Barclays boss ‘shocked’ by Epstein revelations; BP annual profits slump 16% – as it happened

The chief executive of Barclays has said he is “deeply dismayed and shocked” at the “depravity and the corruption” revealed in the Epstein files, as the bank deals with the fallout of its ex-boss Jes Staley’s ties to the convicted child sex offender,In his first public comments on the matter since the US Department of Justice began publishing documents related to Jeffrey Epstein in December, CS Venkatakrishnan said his thoughts went out to the victims of Epstein, who died in jail in 2019 while awaiting child sex trafficking charges,He said:I’m very, very deeply dismayed and shocked by the moral depravity and the corruption that you’re reading about in the latest set of instalments,You know, my heart really goes out to victims of this scandal and these crimes,However, the Barclays boss – speaking as the bank reported annual profits – stopped short of commenting directly on allegations against his predecessor, Staley.

The Guardian reported last week that, in 2019, US prosecutors reviewed allegations of rape and bodily harm against Staley, including that he forced a woman to touch his genitals during a massage before raping her, and left “bloody marks” on the arms of a woman he called “Tinkerbell”.There is no evidence that prosecutors decided to pursue the allegations.Staley, who has previously denied any wrongdoing, has not responded to the Guardian’s requests for comment made over several months, either directly or via his lawyers.He has never been charged with a crime related to the allegations.During a UK court hearing in 2025, Staley admitted to having sex with a member of Epstein’s staff in New York, but agreed with a lawyer during cross-examination that he would describe the intercourse as “consensual”.

When Venkatakrishnan was asked whether the allegations outlined in the Epstein files had prompted any further internal reviews at Barclays, the bank’s head of media said: “We have nothing further to add on that point.”It comes as the bank and its chair, Nigel Higgins, continue to battle a class action lawsuit in the US over claims they defrauded and misled investors over Staley’s relationship with Epstein.The chief executive of Barclays has said he is “deeply dismayed and shocked” at the “depravity and the corruption” revealed in the Epstein files, as the bank deals with the fallout of its ex-boss Jes Staley’s ties to the convicted child sex offender.In his first public comments on the matter since the US Department of Justice began publishing documents related to Jeffrey Epstein in December, CS Venkatakrishnan said his thoughts went out to the victims of Epstein, who died in jail in 2019 while awaiting child sex trafficking charges.“I’m very, very deeply dismayed and shocked by the moral depravity and the corruption that you’re reading about in the latest set of instalments.

You know, my heart really goes out to victims of this scandal and these crimes,” he said.BP has halted share buybacks after reporting weaker annual profits as it prepares to continue a plan to resuscitate its fortunes under a new chief executive.The company became the first large oil company to suspend its buybacks after its underlying earnings fell to just below $7.5bn (£5.5bn) for 2025, down from almost $9bn for 2024.

Japan’s stock market has hit a record high after Sanae Takaichi’s Liberal Democratic party (LDP) secured a comprehensive victory in Sunday’s election,The boss of Britain’s biggest pharmaceutical company has said the government’s recent drug pricing deal is a “very positive step” but is unlikely to unfreeze a paused £200m investment in Cambridge,AstraZeneca’s chief executive, Pascal Soriot, suggested that a UK-US deal on NHS pricing agreed in December would not be “sufficient” to restart the project to build a research site in the east of England, which was paused in September,Thank you for reading,We’ll be back tomorrow.

Take care – JKHere’s more on steel, from the Guardian’s Lisa O’Carroll.The head of the UK’s biggest steel outfit, Tata, has said the British steel industry is “teetering on the brink” of extinction with just “two months” to be saved.Russell Codling, director of markets business development at Tata Steel UK, told MPs on the trade select committee that he was not exaggerating when he said the government had eight weeks to go before the industry could be drowned by cheap Chinese imports.He urged the government to urgently act to safeguard the sector with measures following the footsteps of the EU and the US.“If the UK doesn’t act we won’t have a steel industry not many months from now,” he warned.

Safeguards which impose a 25% tariff on specific imported steel products expires at the end of June but the government has yet to announce any replacement system, which in turn must be agreed internationally.Codling told MPs:We need action, we need action now, that needs to be in position by 1 July.We only have 8 weeks in which to act.I know it sounds radical statement to make but we are really there.If we need to act by 1 July, the market needs to understand what is happening and it doesn’t there have been no announcements yet.

He pointed out that China exported a record 119m tonnes of steel last year, dwarfing the 90m tonnes the US consumed and close to the 140m the whole of Europe including the UK used in 2025.It is an inordinate amount of material, massively distorting the global steel industry.The US has chosen to act, the EU has proposed to act… they are choosing to put 50% tariff in place and halve their quota system.Many many other countries in the world are doing the same and in the UK we are still processing it and we haven’t made an announcement yet.We risk over analysing, over assessing and ending up with something that either doesn’t dl against the goal of protecting the industry, the last bit of the industry, there is not a steel company in the UK that is making any form of a profit, they are all just about teetering on the edge and just about to maintain their position.

“On Wall Street, the Dow Jones has hit an intra-day record high.In Asia, Japan’s Nikkei stock index rose 2.3% to a new all-time high for the second day in a row, extending a rally sparked by prime minister Sanae Takaichi’s Liberal Democratic party (LDP) securing a comprehensive victory in Sunday’s election.European shares have edged higher with the exception of Spain’s Ibex, which is down 0.25%, while the UK’s FTSE index lost almost 0.

4%, or 37 points, to 10,348.European insurance stocks are falling, mirroring moves in US insurance brokers yesterday amid fresh fears that new artificial intelligence tools could hit the sector.In London, Hiscox is down 3.5% while Aviva has lost 2.7% and Admiral shares fell 1.

7%, while France’s Axa dropped 2.1% on Euronext Paris.UK financial comparison websites have also suffered steep losses, with Moneysupermarket owner Mony Group sliding 12% and GoCompare owner Future down 3.6%.On Monday, shares in top US insurance brokers Willis Towers Watson, Aon and Arthur J Gallagher slumped after the Masschusetts-based online insurance platform Insurify released an AI-powered comparison tool built on ChatGPT.

They have clawed back some of these losses today,This comes after European legal software and data analytics stocks slumped last week, after an update for start-up Anthropic’s AI tools,The British government has just two months to save the British steel industry, a senior executive of the country’s biggest industry player has told MPs,Russell Codling, director of markets business development at Tata Steel UK, told the parliamentary select committee that official safeguards against international competition expire in less than four months’ time, leaving the already fragile industry on a precipice,“This is a death toll for the industry at large and all its supply chains,” he said, urging the government to step up efforts to introduce new safeguards.

Tata Steel UK, which owns the steel plant in Port Talbot along with other facilities in Wales and in Corby in Northampshire and Hartlepool in the north east, warned that the already fragile industry is facing a flood of cheap products from China and elsewhere.Codling said:The safeguard position expires at the end of June this year, exposing the UK steel industry to the full force of that global oversupply, around the world.Frankly speaking, we have two months where the UK government has two months in which to save the steel industry because this is, a death toll for the, for the industry at large and all of its supply chain.Paramount has sweetened its $108bn bid for Warner Bros Discovery.The company, led by billionaire David Ellison, has been trying to gatecrash Netflix’s agreed $83bn deal with Warner Bros for its studio and streaming assets.

Paramount has improved its $30 a share bid for WBD, offering shareholders extra cash that will compensate them if regulators delay completion of the transaction.It has also agreed to cover the $2.8bn breakup fee the HBO owner would owe Netflix if it walked away from their deal.The 25 cent per share “ticking fee” is worth $650m in cash each quarter between January 1, 2027, and the completion of the Paramount deal, Paramount said on Tuesday.Both Netflix and Paramount want to acquire WBD for its leading film and television studios, extensive content library and major franchises such as “Game of Thrones,” “Harry Potter” and DC Comics’ superheroes Batman and Superman.

Paramount has engaged in an aggressive media campaign to try to convince shareholders that its bid is superior, but WBD has so far spurned the company.WBD will hold a special investor meeting to vote on the Netflix deal, with the streaming pioneer saying that the meeting is expected to be held by April.Wall Street has opened moderately higher, after yesterday’s rally, when technology stocks bounced back after last week’s heavy sell-off.The Dow Jones climbed nearly 60 points, or 0.1%, at the open to 50,193.

The S&P 500 rose almost 10 points, also a 0,1% gain, to 6,974 while the tech-heavy Nasdaq gained 32 points, or 0,1%, to 23,271 at the opening bell,The dollar has slipped slightly, by 0,16% against a basket of major currencies.

In Asia, Japan’s benchmark, the Nikkei, rose 2.3% to a new record high for the second day in a row.Crude oil prices have risen, with Brent up 0.45% at $69.35 a barrel.

Gold has edged lower but remains above $5,000.It dipped.1% to $5,058 an ounce.Retail sales in the US were flat in December, confounding expectations of a small increase.Retail sales volumes showed no change against forecasts of a 0.

4% gain, and compared with a 0.6% increase in November, according to official figures from the US Commerce Department.Food sales rose by 0.2%, following a 0.1% drop in November.

Clothing sales were down 0.7% after a 0.5% increase the month before.Liz Ann Sonders, chief investment strategist at Schwab Center for Financial Research, summed up the main numbers:December retail sales 0% vs.+0.

4% est.& +0.6% prior; control group -0.1% vs.+0.

2% prior (rev down from +0.4%); ex-autos 0% vs.+0.4% prior (rev down from +0.5%) pic.

twitter,com/BbJwHL35neUS economic data releases have been delayed because of the recent government shutdown,Tomorrow, we’ll be getting non-farm payrolls for January, a key jobs report,Barclays bankers will be popping the champagne corks after the lender hiked bonuses to their highest level in 12 years,Bankers will be sharing £2.

2bn worth of bonuses for the 2025 financial year, marking a 15% increase from £1.9bn last year.It comes after Barclays revealed a 13% rise in full year profits on Tuesday to £9.1bn.It is the biggest sum put aside for its bankers since 2013 – when the bank controversially hiked payouts despite profits dropping by nearly a third that year – and comes after the UK scrapped a cap on bonuses for bankers in 2023

Prediction market Kalshi reached $1bn in trading volume during Super Bowl

Online prediction market Kalshi hit a daily record on Super Bowl Sunday, surpassing $1bn in trading volume, the company announced on Tuesday.Kalshi’s CEO, Tarek Mansour, called it an “incredible weekend”, telling CNBC that “Kalshi was the biggest brand of the Super Bowl this year, without running a Super Bowl ad”.Kalshi trading volume during the game was up 2,700% year over year. More than $100m were bets on Bad Bunny’s opening song and $45m on which artists would perform with him on stage. In comparison, the platform saw $27m in total trading volume at last year’s Super Bowl

Honeymoon period for new BP boss won’t last long

The clearing of the decks continues apace at BP. The last chief executive, Murray Auchincloss, got the heave-ho in December. Last month brought news of hefty write-downs on the troublesome low-carbon energy assets in solar and biogas. Now comes an admission that the current debt-reduction measures aren’t enough to ease the strain on an over-extended balance sheet. Share buy-backs are being suspended

Will the Gulf’s push for its own AI succeed?

Hello, and welcome to TechScape. Today in tech, we’re discussing the Persian Gulf countries making a play for sovereignty over their own artificial intelligence in response to an unstable United States. That, and US tech giants’ plans to spend more than $600bn this year alone.I spent most of last week in Doha at the Web Summit Qatar, the Gulf’s new version of the popular annual tech conference. One theme stood out among the speeches I watched and the conversations I had: sovereignty

Apple and Google pledge not to discriminate against third-party apps in UK deal

Apple and Google have committed to avoid discriminating against apps that compete with their own products under an agreement with the UK’s competition watchdog, as they avoided legally binding measures for their mobile platforms.The US tech companies have vowed to be more transparent about vetting third-party apps before letting them on their app stores and not discriminate against third-party apps in app search rankings.They have also agreed not to use data from third-party apps unfairly, such as using information about app updates to tweak their own offerings.Apple has also committed to giving app developers an easier means of requesting use of its features such as the digital wallet, and live translation for AirPod users.The commitments have been secured as part of a new regulatory regime overseen by the Competition and Markets Authority, (CMA), which has the power to impose changes on how Apple and Google operate their mobile platforms after deciding last year that they had “substantial, entrenched” market power

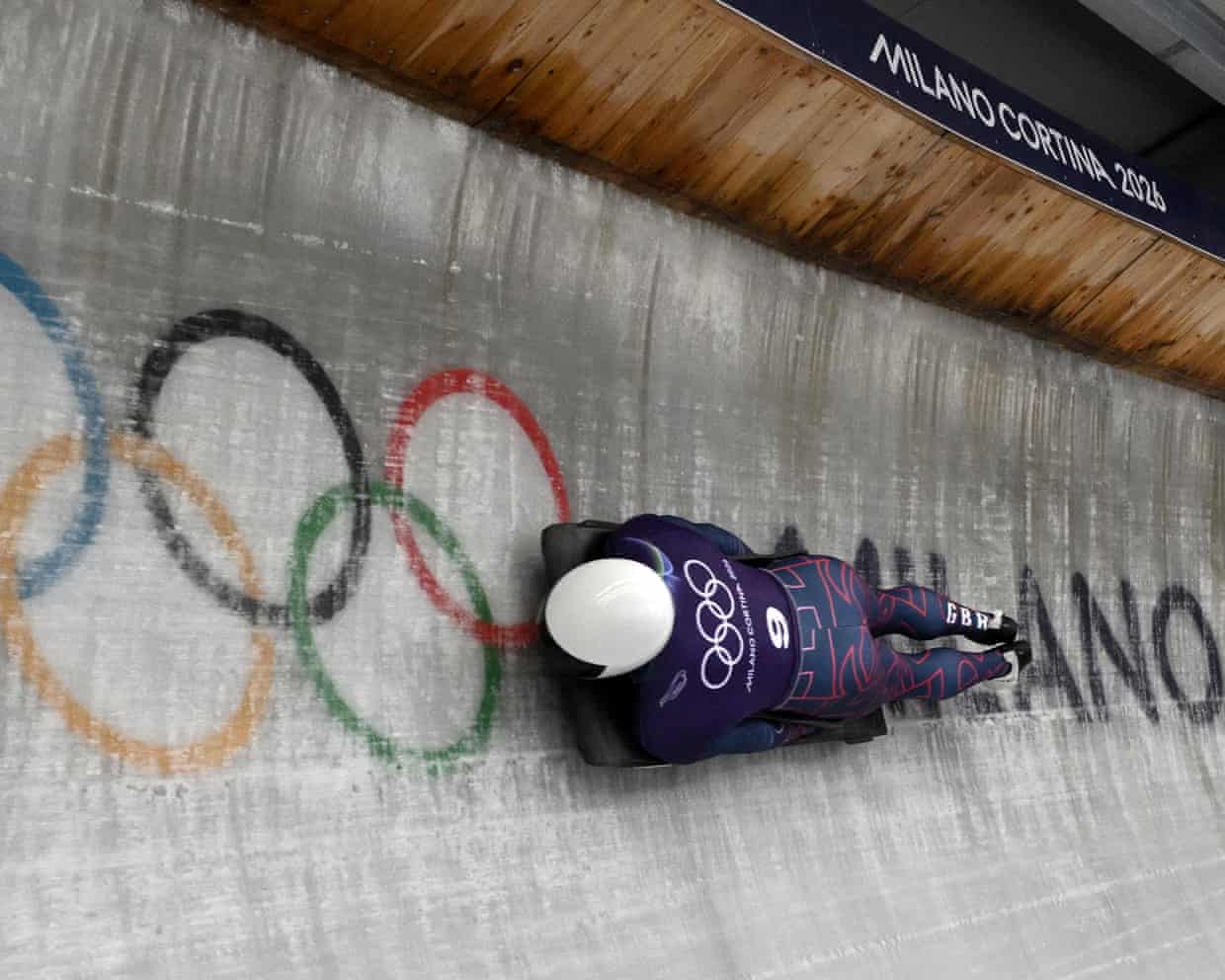

Winter Olympics 2026 day four: Slovenia win ski jumping gold as Sweden’s Wranå siblings star – as it happened

And you know what? That’s probably enough from us for the day. Medals tomorrow in Super-G, Nordic combined, biathlon, moguls, 1000m speed skating, doubles luge, and the free dance figure skating. Come and hang out with us then. Stay cool.Figure skating: Italian skater Daniel Grassl has gone top of the short program with an astonishing 93

Squeaky bum time? How Team GB can save Winter Olympics despite slow start | Sean Ingle

Still the wait goes on. When Britain arrived in Milano Cortina there was heady talk of the country having one of its “most potent ever teams” for a Winter Olympics. So far, though, Team GB is still firing blanks.It is not for the want of trying. Kirsty Muir missed out on a freeski slopestyle bronze by 0

Logitech MX Master 4 review: the best work mouse you can buy

‘It felt hypocritical’: child internet safety campaign accused of censoring teenagers’ speeches

‘I fell into it’: ex-criminal hackers urge Manchester pupils to use web skills for good

Battle of the chatbots: Anthropic and OpenAI go head-to-head over ads in their AI products

Why has Elon Musk merged his rocket company with his AI startup?

Victims urge tougher action on deepfake abuse as new law comes into force