Buy now, pay later holiday purchases leaving travellers exposed to losses

People are missing out on vital protections by using buy now, pay later instead of credit cards to pay for holidays, experts warn.Buy now, pay later (BNPL) has grown hugely in recent years, and holiday firms and hotel chains have been adding it to the options for payment when booking online, saying it can make trips more attainable.“Stay now, pay later” is the new slogan from budget hotel chain Travelodge, which recently announced that guests can now pay via Klarna, Clearpay or PayPal – the three companies that dominate the UK BNPL market.Similarly, a number of travel agents and flight booking sites offer BNPL under the banner of “Fly now pay later”.Customers do not have to pay the full cost of their flights upfront – they can spread the cost over instalments.

And Airbnb announced in late 2023 that it was teaming up with Klarna in the UK so guests could spread the cost of stays over weeks or months.The service is available for reservations priced between £35 and £4,000.Data issued this week showed that searches on Google for phrases such as “buy now pay later flights” and “buy now pay later hotels” are up sharply on earlier this year, suggesting people are looking for ways to book more flexibly.BNPL is a form of credit where the cost of what you are buying is typically split into three or four instalments.If you keep to your repayment plan, you will not usually pay interest or charges.

However, there is concern that some people could end up taking out loans they cannot afford to pay back on time, thereby incurring charges, tipping them into debt and damaging their credit score.Experts warn that using BNPL to pay for holidays or trips also offers fewer consumer protections than more traditional credit.“While it can be really convenient, it’s worth remembering that it doesn’t come with the same protections as a credit card,” says Matthew Sheeran from Money Wellness, a debt solutions and budgeting website.If you pay with a credit card, section 75 of the Consumer Credit Act means that if a purchase between £100 and £30,000 goes wrong, the credit card provider is jointly liable with the retailer.Sheeran says that with BNPL, if there is a problem, “you’ll usually have to chase the retailer or travel provider yourself, which can be stressful and time-consuming.

It’s worth checking whether the BNPL provider offers any dispute process, but these aren’t as robust or guaranteed as section 75”.He adds that while this form of payment is fine for smaller low-risk purchases, for bigger spends, a credit card still offers a safety net.“BNPL is starting to edge into travel because it offers a way for people to ‘buy now, budget later’,” says Maisie Blewitt at Transfer Travel, an online marketplace where people can buy and sell unused trips.She says that if you pay using BNPL and the airline or hotel goes bust, for example, your money could be at risk of being lost.“Refunds can be messy, too, because if a trip is cancelled, instalments can keep coming out of your account until the refund clears, which could take weeks,” she says.

She adds that as this is a developing area of regulation, terms and protections can differ from provider to provider.“Before using buy now, pay later for a holiday, make sure you carefully read and fully understand the small print,” says Blewitt.People who use BNPL in this way typically do not have to pay for the trip before they travel, so charges may still be coming out of their account months after they have been away.There is no universal maximum spending limit, so how much you can borrow depends on which provider you use, your creditworthiness, and how much risk it is willing to take.“It feels risk-free, and that’s the problem,” says Sebrina McCullough from Money Wellness.

“Interest-free offers make it feel like a payment method, not borrowing,But it’s still credit, and if you use it to fund what you can’t afford, the risks grow,”The UK’s financial regulator, the Financial Conduct Authority, is to start regulating BNPL from July 2026,This means BNPL loans will become regulated credit agreements and, crucially, people using this form of credit will be covered by section 75,They will also be able to access the Financial Ombudsman Service if they need to make a complaint.

NatWest boss warns against higher bank taxes as lender’s profits rise 30%

NatWest Group’s chief executive has warned the government against increasing taxes on banks in the autumn budget as the high street lender reported a 30% jump in profits.Paul Thwaite said he understood the “difficult choices” that the chancellor, Rachel Reeves, had to make in order to help close a potential £30bn shortfall in the public finances but argued she needed to “balance fiscal discipline” with “policies that create stability, consistency and support growth”.Twaite said on a call with journalists on Friday: “I think the government should be thoughtful about signals it sends to investors who are looking at the UK as a long-term home for capital.”His comments came as NatWest reported a strong jump in profits, which grew 30.4% to £2

Dash for gold helps drive retail sales in Great Britain to three-year high

Sales at UK retailers rose unexpectedly last month to their highest level since July 2022, according to official figures, boosted by tech purchases amid the release of the new iPhone 17 as well as strong online demand for gold.Data from the Office for National Statistics (ONS) shows that retail sales volumes rose by 0.5% in September, the fourth consecutive monthly increase, confounding economists’ forecasts of a 0.2% monthly drop.Sales of products at computer and telecommunication retailers grew strongly last month

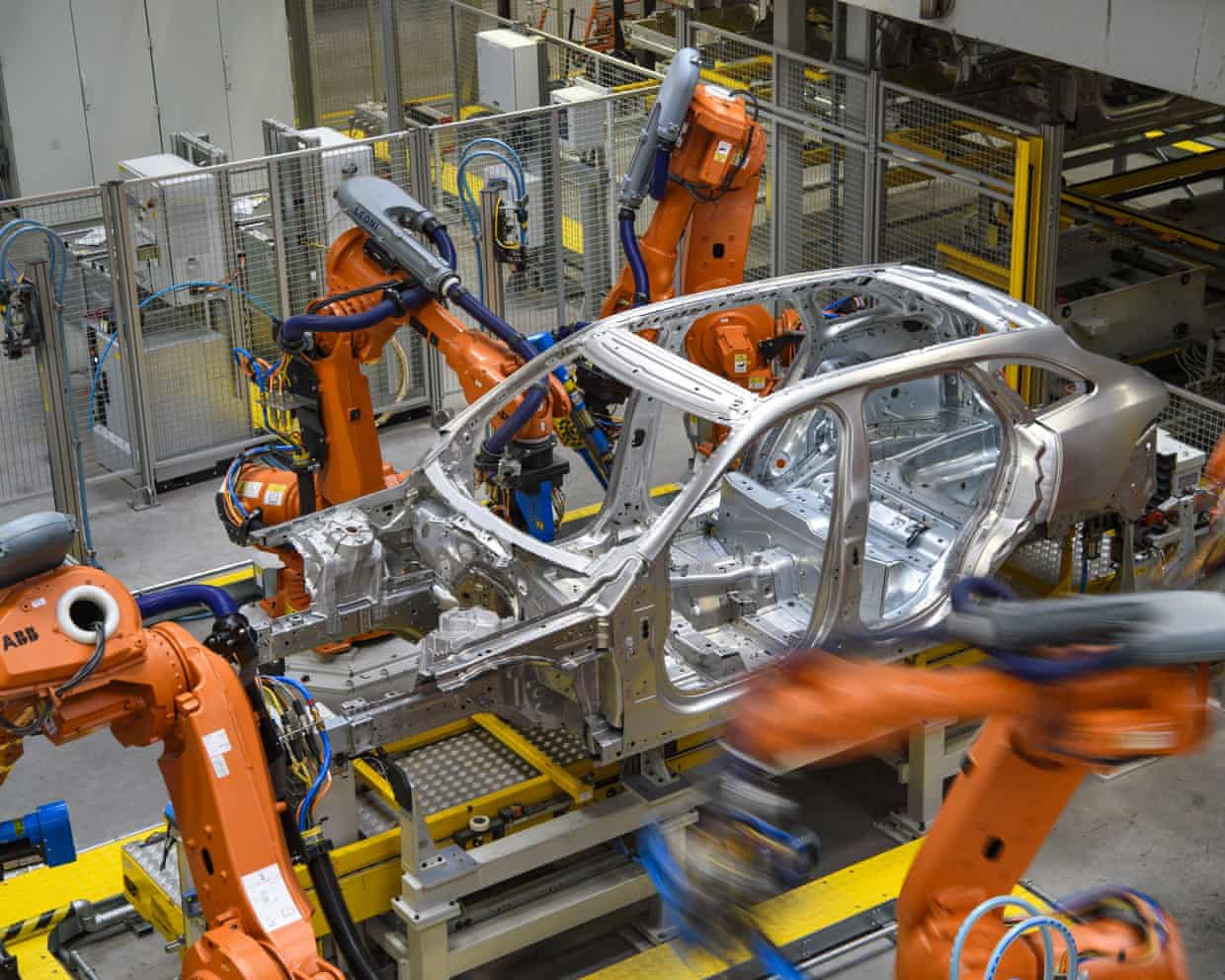

Car production slumps to a 73-year low after JLR cyber-attack

Car production in British factories slumped in September to the lowest level for the month since 1952 after Jaguar Land Rover was hit by an unprecedented cyber-attack.JLR, Britain’s largest automotive employer, was forced to shut down all its computer systems at the start of September and was unable to make another car until early October.That contributed to a 27% slump in total UK car production in September compared with the same month a year earlier, according to the Society of Motor Manufacturers and Traders (SMMT), a lobby group.Car output dropped to 51,100, from 70,000 in September 2024, while output for the first nine months of the year was down by 8%. Van production has also slumped by nearly 40% so far this year, after the closure by the Vauxhall owner Stellantis of its factory in Luton

Battle between Netherlands and China over chipmaker could disrupt car factories, companies say

Car companies across Europe and Japan including Volvo, Volkswagen, Honda and Nissan have warned that the battle between the Netherlands and China over control of the chipmaker Nexperia could hit production at factories.Last week’s decision by the Dutch government to take control of the Chinese-owned chipmaker, which is based in the Netherlands, has sent shock waves across the car industry, which is already facing potential shortages of products such as magnets amid China’s latest restrictions on rare earths exports.The Hague said at the time that it was taking control of Nexperia to safeguard Europe’s supply of semiconductors and that it had invoked a cold-war era law to take effective control of the company following concerns raised by the US about the Chinese owner, Wingtech.That decision caused an immediate rift with Beijing, which banned all exports from the chipmaker, escalating the already tense relations between China and the US before a potential meeting between Donald Trump and Xi Jinping next week in Korea.The Japan Automobile Manufacturers Association, whose members include Nissan, Toyota, Honda and Mazda, said on Thursday it had received a warning from Nexperia that chips could now be in short supply, potentially holding up manufacturing

UK manufacturers hit by largest drop in orders since 2020; FTSE 100 hits record high – as it happened

British manufacturers see the weakest prospects for orders over the next three months since 2020, new data from the Confederation of British Industry shows.The CBI’s latest healthcheck on manufacturing has found that business sentiment deteriorated this month, with goods producers expecting the total volume of new orders to decline in the three months to January.Business sentiment deteriorated in October. Export optimism for the year ahead also declined further. pic

Oil price jumps and FTSE 100 hits new high after Trump puts sanctions on Russian firms

Oil prices jumped and energy companies helped the FTSE 100 to a record high after Donald Trump announced new sanctions on Russia’s two biggest oil producers.Brent crude increased by 5.7% to $66.13 a barrel after the news of the fresh restrictions on Rosneft and Lukoil, as the US president ramps up pressure on Vladimir Putin to end the war in Ukraine.The jump in oil price also boosted shares in the energy companies Shell and BP by about 3%, which in turn helped to drive the FTSE 100 to a record high of 9,594

Rachel Roddy’s recipe for leftover polenta biscuits | A kitchen in Rome

Don’t chuck your parmesan rind – it is an excellent stock cube – recipe | Waste not

No waste, all taste: Max La Manna’s comfort food pantry-raid recipes

When restaurateurs go rogue: is it right to lambast locals who won’t come and dine with you?

If you like piña coladas: how to make slushies at home without a machine

Pickle power: how to make your first ferments | Kitchen aide