What are the odds? The RBA has raised interest rates – for no real reason other than to meet the desires of speculators | Greg Jericho

Has there been an interest rate rise more desired by some economists and commentators despite no real reason, than the one pushed for on Tuesday? Alas, the Reserve Bank listened to the noise and felt compelled to raise the cash rate to 3,85%, but one wonders if they listened more to the noise of the commentariat than the data,In Tuesday’s announcement, the RBA monetary policy board barely changed anything from its December statement,In December the board thought: “While inflation has fallen substantially since its peak in 2022, it has picked up more recently”,Now it says: “While inflation has fallen substantially since its peak in 2022, it picked up materially in the second half of 2025.

”That is a weird statement given that we have had two inflation releases since then – the one for November showed 0% inflation and the December one had 1%, but all that was due (as I noted last week) to holiday travel (ie the Ashes).There was, however, one very interesting new addition to the RBA’s statement on Tuesday.The board noted: “More recently, the exchange rate, money market interest rates and government bond yields have risen following a rise in market expectations for the cash rate.”It’s hard not to read that as the RBA saying: well, the speculators expected us to do it, so I guess we better.And over the past month the odds of a rate increase on Tuesday changed rather dramatically.

Early in January there was almost no prospect of a rate rise after the October inflation figures showed an unexpected dip in inflation,In December, the governor of the RBA, Michele Bullock, told the media that “the balance of risk to inflation had tilted a bit to the upside”,But even with these words hovering over everything, the market only gave about a 20% chance of a rate rise,This all changed on 22 January,And rather oddly the reason it changed was not due to any new data on inflation, but on unemployment.

On 22 January the December unemployment figures were released, showing a large drop in unemployment to 4.1%.That massively changed the outlook for a rate rise, and last week’s latest inflation figures didn’t really have anywhere near the same impact:If the graph does not display click hereThe reason low unemployment drove speculators to bet that the RBA would raise rates is because the bank is very loud about suggesting that the labour market is “tight”.This is economic speak for there being too few people unemployed.Some economists (and everyone working for the RBA, it seems) worried about this because they believe it means employers will have to raise wages in order to attract and keep workers.

And if wages start going up faster, then so too, they argue, will inflation.Thus, the low unemployment and the higher-than-expected inflation figures had some economists absolutely salivating for a rate rise.One in The Australian suggested the RBA needed to raise rates to “restore” Bullock’s “lost credibility”.Good thing economic commentators never have to worry about lost perspective.And so the RBA raised rates and suggested they needed to do so because “growth in private demand has strengthened substantially more than expected, driven by both household spending and investment.

”Well, about that … As readers will recall, that surge in investment was almost all in AI datacentres.But even apart from the fact they are not great employers, private demand remains pretty weak:If the graph does not display click hereAnd let us also look at the fall in unemployment:If the graph does not display click hereUnemployment has now been below 4.5% for more than four years – long enough to argue that it should be below that as a matter of course.But in December, there was an oddly large 0.2 percentage point drop in unemployment.

In the past 48 months a drop of that size has now only happened three times,Once in 2022 when the effects of the pandemic saw unemployment fall quickly for almost a year,The other time was in February 2024, when the rate fell from 4,1% to 3,7%, Funny thing though: by April the rate was back up to 4.

1%.At this point, no one has any real clue if unemployment in January and February is going to stay low or bounce back up.However, as I noted last week – the fact that job vacancy numbers seem to be falling suggests a rise in unemployment is the more likely outcome.At any rate, are we seeing any signs of wages taking off?The most recent wage price data is only up to September (the next figures come out in a couple of weeks).But here we see absolutely no signs of wages galloping upwards:If the graph does not display click hereHeck, in December the shadow treasurer, Ted O’Brien, was banging on about how real wages were falling – ie that wages were growing slower than inflation.

He was right: in the September quarter real wages fell, and over the past year they were flat,If the graph does not display click hereBut apparently a time when wages are growing slower than inflation is also a time when we need to raise interest rates in order to keep wages down,Make it make sense,The RBA failed to do so, and instead succumbed to meeting the desires of speculators and those who think more unemployment is a good thing for the economy,Greg Jericho is a Guardian columnist and chief economist at the Australia Institute

FTSE 100 falls back from record high amid AI worries; gold heads for best day since 2008 – as it happened

And finally, the FTSE 100 has closed down 27 points or 0.26% at 10,314, away from the record high hit this morning.Although miners and precious metal producers rallied, as the gold and silver price jumped, the index was dragged down by Relx (-14.3%) and the London Stock Exchange Group (-12.8%), as investors reacted to US artificial intelligence firm Anthropic unveileing a tool for companies’ in-house lawyers

What are the odds? The RBA has raised interest rates – for no real reason other than to meet the desires of speculators | Greg Jericho

Has there been an interest rate rise more desired by some economists and commentators despite no real reason, than the one pushed for on Tuesday? Alas, the Reserve Bank listened to the noise and felt compelled to raise the cash rate to 3.85%, but one wonders if they listened more to the noise of the commentariat than the data.In Tuesday’s announcement, the RBA monetary policy board barely changed anything from its December statement.In December the board thought: “While inflation has fallen substantially since its peak in 2022, it has picked up more recently”. Now it says: “While inflation has fallen substantially since its peak in 2022, it picked up materially in the second half of 2025

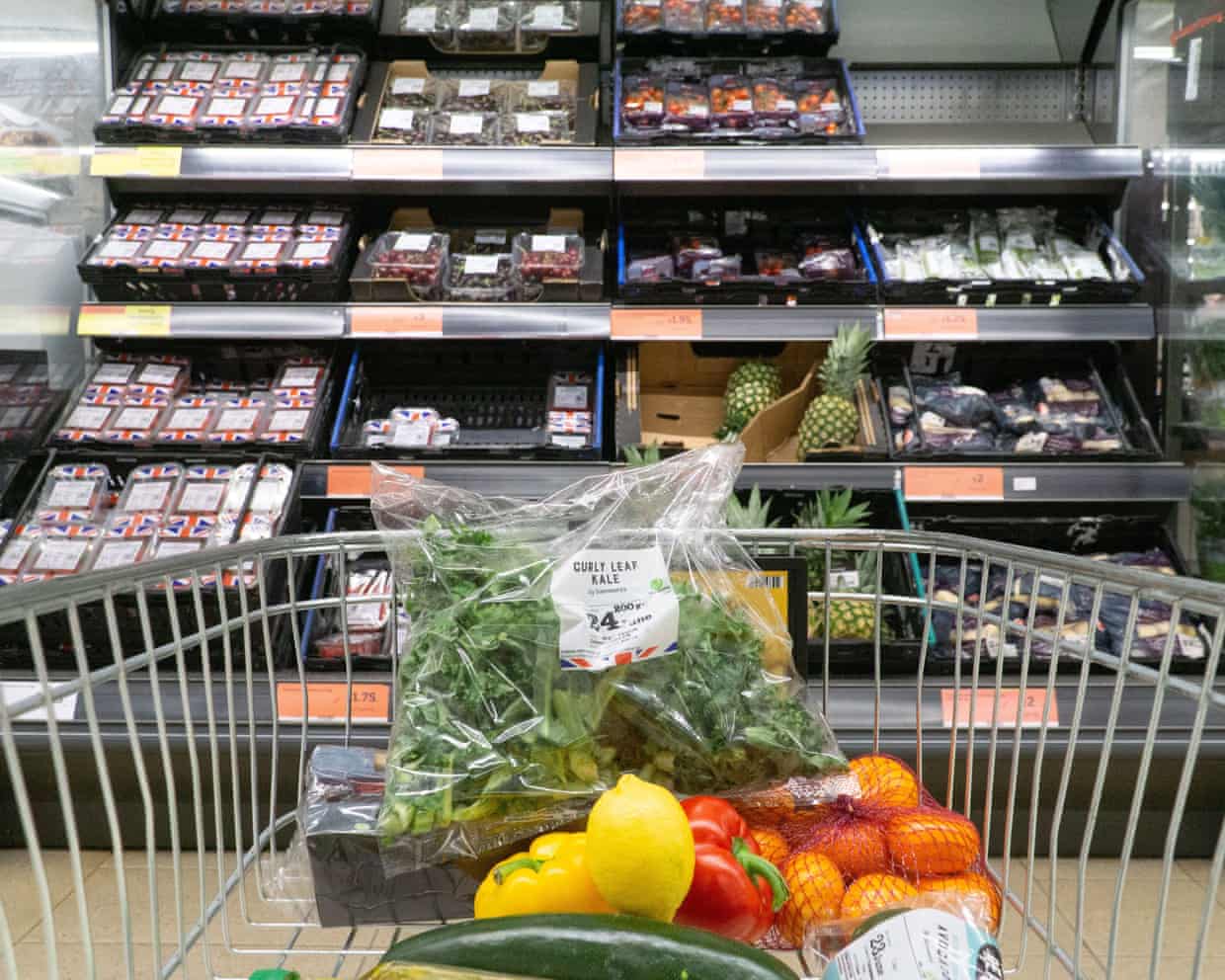

UK shoppers buy more fruit and yoghurt in healthy start to 2026

Britons started 2026 by buying more healthy food such as fruit and yoghurt as they attempted to hit new year health goals, while grocery price inflation eased to the lowest level since April, research has shown.Annual grocery inflation fell back to 4% in the four weeks to 25 January from 4.7% in December, offering some relief for shoppers, according to a monthly snapshot of the grocery sector from the research company Worldpanel by Numerator.Consumers turned to healthy eating, it said, with sales volumes of fresh fruit and dried pulses up 6% year on year, while fresh fish was up 5%, poultry 3% and chilled yoghurt 4%. Cottage cheese sales jumped by 50% and it was bought by 2

Barnsley rebranded UK’s first ‘tech town’ as US giants join AI push

In 2002 Barnsley toyed with a redesign as a Tuscan hill village as it sought out a brighter post-industrial future. In 2021 it adopted the airily vague slogan “the place of possibilities”. Now it is trying a different image: Britain’s first “tech town”.The technology secretary, Liz Kendall, has anointed the South Yorkshire community as a trailblazer for “how AI can improve everyday life” in the UK.In the latest move in Labour’s drive to inject AI into Britain’s bloodstream, the government has announced four US tech companies – Microsoft, Google, Cisco and Adobe – have agreed to help as the council pushes to apply AI to local schools, hospitals, GPs and businesses in Barnsley, an area of South Yorkshire which has struggled with unemployment and deprivation since the coal pits closed

US jobs report delayed again amid government shutdown

The US’s closely watched jobs report will once again be delayed, the Bureau of Labor Statistics (BLS) announced on Monday, amid a government shutdown.The January 2026 jobs report, originally scheduled to be released on Friday, will be rescheduled when federal funding resumes. Data collection for the report has been completed, but the shutdown has forced a delay to releasing the report, which will provide crucial jobs data on the US labor market following the weakest year for job growth since 2020, with the addition of only 584,000 jobs in 2025 compared with 2 million in 2024.“The Employment Situation release for January 2026 will not be released as scheduled on Friday, February 6, 2026. The release will be rescheduled upon the resumption of government funding,” Emily Liddel, associate commissioner of the BLS, said in a statement

Gold and silver prices seesaw as FTSE 100 hits record high

Gold and silver prices seesawed on Monday, after a “meltdown” in the metals market deepened and rattled investors around the world.Gold prices tumbled by as much as 8% to $4,465 an ounce on Monday, ending a run of record highs that took it to nearly $5,600 last week. It later recovered some ground, but was still down by 3.5% at $4,700 in afternoon trading.Silver fell by as much as 7%, after a 30% slump on Friday, before recovering slightly to $79

From Dorset to the world: wave of donations helps to secure Cerne giant’s home

‘We put a stink bomb in Stephen Fry’s shoe’: Vic and Bob on the inspired idiocy of Shooting Stars

Sydney Biennale 2026: Hoor Al Qasimi unveils expansive program for 25th edition

Meryl Streep is as withering as ever in first full-length trailer for Devil Wears Prada 2

Letter: Mark Fisher obituary

Wil Anderson: ‘I honestly believe being mistaken for Adam Hills is one of the great gifts of my life’