Software stock sell-off goes global amid fears over AI-led disruption – business live

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.A selloff in software and data company stocks that began in Europe yesterday has spread to Asia-Pacific markets, via the US, today.Software stocks slid from India to Japan, following losses on Wall Street overnight, on growing concerns that their business models will be devoured by AI.The trigger for the selloff appears to be an updated chatbot release from AI developer Anthropic, the company behind the chatbot Claude, designed to automate legal work such as contract reviewing, non-disclosure agreement triage, compliance workflows, legal briefings and templated responses.The news had an immediate impact in London yesterday, where information and analytics company Relx plunged 14%, UK publishing group Pearson fell by nearly 8%, and the London Stock Exchange Group fell by 13%.

There’s was a knock-on effect since.Last night in New York, Salesforce, Datadog and Adobe lost about 7%, Synopsys and Atlassian fell about 8%, and Intuit slumped 11%, as investors anticipated that their business models could be disrupted by AI.And now the selloff has swept around the globe.Shares of Indian information technology firm bellwether Tata Consultancy Services are down 6.8%, while Infosys has lost more than 8%.

Chinese software companies dropped too, with Kingdee International Software down 12.5%.In Japan, economics data firm Nomura Research Institute fell 8%.The selloff has rattled markets that had only just recovered from the slump in gold and silver last week.Ipek Ozkardeskaya, senior analyst at Swissquote, says:The relief that came with the easing selloff across the metals space lasted until news broke that Anthropic, an AI startup backed by Amazon and Google, had rolled out a new AI tool designed to handle legal and research work traditionally done using paid databases.

The announcement spooked markets, triggering a sharp selloff in software companies that sell data analytics and decision-making tools to lawyers, banks and corporates, on fears that AI and new players are coming for their lunch — and at an accelerated pace.9am GMT: Eurozone services PMI report for January9.30am GMT: UK services PMI report for January10am GMT: Eurozone inflation report for January10am GMT: House of Lords inquiry on stablecoins in the UK to hear evidence1.15pm GMT: ADP US private payroll report for January3pm GMT: US services PMI report for JanuaryYesterday’s software sell-off marked “a dramatic acceleration” of the recent trend, says market strategist Jim Reid of Deutsche Bank, adding:It means the 9 worst-performing companies in the S&P 500 YTD are all in the software and related services sectors, having now seen declines of 25% or more.While the question over the end-winners from AI is unlikely to be answered in 2026, recent months have seen a clear shift in markets from AI euphoria towards more differentiation between companies, and growing concern about its disruption to existing business models.

The drawdown in S&P 500 Software stocks is now -25.2% from the high...that's worse than last year's plunge pic.

twitter.com/Th3DR6DVzOIn the insurance world, Zurich appears to have won its battle to aquire smaller rival Beazley after increasing its offer price.The two companies have told the City this morning they’ve reached “agreement in principle” on the key financial terms of a possible recommended cash offer, which values Beazley at £8bn.At 1,310 pence in cash plus a 25p dividend, that’s almost 60% higher than Beazley’s closing share price on 16 January, the last business day before Zurich’s interest was public.Zurich had earlier offered 1,280p a share, but has now bumped it up.

Beazley’s board says it would be minded to recommend the new offer to shareholders, should a firm bid be made – once Zurich has completed its due diligence on the bid.Beazley offers specialist insurance products, across areas including cyber, professional indemnity, property, marine, and reinsurance, and had batted away several previous wooings from Zurich.Nvidia CEO Jensen Huang has dismissed fears that artificial intelligence will replace software and related tools, calling the idea “illogical”.Speaking at an artificial intelligence summit in San Francisco hosted by Cisco Systems, Huang said worries that AI will make software companies less relevant are misguided and AI will continue to rely on existing software rather than rebuild basic tools from scratch, Reuters reports.Huang said.

“There’s this notion that the tool in the software industry is in decline, and will be replaced by AI...It is the most illogical thing in the world, and time will prove itself,”“If you were a human or robot, artificial, general robotics, would you use tools or reinvent tools? The answer, obviously, is to use tools..

.That’s why the latest breakthroughs in AI are about tool use, because the tools are designed to be explicit.”Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.A selloff in software and data company stocks that began in Europe yesterday has spread to Asia-Pacific markets, via the US, today.Software stocks slid from India to Japan, following losses on Wall Street overnight, on growing concerns that their business models will be devoured by AI.

The trigger for the selloff appears to be an updated chatbot release from AI developer Anthropic, the company behind the chatbot Claude, designed to automate legal work such as contract reviewing, non-disclosure agreement triage, compliance workflows, legal briefings and templated responses.The news had an immediate impact in London yesterday, where information and analytics company Relx plunged 14%, UK publishing group Pearson fell by nearly 8%, and the London Stock Exchange Group fell by 13%.There’s was a knock-on effect since.Last night in New York, Salesforce, Datadog and Adobe lost about 7%, Synopsys and Atlassian fell about 8%, and Intuit slumped 11%, as investors anticipated that their business models could be disrupted by AI.And now the selloff has swept around the globe.

Shares of Indian information technology firm bellwether Tata Consultancy Services are down 6.8%, while Infosys has lost more than 8%.Chinese software companies dropped too, with Kingdee International Software down 12.5%.In Japan, economics data firm Nomura Research Institute fell 8%.

The selloff has rattled markets that had only just recovered from the slump in gold and silver last week.Ipek Ozkardeskaya, senior analyst at Swissquote, says:The relief that came with the easing selloff across the metals space lasted until news broke that Anthropic, an AI startup backed by Amazon and Google, had rolled out a new AI tool designed to handle legal and research work traditionally done using paid databases.The announcement spooked markets, triggering a sharp selloff in software companies that sell data analytics and decision-making tools to lawyers, banks and corporates, on fears that AI and new players are coming for their lunch — and at an accelerated pace.9am GMT: Eurozone services PMI report for January9.30am GMT: UK services PMI report for January10am GMT: Eurozone inflation report for January10am GMT: House of Lords inquiry on stablecoins in the UK to hear evidence1.

15pm GMT: ADP US private payroll report for January3pm GMT: US services PMI report for January

FTSE 100 falls back from record high amid AI worries; gold heads for best day since 2008 – as it happened

And finally, the FTSE 100 has closed down 27 points or 0.26% at 10,314, away from the record high hit this morning.Although miners and precious metal producers rallied, as the gold and silver price jumped, the index was dragged down by Relx (-14.3%) and the London Stock Exchange Group (-12.8%), as investors reacted to US artificial intelligence firm Anthropic unveileing a tool for companies’ in-house lawyers

What are the odds? The RBA has raised interest rates – for no real reason other than to meet the desires of speculators | Greg Jericho

Has there been an interest rate rise more desired by some economists and commentators despite no real reason, than the one pushed for on Tuesday? Alas, the Reserve Bank listened to the noise and felt compelled to raise the cash rate to 3.85%, but one wonders if they listened more to the noise of the commentariat than the data.In Tuesday’s announcement, the RBA monetary policy board barely changed anything from its December statement.In December the board thought: “While inflation has fallen substantially since its peak in 2022, it has picked up more recently”. Now it says: “While inflation has fallen substantially since its peak in 2022, it picked up materially in the second half of 2025

UK shoppers buy more fruit and yoghurt in healthy start to 2026

Britons started 2026 by buying more healthy food such as fruit and yoghurt as they attempted to hit new year health goals, while grocery price inflation eased to the lowest level since April, research has shown.Annual grocery inflation fell back to 4% in the four weeks to 25 January from 4.7% in December, offering some relief for shoppers, according to a monthly snapshot of the grocery sector from the research company Worldpanel by Numerator.Consumers turned to healthy eating, it said, with sales volumes of fresh fruit and dried pulses up 6% year on year, while fresh fish was up 5%, poultry 3% and chilled yoghurt 4%. Cottage cheese sales jumped by 50% and it was bought by 2

Barnsley rebranded UK’s first ‘tech town’ as US giants join AI push

In 2002 Barnsley toyed with a redesign as a Tuscan hill village as it sought out a brighter post-industrial future. In 2021 it adopted the airily vague slogan “the place of possibilities”. Now it is trying a different image: Britain’s first “tech town”.The technology secretary, Liz Kendall, has anointed the South Yorkshire community as a trailblazer for “how AI can improve everyday life” in the UK.In the latest move in Labour’s drive to inject AI into Britain’s bloodstream, the government has announced four US tech companies – Microsoft, Google, Cisco and Adobe – have agreed to help as the council pushes to apply AI to local schools, hospitals, GPs and businesses in Barnsley, an area of South Yorkshire which has struggled with unemployment and deprivation since the coal pits closed

US jobs report delayed again amid government shutdown

The US’s closely watched jobs report will once again be delayed, the Bureau of Labor Statistics (BLS) announced on Monday, amid a government shutdown.The January 2026 jobs report, originally scheduled to be released on Friday, will be rescheduled when federal funding resumes. Data collection for the report has been completed, but the shutdown has forced a delay to releasing the report, which will provide crucial jobs data on the US labor market following the weakest year for job growth since 2020, with the addition of only 584,000 jobs in 2025 compared with 2 million in 2024.“The Employment Situation release for January 2026 will not be released as scheduled on Friday, February 6, 2026. The release will be rescheduled upon the resumption of government funding,” Emily Liddel, associate commissioner of the BLS, said in a statement

Gold and silver prices seesaw as FTSE 100 hits record high

Gold and silver prices seesawed on Monday, after a “meltdown” in the metals market deepened and rattled investors around the world.Gold prices tumbled by as much as 8% to $4,465 an ounce on Monday, ending a run of record highs that took it to nearly $5,600 last week. It later recovered some ground, but was still down by 3.5% at $4,700 in afternoon trading.Silver fell by as much as 7%, after a 30% slump on Friday, before recovering slightly to $79

Women in tech and finance at higher risk from AI job losses, report says

Elon Musk is taking SpaceX’s minority shareholders for a ride | Nils Pratley

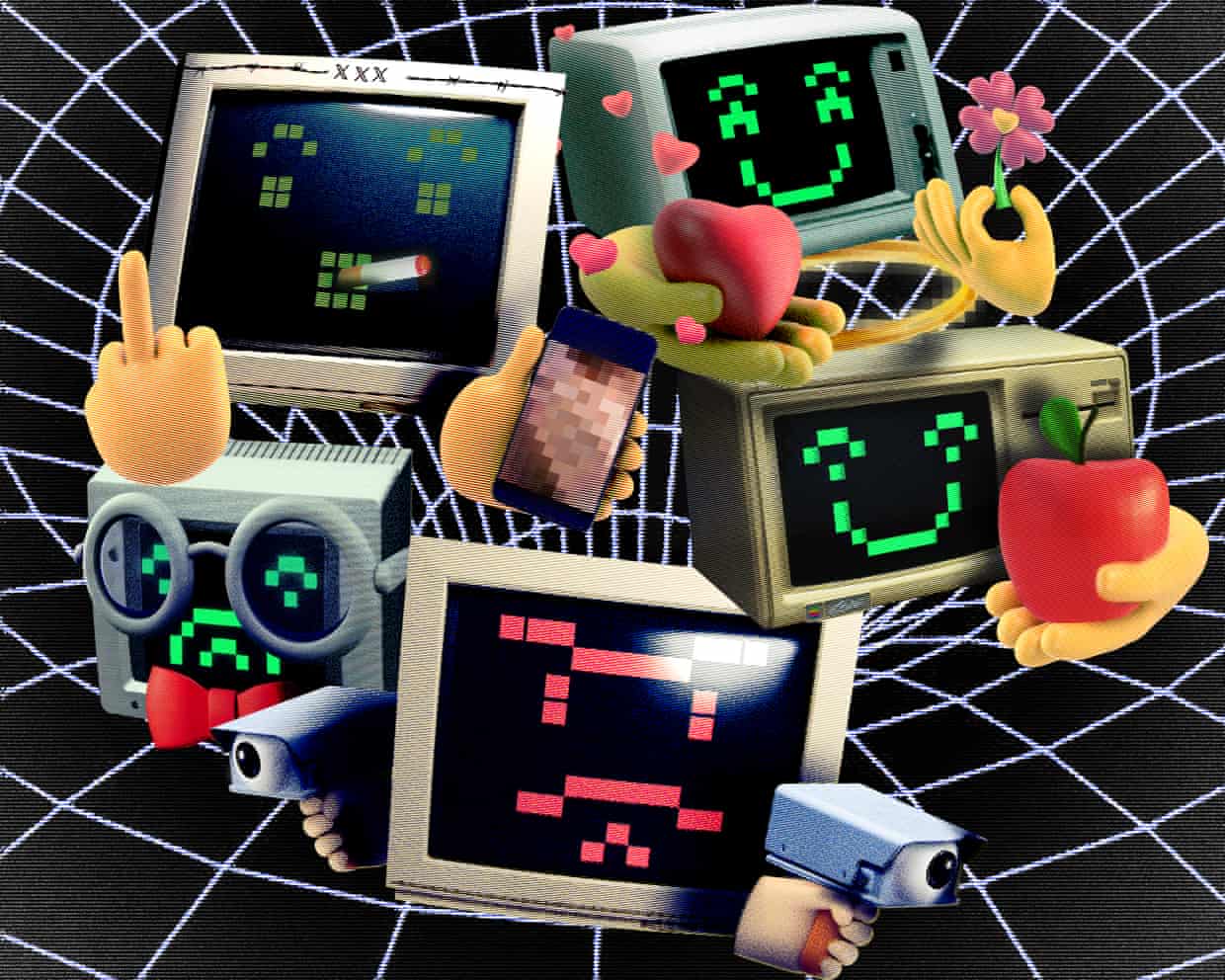

From ‘nerdy’ Gemini to ‘edgy’ Grok: how developers are shaping AI behaviours

UK privacy watchdog opens inquiry into X over Grok AI sexual deepfakes

‘Swagger’ and mindset change is key for England in Six Nations glory chase

England beat Sri Lanka by 12 runs in third T20 to seal 3-0 series win – as it happened