Loss of shops is threatening rural communities | Letter

Without shops, fuel supplies and post offices with banking facilities, will remote communities face further depopulation? The closure of the shop in Kilchoan follows a number of other closures of similar local assets in Lochaber and Argyll (‘Morrisons killed us’: Britain’s most westerly mainland village shop closes after half a century, 30 October).But is it a policy failure or just a case of market forces?Nearly 50 years ago, a government-funded scheme offered a lifeline to communities that were keen to save key assets.A programme was initiated by the Highlands and Islands Development Board in 1977 as a way of supporting community-led development.It offered to match local financial contributions and provide practical support through an outreach team, of which I was a member.Tested in the Western Isles, by 1979 it was expanded to the rest of the Highlands and islands.

Such initiatives contributed to vital community wealth-building and supported community investment in revenue-generating activities.Today there are numerous active co-operatives that help to retain people and money in communities across the Highlands and Islands – but even they are operating in challenging conditions.As Lochaber residents have seen, major retailers have extended home deliveries to remote households.If services are cut off, the economic base of an area inevitably declines.There is a case for public support for communities to maintain essential services, which helps stem depopulation – or is the plan for everyone to move to urban centres?Chas BallHuddersfield, West Yorkshire Have an opinion on anything you’ve read in the Guardian today? Please email us your letter and it will be considered for publication in our letters section.

Sky owner Comcast in talks to buy ITV’s broadcasting arm for about £2bn

The parent company of Sky is in talks to buy ITV’s broadcasting business for about £2bn, in a move that would upend the British television landscape.The US media company Comcast, which owns assets including Universal Studios and bought Rupert Murdoch’s Sky for £30bn in 2018, is in talks to buy ITV’s broadcasting arm, which includes its TV channels and streaming service ITVX.A deal would not involve its production arm ITV Studios – the maker of shows including Love Island, I’m a Celebrity and the hit drama Mr Bates vs The Post Office – which has been the subject of separate takeover talks.It comes two decades after James Murdoch made an audacious move to become the biggest shareholder in the UK’s largest commercial free-to-air broadcaster. Rupert’s youngest son acquired a 17

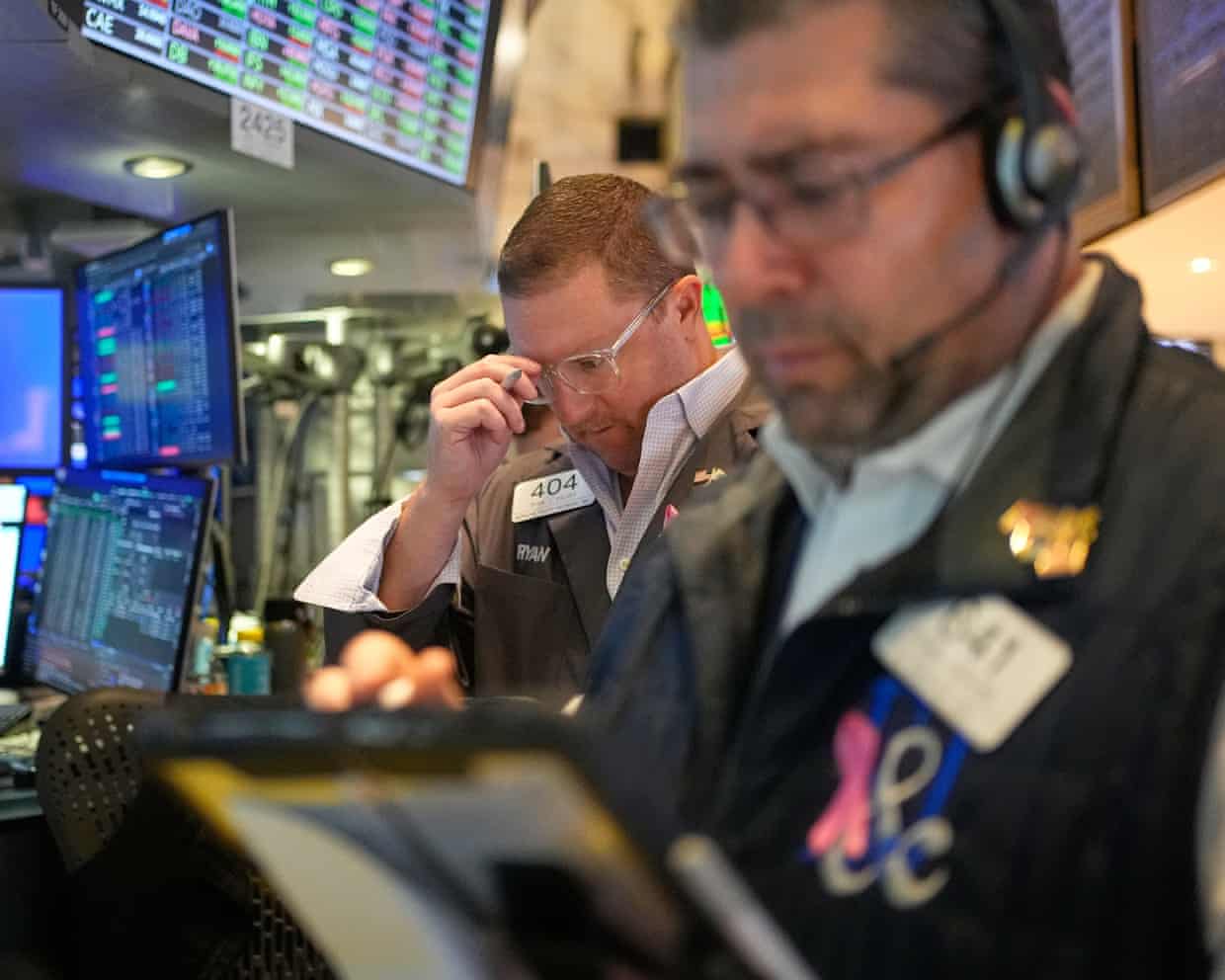

US markets tumble amid Wall Street concern over job losses and AI

Fears that the US economy is slowing, with firms shedding jobs and imposing hiring freezes, sent Wall Street tumbling on Thursday.The S&P 500 index of leading firms was down 1.1% as investors also highlighted concerns about the potential for a slump in the value of businesses that have benefited from huge investments in artificial intelligence. The tech-heavy Nasdaq Composite fell 1.9%

British Airways to offer free fast onboard wifi to all after Starlink deal

Passengers on British Airways flights will be able to access fast wifi onboard at no cost after the airline’s parent company signed a deal with Elon Musk’s satellite company.The carrier said the free “reliable and lightning-fast” wifi from Starlink would be available to customers flying in economy, business or first class from next month.BA’s owner, International Airlines Group (IAG), said it had reached agreement with Starlink to provide internet connectivity on more than 500 aircraft across its carriers, which also include Aer Lingus, Iberia and Vueling.BA said the rollout of the technology was part of a £7bn “transformation” and would provide lag-free internet access to passengers from boarding to landing, even when they are flying over oceans or remote regions. Passengers will be able to connect multiple devices and they will not need a special login

Ignore the howls around pay-per-mile, chancellor. We can’t afford not to tax electric cars

If you want a document to give you sleepless nights, the Office for Budget Responsibility’s biennial Fiscal Risks and Sustainability report is a go-to publication. This is the one that looks to the horizon and covers everything from demographic trends to state pension promises to the climate crisis.The headline finding in this July’s version was a true jaw-dropper. The UK’s public finances are on an unsustainable long-term trajectory because government debt would rise to a remarkable 270% of GDP by the early 2070s – up from almost 100% today – if current policies were left unchanged.The “if nothing changes” qualification is important because some of the risks to the public finances are so blindingly obvious – and have been for ages – that it is astonishing successive governments have ignored them

Bank of England opens door to December rate cut as it signals inflation has peaked

The Bank of England has opened the door to a December interest rate cut after signalling that inflation had peaked, as it kept borrowing costs unchanged before Rachel Reeves’s make-or-break budget.With less than three weeks before the chancellor’s tax and spending statement, the Bank’s monetary policy committee (MPC) voted by a narrow five-four majority to keep borrowing costs unchanged for a second consecutive meeting.However, City economists said the knife-edge decision and the Bank’s latest predictions for a fall in inflation from 3.8% would pave the way for the Bank to cut rates after the budget.Holding the casting vote, Andrew Bailey, the Bank’s governor, said he wanted to “wait and see” whether inflationary pressures would continue to fade and if Reeves’s budget would have an impact

Bank of England says UK inflation has peaked after leaving rates at 4%; US job cuts jump as firms turn to AI – as it happened

Newsflash: The Bank of England believes the recent rise in UK inflation is over.Announcing today’s decision to leave interest rates on hold, the Bank declares “CPI inflation is judged to have peaked.”UK inflation has been recorded at 3.8% in July, August and September – and the Bank is expressing confidence that the process of ‘disinflation’ isn’t over.Its latest Monetary Policy Report, just released, predicts that inflation is likely to fall to close to 3% early next year before gradually returning towards to the 2% target over the subsequent year

Qantas business lounge passenger set on fire after power bank explodes in his pocket

Driving competition: China’s carmakers in race to dominate Europe’s roads

Amazon sues AI startup over browser’s automated shopping and buying feature

Google plans to put datacentres in space to meet demand for AI

Marcus Smith urged to kickstart England attack against Fiji after setbacks

WTA Finals tennis: Jessica Pegula beats Jasmine Paolini, Aryna Sabalenka defeats Coco Gauff – as it happened