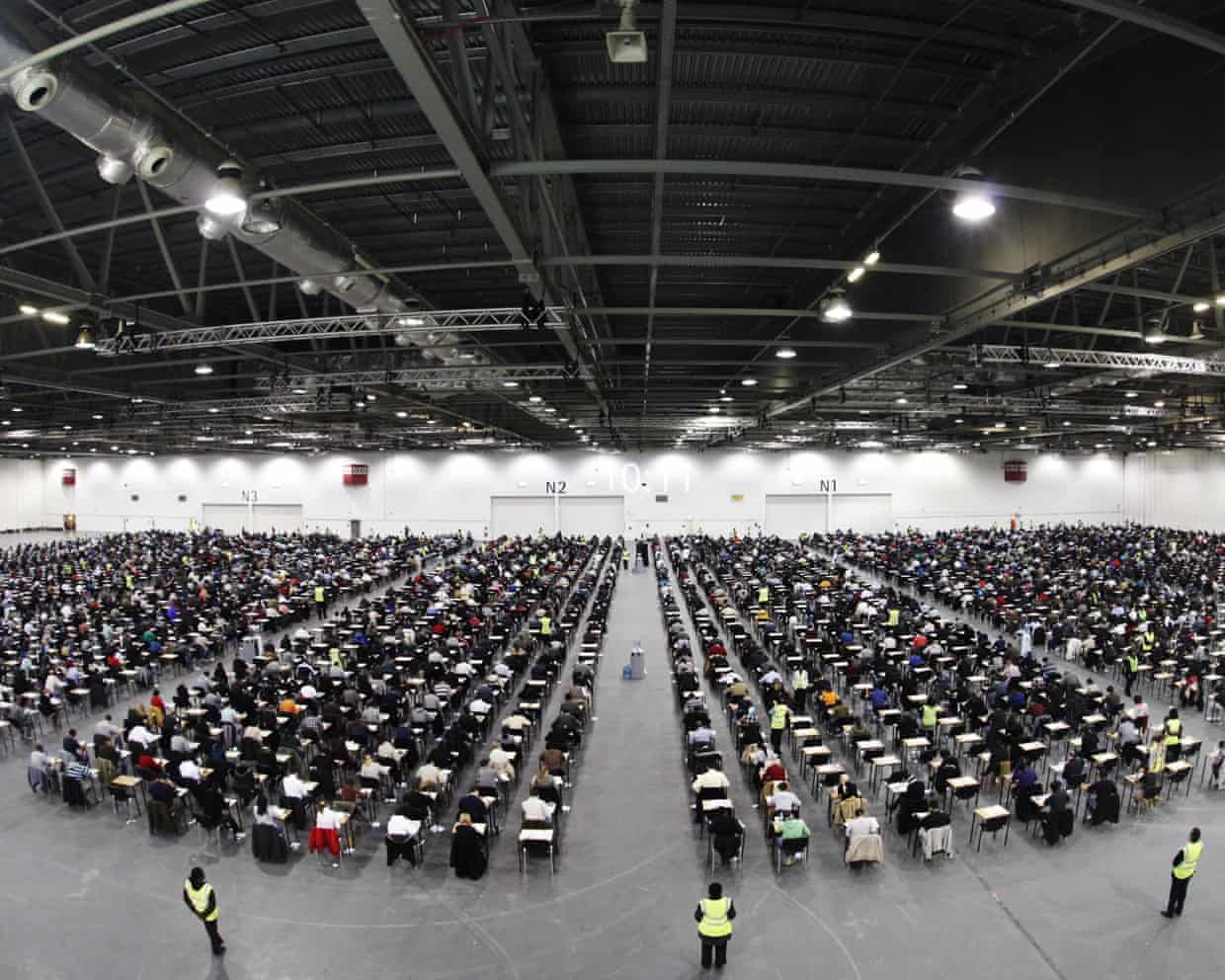

UK accounting body to halt remote exams amid AI cheating

The world’s largest accounting body is to stop students being allowed to take exams remotely to crack down on a rise in cheating on tests that underpin professional qualifications.The Association of Chartered Certified Accountants (ACCA), which has almost 260,000 members, has said that from March it will stop allowing students to take online exams in all but exceptional circumstances.“We’re seeing the sophistication of [cheating] systems outpacing what can be put in, [in] terms of safeguards,” Helen Brand, the chief executive of the ACCA, said in an interview with the Financial Times.Remote testing was introduced during the Covid pandemic to allow students to continue to be able to qualify at a time when lockdowns prevented in-person exam assessment.In 2022, the Financial Reporting Council (FRC), the UK’s accounting and auditing industry regulator, said that cheating in professional exams was a “live” issue at Britain’s biggest companies

Help UK ceramics industry or ‘lose piece of national identity’, government told

Britain will lose a piece of its national identity if the country’s ceramics industry is allowed to descend further into crisis without state assistance, the government has been warned.Ceramics producers including the struggling potteries of Staffordshire have come under huge pressure owing to factors such as the UK’s sky-high energy costs, leading to job losses.In a report, unions and the Green Alliance thinktank urged the government to step in to support the centuries-old sector.“Tens of thousands of working-class jobs rely on the ceramics sector so we cannot afford to leave its future to chance. But so far we aren’t seeing enough action from a government grappling with the unique challenges the sector faces,” said Chris Hoofe of the GMB union

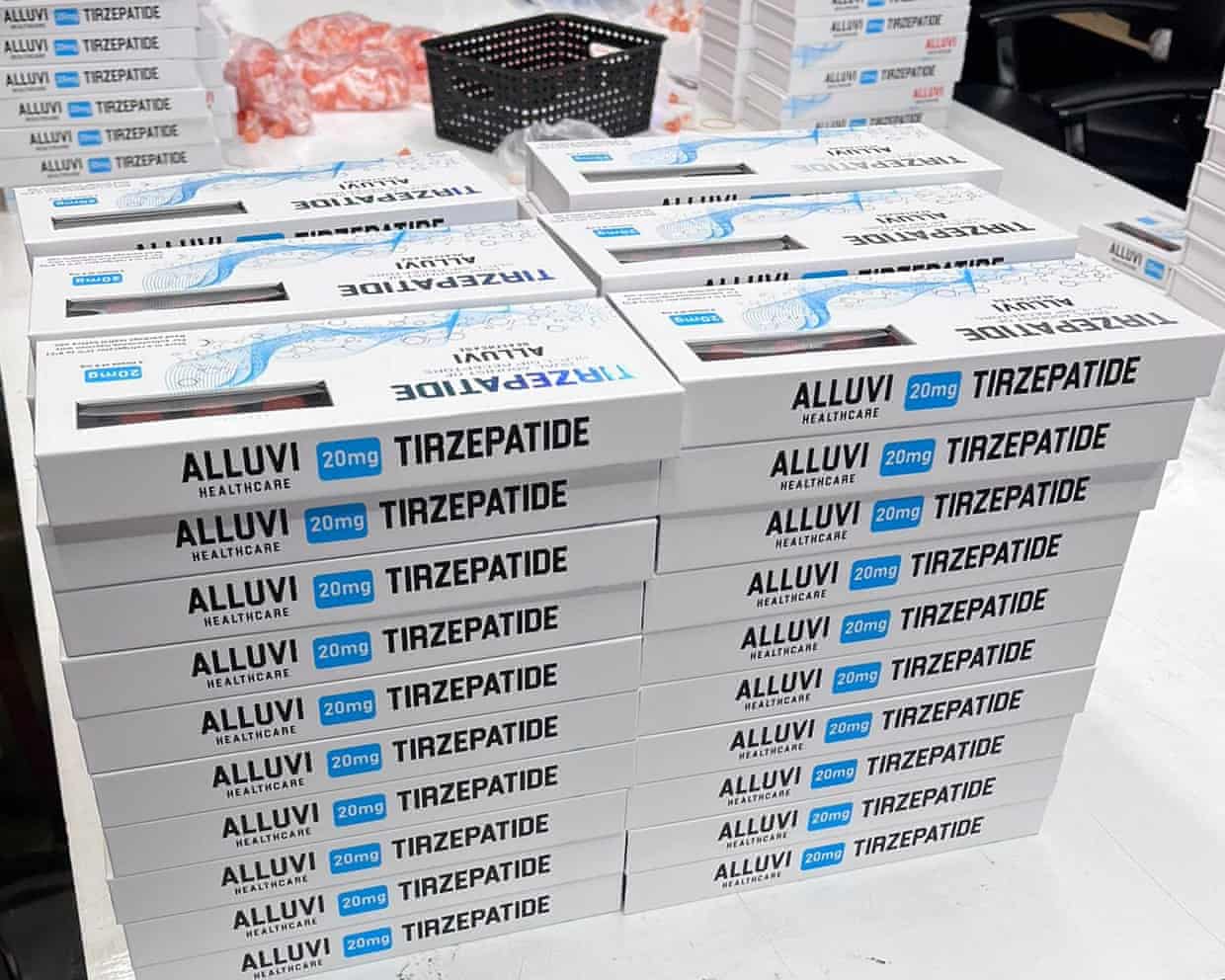

UK medical regulator warns against buying weight-loss jabs from social media channels

Most Europeans think state pensions will become unaffordable, polling shows

‘I tried. I felt everything’: readers tell us how they would use their last chance to send a letter

Gambling firms spent nearly £5m to advertise on TfL since London mayor’s ban pledge

AI being used to help cut A&E waiting times in England this winter

Dagenham’s sewing machinists did not go on strike primarily for equal pay | Letters