Nvidia becomes world’s first $5tn company amid stock market and AI boom

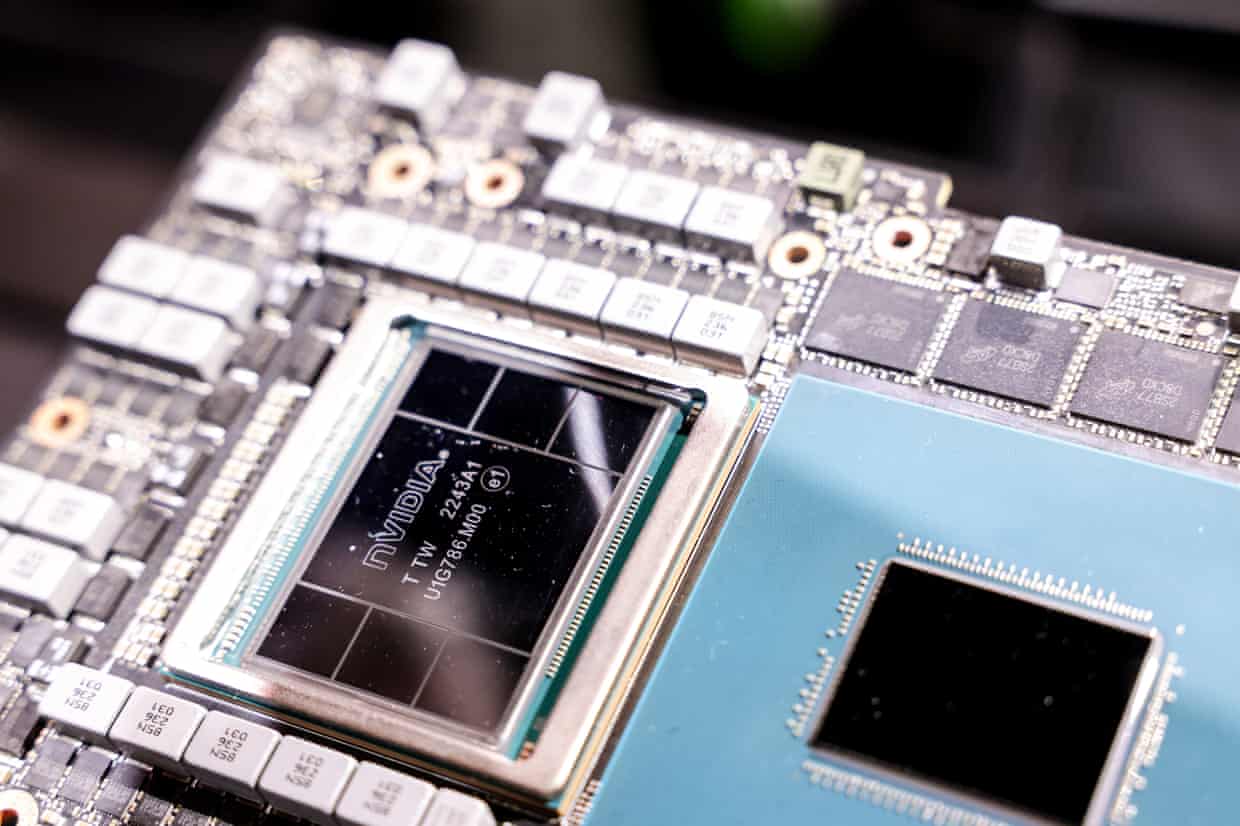

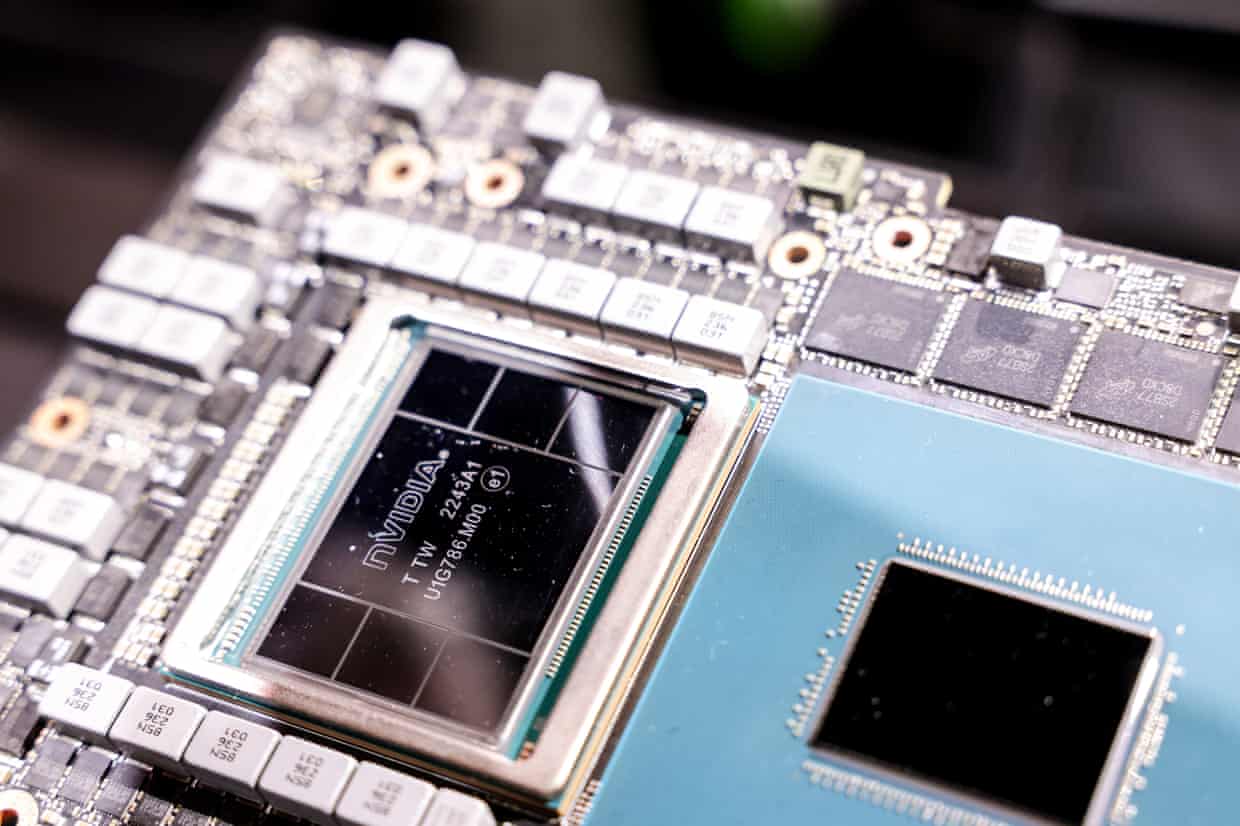

Nvidia has become the world’s first $5tn company as the artificial intelligence industry and wider US stock market boom,Just three months ago, the Silicon Valley chipmaker was the first to break through the barrier of $4tn in market value,In comparison, Nvidia’s value is greater than the GDP of India, Japan and the United Kingdom, according to the International Monetary Fund (IMF),It has far outgrown its competitors in the chip industry, gaining momentum as numerous tech stocks have surged in recent days,Shortly after US stock markets opened on Wednesday, Nvidia’s shares touched $207.

86 with 24.3bn shares outstanding, putting its market cap at $5.05tn.Ravenous appetite for Nvidia’s chips, seen as the most cutting edge in powering artificial intelligence products and software, is the main reason that the company’s stock price has increased so rapidly since early 2023.The US stock market has reached multiple record highs this week, buoyed by expansive investment in artificial intelligence.

On Tuesday, Nvidia’s CEO, Jensen Huang, disclosed $500bn in chip orders.The company also announced a partnership with Uber on robotaxis and a $1bn investment in Nokia, with the two planning to work together on 6G technology.In addition, Nvidia is teaming up with the US Department of Energy to build seven new AI supercomputers.OpenAI’s expansive plans for scaling its AI infrastructure are also heavily dependent on Nvidia’s technology.Last month, Nvidia announced that it will invest $100bn in OpenAI as part of a partnership that will add at least 10 gigawatts of Nvidia AI datacenters to ramp up the computing power for the owner of the artificial intelligence chatbot ChatGPT.

Huang and Nvidia have also gained the backing of Donald Trump, who called the CEO an “incredible guy” during a speech in South Korea on Wednesday.The US president has frequently touted the company as a success story and suggested that he may allow a less-powerful version of the company’s Blackwell chip to be sold to China, a move that could potentially send Nvidia’s shares even higher.Trump also has a financial interest in the company – disclosing in a financial report that as of the end of last year he owned up to $1.3m worth of Nvidia shares.Trump said on Air Force One last week that he would speak with the Chinese president, Xi Jinping, about Nvidia’s chips.

Hitting the new benchmark puts more emphasis on the upheaval being unleashed by an artificial intelligence craze that is widely viewed as the biggest tectonic shift in technology since the Apple co-founder Steve Jobs presented the first iPhone 18 years ago.Apple rode the iPhone’s success to become the first publicly traded company to be valued at $1tn, $2tn and eventually $3tn.Sign up to TechScapeA weekly dive in to how technology is shaping our livesafter newsletter promotionBut there are concerns of a possible AI bubble, with officials at the Bank of England earlier this month flagging the growing risk that tech stock prices pumped up by the AI boom could burst.The head of the IMF has raised a similar alarm.Part of the concern over an AI bubble revolves around the circular nature of some of the industry’s deals.

Nvidia’s $100bn investment in OpenAI, for example, hinges on OpenAI’s own plans to buy millions of Nvidia’s chips.The need for these chips is also primarily driven by the tech industry’s desire to massively scale its computing power, even as there is growing concern from analysts over companies showing that they are failing to secure revenue returns on their AI investments and that nearly all AI pilot programs in businesses fail.

Microsoft reports strong earnings as Azure hit by major outage

Microsoft blew off concerns of overspending on AI on Wednesday, reporting elevated earnings even as it faced an outage of its cloud computing service, Azure, and its office software suite, 365. The strong earnings report comes a day after a deal with OpenAI pushed the value of the tech giant to more than $4tn.After its Xbox and investor relations pages went down, the company issued a statement that said: “We are working to address an issue affecting Azure Front Door that is impacting the availability of some services.”The outage did not dampen the software giant’s financial outlook. The company reported first-quarter earnings of $3

Meta reports mixed financial results amid spree of AI hiring and spending

Meta reported mixed financial results for the third quarter of 2025. The company brought in record quarterly revenue but reported a major tax bill that dampened earnings per share, the company announced on Wednesday. The financial results come as Meta ends a multibillion-dollar hiring spree focused on artificial intelligence talent.The tech giant earned $51.24bn in quarterly revenue, beating Wall Street expectations and the company’s own projections for third-quarter sales

Google parent Alphabet beats forecasts with first $100bn quarter

Google’s parent company, Alphabet, displayed steady growth in its core advertising business and cloud computing division as it reported third-quarter earnings on Wednesday, beating Wall Street estimates as it reported its first quarter of $100bn in revenue.The company thrilled Wall Street – shares rose in after-hours trading – even as it announced that it would spend billions more than previously predicted. Alphabet raised its capital expenditure guidance in financial filings, declaring it would spend between $91bn and $93bn in the upcoming year, nearly all of it on infrastructure like datacenters to support artificial intelligence products, which are becoming an integral part of the company’s business. That estimate is up from an original declaration of $75bn in February and a revised figure of $85bn announced in July.The company reported total revenue of $102

Nvidia becomes world’s first $5tn company amid stock market and AI boom

Nvidia has become the world’s first $5tn company as the artificial intelligence industry and wider US stock market boom. Just three months ago, the Silicon Valley chipmaker was the first to break through the barrier of $4tn in market value.In comparison, Nvidia’s value is greater than the GDP of India, Japan and the United Kingdom, according to the International Monetary Fund (IMF). It has far outgrown its competitors in the chip industry, gaining momentum as numerous tech stocks have surged in recent days.Shortly after US stock markets opened on Wednesday, Nvidia’s shares touched $207

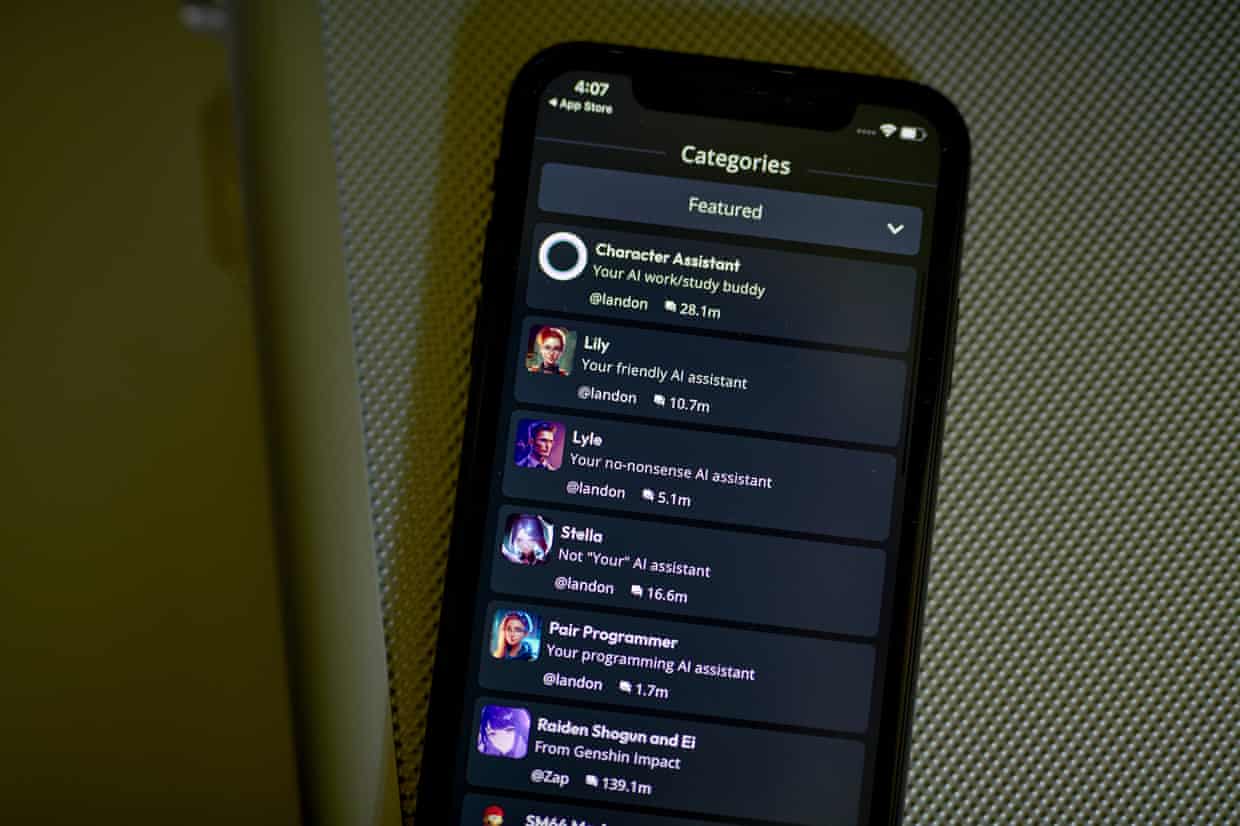

Character.AI bans users under 18 after being sued over child’s suicide

The chatbot company Character.AI will ban users 18 and under from conversing with its virtual companions beginning in late November after months of legal scrutiny.The announced change comes after the company, which enables its users to create characters with which they can have open-ended conversations, faced tough questions over how these AI companions can affect teen and general mental health, including a lawsuit over a child’s suicide and a proposed bill that would ban minors from conversing with AI companions.“We’re making these changes to our under-18 platform in light of the evolving landscape around AI and teens,” the company wrote in its announcement. “We have seen recent news reports raising questions, and have received questions from regulators, about the content teens may encounter when chatting with AI and about how open-ended AI chat in general might affect teens, even when content controls work perfectly

Apple hits $4tn market value as new iPhone models revitalize sales

Apple topped $4tn (£3tn) in market value for the first time on Tuesday, joining Microsoft and Nvidia as the third company in history to hit the milestone, thanks to strong demand for its latest iPhones.Apple’s share price has increased by more than 50% since a low point in April, thanks to the debut of its latest products.“The iPhone accounts for over half of Apple’s profit and revenue, and the more phones they can get into the hands of people, the more they can drive people into their ecosystem,” said Chris Zaccarelli, the chief investment officer for Northlight Asset Management, before the milestone was reached.Apple’s shares had struggled earlier this year on concerns over tough competition in China and how it would cope with high US tariffs on Asian economies such as China and India, its main manufacturing hubs.However, the latest smartphones, the iPhone 17 lineup, have won back customers from Beijing to Moscow, while the company has swallowed tariff costs instead of passing them on to consumers

Lib Dem members criticise ‘trans-exclusionary’ rule change for party elections

Kemi Badenoch smiles from the stump as she heads towards oblivion | John Crace

Ministers to delegate some public appointments in attempt to cut delays

No 10 refuses to say if ethics adviser saw proof Reeves’s rental breach was ‘inadvertent’

Tories will not deport legally settled people, Badenoch clarifies

Boris Johnson tells Tories to stop ‘bashing green agenda’ or risk losing next election