Rachel Reeves’s test from the bond markets starts now

Good news for Rachel Reeves: the cost of government borrowing has fallen a bit relative to the US and eurozone countries.Better news: the chancellor may have something to do with it.Better still: some economists think there’s more to come.Let’s not get carried away, though.The UK is still paying a painful premium on its borrowing costs, as the Institute for Public Policy Research thinktank illustrates.

Since last year’s general election the yield on 10-year government gilts is up almost 70 basis points – or seven-tenths of 1% – compared with US Treasury bonds, and the increase versus the eurozone is almost 25 basis points.The gaps are wider for 30-year bonds and the consequences are real.IPPR calculates that if the premium could be reduced to zero, the Treasury would save as much as £7bn a year until 2029-30.A key point here is that the premium can’t be wholly explained by factors that are widely acknowledged and beyond the government’s control: the reduced appetite for gilts among mature UK defined-benefit pension funds, for example, and the Bank of England’s steady selling of the gilts it bought in the years after the great financial crisis.The reality behind the yield premium is that the UK isn’t getting much credit for having debt and deficit ratios that, while definitely not pretty, are less horrible than those of many other G7 countries.

The explanation will relate to some combination of the market’s doubts over long-term inflation and the government’s willingness to stick to its fiscal plans.So the improvement in sentiment – if that is what is – in the last few months is significant if it continues.IPPR suggests there was a turning point at the Labour conference in September, when Reeves said “there is nothing progressive, nothing Labour” in spending almost £1 in every £10 of public money on debt interest.She also made it clear that after U-turns on welfare spending she was in the business of rebuilding headroom against her fiscal rules.“The government’s strong recommitment to its fiscal plans does appear to be reducing costs more recently,” the IPPR report says, noting the fall of 20 basis points since the conference.

It’s more of a struggle to detect a serious move since last month’s budget.IPPR sees “early/tentative signs” of further progress but 10-year gilt yields still stand almost exactly where they were on the day at 4.5%.On one hand, the market clearly likes the comfort blanket of £22bn of fiscal headroom and the (slightly) greater credibility on the ambition to halve the annual deficit over the life of the parliament.On the other, the back-loaded nature of Reeves’ tax rises creates worry about whether they will happen.

Meanwhile, the Office for Budget Responsibility downgraded the outlook for growth, and the communications chaos in the run-up to the budget hardly boosted confidence.But there is a sketch of a possible positive narrative here for Reeves.Financial markets expect the Bank of England to cut interest rates three times by the end of next year as inflation in food prices and energy cools.One can already see banks scrapping a bit harder on mortgage rates.A further boost would come if gilts markets were less punishing of the UK and if the political risk premium were to reduce further.

It would help, as IPPR suggests, if the Bank, as the biggest owner of gilts, was a less enthusiastic seller.Sign up to Business TodayGet set for the working day – we'll point you to all the business news and analysis you need every morningafter newsletter promotionThe alternative script is the one outlined by Oxford Economics in its outlook for 2026: “We expect markets will increasingly question the fiscal credibility of the budget and the survival of the Labour leadership.A slow burn of a steepening yield curve and weaker sterling could morph into a more serious confidence crisis.” It points to “no sign of a sustainable growth driver”, which is also the view in much of the business world.Timing matters if, as the Westminster watchers say, next May’s local elections are the next critical political moment.

If the UK’s yield premium continues to fall towards the level the government inherited, Reeves has the gist of an “it’s working, be patient” narrative.But it does need to happen.

Rachel Reeves’s test from the bond markets starts now

Good news for Rachel Reeves: the cost of government borrowing has fallen a bit relative to the US and eurozone countries. Better news: the chancellor may have something to do with it. Better still: some economists think there’s more to come.Let’s not get carried away, though. The UK is still paying a painful premium on its borrowing costs, as the Institute for Public Policy Research thinktank illustrates

Bank of England expects budget will cut inflation by up to half a percentage point

The Bank of England expects Rachel Reeves’s budget will reduce the UK’s headline inflation rate by as much as half a percentage point next year.In a boost for the chancellor after last month’s high-stakes tax and spending statement, Clare Lombardelli, a deputy governor at the central bank, said its early analysis showed the policies would lower the annual inflation rate by 0.4 to 0.5 percentage points for a year from mid-2026.Reeves made cutting inflation a central ambition of her budget alongside a sweeping £26bn package of tax increases to cover a shortfall in the public finances and fund scrapping the two-child benefit policy

Trump clears way for Nvidia to sell powerful AI chips to China

Donald Trump has cleared the way for Nvidia to begin selling its powerful AI computer chips to China, marking a win for the chip maker and its CEO, Jensen Huang, who has spent months lobbying the White House to open up sales in the country.Before Monday’s announcement, the US had prohibited sales of Nvidia’s most advanced chips to China over national security concerns.Trump posted to Truth Social on Monday: “I have informed President Xi, of China, that the United States will allow NVIDIA to ship its H200 products to approved customers in China, and other Countries, under conditions that allow for continued strong National Security. President Xi responded positively!”Trump said the Department of Commerce was finalising the details and that he was planning to make the same offer to other chip companies, including Advanced Micro Devices (AMD) and Intel. Nvidia’s H200 chips are the company’s second most powerful, and far more advanced than the H20, which was originally designed as a lower-powered model for the Chinese market that would not breach restrictions, but which the US banned anyway in April

AI researchers are to blame for serving up slop | Letter

I’m not surprised to read that the field of artificial intelligence research is being overwhelmed by the very slop that it has pioneered (Artificial intelligence research has a slop problem, academics say: ‘It’s a mess’, 6 December). But this is a bit like bears getting indignant about all the shit in the woods.It serves AI researchers right for the irresponsible innovations that they’ve unleashed on the world, without ever bothering to ask the rest of us whether we wanted it.But what about the rest of us? The problem is not restricted to AI research – their slop generators have flooded other disciplines that bear no blame for this revolution. As a peer reviewer for top ethics journals, I’ve had to point out that submissions are AI-generated slop

20-year-old charged with attempted murder over shooting of Jets’ Kris Boyd

A Bronx man has been charged with attempted murder in the shooting of New York Jets player Kris Boyd, police announced Tuesday.The New York police department said Frederick Green, 20, was charged late Monday night. Police had revealed Monday that a “person of interest” was in custody but didn’t name them. It was not immediately clear if Green has an attorney. He also faces additional charges of assault and criminal possession of a weapon, police said

Questions over Champ playoffs with only two clubs applying for promotion

Arguments behind the scenes about the proposed transformation of the top tier of English club rugby into a franchise-based league are intensifying with just two Champ clubs seemingly now eligible for promotion this season. Only Ealing Trailfinders and Doncaster Knights have applied formally to be promoted to the Prem, with Worcester Warriors understood to have missed the deadline.A Rugby Football Union spokesperson suggested on Tuesday that the absence of Worcester’s name reflects the reality that the club is still “getting back on its feet” after its financial collapse in September 2022 with debts of more than £25m. But with Ealing unable to satisfy the Prem minimum standards for the past two seasons, and with Doncaster off the pace in 10th place, it raises fresh questions about the raison d’être of the scheduled new end‑of‑season Champ playoffs, unveiled this year amid much fanfare.Originally it had been intended that the playoff winner should qualify for a merit-based, two-leg showdown with the Prem’s bottom side, but other scenarios have since emerged

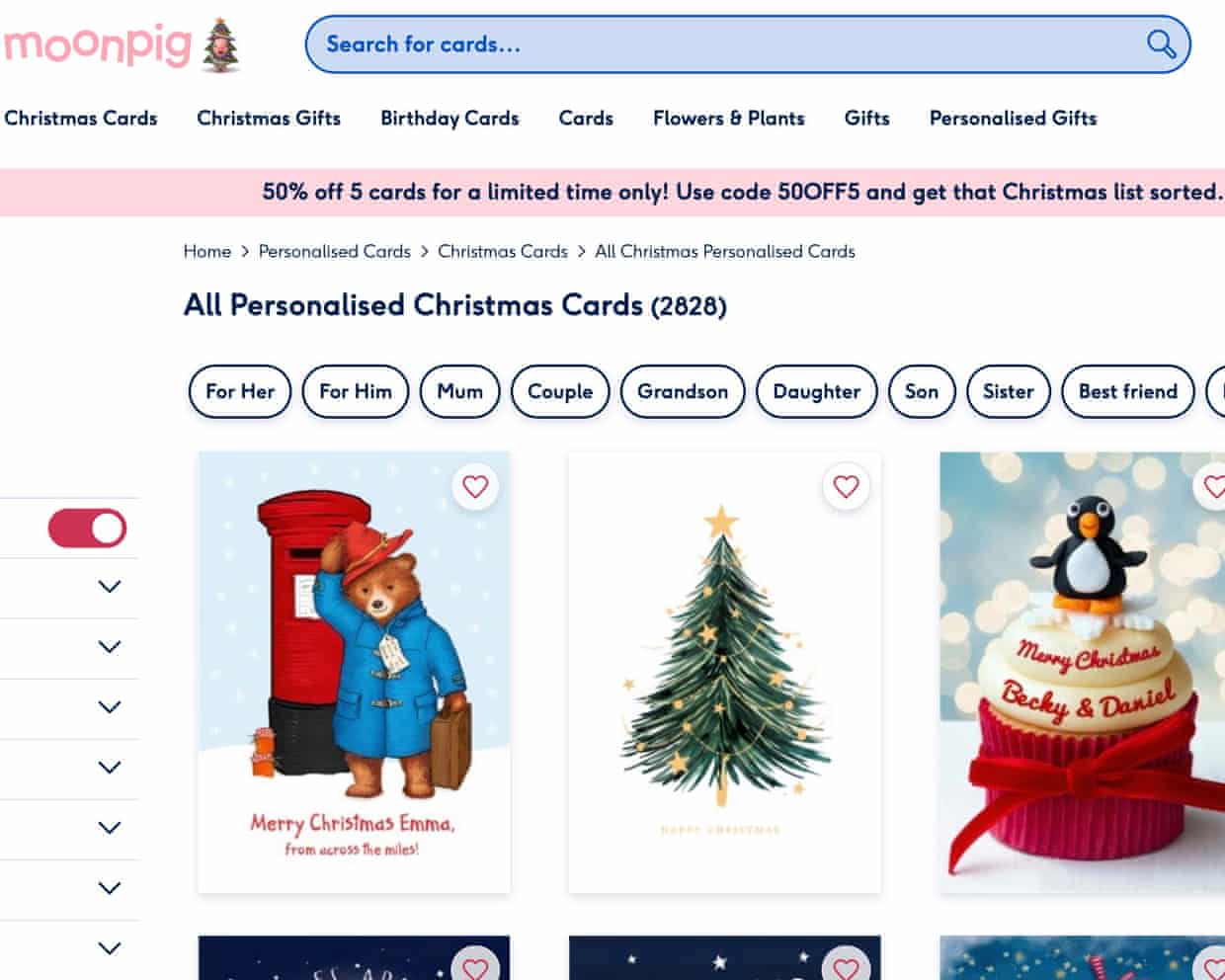

Moonpig’s use of AI to design and personalise cards drives up sales

Home movers in Great Britain could get just £30 of energy use without account

Western carmakers ‘in fight for lives’ against Chinese rivals, says Ford boss

‘Bring it on!’: growing support in England for four-day week in schools

UK fraud prevention ‘still lacking’ after Covid-related scams and errors cost £11bn

Britons face higher chocolate prices but average cost of Christmas dinner falls