UK inflation stays at 3.8% as food price rises slow for first time since March – as it happened

Our top story: UK inflation was unchanged last month at 3.8%, confounding expectations of a rise, in welcome news for the chancellor, Rachel Reeves, as she plans for her crucial budget next month.The Office for National Statistics (ONS) said that inflation measured on the consumer prices index remained at the same level in September as in August and July.City expectations had pointed to a 4% reading but the ONS said upward pressure from transport prices was offset by cheaper food and a slowdown in inflation for “recreation and culture”, including live music tickets.It was the 12th month in a row CPI remained above the government’s 2% target, however.

Our other main stories:Thank you for reading,We’ll be back tomorrow,– JKHeathrow’s third runway plans will be fast-tracked so Britain can “experience the benefits sooner”, the government said, as ministers launched a policy review required for the airport’s expansion,The transport secretary Heidi Alexander said work had started to review the Airports National Policy Statement (ANPS), which sets out the framework for expansion, allowing a final decision by the end of this Parliament to “realise the government’s ambition” of a runway by 2035,She said that new environmental and climate obligations meant an updated ANPS was necessary to allow a decision, but pledged it would be published for consultation by summer 2026, three years quicker than the ANPS arrived when the previous government backed Heathrow.

The updated policy statement will include Labour’s four key tests for proposed airport expansion – on climate, noise, air quality, and economic growth – and be consistent with net zero commitments, the government said.Alexander said that Heathrow, as well as the Arora Group, which submitted an alternative proposal, had been asked to provide additional details, with a view to a single scheme being taken forward by November.On Wall Street, stocks are broadly flat.The Dow Jones and S&P 500 opened slightly higher while the Nasdaq is down by 19 points, or nearly 0.1%.

In London, the FTSE 100 index is 100 points, or 1% ahead at 9,527, with Barclays among the biggest risers, after it upgraded its profitability expectations – despite putting aside another £235m to compensate drivers over the car loan commissions scandal.Housebuilders are also among the main gainers, with Persimmon rising by nearly 5%, Barratt Redrow up 3.6% and Berkeley Group 3.2% ahead.Building materials supplier Howden Joinery is the top riser, up 5.

2%, while B&Q owner Kingfisher has gained 3.8%.There has been talk of a housebuilding package from central government for London that will water down affordable housing targets to kickstart stalled development.It is expected in the next few weeks, although some regard it as “Labour’s big housing betrayal”.In financial markets, crude oil is pushing higher for a second day in a row, rising by more than 2%, lifted by hopes of progress on a US trade deal with China and India.

Brent crude futures, the global benchmark, rose by 2.1% to $62.64 a barrel while US West Texas Intermediate crude futures climbed by 2.4% to $58.64 a barrel.

Donald Trump said he spoke to Indian prime minister Narendra Modi on Tuesday, adding that Modi assured him India would limit its oil purchases from Russia – a thorny issue.India’s Mint newspaper reported today that the two countries are inching closer to a long-stalled trade agreement that would reduce US tariffs on Indian imports to 15%-16%, from 50% at the moment.Turning to China, officials from Washington and Beijing are set to meet this week in Malaysia.Trump said on Monday he expected to hammer out a fair trade deal with Chinese president Xi Jinping, whom he is due to meet in South Korea next week – although on Tuesday he said the meeting might not happen.A summit between the US and Russian presidents has been put on hold.

Spot gold fell by 1,6% to $4,051,89 an ounce, reversing a modest gain earlier,On Tuesday, gold tumbled by 5%, its biggest sell-off since 2020 after weeks of record-breaking gains,The UK’s energy companies have called for a radical shake-up of the regulator Ofgem, accusing it of overseeing a rise in domestic bills and slowing Britain’s economic growth.

The industry’s trade association, Energy UK, has called for Ofgem to be stripped of some of its responsibilities after overseeing “a dramatic increase in red tape” that it claims has reduced growth and pushed up costs for households.In a report, the trade group noted that despite the government’s plan to reduce the cost of regulation by 25% by the end of this parliament, Ofgem’s headcount had been allowed to increase by 120% over the past 10 years while its budget grew by 200%.By contrast, the energy sector’s workforce had grown by only 8% over the same period.Ofgem is the energy regulator for Great Britain.Work to connect HS2 to the west coast mainline will be deferred for another four years as part of a “reset” of the troubled high-speed rail project.

The work between Birmingham and Handsacre in Staffordshire was originally halted in early 2023 by the previous government to limit spending on HS2.The decision to extend the pause means cities in northern parts of the country will have a long wait for even the secondary benefits of HS2, after construction of the planned remaining leg of the railway north of Birmingham was scrapped in 2023.The connection will eventually cut 25 minutes from journeys between London, Liverpool, Manchester and beyond, using new high-speed trains and track as well as the existing mainline.The company behind Princes Tuna, Napolina Pasta and Naked Noodle is targeting a lower-than-expected valuation of up to £1.24bn when it floats on the London stock market.

Princes Group reiterated that it hopes to raise £400m, and plans to use the money to fund expansion.The 150-year-old group, owned by Italian food and drinks maker NewPrinces since May last year, said today that it is aiming for a market valuation of £1.16bn to £1.24bn, rather than £1.5bn, in a sluggish UK IPO (initial public offering) market.

The Liverpool-based company has become one of Europe’s biggest grocery suppliers in recent decades through nearly two dozen acquisitions and mergers.The company plans to sell up to 84.2m new shares priced between 475 and 590 pence, with NewPrinces intending to buy up to £200m worth of shares.Shares in its parent company dropped by 10% on the Milan stock exchange following the announcement.Princes shares are expected to trade on the London Stock Exchange on 5 November 5.

Its debut will test investor appetite in the London stock market, which has lost mega deals including Unilever’s ice cream business and fast-fashion retailer Shein and is on track for its lowest number of new flotations this year,Princes joins Texas-based data centre company Fermi’s dual listing - the biggest this year - and alternative lender Shawbrook’s planned float of up to £2bn,Fermi raised more than $680m in early October, giving it a valuation of close to $12,5bn,*This post has been corrected.

An earlier version said the expected valuation was £1.14bn, not the actual £1.24bn.The hack of Jaguar Land Rover has cost the British economy an estimated £1.9bn and affected more than 5,000 organisations, a cybersecurity body has said.

A report by the Cyber Monitoring Centre (CMC) said losses could be higher if there were unexpected delays to the return to full production at the carmaker to levels before the hack took place in August.“This incident appears to be the most economically damaging cyber event to hit the UK, with the vast majority of the financial impact being due to the loss of manufacturing output at JLR and its suppliers,” the report said.The CMC is an independent non-profit organisation made up of industry specialists including the former head of Britain’s National Cyber Security Centre.Rachel Reeves, the UK chancellor, is reportedly planning to close a tax loophole in her budget next month that allows overseas retailers including Shein and Temu to send small packages to the UK without paying any customs duties.The arrangement, central to the business model of the online marketplaces where almost all sellers are based in China, has been criticised by British high street chains that complain it creates an uneven playing field.

Currently parcels containing goods worth up to £135, known as “low-value imports”, can be imported without incurring any customs duty.By contrast, goods worth over £135 can incur duty of up to 25%.Reeves will use her 26 November budget to close this loophole, which experts say costs the industry as much as £600m a year, according to a Financial Times report quoting unnamed government officials.ITV’s share price has dropped sharply to its lowest since April after its biggest investor, Liberty Global, sold half its stake.Shares in the Love Island broadcaster were down by 8% on Wednesday morning, after Liberty on Tuesday said that it would sell 193m shares, worth about £135m.

The sale will reduce Liberty’s shareholding from about 10% to approximately 5%.ITV has been the target of repeated takeover rumours, with Liberty seen as a possible suitor after it acquired BSkyB’s 6.4% stake for £481m in 2014.However, the company’s valuation has languished as linear broadcast’s share of advertising has been reduced by competition from online social media video.While that could make it easier to take over, no formal approaches have been made.

The share price decline has come despite the success of the ITV Studios arm, which makes hits for ITV and other broadcasters.Those include the reality TV smash Love Island for ITV, the Until I Kill You miniseries that aired in New Zealand, Canada and the UK, and the Jilly Cooper adaptation Rivals for Disney’s streaming service.Barclays is the top riser on the FTSE 100, after it upgraded its profitability expectations despite putting aside another £235m to compensate drivers over the car loan commissions scandal.The bank’s share price is up by 4.4%, compared with a 0.

8% increase on the broader FTSE 100,Russ Mould, investment director at AJ Bell, an investment platform, said:After a slight stumble thanks to concerns over whether a couple of spectacular bankruptcies in the USA mean the credit cycle is turning down, and some turbulence in US banking stocks, shares in Barclays are turning higher again after a strong set of third-quarter results,Management feels confident enough to launch a third share buyback of the year, this time for £500m, to take the total for the year to £2,5bn,That strong signal, and maintenance of targets for return on tangible equity for 2025 and 2026, may help to soothe those who had started to fret as US banking shares took a dive after the high-profile failures of First Brands and Tricolor.

Barclays shares are now heading back toward the 17-year high reached last month.The Confederation of British Industry (CBI) has appointed the chair of weapons maker BAE Systems, Cressida Hogg, to be its president.The appointment means that Britain’s biggest business lobby group will have two women leading it, as it continues to try to rebuild its reputation and influence after a scandal in 2023 over governance, bullying and sexual misconduct.The Guardian in 2023 revealed allegations of sexual misconduct and rape by senior men at the organisation.Hogg will take over on 1 January from Rupert Soames, who was appointed in December 2023 in the wake of the scandal.

She will act as the lobby group’s figurehead alongside director-general Rain Newton-Smith.As it has rebuilt its reputation, the CBI has taken an increasingly critical stance towards the Labour government.Soames was particularly aggrieved by tax rises at last year’s budget.Hogg was appointed chair of the FTSE 100’s BAE Systems in May 2023, after a career mainly focused on infrastructure investment.She was previously head of infrastructure at the Canada Pension Plan Investment Board from 2014 and 2018, and before that was managing partner of 3i Infrastructure.

The CBI said it had considered 50 candidates, via the recruitment firm Egon Zehnder.Hogg said:I am pleased and honoured to have been nominated to be the next president of the CBI.Whilst this is a challenging time for business, it is also one of opportunity.I look forward to working with the CBI team as we help government achieve our common objectives of making the UK a high-growth economy, attracting the investment needed to drive global competitiveness and increased productivity.The surprisingly steady inflation reading may be offering some solace to the chancellor, Rachel Reeves, in Whitehall and the Bank of England governor Andrew Bailey in Threadneedle Street.

Isabella Galliers-Pratt, an investment director at Rathbones, an asset manager, said:This morning’s consumer price index release delivered a modest but meaningful reprieve for policymakers and markets alike, defying expectations of a rise to 4.0% and offering a glimmer of stability ahead of the chancellor’s autumn budget on 26 November.She flagged declines in prices in food, recreation, and culture as particularly welcome, “suggesting inflationary fears linked to corporate cost pressures may be easing”.She said:Markets responded positively this morning, with government bond yields edging lower and the FTSE moving higher, offering the chancellor some breathing room given the UK’s substantial proportion of inflation linked debt.Lower inflation expectations help ease borrowing costs, improving fiscal flexibility.

This backdrop also provides the Bank of England with greater scope for policy manoeuvre and may prompt speculation around a more dynamic path for the bank rate,Annual house price inflation slowed in August across the UK, while private rent rises also eased, according to official figures,The average price of a home rose by 3% to £273,000 in the 12 months to August, down from 3,2% in July, the Office for National Statistics said,Average house prices increased to £296,000, with an an annual rate of 2

Groceries via delivery apps like UberEats, DoorDash and MilkRun can be up to 39% more expensive

Convenience can come at a steep price, Choice has found, with Australian consumers paying up to 39% more for groceries ordered through rapid delivery apps.Choice compared in store prices of 13 common grocery items available at Coles, Woolworths and Aldi with their equivalents on third party apps UberEats, DoorDash and Woolworths-owned MilkRun.They found that items including pasta, milk and fresh vegetables cost on average 11% more on third-party apps and delivery charges of between $5 and $11 significantly drove up bills.Seven out of 13 items at Aldi were priced higher on DoorDash than in store, while MilkRun charged more for 11 out of 13 items from Woolworths.“Not all items are increased in price,” the editorial director at Choice, Mark Serrels, said, but “the majority of them are”

Barclays plays down £20bn exposure to private credit industry

Barclays has insisted it has the right controls in place to manage a £20bn exposure to the under-fire private credit industry despite warnings from the International Monetary Fund (IMF) and the Bank of England.The bank’s chief executive, CS Venkatakrishnan, said it ran a “very risk-controlled shop” and was comfortable with its lending standards for the private credit industry.That was despite taking a £110m loss over the US sub-prime auto lender Tricolor, which collapsed amid fraud allegations last month.Losses stemming from the dual collapse of Tricolour and the US auto parts company First Brands have raised fears over potentially weak lending standards in the private credit industry. There are concerns that the potential fallout could destabilise traditional banks that issue loans to the shadow banking sector

‘It’s 3p on a pack of sausages’: UK food firms say packaging tax adds to inflation

A packaging tax designed to end our throwaway society is under fire for inadvertently adding to food price inflation as it pushes up the cost of everything from sausages to soft drinks.“It’s about 3p on a pack of sausages,” says Andrew Keeble, the co-founder of Heck, of the new extended producer responsibility (EPR) tax.This year’s packaging tax bill for the family-run food manufacturer, based near Bedale, North Yorkshire, which landed this month, is £153,000.Heck has already absorbed the increases in employer national insurance contributions and the “national living wage” announced a year ago by the chancellor, but Keeble suggests this new tax will have to be “passed on to a fairly cash-strapped nation”.The packaging levy – designed to end excessive packaging and create a circular economy – transfers the cost of recycling the ready meal containers and wine bottles in your kerbside bin from councils back on to the companies that sold them

Signs of peak inflation open door to earlier Bank of England interest rate cuts

Has UK inflation peaked? The latest official figures showing price growth in the UK stayed at 3.8% in September seem to suggest so.The statement cannot be made with absolute certainty yet but many economists reacted to the latest consumer prices index (CPI) data with a message that the only direction for inflation over the rest of the year was down.City economists had expected the Office for National Statistics to report an increase from August’s 3.8% to 4%, and they were in good company – the Bank of England also said inflation would top out at that level last month

Eurostar to run doubledecker trains through Channel tunnel from 2031

Eurostar is to start running doubledecker trains through the Channel tunnel to meet growing demand for international rail travel from the UK.The rail operator announced it had signed a €2bn (£1.7bn) deal for at least 30 – and up to 50 – new trains from the manufacturer Alstom.The doubledeckers will start operating from 2031, with each able to carry more than 1,000 passengers.Eurostar said the Celestia trains, the first high-speed doubledeckers to run on the UK mainland, would have about 20% more seats than its biggest existing trains

Real living wage to rise by almost 7% in boost for low-paid UK workers

Almost half a million workers are to receive a pay boost after it was announced that the real living wage paid voluntarily by 16,000 UK companies will rise to £13.45 an hour.Distinct from the national living wage, which is a statutory minimum, the real living wage is calculated each year based on the cost of essentials, and is paid by more than half of the companies in the FTSE 100.Born from a long-running campaign about the difficulties of making ends meet on poverty pay, employers can agree to pay the more generous rate. The Japanese clothing store Uniqlo, the University of Salford and Truro city council are among the latest to sign up

UK inflation unexpectedly remains at 3.8% for third month in a row

UK inflation stays at 3.8% as food price rises slow for first time since March – as it happened

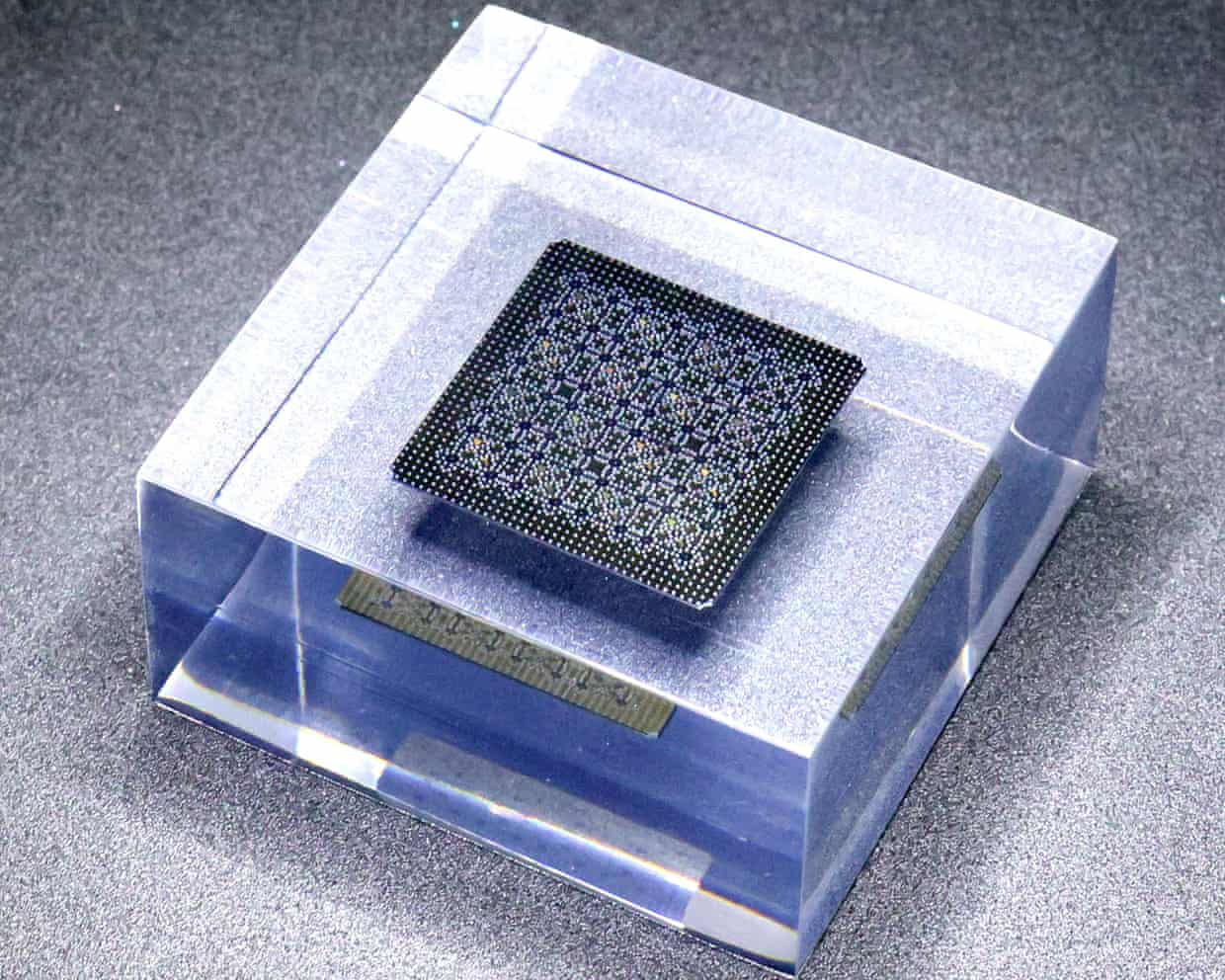

Google hails breakthrough as quantum computer surpasses ability of supercomputers

iPhone 17 review: the Apple smartphone to get this year

Australia beat England by six wickets at Women’s Cricket World Cup – live reaction

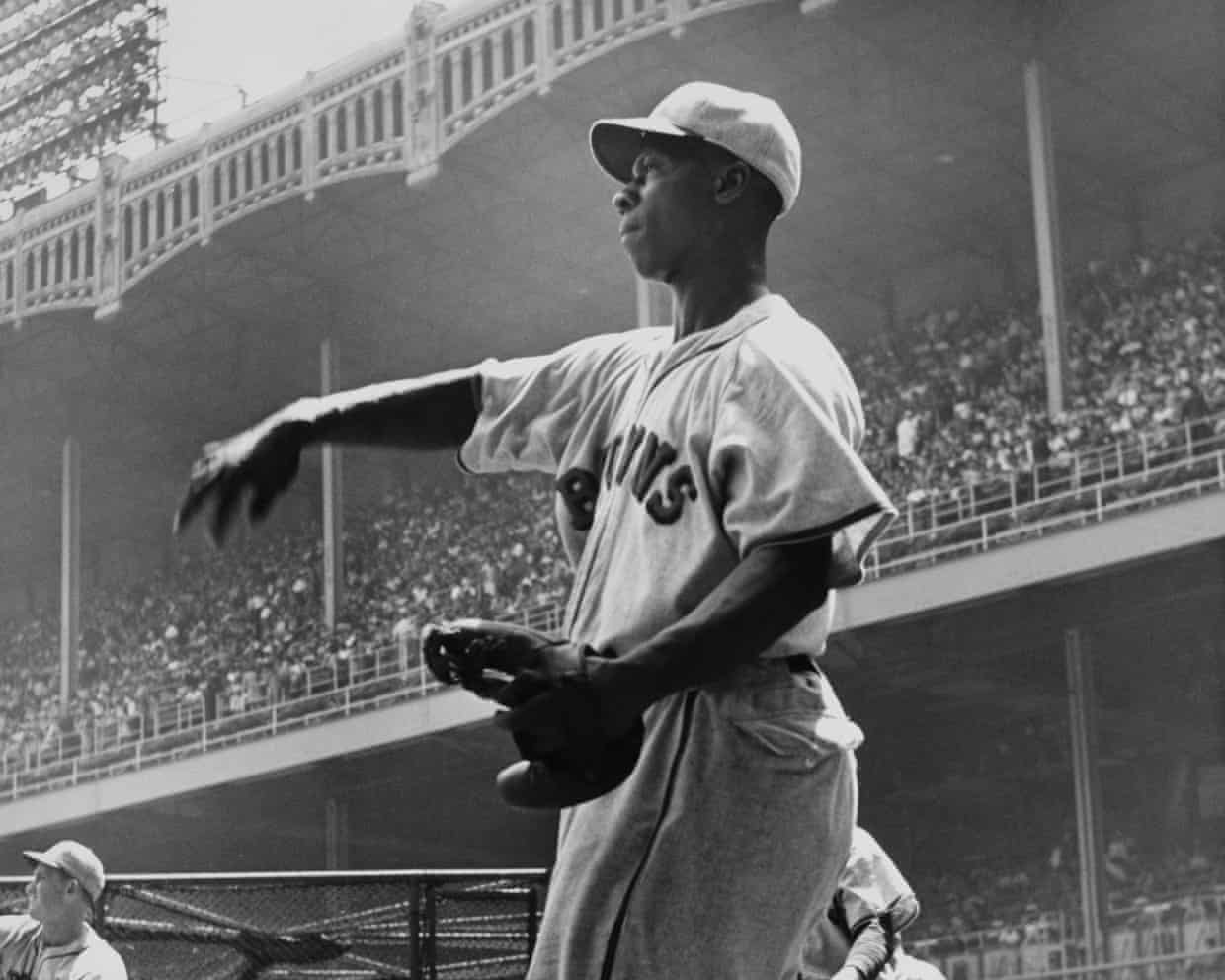

The forgotten story of the US soldiers who integrated baseball before Jackie Robinson