Silver and other precious metals hit new peaks before falling back; oil price rises after Trump-Zelenskyy meeting – as it happened

Global stocks are on course to end the year at all-time highs, while the dollar is trading close to a three-month low, as markets are expecting further interest rate cuts from the US Federal Reserve next year.The MSCI’s world equity index is flat, leaving the global stock benchmark with a near-21% gain so far this year, after Wall Street hit record highs at the end of last week – dubbed a Santa rally.European shares on the Stoxx 600 index briefly touched an all-time intra-day peak this morning.The FTSE 100 index in London is broadly flat (up 3 points at 9,873), with the world’s leading silver miner Fresnillo leading gains, up 2.6%, while defence shares are down on Ukraine peace hopes.

MSCI’s broadest index of Asia-Pacific shares rose by 0.4%.Most Asian markets have notched up double-digit gains this year despite Donald Trump’s global trade tariffs.South Korea’s Kospi rose by 2.2% and is on track for its best year since 1999, and Taiwanese stocks are 25% higher so far in 2025.

Becky Qin, multi-asset portfolio manager at Fidelity International, told Reuters:We’re not seeing runaway inflation risk as a base case so we’re still thinking the Fed has room to cut,So you can still build a case for a reasonably strong backdrop for risk assets,America’s central bank cut its main funds rate to a range of 3,5% to 3,75% this month and markets are pricing in two further quarter-point cuts by September.

Minutes of the last meeting are due to be released tomorrow.Trump, who has called for more rate cuts, has sparred with outgoing Fed chair Jay Powell over rates and said last week that “anybody that disagrees with me will never be the Fed chairman”.A surge in AI stocks has raised fears of a bubble that could burst but so far investors are reluctant to sell those stocks, such as Nvidia.They have also hedged against geopolitical and other risks by buying gold, silver, platinum and palladium, whose prices have jumped to record highs.Traders took some profits on precious metals, sending gold down 1.

6% to $4,460 an ounce.It remains on track for its biggest annual gain since 1979 with an increase of more than 70%.Silver jumped above $80 an ounce for the first time before falling back 4.8% to $75.35 an ounce in volatile trading.

Copper prices have also risen, by more than a third this year, approaching $13,000 a tonne.Three-month copper on the London Metal Exchange is trading 3.3% higher at $12,560 a tonne, after setting a new record of $12,960 earlier today.Oil prices have gained 2% after the weekend talks between Trump and Ukrainian president Volodymyr Zelenskyy in Florida, and amid tensions in the Middle East.The US president said a deal to end the war in Ukraine is “closer than ever” but has admitted that “thorny” questions over the future of the eastern Donbas region have yet to be resolved.

Brent crude jumped by 2% to $61.8 a barrel while New York crude also rose by 2%, to $57.88 a barrel.The rally in precious metals prices is taking a breather.Silver, platinum and palladium all hit all-time highs early in today’s trading session but have fallen since, as investors take profits.

Silver jumped above $80 an ounce for the first time this morning, but is now down 8% at $72.8 an ounce in volatile trading.Gold has lost 3.5% to $4,373 an ounce, after repeatedly hitting record highs this year.Charu Chanana, chief investment strategist at Saxo Bank, said precious metals have been lifted this year by US interest rate cut hopes, and hedging against geopolitical and fiscal uncertainty.

She added:The big picture, however, for precious metals still looks structurally supportive with easier rates ahead, persistent fiscal and geopolitical unease, and ongoing diversification demand.That means any pullbacks may be seen as opportunities for long-term investors to rebuild exposure — though timing could still be bumpy after such a strong run.Wall Street stocks have drifted lower as the technology rally that pushed the S&P 500 to new highs last week faltered.UK and European shares are up slightly.Investors were hoping for a “Santa Claus rally,” where the S&P 500 posts gains in the last five trading days of the year and the first two in January, according to Stock Trader’s Almanac.

Oil prices have jumped over 2%, amid rising Middle East tensions and the latest Ukraine peace talks which failed to deliver an agreement.Brent crude climbed 2.2% to $62 a barrel while New York light crude rose 2.45% to $58.13 a barrel.

Unrest in the Middle East, including Saudi air strikes in Yemen and Iran’s declaration of a “full-scale war” with the US, Europe, and Israel at the weekend, has triggered concerns of supply disruptions.Our main stories:Thank you for reading.We’ll be back tomorrow.Bye! – JKCopper, the metal that underpins the fast-growing renewable energy industry, is on course for its biggest annual price rise in more than 15 years as traders react to fears of global shortages.As one of the main beneficiaries of the “electrification of everything”, copper has soared by more than 35% in value this year, spurred by US tariff uncertainty and concerns about mining disasters that could restrict supply.

Analysts said copper had also joined silver and gold as a safe haven asset for investors wanting to hedge against the falling value of the dollar.Silver reached a record high on Monday, pushing the value of the Mexican mining company Fresnillo, which is listed on the London stock market, to a record high this month.The price of gold has jumped above $4,400 (£3,263) an ounce, up more than 70% since the beginning of January.Kyle Rodda, a senior financial market analyst at the investment company Capital.com, said the rise of copper, gold and silver demonstrated “a world marked by greater scarcity and investors’ desire to get their hands on things with relatively limited supply”.

Stocks on Wall Street have opened lower.The S&P 500 index is down nearly 30 points, or 0.4%, at 6,899 while the Nasdaq opened 179 points lower at 23,413, a 0.8% drop, and the Dow Jones fell by 103 points, or 0.2%, to 48,607.

In London, the FTSE 100 index is still flat – up less than 5 points at 9,875,Germany’s Dax is also flat at 24,349 while France’s CAC is 0,3% ahead at 8,127 and Italy’s FTSEE MiB has lost 0,3%% to 44,481, and Spain’s Ibex rose by nearly 0,2% to 17,203.

Britain will lose a piece of its national identity if the country’s ceramics industry is allowed to descend further into crisis without state assistance, the government has been warned.Ceramics producers including the struggling potteries of Staffordshire have come under huge pressure owing to factors such as the UK’s sky-high energy costs, leading to job losses.In a report, unions and the Green Alliance thinktank urged the government to step in to support the centuries-old sector.“Tens of thousands of working-class jobs rely on the ceramics sector so we cannot afford to leave its future to chance.But so far we aren’t seeing enough action from a government grappling with the unique challenges the sector faces,” said Chris Hoofe of the GMB union.

Retailers of home improvement products are having a glittering year on the London stock market, as cash-strapped UK consumers turn to DIY projects after being priced out of moving home or undertaking expensive renovations.Publicly listed retailers including the B&Q owner, Kingfisher, as well as Topps Tiles, Wickes and the sofa seller DFS are on track for double-digit percentage share price increases of as much as 56% this year.Kingfisher and Topps Tiles have posted share price increases of 26.5% and 13% respectively, their best annual gains since the pandemic, while a 23% year-to-date rise at DFS is its strongest year since 2019.Kingfisher, which also operates in France and Poland, has issued two profit upgrades since September on the back of the company’s strong performance in the UK.

The biggest winner is Wickes, a leading retailer of paint, whose shares have risen 56% in its best year since listing on the London Stock Exchange in 2021.Retailers in the home improvement sector have been aided by the closure of their rival Homebase, which collapsed into administration in November last year.Gambling companies have spent nearly £5m to advertise on the London transport network since Sadiq Khan pledged to stop them from doing so, amid a prolonged impasse between the mayor’s office and the government.Khan said during his 2021 mayoral election campaign that he would order Transport for London (TfL) to extend a ban on junk food ads to cover online casinos and bookmakers as well, citing the “devastating” impact of addiction.Yet the mayor’s office has yet to make good on the manifesto promise, blaming a lack of guidance from central government on the links between gambling adverts and harm.

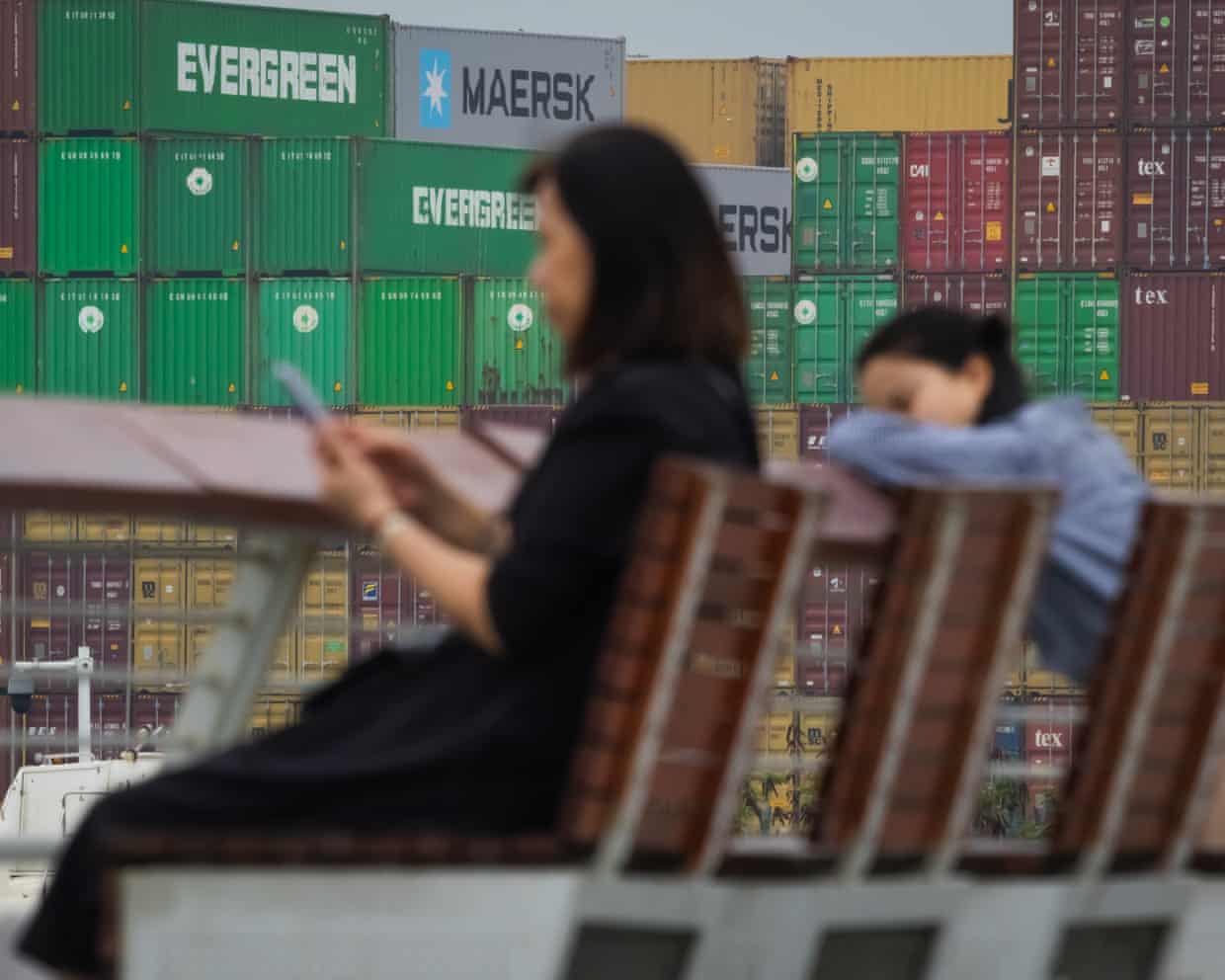

In the meantime, the number of gambling ads has increased, including a campaign for the online casino 888 that had to be withdrawn amid an outcry about its flippant tone.The UK is poised for an influx of cheap Chinese imports that could bring down inflation amid the fallout from Donald Trump’s global trade war, leading economists have said.After figures showed China’s trade surplus surpassed $1tn (£750bn) despite Washington’s tariff policies hitting exports to the US, the Bank of England said the UK was among the nations emerging as alternative destinations for the goods.Stephen Millard, a deputy director at the National Institute of Economic and Social Research, said:There is an expectation that given the high tariffs the US are imposing on China, that China will divert its trade elsewhere and one of those places will be the UK.This month Catherine Mann, an external member of the Bank’s rate setting monetary policy committee, told MPs on the Treasury committee there were early signs of trade diversion affecting UK inflation.

Import prices have started to moderate on the back of sterling appreciation and some of the spillover of the diversion of Chinese products from the US tariff burdens to other places, including to our docks.Not a lot.Actually less than I would’ve thought.But it’s there.Official figures released by Beijing this month show China’s trade surplus reached more than $1tn in the year to November for the first time, as manufacturers shipped more to non-US markets to sidestep Trump’s tariffs.

While prices for luxury properties are still falling, the declines have slowed across the UK since the 26 November budget, according to research from Savills, as changes to the taxation of high-value homes were not as bad as feared.The capital’s more domestic prime housing markets (beyond central London) saw values fall by 0.2% in the fourth quarter, compared with a drop of 0.7% in the previous quarter, while prime regional locations saw values dip by 0.6% (vs -1.

4% in the third quarter).Price falls for luxury pads in central London have also eased, with values down 0.9% between October and December, compared with falls of 1.8% three months earlier.Prices in the capital’s most traditional prime neighbourhoods remain 24.

5% below their peak, meaning that properties in these locations have now lost a quarter of their value since 2014.Properties in Chiswick showed the strongest growth in the fourth quarter, with prices up 1.3%.This market, which is synonymous with £2m-plus family homes, reported a backlog of buyers bouncing back into action when it emerged that the new high value council tax surcharge would have a more limited impact.In prime central London, the more domestic neighbourhoods of Marylebone (prices flat), Bayswater (-0.

2%) and Notting Hill (0.2%) held up strongest on the quarter, and the year.Scotland has been the strongest performing prime market in 2025, and is the only part of the UK where values have held steady.Frances McDonald, director of research at Savills, said:Our latest survey of prime buyers and sellers following the budget shows a shift in confidence, with a net 12% more people now committed to moving over the next two years.The biggest lift has been among buyers in the £2m-plus market who had put plans on hold as they braced for the worst.

Agents, particularly in outer prime London neighbourhoods, are reporting a pick-up in viewings and exchanges since the Budget announcement.But despite tax changes being ‘better than feared’, demand remains thin on the ground in more rarefied prime central London postcodes, with the pool of buyers already much shallower since the end of the non-dom regime.Much of the budget’s impact on prices had effectively already been built in after rumours started circulating late summer.But it will take some time for the market to fully absorb the changes, with moderate falls expected to continue in the New Year.The boss of the upmarket cinema chain Everyman has stepped down, weeks after a profit warning

From Central Cee to Adolescence: in 2025 British culture had a global moment – but can it last?

Despite funding cuts and shuttered venues, homegrown music, TV, film and, yes, memes have dominated the global zeitgeist over the past 12 years. Now this culture must be future-proofed from the forces of globalisationOn the face of it, British culture looks doomed. Our music industry is now borderline untenable, with grassroots venues shuttering at speed (125 in 2023 alone) and artists unable to afford to play the few that are left; touring has become a loss leader that even established acts must subsidise with other work. Meanwhile, streaming has gutted the value of recorded music, leading to industry contraction at the highest level: earlier this year the UK divisions of Warners and Atlantic – two of our biggest record labels – were effectively subsumed into the US business.In comedy, the Edinburgh fringe – the crucible of modern British standup, sketch and sitcom – is in existential crisis thanks to a dearth of sponsorship and prohibitively high costs for performers

The best songs of 2025 … you may not have heard

There is a sense of deep knowing and calm to Not Offended, the lone song released this year by the Danish-Montenegrin musician (also an earlier graduate of the Copenhagen music school currently producing every interesting alternative pop star). To warmly droning organ that hangs like the last streak of sunlight above a darkening horizon, Milovic assures someone that they haven’t offended her – but her steady Teutonic tenderness, reminiscent of Molly Nilsson or Sophia Kennedy, suggests that their actions weren’t provocative so much as evasive. Strings flutter tentatively as she addresses this person who can’t look life in the eye right now. “I see you clearly,” Milovic sings, as the drums kick in and the strings become full-blooded: a reminder of the ease that letting go can offer. Laura SnapesIn a year that saw the troubling rise of AI-generated slop music, there is something endlessly comforting about a song that can only have been written by a messy, complicated human

The Guide #223: From surprise TV hits to year-defining records – what floated your boats this year

Merry Christmas – and welcome to the last Guide of 2025! After sharing our favourite culture of the year in last week’s edition, we now turn this newsletter over to you, our readers, so you can reveal your own cultural highlights of 2025, including some big series we missed, and some great new musical tips. Enjoy the rest of the holidays and we’ll see you this time next week for the first Guide of 2026!“Get Millie Black (Channel 4), in which Tamara Lawrance gives a powerhouse performance as a loose-cannon detective investigating a case in Jamaica. The settings are a tonic in these dreary months, and the theme song (Ring the Alarm by Shanique Marie) is a belter. But be warned: the content of the final, London-set episode goes to some dark places.” – Richard Hamilton“How good was Dying For Sex! This drama about a terminally ill woman embarking on an erotic odyssey was so funny and sad and true and daring

My cultural awakening: a Turner painting helped me come to terms with my cancer diagnosis

My thyroid cancer arrived by accident, in the way life-changing things sometimes do. In May of this year, I went for an upright MRI for a minor injury on my arm, and the scan happened to catch the mass in my neck. By the following month, I had a diagnosis. People kept telling me it was “the good cancer”, the kind that can be taken out neatly and has a high survival rate. But I’m 54, and my dad died of cancer in his 50s, so that shadow came down on me hard

From Marty Supreme to The Traitors: your complete entertainment guide to the week ahead

Marty SupremeOut nowJosh Safdie’s new sports comedy takes loose inspiration from the career of New York ping-pong icon Marty “the Needle” Reisman, with Gwyneth Paltrow, Abel Ferrara and Fran Drescher in supporting roles, and Timothée Chalamet in the lead as the vibrantly eccentric sportsman.The SpongeBob Movie: Search for SquarePantsOut nowThe ever-popular underwater adventures of the amiable yellow sponge continue, with a fourth big-screen adventure that sees SpongeBob tracking down the Flying Dutchman (Mark Hamill). Expect to see just as many child-free millennials in the audience as families.AnacondaOut nowApologies to anyone who views it through rose-tinted spectacles, but the original 1997 Anaconda was a load of drivel. But this isn’t a faithful remake: it’s a meta-horror-comedy-action remake about a couple of guys (Jack Black and Paul Rudd) attempting to remake Anaconda only to be attacked by – yes – a giant snake

Jewish klezmer-dance band Oi Va Voi: ‘Musicians shouldn’t have to keep looking over their shoulders’

After 20 years playing around the world, the group had two UK gigs cancelled this year after protests from activists. It’s made them feel targeted for who they are, the band sayJosh Breslaw was looking forward to a homecoming gig with his band of two decades’ standing. Oi Va Voi, a predominantly Jewish collective mixing traditional eastern European folk tunes with drum’n’bass and dance, were due to conclude a spring tour of Turkey with a gig in May at Bristol’s Strange Brew club, plus one in Brighton where Breslaw lives. But then, after protests from local activists about both the band’s past performances in Israel, and with Israeli singer Zohara, Strange Brew abruptly cancelled, citing “the ongoing situation in Gaza”.To be told they hadn’t met the venue’s “ethical standards” was devastating, says Breslaw, the band’s 52-year-old drummer: “It felt so unjust

DIY shops enjoy bumper year as UK property market slows

Copper price on track for biggest rise in 15 years amid global shortage fears

Nearly half of Americans believe their financial security is getting worse, poll finds

Influx of cheap Chinese imports could drive down UK inflation, economists say

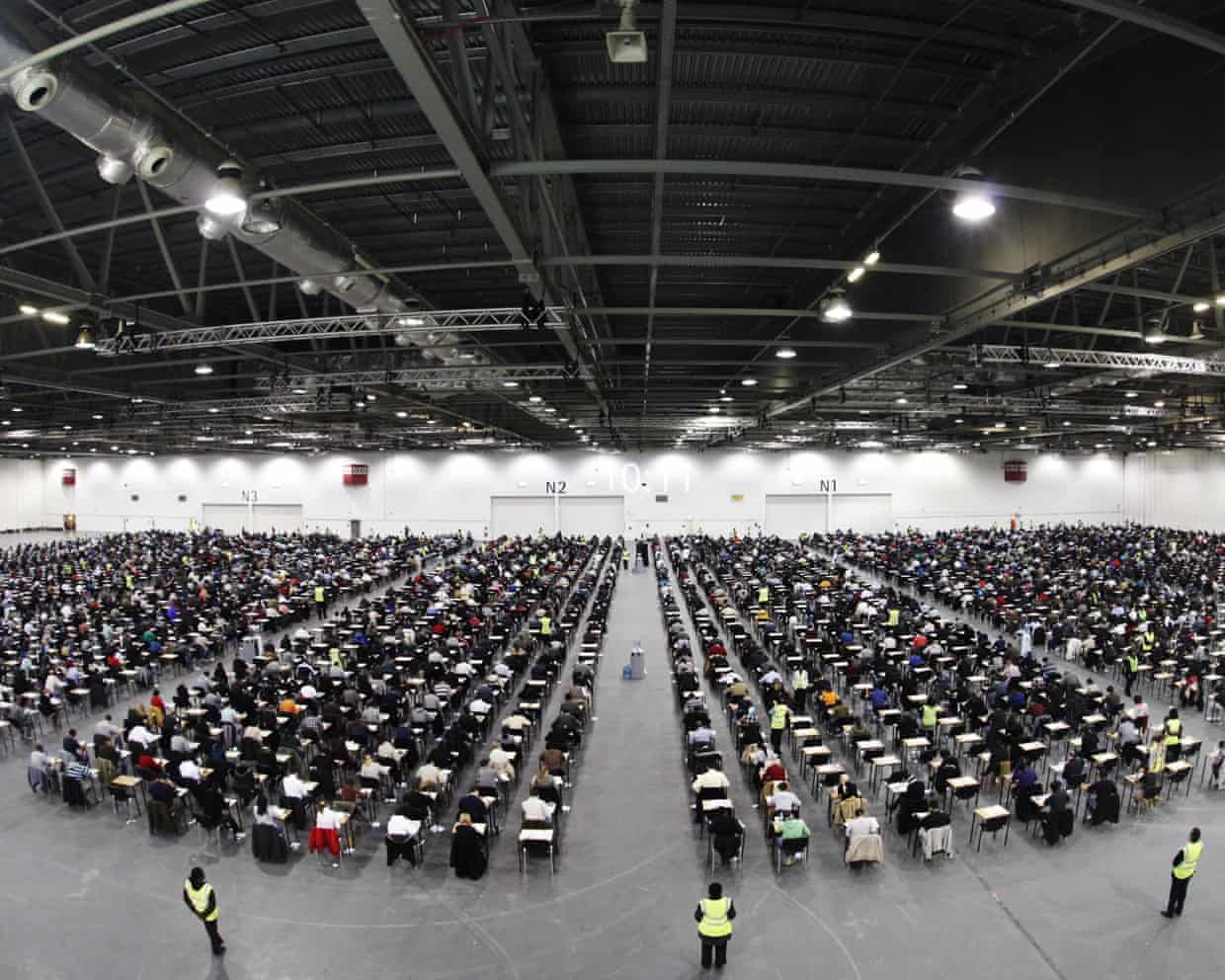

UK accounting body to halt remote exams amid AI cheating

Help UK ceramics industry or ‘lose piece of national identity’, government told