Trump ‘plans to roll back’ some metal tariffs; US inflation weaker than expected in January - business live

Time to wrap up…US inflation moderated in January to 2,4%, an easing after Donald Trump’s tariffs triggered price fluctuations last year,Prices rose 0,2% from December to January, according to data released by the US Bureau of Labor Statistics on Friday measuring the consumer price index (CPI), which measures the price of a basket of goods and services,Core CPI, which strips out the volatile food and energy industries, went up 0.

3% over the month.A trio of bank bosses have been handed huge pay packets in the latest sign that the vast salaries and bonuses handed to Wall Street and City of London executives in the run-up to the 2008 financial crisis have started to return.NatWest on Friday revealed a £6.6m pay package for its boss, Paul Thwaite, marking the largest payout for a chief executive of the banking group since his disgraced predecessor Fred Goodwin took home £7.7m in 2006.

Details of Thwaite’s pay deal came hours after the US lender Citigroup announced that its chief executive, Jane Fraser, had been paid a record $42m (£31m) for 2025,That included a $1,5m base salary and a $40,5m bonus, helping push her overall pay up by almost a quarter from $34,5m a year earlier.

Lloyds Banking Group also announced it had handed its chief executive, Charlie Nunn, a 20% rise in pay for 2025 to £7.4m, which included £4.4m in bonuses.That was the highest sum in a decade.The boss of P&O Ferries owner, DP World, has left the company after revelations over his ties with the sex offender Jeffrey Epstein forced the ports and logistics company to take action.

Dubai-based DP World, which is ultimately owned by Dubai’s royal family, announced Sultan Ahmed bin Sulayem’s departure as the group’s chair and chief executive on Friday.Sulayem – the brother of Mohammed Ben Sulayem, the head of the FIA, which governs the world’s motor sport championships including Formula One – has been under intense pressure after the publication of messages with Epstein.Stellantis has reportedly relaunched several diesel cars and vans across Europe, as part of a costly retreat from electric vehicles that it says is in response to customer demand.The European-based carmaker, which owns marques including Peugeot, Fiat, Jeep and Citroën, reintroduced diesel versions of at least seven models late last year, Reuters reported.These include the Peugeot 308 and the premium DS No.

4 hatchback, alongside a range of passenger vans – though only the DS No.4 has been relaunched as a diesel car in the UK.A spokesperson for Stellantis said it “remains committed to electrification,” but added:Our goal is to build a relevant offer to our customers, giving them what they want and what they need.Based on that, the company also offers some diesel engines in its product portfolio.For instance, in response to sustained customer demand, we have decided to reintroduce it on some models such as DS No.

4.”Stellantis admitted last week that it had “overestimated” the pace of the shift to EVs and revealed a €22bn (£19.1bn) charge, after lacklustre sales and governments on both sides of the Atlantic walking back emissions targets.Demand in the US has collapsed after the Trump administration withdrew a $7,500 (£5,527) consumer tax credit, and moved to repeal emissions standards for cars and trucks.Europe has also watered down its targets, despite stronger EV sales, allowing combustion engines to remain on sale for longer.

There aren’t huge moves in the US stock market so far, as investors digest the latest inflation figures.The blue chip S&P 500 stock index has slipped 0.08%, while the Dow Jones Industrial Average is down 0.03%.Futures for the US stock market, which will open in less than half an hour, are now up slightly after weaker than expected inflation in January.

While investors are taking some confidence from the inflation data, Stuart Clark, a portfolio manager at the investment firm Quilter, warns that there are still some “difficult decisions” ahead for the Federal Reserve,After a stronger than expected jobs print earlier this week, inflation has fallen more than expected to 2,4% year-on-year, with core inflation rising 2,5% - approaching five years above the 2% target,Lower gas prices were the key driver to bringing inflation down more than expected, but how long this downward trajectory remains to be seen.

Tariffs continue to cause prices to fluctuate, while President Trump wants a hot economy heading into the midterms, so we still see inflation pick up once again.This is all leaving a cloudy picture for monetary policy setters.Recent months has seen the Fed focus more on the employment data as concerns began to present themselves that the labour market was faltering.On the surface, the payrolls number earlier this week put some of that to bed, but under the surface things remain volatile and as such there is no easy path when it comes to interest rates.While the continued downward trend towards target will undoubtedly be used to encourage the Fed to cut rates sooner rather than later, and opens the door to Kevin Warsh being more accommodative to President Trump when his term begins, it is by no means a foregone conclusion that the US needs easier monetary policy at this point in time.

”Weaker than expected inflation for January is starting to feed expectations that the Federal Reserve could cut interest rates this year,Isaac Stell, investment manager at the broker Wealth Club, says:US inflation has surprised to the downside, showing disinflationary progress is the US is on track and that rate cuts could well be on the cards as we move through 2026,Economic conditions in the US are currently showing signs of improvement in the form of solid GDP growth and a stabilising labour market,These latest positive inflation figures mean that if the disinflation trend continues, policy makers are likely to ease rates as 2026 progresses,Bond markets are currently pricing in two cuts for 2026, starting in May, which would bring interest rates down to a range of 3.

00-3,25%, a level at which many analysts deem to be a sensible neutral rate,With tariff related goods inflation expected to peak in the first half of the year and rental inflation set to continue to normalise, the signs look positive for inflation to continue its downward trend,In the near term however, policy makers may deem it appropriate to keep rates steady for a couple more meetings whilst they continue to survey incoming data and make sure the disinflation seen today, is the start of a trend and not just a blip,”The Trump administration has put unprecedented pressure on the Fed chair, Jerome Powell, to cut rates, with Donald Trump launching personal attacks on Powell and the justice department opening a criminal investigation into his handling of the refurbishment of the central bank’s offices.

The FOMC has 12 voting members and meets eight times a year to set interest rates.US inflation for January came in lower than expected, at a year-on-year rate of 2.4%, in a sign that price pressures are easing for Americans.The consumer price index (CPI) figure for January marked a deceleration compared with a rate of 2.7% in December and slightly lower than expectations of 2.

5% among economists polled by Reuters,US CPI MISS: US Inflation cools to 2,4% YoY (vs 2,5% exp), defying fears of re-acceleration after this week's hot jobs report,The Breakdown:•Headline: 2.

4% (Lowest since May)•Core: 2.5% (Slowest since Mar '21)Driver: Core Services (yellow bars) remains the sticky factor.… pic.twitter.com/5OX5F0TOyiCore inflation, which does not include food and energy prices, slowed to to 2.

5%, in line with expectations.It comes after official figures on Wednesday showed the US economy added 130,000 jobs last month, well ahead of forecasts.Last month the Federal Reserve held interest rates at a range of 3.5 per cent to 3.75 per cent, following three consecutive quarter-point cuts.

Inflation in the UK is running at about 2.5%, Huw Pill, the chief economist at the Bank of England, has said.Speaking at an event hosted by the bank Santander in London, he said:I think when we look at where we are now, short of something happening, underlying inflation is going to be two and a half percent, once we take that half percentage-point impact from the budget out of the forecast we have for April/May,.The Bank has said it expects inflation to fall to about 2% in April or May.Last week Pill voted with a narrow majority to keep interest rates on hold at 3.

75%.He reiterated his view that the cooling of inflation pressures in Britain was not complete and said the outlook for businesses’ wage and price-setting plans was like a “shallow saucer”.In order to complete that (disinflation) process, monetary policy has a part of play and that means we do need to retain some restrictiveness in the stance of monetary policy until that process of disinflation is complete.He added he did not expect “a collapse” in economic activity and that much of the recent rise in unemployment could be due to structural factors.A top lawyer at Goldman Sachs has also recently left her job after emails in the latest tranche of Epstein files revealed she had a close relationship with the convicted child sex offender , who she called “Uncle Jeffrey”.

Kathy Ruemmler said she would step down as the bank’s chief legal officer and general counsel at the end of June.She told the Financial Times, which first reported her departure:I made the determination that the media attention on me, relating to my prior work as a defence attorney, was becoming a distraction,”Ruemmler’s resignation marks a U-turn for the bank’s top lawyer, having initially insisted she would not resign from the job she has held since 2020.The boss of Dubai-based logistics group DP World, Sultan Ahmed Bin Sulayem, has left his post after revelations over his ties with the paedophile Jeffrey Epstein.The company named Yuvraj Narayan as chief executive officer and Essa Kazim as chairman, the Dubai Media Office said on X on Friday.Both positions were previously held by Bin Sulayem.

DP World announces the appointment of Essa Kazim as Chairman of its Board of Directors and the appointment of Yuvraj Narayan as Group Chief Executive Officer,Bin Sulayem led DP World, a multinational ports and logistics enterprise with operations spanning more than 80 countries,Documents released by the US Department of Justice revealed that he emailed Epstein in 2015 that he met a girl “two years ago” that went to an American university in Dubai was “the best sex I ever had amazing body”,“She got engaged but now she back with me,” he said,DP World owns six ports in Canada, the London Gateway container port, as well as P&O which it acquired for £3.

3bn in 2006.It came under fire in 2022 when the P&O Ferries business fired 800 staff and replaced them with cheaper agency workers.European markets are subdued this morning – the FTSE 100 is now down very slightly by 0.01%, and the pan-continental Europe Stoxx 600 index is down by 0.34%.

That loss is being led by the basic materials sector, which is down 1,43%,The French IT company Capgemini is a bright spot, with its shares rising by 4,9% after it beat its own target for full-year revenue, up 3,4% at constant exchange rates to €22.

5bn (£19,25bn) in 2025,Net income slipped 4% to €1,6bn,But all eyes will be on the US when the market opens in a few hours, as investors grapple with concerns about how AI could disrupt various industries.

Mohit Kumar, an economist at the investment broker Jefferies, thinks some of the fears might be overblown.He said:We do not agree with the frenzy, but we also know not to stand in the way of position unwinds and flows.Hence, we would not be stepping in to fade the recent weakness.We believe that the current market is more nuanced and requires more detailed bottoms up approach to identify winners and losers.AI disruption is not a negative

Trump ‘plans to roll back’ some metal tariffs; US inflation weaker than expected in January - business live

Time to wrap up…US inflation moderated in January to 2.4%, an easing after Donald Trump’s tariffs triggered price fluctuations last year.Prices rose 0.2% from December to January, according to data released by the US Bureau of Labor Statistics on Friday measuring the consumer price index (CPI), which measures the price of a basket of goods and services. Core CPI, which strips out the volatile food and energy industries, went up 0

Penalty notice: Euro Car Parks fined £473,000 for ignoring regulator

Euro Car Parks is infamous for dishing out fines but the private parking company has been hit with an almost £475,000 penalty of its own after it failed to hand over information to a regulator.The Competition and Markets Authority (CMA) said it had imposed a £473,000 fine after the company did not respond for three months to seven requests for information, including by registered post, email and hand-delivered letter.It is the first time the CMA has issued a penalty under the new fining powers it was given in 2024.The regulator sends out “information notices” to companies when deciding whether to open an investigation, and businesses have a legal obligation to comply.The CMA said Euro Car Parks, which provides payment systems in car parks, only responded after it raised the spectre of a fine

Elon Musk’s xAI faces second lawsuit over toxic pollutants from datacenter

Elon Musk’s artificial intelligence company xAI is facing a second lawsuit alleging it is illegally emitting toxic pollutants from its enormous datacenters, which house its supercomputers and run the chatbot Grok.The new pending suit alleges xAI is violating the Clean Air Act and was filed Friday by the storied civil rights group the NAACP. The group’s 40-page notice of intent to sue alleges xAI has been polluting Black communities near its facility in Southaven, Mississippi. The pollution comes from more than a dozen portable methane gas generators that xAI set up without permits, the notice alleges.The NAACP’s first notice of intent to sue was filed last June and involves similar allegations regarding the company’s datacenter in Memphis, Tennessee

AI is indeed coming – but there is also evidence to allay investor fears

The message from investors to the software, wealth management, legal services and logistics industries this month has been clear: AI is coming for your business.The release of new, ever more powerful AI tools has coincided with a stock market slide, which has swept up sectors as diverse as drug distribution, commercial property and price comparison sites. Advances in the technology are giving increasing credulity to predictions that it could render millions of white-collar jobs obsolete – or, at least, eat into the profits of established companies.Carl Benedikt Frey, the author of How Progress Ends and an associate professor of AI and work at the University of Oxford, says investors are reassessing the value of companies that rely heavily on selling software or specialist knowledge.“AI turns once-scarce expertise into output that’s cheaper, faster, and increasingly comparable, which compresses margins long before whole jobs disappear

Six Nations: Storming Scotland stun England to seal Calcutta Cup glory

Certain wins feel bigger than others and, for Scotland, this result will reverberate for ages. Reclaiming the Calcutta Cup is always sweet but convincingly ending England’s 12-Test unbeaten record was a glorious bonus. For Gregor Townsend and his side, under pressure after their opening round defeat in Rome, this was some riposte to their criticsUltimately, it was not even close. Two tries by Huw Jones, a hard-nosed collective effort from the Scottish pack and a typically artful display from Finn Russell were simply too much for an England team who had dared to believe this week that their previous tartan traumas were behind them. Instead, they were outplayed and tactically out-thought by Townsend and his coaching staff and have now won just two of the past nine meetings between the nations

Scotland 31-20 England: Six Nations player ratings from Murrayfield

Tom Jordan Solid under high ball, did his bit in a cohesive attacking display from Gregor Townsend’s fluent backline. 7Kyle Steyn Profound threat with powerful, direct running – and he kept coming all game. Quite a contrast between his scintillating performance and Henry Arundell’s. 9 Player of the matchHuw Jones Ran the length for decisive try after George Ford was charged down. Confident early finish helped establish home supremacy

Jimmy Kimmel on Maga: ‘It’s such a delicate balance between stupid and evil’

Fantastic. Great move. Well done Angus: the story of one of Australia’s favourite political memes

Jimmy Kimmel on Trump: ‘A code orange de-mental emergency going on here right now’

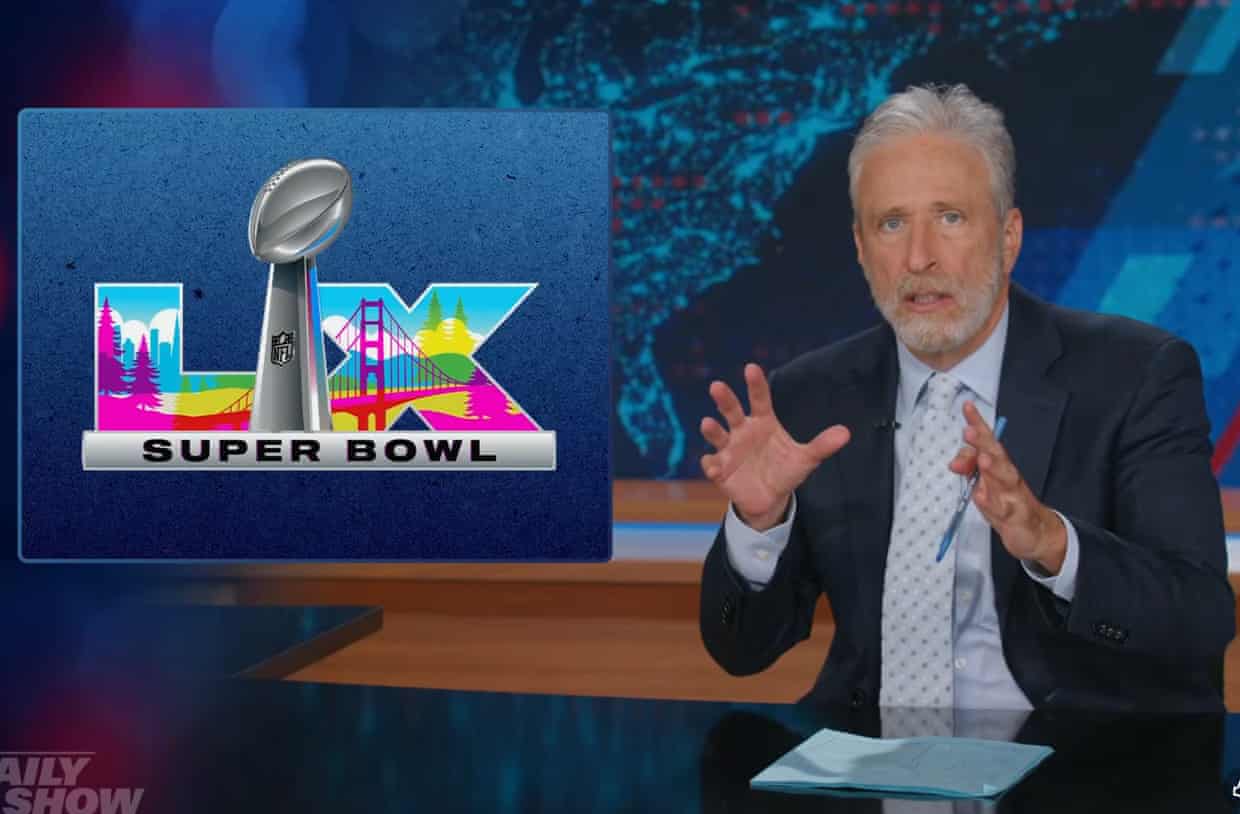

Jon Stewart calls Maga backlash to Bad Bunny’s Super Bowl show ‘actually pathetic’

‘We recorded it in a kitchen!’ How China Crisis made Black Man Ray

Super Bowl: Bad Bunny, the ads and everything but the football – as it happened