March cut to UK interest rates more likely after inflation drops to 10-month low; London house prices fall – as it happened

Many economists are predicting the Bank of England will cut interest rates in March, after seeing inflation fall to 3% this morning,The money markets now indicate there’s an 86% chance of a rate cut in March (taking Bank rate down from 3,75% to 3,5%), at next month’s meeting,That’s up from 77% last night, and 65% a week ago.

Yael Selfin, chief economist at KPMG UK, says the fall in inflation in January “paves the path for a March interest rate cut”.“Today’s inflation data will likely prompt the Bank of England to lower interest rates next month.The MPC will welcome the broad-based fall in inflation, with both headline and underlying measures of inflation easing.Given the favourable inflation outlook, the Bank is expected to cut interest rates three times this year, leaving interest rates at 3% by the end of 2026.“Headline inflation has gradually eased since last summer and is expected to fall further as food and energy prices drop.

The combined impact of the government’s energy bill package and the fall in wholesale gas prices could see household energy bills decrease by around 7% from April.Forward-looking data also points to food prices softening over the coming months, as recent declines in global food prices are passed on to households, with the recent adverse weather episodes across Europe not yet making their mark.Rob Morgan, chief investment analyst at wealth manager Charles Stanley, predicts at least two interest rate cuts this year:Another reduction as soon as the March meeting is now firmly on the table, and that’s unlikely to be the end of the matter with one or two further cuts likely as the year progresses.The Bank’s latest decision highlights just how close the committee already is to moving.The MPC voted 5-4 to hold Bank Rate at 3.

75%, far tighter than the widely expected 7–2 split.Notably, long‑time hawk Catherine Mann signalled her position is shifting, acknowledging that new analysis has “moved the appropriate time for a cut closer.” With Governor Bailey’s vote pivotal and Mann softening, the MPC’s balance is clearly tilting toward easing.The Bank’s updated projections reinforce that shift.It now expects CPI to fall to 2.

1% by the second quarter of 2026, down from 2,8% in the previous forecast, driven by lower energy costs and fiscal measures from the Autumn Budget,More strikingly, inflation is projected to dip below target to 1,7% next year and to remain subdued through 2028 – a sharp departure from earlier forecasts that had inflation above target into the 2030s,TUC general secretary Paul Nowak is urging the Bank to act fast:“Inflation easing is welcome news for working people.

“And it’s right that the government has reduced the pressure - cutting energy bills, freezing rail fares and prescription charges, and raising the minimum wage.“But after years of falling living standards millions of families are still struggling to make ends meet.“With households squeezed there’s less money being spent on the high street - holding back businesses and choking off growth.“The Bank of England must now act.“From next month we need a series of quick fire interest rate cuts.

“That would put money back into people’s pockets, give businesses the confidence to invest and help Britain finally move on from a cost-of-living crisis that has dragged on for far too long.”Time to wrap up….City investors are betting on a cut to UK interest rates next month, after inflation fell to its lowest level in 10 months this morning.A March rate cut is now seen as an 80% chance by the money markets, after CPI inflation dropped to 3% in January.The slowdown was in line with a majority of City economists’ forecasts and marks the lowest level since March 2025.

The Office for National Statistics (ONS) said that falls in petrol prices, air fares and food had driven the drop.In a welcome boost for households’ shopping budgets, the rise in prices for food and non-alcoholic drinks slowed sharply to 3.6% in the year to January, down from 4.5% in December, and reaching a nine-month low.Petrol and diesel prices fell by 2.

2% over the year compared with a 0.9% rise last year.The average price of petrol fell by 3.1p a litre between December and January to stand at 133.2p a litre, while diesel fell by 3.

2p to stand at 142.5p a litre.Several economists predicted the fall in inflation, after a rise in unemployment yesterday, would nudge the Bank of England into cutting borrowing costs at its next meeting.Others, though, suspect the Bank may wait until April, with services inflation still looking sticky.Seperate data showed that house price inflation, and rising rents, have slowed, with property prices falling in London, particularly in inner districts of the capital.

Wall Street’s main share indexes have opened higher, supported by gains in technology stocks as the AI worries that hit the sector in recent sessions ease.The Dow Jones Industrial Average is up 123 points or 0.25% at 49,657.15 points in eary trading.The broader S&P 500 share index gained 0.

2% and the tech-focused Nasdaq Composite rose by 0,28%,The oil price has risen today, threatening to undermine some of the progress against inflation,Brent crude is up 2,6% at 69.

20 per barrel, hitting its highest level in almost a week.Oil rose as the talks in Geneve between Russia and Ukraine fail to yield any agreement, yet.The battle to get inflation in the UK sustainably down to the Bank of England’s 2% target may not be won for some time….Oxford Economics, the consultancy, have slightly raised their forecasts for UK inflation this year and in 2027.They do expect price pressures to ease this spring, but then see inflation picking up again.

As a result, they now expect the CPI measure of inflation to average 2.6% this year and next year, up from 2.3% and 2.5% previously forecast.Edward Allenby, senior UK economist at Oxford Economics, explains:Looking ahead, several factors should pull headline inflation materially lower in the near term.

We expect a combination of smaller once-a-year rises in index-linked and regulated prices, a substantial fall in the energy price cap, and the impact of policy measures from the 2025 Budget to drag inflation close to 2% in April.However, we think there’s a good chance that inflation edges higher again from H2 2026, with sticky pay growth likely to prevent services inflation from cooling significantly.The path for inflation this year is likely to be a little stronger than we previously forecast.This is partly due to us factoring in new regulatory price announcements over the past month, some of which have been slightly higher than anticipated.Meanwhile, the Office for National Statistics increased the weight assigned to services prices, which boosts headline inflation.

Incorporating these changes into our forecast means we now see CPI inflation averaging 2,6% this year and next, up from 2,3% and 2,5% previously,Back in the City, Vodafone’s shares have hit a three and a half-year high after it announced the sale of its stake in its Dutch joint venture.

Vodafone is selling its 50% stake in Dutch telecom company VodafoneZiggo to Liberty Global plc for €1.0bn.Vodafone is also getting a 10% stake in a new company, to be called '“Ziggo Group”, which will own both VodafoneZiggo and Liberty Global’s Belgian subsidiary, Telenet Group.Liberty Global plans to list Ziggo Group on the Euronext market in Amsterdam in 2027.Margherita Della Valle, chief executive of Vodafone Group, says:“We’re pleased to have agreed the sale of our 50% share in VodafoneZiggo at an attractive valuation.

This transaction delivers €1 billion in cash to Vodafone, and we have the potential for further value creation through our 10% stake in Ziggo Group, a business with greater scale.”Vodafone’s shares rose as high as 120p, the highest since August 2022, after the deal was announced, helping to keep the FTSE 100 at record levels today.Over in the US, orders for durable goods such as household appliances, automobiles and furniture, have dropped.New orders for manufactured durable goods decreased by 1.4%, the US Census Bureau has announced, due to a drop in orders for transportation equipment.

That follows a 5.4% increase in November.The US Census Bureau says:Excluding transportation, new orders increased 0.9%.Excluding defense, new orders decreased 2.

5%.Transportation equipment, also down two of the last three months, drove the decrease, $6.4 billion or 5.3% to $113.5 billion.

PA Media have written a handy explainer about today’s inflation report:Inflation is the term used to describe the rising price of goods and services.The inflation rate refers to how quickly prices are going up.January’s inflation rate of 3% means if an item cost £100 a year ago, it would now cost £103.It is lower than the 3.4% rate recorded in December, meaning that prices are still rising but at a slower rate than they had been before.

Official statisticians said the falling price of petrol and diesel was the biggest single downward drag on inflation in January.The average price of petrol fell by 3.1p per litre between December 2025 and January 2026 and the price of diesel slid 3.2p per litre, the ONS said.It also highlighted that a drop in airfares also helped bring inflation down.

The cost of air travel typically drops in January as airlines launch sales and discounts, but prices plunged by 26,5% in January compared with the previous month in a much sharper drop than usual,Food and non-alcoholic drink prices were also lower month-on-month, with bread and cereals among those dropping in price,Meanwhile, butter prices were up 1,4% for the month after a sharp slowdown from 8.

9% in December, while recent coffee price increases also slowed sharply.The decrease in broad inflation in January does not mean that price rises are slowing for all goods and services.Wednesday’s figures showed that hotels and other accommodation costs swung higher in January, rising by 0.4% in the month after declining in December.A number of other prices linked to leisure and hospitality also accelerated, amid recent warnings from the sector over high labour costs and impending tax rises

Colbert on Kristi Noem: ‘Everyone can’t wait to tell a reporter how awful you are’

With Seth Meyers and Jimmy Kimmel off air for the Presidents’ Day holiday, Stephen Colbert focused his monologue on a Kristi Noem scandal and Maha’s new suggested way to enjoy vegetables.On Monday night’s Late Show, Colbert returned after a week off the air to focus on the Wall Street Journal’s recent exposé of Kristi Noem, the US homeland security secretary. The host described the piece as “the kind of article that gets published only if everyone who works for you can’t wait to tell a reporter just how awful you are”.The Journal exposé claims that Noem is jealous of the border czar, Tom Homan, and monitors her media appearances to make sure that she is on TV more than he is. The article also reports that Noem’s relationship with the Trump aide Corey Lewandowski is more than professional, and the pair are in a romantic relationship despite both being married with children

Barbican arts director to leave, months after revealing creative vision for centre

Devyani Saltzman is leaving the Barbican as the arts institution undergoes another significant leadership change just a few weeks after its new CEO joined.The shock departure of Saltzman, who became director of arts and participation at the Barbican in February 2024, comes months after she unveiled a five-year creative vision for the venue.Saltzman was named recently as one of the 40 most influential women working in the arts in the UK, and was described as the “driving force behind the organisation”.The Barbican refused to confirm the exit, with a spokesperson telling the Guardian it would be “unable to comment on individual staffing matters”.It is unclear when Saltzman will leave the organisation and there are no plans to replace her

British Museum removes word ‘Palestine’ from some displays

The British Museum has removed the word “Palestine” from some of its displays, saying the term was used inaccurately and is no longer historically neutral.Maps and information panels in the museum’s ancient Middle East galleries had referred to the eastern Mediterranean coast as Palestine, with some people described as being “of Palestinian descent”.Concerns were recently raised by UK Lawyers for Israel (UKLIF), a voluntary group of solicitors, about references to “Palestine” in displays covering the ancient Levant and Egypt, which risked “obscuring the history of Israel and the Jewish people”.In a letter to the museum’s director, Nicholas Cullinan, the group wrote: “Applying a single name – Palestine – retrospectively to the entire region, across thousands of years, erases historical changes and creates a false impression of continuity.“It also has the compounding effect of erasing the kingdoms of Israel and of Judea, which emerged from around 1,000BC, and of reframing the origins of the Israelites and Jewish people as erroneously stemming from Palestine

My cultural awakening: ‘Thirteen influenced my hedonistic youth, until a psychotic episode ended it’

My teenage self was shy and miserable, before a coming-of-age film unleashed an adolescence of drink, sex and drugs. It was a years-long party that eventually came crashing downAt 13, what felt like almost overnight, I turned from a happy, musical-theatre-loving child into a sad, lonely teenager. Things I had cared about only yesterday were suddenly irrelevant, as I realised that nothing and no one mattered, least of all me. It’s an angst that adults often find difficult to remember or understand; as the famous line from The Virgin Suicides goes: “Obviously, Doctor, you’ve never been a 13-year-old girl.”Going to an all-girls Catholic school, I didn’t even really know that sex, drugs and alcohol existed, or that they had currency, until I watched Thirteen for the first time at 14, after seeing a still on Pinterest

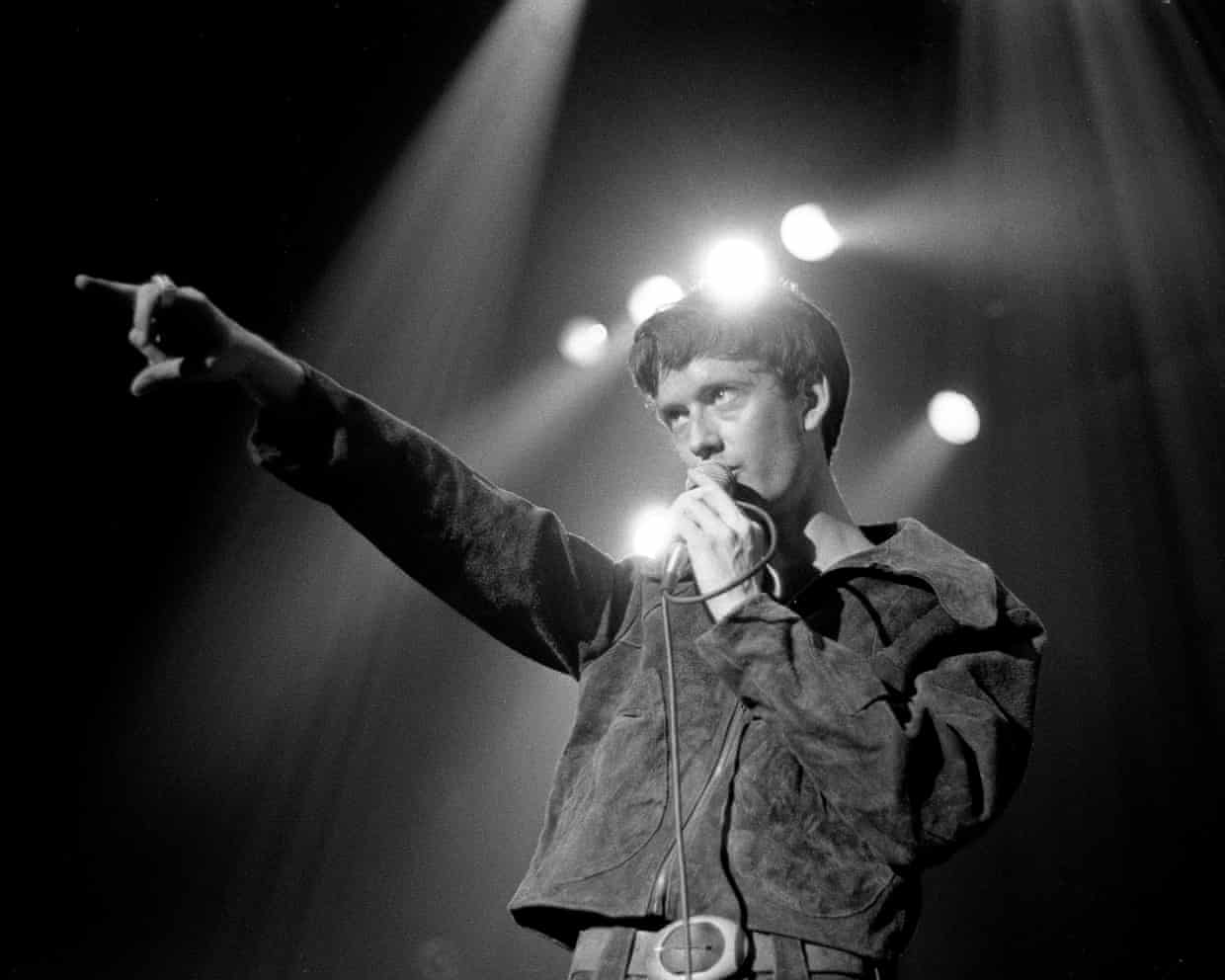

The Guide #230: From Oasis to Bowie, your stories of seeing pre-stardom acts

From the Beatles slogging through mammoth sets for jeering sailors in Hamburg basement bars, to Ed Sheeran playing just about every open mic night in the south of England, even the biggest acts had to start small. So when we asked Guide readers to share their memories of seeing now-massive bands and artists before they were famous, it was inevitable we’d get some great tales. So much so, in fact, that we’ve decided to devote the main chunk of this week’s Guide to your pre-fame gig recollections. We’ve also asked Guardian music writers – seasoned veterans of seeking out the next big thing – to share a few of their memories. Read on for tales of Kurt Cobain in Yorkshire, Playboi Carti’s set in an east London snooker club and an ill-advised David Bowie mime performance …PulpIn 1991, I was a young music writer starting out when I came across a pre-fame Pulp (pictured above) at a short-lived event called Piece Hall Live in Halifax

From Wuthering Heights to Mario Tennis Fever: your complete entertainment guide to the week ahead

Emerald Fennell’s film brings the raunch to Brontë’s romance, while Nintendo’s beloved plumber stars in a colourful, family-friendly sports gameWuthering HeightsOut now Out on the wily, windy moors, writer-director Emerald Fennell has constructed a new interpretation of the Emily Brontë classic. Margot Robbie is Cathy while Jacob Elordi takes on Heathcliff, and as you might expect from the film-maker behind Saltburn, the passionate pair are set to leave no height unwuthered.It’s Never Over, Jeff BuckleyOut now Very few musicians have the impact that Jeff Buckley had during such a short space of time. This documentary from Amy Berg explores the success of his only album, Grace, and his death at a young age by accidental drowning, through previously unseen archive materials and the perspectives of the people in his life.WhistleOut now Whistling is easy – as Lauren Bacall advised Humphrey Bogart: just put your lips together and blow … or maybe don’t, if the whistle in question is an ancient Aztec death whistle that has the power to summon dark and deadly forces to your local high school

Brazilian butt lifts should be banned in UK amid ‘wild west’ industry, MPs say

UK shoppers warned over spread of harmful and illegal skin lightening kits

‘It’s soul-crushing’: young people battle to find any work in bleak jobs market

Fostering target brings hope for thousands of children | Letter

Developers will only bring us more car-dependent sprawl | Letters

Health support needed to tackle joblessness | Letter