Gambling crackdown in Romania as councils can ban ‘toxic’ betting shops

Romania’s government has overhauled gambling regulations through an emergency decree allowing municipalities to restrict or ban betting shops and slot machine halls in the biggest tightening of the industry the country has seen.Licensed operators must now obtain not only a national permit but also local authorisation to open a gambling venue, giving mayors and local councils a decisive veto power. Officials say more than 200 localities could pursue full bans.There has been a rapid expansion of Romania’s gambling industry, with tens of thousands of slot machines and betting outlets open nationwide, especially in the capital, Bucharest.Until now, gambling halls were authorised centrally without city approval, leaving communities powerless even as venues proliferated near schools and residential areas

Cancer death rate in Britain down by almost a third since 1980s

The rate of people dying from cancer in the UK has fallen by almost a third since the 1980s amid seismic progress in prevention, diagnosis and treatment, a report has found.About 247 in every 100,000 people die from cancer each year, a 29% drop from the peak in 1989 of about 355 per 100,000, according to an analysis by Cancer Research UK (CRUK).Cancer remains Britain’s biggest killer, causing about one in four deaths, and survival rates lag behind a number of European countries, including Romania and Poland.However, in the past decade alone, the rate of people dying from cancer has fallen by 11%. The death rate for ovarian cancer dropped by 19% between 2012-2014 and 2022-2024, stomach cancer fell by 34% and lung cancer 22%

NHS England pauses new referrals for masculinising or feminising hormone treatment in under-18s

The NHS is pausing new referrals for masculinising or feminising hormone treatment for 16 and 17-year-olds after an in-depth review found there was insufficient evidence to support its continued use.Prescriptions for hormones had been available in England for under-18s with a diagnosis of gender incongruence or dysphoria who met certain criteria.But after the Cass review, NHS England commissioned its own review of all the available clinical evidence. That review has now concluded and found the evidence did not back the continued use of the treatment for 16 and 17-year-olds.In her review of children’s gender care, Hilary Cass had recommended “extreme caution” in providing such treatment and a “clear clinical rationale for providing hormones at this stage rather than waiting until an individual reaches 18”

Labour to set up new extremism whistleblowing service for university staff

The UK government will expand powers to tackle extremism by setting up a new whistleblowing route for university staff and giving the Charity Commission powers to shut down charities, as part of a new action plan to strengthen social cohesion.The plan, announced by the housing, communities and local government secretary, Steve Reed, will invest a further £5m in the Common Ground Resilience Fund, which was launched to support organisations and authorities tackling divisions in communities.“We must listen to people’s concerns about growing divisions and take action to bring our communities back together,” Reed said.As well as a new whistleblowing service, the plan will include a new Campus Cohesion Charter to strengthen respect and shared values across universities.The strategy will also introduce an annual State of Extremism report setting out the nature and scale of the threat facing the UK and the government’s response, while the Visa Watchlist Taskforce will be strengthened to block hate preachers and extremists from entering the country

Recreational drugs can more than double risk of stroke, study suggests

Recreational drugs can more than double the risk of stroke, with some of the most concerning impacts seen among younger people, a major review suggests.Scientists analysed medical data from more than 100 million people and found that the risk of stroke was 122% higher for amphetamine users and 96% higher for cocaine users compared with those who did not take the drugs.Cannabis users were also at greater risk, suffering 37% more strokes than non-users, the review found, though researchers saw no evidence that opioids, a highly addictive painkiller, added to a person’s risk of stroke.The rise in strokes observed in connection with some drugs was not confined to older people. When researchers focused on under-55s, they saw a near tripling in stroke risk among amphetamine users

Martha’s rule may have saved 400 lives so far in England, figures show

More than 400 lives may have been saved as a result of Martha’s rule, which lets NHS patients request a review of their care, official figures reveal.Helplines received more than 10,000 calls in the first 16 months of the scheme after its introduction in England in 2024, according to data seen by the Guardian. Thousands of patients were either moved to intensive care, received drugs they needed or benefited from other changes as a direct result of the calls.The system is named after Martha Mills, 13, who died in 2021 from sepsis after a bicycle accident. A coroner found she would probably have survived if she had been moved to the intensive care unit at King’s College hospital in London when she began deteriorating

US stock markets close on high after Iran war drove oil prices above $100 a barrel

We may not be running out of gas but we still need a serious strategic gas reserve | Nils Pratley

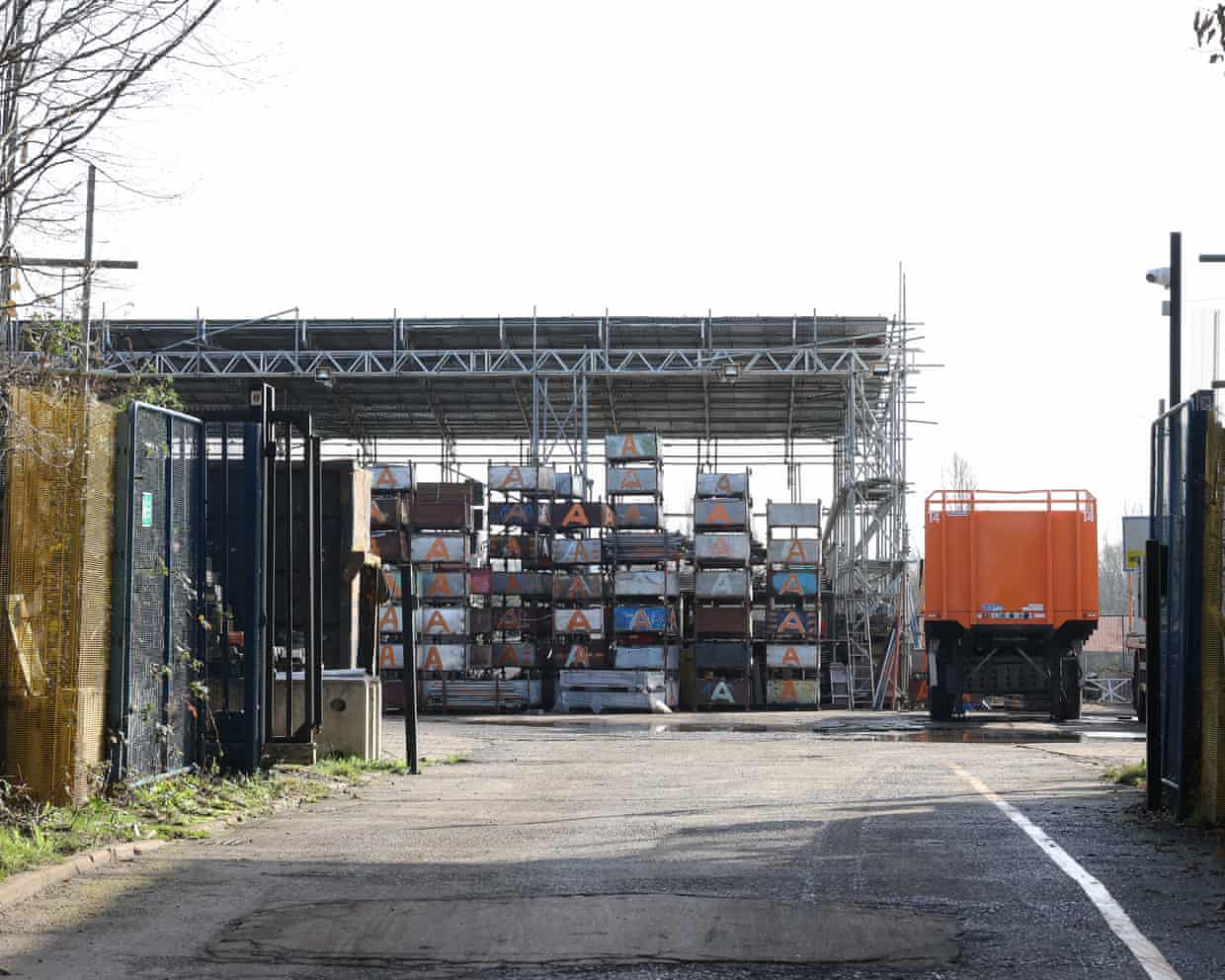

From press release … to scrap metal site: the Essex ‘supercomputer’ that’s still a scaffolding yard

Revealed: UK’s multibillion AI drive is built on ‘phantom investments’

Dolphins take $99m hit on Tagovailoa and sign Willis; Tampa’s star WR Evans heads to 49ers

‘Revolutionary’: Ukrainian para-biathlete wins silver using ChatGPT as his coach