European stock markets fall as Trump renews tariff threats; trade war would be a ‘wrecking ball’ for UK manufacturing, union says

It looks like it will be a rocky start to the week for investors after Donald Trump threatened eight European countries with new tariffs until they support his ambition to acquire Greenland.The US president is planning to impose new trade levies of 10% on goods from Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands and Finland from 1 February, rising to 25% on 1 June.Investors in Europe are spooked: futures for the continent’s European Stoxx 50 index are down 1.51%.Futures for the UK’s FTSE 100 blue chip index are down 0.

48%, while the French Cac 40 is posed to fall 2.1% and the German Dax pointing to a 1.35% drop at the open.In Asia, the picture has been more mixed as investors digested reports from China that its economy expanded at a 5% annual pace in 2025, though it slowed in the last quarter.In Japan, the Nikkei 225 slipped 0.

7%,Oil prices and the dollar are falling too,Brent crude is down 0,73% to $63,66 a barrel, while West Texas Intermediate is down 0.

61% to $59,08 a barrel,The US Dollar index, which tracks the dollar against a basket of other major currencies, is down 0,23%,And gold, which is seen as a “safe haven” asset during periods of instability, hit another fresh high this morning, rising to as much as $4,689.

39 per ounce,It is now trading up around up 1,6% at $4,668,Spot silver is also up by about 3,8% to $93.

39 per ounce, after hitting a record high of $94.08.The US markets will be closed today to commemorate Martin Luther King Jr.Day.But US futures for now are pointing to a 1% drop when the market opens on Tuesday.

Jim Reid, of Deutsche Bank, notes while markets are spooked this morning, the shock could wane.There will be hundreds of different opinions on how this will all pan out but remember that the tariffs announced on Liberation Day were ultimately softened a week later, on the day that long-end US Treasury yields saw a scary Asian session as international investors started to vote with their feet in terms of US funding.So financial markets may play a big part in how this situation resolves itself.The main Achilles Heel of the US is the huge twin deficits.So while in many ways it feels like the US holds the economic cards, it doesn’t hold all the funding cards in a world that will be very disturbed by the weekend’s events.

It also remains to be seen what political benefit there would be for President Trump domestically given that the mid-terms are widely believed to likely be about the cost of living,In addition, a Reuters/Ipsos poll last week suggested that only 17% of US citizens supported efforts to acquire Greenland, with 47% against,Only 4% approved of using military force with only 8% of Republican voters agreeing,That all being said, the tariff threats are still very real, he says,Europe also needs the US in terms of helping with Ukraine.

As such expect diplomacy to be going into overdrive over the next 12 days.There has been lots of talk over the weekend around the EU activating its anti-coercion instrument (ACI) which officially came into force at the end of 2023.It has a high bar to be activated but this episode could well pass that threshold.Macron yesterday called on it to be used but he also wanted it used last year on China and talked of its use with the US after Liberation Day.One of the problems is that it would likely take months to come to fruition as the formal and legal processes would need to follow due process.

Given the extended timeline and potential difficulty in agreeing ACI use, last night EU ambassadors also explored the option of activating the EUR 93bn in retaliatory tariffs that were prepared in response to Trump’s tariffs last year but never implemented.We’ll find out over the next few days how coordinated Europe is as it tries to respond, with an emergency summit of EU leaders being scheduled for this week, likely Thursday according to Politico.Elsewhere this morning, chancellor Rachel Reeves is in London this morning, expected to hail a “new golden age” for the City.This morning new regulatory rules come into effect for businesses considering an IPO or raising capital, reducing paperwork and costs following changes to UK Listing Rules.She is expected to say:Two years ago, some said the City’s best days were behind it.

They were wrong.We have taken a significant step forward today and I look forward to continuing to work closely with everyone here to ensure that our capital markets remain world-leading.As the FTSE 100 reaches record highs and global firms once again choose London, we are seeing the first signs of a new golden age for the City.London has thrived because it is open, dynamic and forward-looking.With simpler, faster prospectuses and a more competitive listings regime, we are reinvigorating that spirit – making the UK the best place in the world to start, scale and list a company, and ensuring the benefits of this new golden age for the City are felt in jobs and higher living standards in every part of our country.

”US importers are paying almost all of the costs associated with tariffs imposed by Donald Trump last year, according to a study published today by the Kiel Institut.Its analysis of shipment-level data showed US importers bear 96% of the burden of tariffs introduced last year.Julian Hinz, one of the authors of the study, found that “tariffs do not transfer wealth from foreigners to Americans.”He said:The tariffs are an own goal.The claim that foreign countries pay these tariffs is a myth.

The data show the opposite: Americans are footing the bill.”The research is based on more than 25 million shipment records, covering almost $4trn worth in US imports.It found that when exporters are faced with tariffs, they could seek out alternative markets or even accept lower sales at the same margin.It added that many US importers have long-standing relationships with foreign suppliers and cannot easily switch to alternative sources.Meanwhile US importers and wholesalers must pay tariffs at the border, which appears as a higher cost of goods in their books.

Retailers who buy these products must then also face the same choice: absorb the higher cost or pass through,The study said evidence from the 2018–19 tariffs suggests most firms pass through cost increases to customers,If Trump presses ahead with his latest tariff threat, it would cost UK businesses £15bn by June, the British Chambers of Commerce has estimated,Shevaun Haviland, BCC director general, said:We are still in the foothills when it comes to these new tariff proposals from the president and there is some way to go before we will have final clarity on them,But should the worst-case scenario come to pass, then the impact would be significant.

A £6bn hit at the end of January, rising to £15bn in June,If that happens, orders will drop, prices will rise, and global economic demand will be weaker as a result,That would be a lose-lose situation for everyone,The UK is not without influence, our bilateral trade with the US is worth £300bn, we have £500bn invested in its economy and it has £700bn tied up in ours,There is a high-level of co-dependency.

The government should keep everything on the table during talks,Many firms, especially [small and medium enterprises], will now be facing difficult decisions and we urge it to consider its contingency plans for support should the worst happen,The existing 10% tariff means that many businesses have already negotiated with their US customers on managing the impact and we would suggest they continue this dialogue,Last year, enhanced credit and financial support was offered through UK Export Finance and the British Business Bank to cushion the effect of tariffs, and this is another option,”The BCC said it spoke with trade minister Chris Bryant this morning in a previously scheduled meeting.

It said it expressed its support for the “level-headed” response from Keir Starmer to Trump’s latest tariff threat.Stephen Davies, chief executive of Welsh whisky maker Penderyn, said further tariffs would put the health of the distillery’s US business at risk.We export to about 20 states in the US.It’s business that we want to build and, as an export market, it’s very important to us.In the US, there is already a three-tier system where the importer has to be separate to the distributor and the retailer.

You have three parties before you get on the shelf in a liquor shop and you’re giving margin to all of those parties.If you add a tariff on top of that it compounds the whole thing.It’ll make products from the UK a lot more difficult to be competitive.Some of the bigger UK brands might absorb some of that.When it’s 10% it’s painful but if it gets to 25%, I don’t think either us or the distributor can cope with that, it’s just not going to work.

People will disappear from the market and just hold fire until conditions get better,But you’ve been working for years building reputation and building product knowledge with consumers and you don’t want to stop doing that,”Shares in the FTSE 100 insurer Beazley have shot up by more than 40% to an all-time high of £11,57 per share after the Swiss group Zurich Inusrance revealed it had made a £7,7bn takeover offer for the company.

Zurich said it made an offer of £12.80 per share, at a 56% premium to Beazley’s closing share price on 16 January 2026, the last business day before it submitted its offer to the business.The company said it had previously tabled a bid of £12.30 per share, which Beazley rejected on the grounds that it undervalued the business.Beazley, which is headquartered in London and employs about 2,500 people, is one of the biggest specialist insurers in the world.

Its expertise ranges from cybersecurity to fine art.Zurich’s chief executive Mario Greco told the Financial Times that the latest bid was the group’s fifth offer for Beazley since its first takeover approach about a year ago.He told the paper:It was time to go public and eventually have [Beazley’s] shareholders say what they think.Beazley said it has “not yet had the chance to consider Zurich’s improved proposal of 1,280 pence per share, received on 19 January 2026.”The company said in a statement:We will update shareholders in due course.

In the meantime, Beazley shareholders are urged to take no action.The dollar is still falling today, now down 0.23% against a basket of other major currencies.Meanwhile other traditional safe haven assets, such as the Swiss franc, are rallying.The euro is up about 0.

3% against the dollar, to $1.163 and the pound is still up by about 0.2% to $1.3415.Khoon Goh, head of ANZ, told Reuters:Typically you would think tariffs being threatened would lead to a weaker euro.

But, as we’ve seen last year as well, when the ‘Liberation Day’ tariffs were getting put in place, the impact in FX markets actually has been more towards dollar weakness every time there is heightened policy uncertainty emanating from the United States.”Jane Foley, at Rabobank, warned against assuming that the US dollar no longer had its safe haven status.She said:Even if non-US investors decided to take their money out, where would they go? Other markets aren’t big enough to maintain that.The sheer size of the [US] market means that there is always going to be some safe-haven value associated with US assets.”Analysts at Goldman Sachs have made a more conservative estimate about the potential economic impact of Trump’s latest tariff threat

Jimmy Kimmel on the midterms: ‘We can’t have an election soon enough’

Late-night hosts covered alarming new comments by Donald Trump as well as his outburst at a heckler in Michigan.On Jimmy Kimmel Live! the host said that in the first two weeks of 2026, “all hell has broken loose” and “if this was Jenga, there’d be blocks of wood all over the house.”He spoke about Trump threatening to invoke the Insurrection Act as a result of his ICE officers causing chaos in Minneapolis. Kimmel joked that “he hasn’t been able to get an insurrection for years”.The host said that instead of trying to de-escalate the situation, he is doing the opposite and that “he turns the temperature up on everything but his wife

Civilised but casual, often hilarious, Adelaide writers’ week is everything a festival should be – except this year | Tory Shepherd

The sun almost always shines on Adelaide writers’ week, held on Kaurna land each year at the tail end of summer.For those who start looking forward to it as soon as soon as the Christmas tree is packed away (or earlier, frankly) there’s a sense of loss, of betrayal, at the omnishambles that has led to its cancellation this year.We’re bereft, and angry – not least because some of the most vocal critics seem to have no idea what writers’ week actually is.During Adelaide’s Mad March, the city’s parklands are home to the festival fringe’s sprawling performance spaces, bars and restaurants. On a Sunday you might leave behind the carnival chaos of the Garden of Unearthly Delights

‘Soon I will die. And I will go with a great orgasm’: the last rites of Alejandro Jodorowsky

The Chilean film-maker’s psychedelic work earned him the title ‘king of the midnight movie’, and a fan in John Lennon. Now the 96-year-old is ready for the end – but first there is more living to doThe Guardian’s journalism is independent. We will earn a commission if you buy something through an affiliate link. Learn more.There is an apocryphal story of an ageing Orson Welles introducing himself to the guests at a half-empty town hall

Call this social cohesion? The war of words that laid waste to the 2026 Adelaide writers’ festival

How a boardroom flare-up sparked an international boycott – and a looming defamation battleIt began as a quiet programming dispute in the genteel city of churches.But by Wednesday morning, a frantic, six-day war of words had culminated in the end of the 2026 Adelaide writers’ week and total institutional collapse.What started with the discreet exit of a business titan and arts board veteran spiralled into boardroom carnage last weekend, with mass resignations, lawyers’ letters of demands and allegations of racism and hypocrisy flung by all sides.By the time the writers’ week director, Louise Adler, walked, the boycott of writers, commentators and academics had gone global and the state’s premier cultural event had become a hollowed-out shell.The cancellation of AWW may only be the opening act

Seth Meyers on ICE: ‘An army of out-of-shape uncles’

Late-night hosts talked cratering public opinion on the Trump administration’s deployment of Immigration and Customs Enforcement (ICE) in US communities and the president’s apparent preference for whole milk.Seth Meyers opened Wednesday’s Late Night with a reminder to viewers about how Trump “sold his mass deportation program to voters during the campaign”.That would be by declaring some version of “We are going to start with violent criminals” again and again.“If you say you’re going to get violent criminals off the streets, of course people are going to be into that. But that was a lie,” Meyers noted

Ian McKellen to star as LS Lowry in documentary revealing trove of unheard tapes

Fifteen years ago, Sir Ian McKellen was among the leading arts figures who criticised the Tate for not showing its collection of paintings by LS Lowry in its London galleries and questioned whether the “matchstick men painter” had been sidelined as too northern and provincial.Now, 50 years after Lowry’s death, McKellen is to star in a BBC documentary that will reveal a trove of previously unheard audio tapes recorded with Lowry in the 1970s during his final four years of life.The interview is the longest the artist ever gave and was recorded in his living room, his “private sanctuary”. The tapes are said to reveal Lowry’s authentic voice, which McKellen will lip-sync on screen.The Lancashire-born actor described the role as a “unique privilege”

Charter to tackle sexual harassment across NHS in England has failed, say unions

Sleep, stress and sunshine: endocrinologists on 11 ways to look after your metabolism

Betfair urged to hand tens of thousands to victim of gambling fraudster

Study debunks Trump claim that paracetamol causes autism

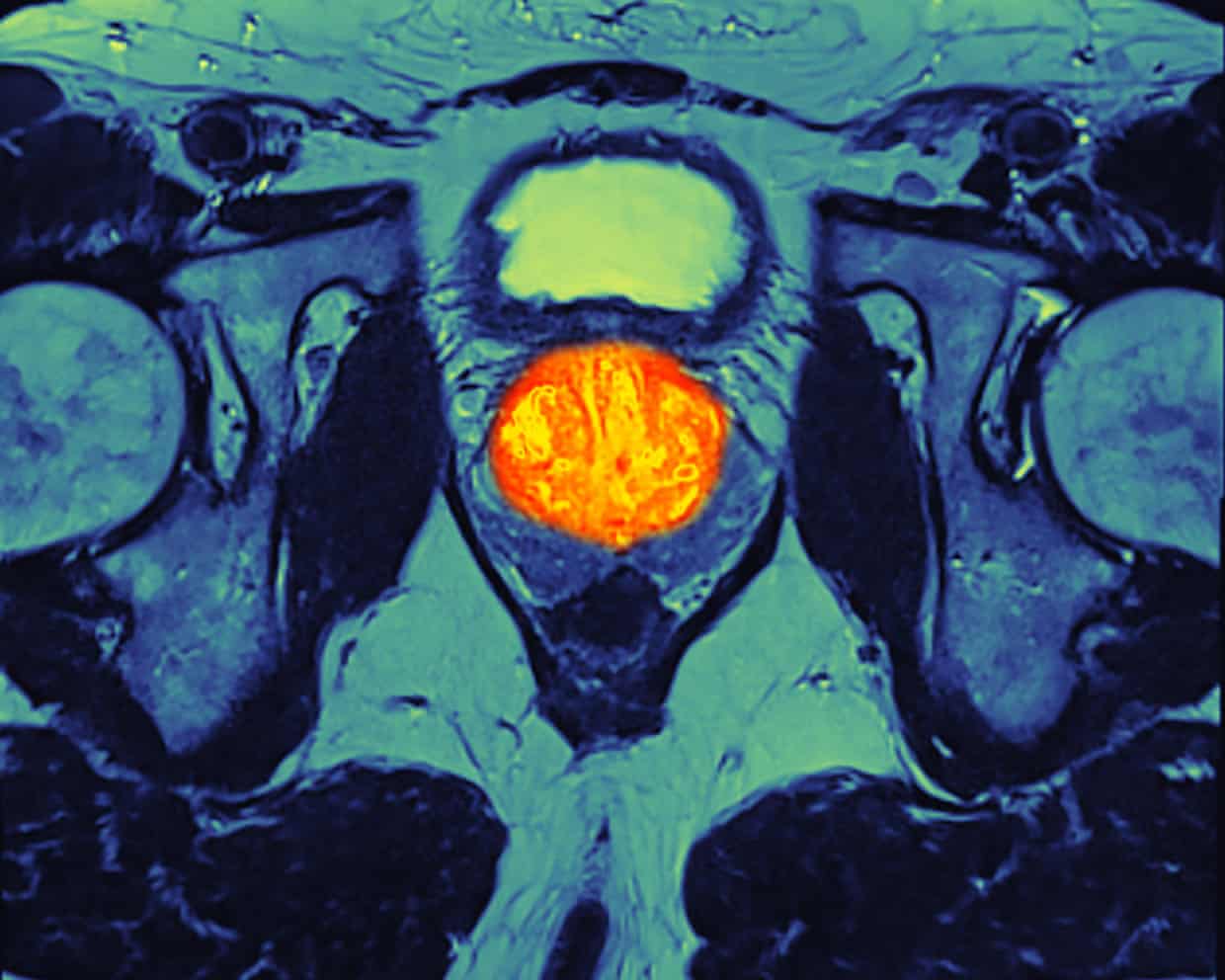

NHS expands access to prostate cancer drug in England to save thousands of lives

Dr Aggrey Burke obituary