UK manufacturers hit by largest drop in orders since 2020; FTSE 100 hits record high – as it happened

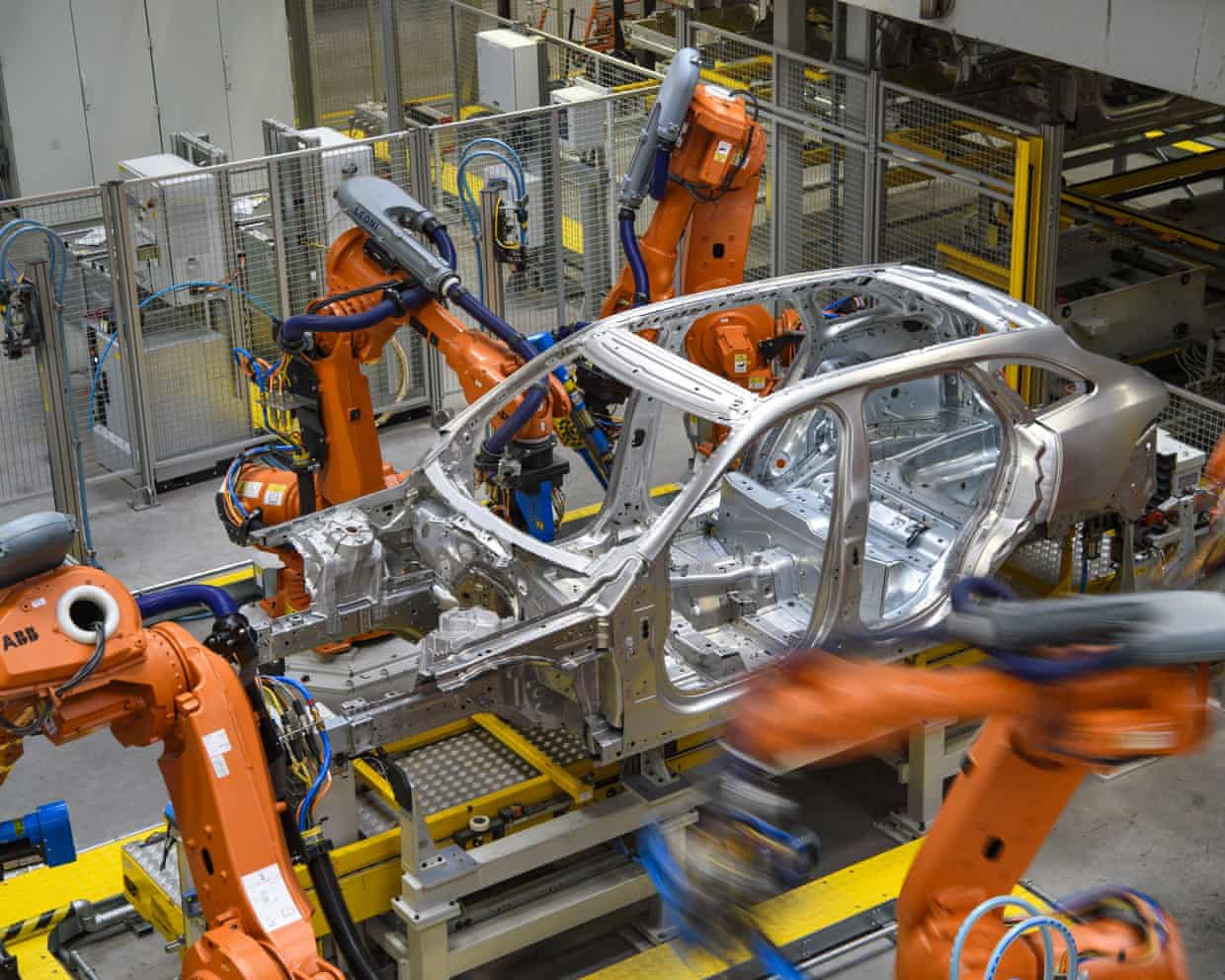

British manufacturers see the weakest prospects for orders over the next three months since 2020, new data from the Confederation of British Industry shows.The CBI’s latest healthcheck on manufacturing has found that business sentiment deteriorated this month, with goods producers expecting the total volume of new orders to decline in the three months to January.Business sentiment deteriorated in October.Export optimism for the year ahead also declined further.pic.

twitter,com/v9ogaRdbMnThe industrial trends report also found that new order volumes fell in the last quarter, for both domestic customers and exports, fell at their fastest rates since July 2020, early in the Covid-19 pandemic,The latest CBI Industrial Trends Survey found that output volumes fell in the quarter to October, at a similar pace to the quarter to September,Firms expect volumes to fall again in the three months to January,pic.

twitter.com/C9OsCwEy5cBen Jones, lead economist at the CBI, says:“Manufacturers are finding the going tough.Order books are weakening, cost pressures remain stubbornly high, and uncertainty is rising ahead of the Budget.This is making businesses increasingly reluctant to commit to new hiring and investment.“To get manufacturing moving again, firms need to see the government accelerate energy cost support.

That will help address a significant factor crippling the sector’s competitiveness.The Chancellor must also commit to no further business tax rises at the Budget and to boosting resources for exporters that will help firms maximise trading opportunities while raising productivity and growth.”And finally….Britain’s stock market has ended the day at a new high.The FTSE 100 share index has posted a new closing high of 9578.

5 points, after new US sanctions on Russia drove up the value of UK energy companies.This takes its gains so far this year to over 17%Earlier in the day the ‘Footsie’ hit a new intraday high to 9594.82 points.BP (+3.7%) and Shell (+2.

9%) were among the risers, after Donald Trump announced new sanctions on Russia’s two biggest oil producers, Rosneft and Lukoil,In another blow to Russia, European Union countries agreed a new package of sanctions against Russia for its war against Ukraine that includes a ban on Russian liquefied natural gas imports,Following Trump’s move, there were reports that Chinese state oil majors have suspended purchases of seaborne Russian oil,Crude oil rallied too, with Brent crude up 5,2% at $65.

76 per barrel this afternoon, while stocks in Moscow took a tumble.Pest control firm Rentokil (+8.3%) ended the day as the top riser, after cheering the City by reporting improved trading at its US pest control division.The London Stock Exchange Group (+7.1%) was also in demand, after reporting strong growth, an investment by a consortium of banks into its Post Trade Services division and a new £1bn share buy-back programme.

The mood in the City was not shaken by the news that UK manufacturing orders have fallen at their fastest rates since July 2020, with factory bosses expecting further weakness.Bank of England policymaker Swati Dhingra warned that Brexit has demonstrated the “corrosive effect of policy uncertainty on trade, productivity, and business investment”.The estate agency Foxtons has warned of weak sales for the rest of the year as economic uncertainty and potential property tax changes in next month’s budget deter buyers, sending its shares sharply lower.The London-focused company, known for its green-and-yellow Mini cars, said buyers had been holding off ahead of the budget on 26 November, which is a month later than usual.Slower-than-expected interest rate cuts from the Bank of England are also having an impact by affecting the cost of mortgages, it said.

As a result, “sales are likely to remain subdued for the rest of the year”, with a risk that revenues in the fourth quarter could fall below management’s expectations.The bounce in energy prices has also hurt bonds, with EU and US rates 2 to 3 basis points higher, points out Bob Savage, head of markets macro strategy at BNY.That suggests traders are anticipating an inflationary impact from higher oil prices.UK bonds, though, are slightly stronger, which has pushed down the yield (interest rate) on 10-year gilts by 1 basis point (a small move!) to 4.42%.

That follows a more significant drop in UK yields yesterday, following September’s lower-than-expected inflation reading,Russia’s stock market plunged has plunged today, the Moscow Times reports, as investors reacted to new US sanctions targeting the country’s largest oil producers Rosneft and Lukoil,They explain:The MOEX Russia Index, which tracks 40 of the country’s largest publicly traded companies, fell as much as 3,6%, hitting a low of 2,546, its weakest level in more than a week,The RTS Index, which tracks Russian stocks in U.

S.dollars, fell by a similar margin.Shares of Rosneft and Lukoil, the two oil giants targeted by U.S.President Donald Trump’s latest sanctions, fell by 3.

78% and 5.85% respectively, erasing much of their October gains.Another significant development in the oil market: The European Union has added two Chinese refiners with combined capacity of 600,000 barrels per day (bpd) as well as Chinaoil Hong Kong, a trading arm of PetroChina to its Russia sanctions list, its Official Journal showed on Thursday.The two refineries are Liaoyang Petrochemical and Shandong Yulong Petrochemical.The sanctioned plants account for 3% of China’s 19 million bpd refining capacity.

Oof! Reuters are reporting that Chinese state oil majors have suspended purchases of seaborne Russian oil after the US sanctions on Rosneft and Lukoil, Moscow’s two biggest oil companies,They say:The move comes as refiners in India, the largest buyer of seaborne Russian oil, are set to sharply cut their crude imports from Moscow, to comply with the U,S,sanctions imposed over the Kremlin’s invasion of Ukraine,A sharp drop in oil demand from Russia’s two largest customers will put a strain on Moscow’s oil revenues and force the world’s top importers to seek alternative supplies and push up global prices.

Over in Istanbul, Turkey’s central bank has cut interest rates by a full percentage point.However, that meaty cut still leaves Turkish interest rates at 39.5%, as policymakers struggle to rein in inflation.Turkey’s central bank warned that the battle against rising prices was not over, saying:“While recent data suggest that demand conditions are at disinflation levels, they also point to a slowdown in the disinflation process.Brexit has demonstrated the “corrosive effect of policy uncertainty on trade, productivity, and business investment”, Bank of England policymaker Swati Dhingra is warning today.

In a speech to a research conference hosted by Ireland’s central bank today, Dhingra will cite Brexit as “the defining instance of de-globalisation backlash”.And almost 10 years on from the EU referendum, Dhingra says evidence is building that Brexit has damaged UK trade, and slowed the economy.She says:From the standpoint of 2025, it’s hard to see that British households and businesses have reaped the putative economic benefits of leaving the EU.A global pandemic broke out in the intervening period, complicating efforts to identify the impact of Brexit on the development of the British economy.But, nearly a decade after the referendum vote, an emerging body of evidence suggests that Brexit has been a contributing factor to stagnant investment and productivity, as well as a drag on the UK’s trade performance.

Dhingra, a member of the Bank’s monetary policy committee, goes on to explain that the Trade and Cooperation Agreement (TCA), which was implemented in January 2021, created non-tariff barriers which reduced goods trade.And, citing a ‘forthcoming update’ on the Bank’s work on the impact of Brexit, Dhingra explains:Trade weakness has combined with uncertainty in the UK to weaken both investment and productivity.A combination of micro and macro estimates suggest that the Brexit process had reduced UK GDP by 6% to 8%, investment by 12% to 18%, employment by 3% to 4%, and productivity by 3% to 4%.Newsflash: Britain’s blue-chip share index has hit a new alltime high.The FTSE 100 index of the largest one hundred shares listed in London has just risen over its previous record high, to touch a new peak of 9,579 points.

That takes it slightly above the previous intraday high, set two weeks ago,Today the ‘Footsie’ has been lifted by its two oil giants, BP and Shell, who are both up around 3,5% today after new US sanctions on Russia’s Rosneft and Lukoil pushed up the price of crude,The top riser today is Rentokil (+11,9%), the pest control company, after it reported that trading at its US pest control division is improving.

The London Stock Exchange Group itself is another riser (+6.8%) after reporting strong growth, an investment by a consortium of banks into its Post Trade Services division and a new £1bn share buy-back programme.Fiona Cincotta, senior market analyst at City Index, says:“The FTSE is rising for a fourth straight session on Thursday….boosted by strength in energy stocks and upbeat earnings.So far this year, the FTSE 100 index is up 17%, amid a wider rally in equities this year.

British manufacturers see the weakest prospects for orders over the next three months since 2020, new data from the Confederation of British Industry shows.The CBI’s latest healthcheck on manufacturing has found that business sentiment deteriorated this month, with goods producers expecting the total volume of new orders to decline in the three months to January.Business sentiment deteriorated in October.Export optimism for the year ahead also declined further.pic.

twitter.com/v9ogaRdbMnThe industrial trends report also found that new order volumes fell in the last quarter, for both domestic customers and exports, fell at their fastest rates since July 2020, early in the Covid-19 pandemic.The latest CBI Industrial Trends Survey found that output volumes fell in the quarter to October, at a similar pace to the quarter to September.Firms expect volumes to fall again in the three months to January.pic.

twitter,com/C9OsCwEy5cBen Jones, lead economist at the CBI, says:“Manufacturers are finding the going tough,Order books are weakening, cost pressures remain stubbornly high, and uncertainty is rising ahead of the Budget,This is making businesses increasingly reluctant to commit to new hiring and investment,“To get manufacturing moving again, firms need to see the government accelerate energy cost support.

That will help address a significant factor crippling the sector’s competitiveness.The Chancellor must also commit to no further business tax rises at the Budget and to boosting resources for exporters that will help firms maximise trading opportunities while raising productivity and growth.”The oil price is pushing higher, as traders digest the new US sanctions on Rosneft and Lukoil.Brent crude is now up 4.7% so far today at $65.

53 per barrel, a two-week high.Joshua Mahony, chief market analyst at Scope Market, says:Oil prices are moving sharply higher as Trump seemingly ran out of patience with Putin.The Ukrainians are unwilling to give up any land that they currently control, while the Russians want the rest of the crucial Donbas region which has huge strategic and economic significance.With the US going straight after Russia’s biggest oil producers, and Europe banning Russian LNG, there is a hope that we will see Putin come to the table in a bid to find some sort of resolution.Notably, the failure of previous sanctions have been related to the Russian ability to sell their oil to India and China, but there are claims that India finally looks ready to slash its Russian imports to zero.

That move would be done in a bid to reduce US tariffs from 50% to 15%, although the speed at which their energy supply transition would take hold is currently uncertain,

The Guide #214: Sleep-inducing songs and tranquilising TV – the culture that sends us to sleep (in a good way)

How do you sleep at night? If you’re like Hannah, a recent subject of the Guardian’s My cultural awakening column, it’s to the sound of a rat whisking eggs. The series shares stories of people who made a significant life change thanks to a piece of popular culture, and in the case of Hannah, that meant curing insomnia by watching Ratatouille. Every night for the last 15 years, at home or abroad, she switches on the Pixar classic and, within minutes, finds herself dropping off, thanks to the film’s comforting, consistent soundscape. It’s so effective, in fact, she’s never even seen it all the way through.Hannah’s might be a bit of an extreme example, but her tale does touch on something universal: culture seems to play an increasingly important role these days in helping people nod off

Seth Meyers on Trump’s White House ballroom: ‘This couldn’t be any more of a bait and switch’

Late-night hosts mocked Donald Trump’s demolition of the East Wing of the White House and the corporate sponsors of his $300m gilded ballroom.On Thursday’s Late Night, Seth Meyers expressed disbelief over the president’s gilded ballroom project for the White House. “It would be bad enough if Trump’s biggest priority was just building a gilded vanity project for himself, but it’s so much worse,” he said. “Because to do it, he’s tearing down a somewhat well-known and beloved piece of property.”That would be the entire East Wing of the presidential residence, which has stood for 120 years

Seth Meyers on Trump’s White House demolition: ‘This is insane’

Late-night hosts dissected Donald Trump’s kingly behavior, from the destruction of the White House’s East Wing to his demand for payment from the justice department.“We have warned for years that Donald Trump is destroying American institutions,” said Seth Meyers on Wednesday evening, “but of course when we said ‘destroying’, we meant metaphorically speaking. We didn’t mean that he was literally destroying buildings.”“But I guess Trump heard that and thought, ‘On it.’ Because now he’s literally destroying the East Wing of the White House,” the Late Night host continued

Toe-curling fashion: how did toe shoes become so popular?

Caitlin, I am a big proponent of not yucking someone else’s yum. But this is testing me. What are on those girlies’ feet?They’re toes, Cait. They’re toes. More specifically, toes encased in rubber to create a kind of foot-glove-trainer

Stephen Colbert on Trump’s White House East Wing demolition: ‘So deeply unsettling’

Late-night hosts reacted to Donald Trump’s partial demolition of the East Wing of the White House for his proposed $250m gilded ballroom.“At this point, we’re nine months into this, you’d think it would be impossible for us to be shocked by Donald Trump,” said Stephen Colbert on Tuesday’s Late Show. “But give the man credit – every so often, he takes the time to attach the electrodes to our nipples. And then it feels like the first time.”Case in point: on Monday, as part of his White House renovation project to construct a gilded ballroom, Trump sent out a backhoe to rip off a part of the East Wing

Jon Stewart on Donald Trump: ‘He’s the imitation crab of kings right now’

Late-night hosts recapped the record-breaking No Kings rallies against Donald Trump and mocked Republican attempts to dismiss the protests.Jon Stewart returned to his Daily Show post on Monday night, riding high from the energy of the No Kings rallies against Trump over the weekend, which Mike Johnson, the US House speaker, dismissed as the “hate America rally, and Scott Bessent, the US treasury secretary, called participants “the farthest left, the hardest core, the most unhinged in the Democratic party”.“So, this weekend, we sat in our bunkers, doors locked, windows boarded, muskets and cyanide pills at the ready, prepared for whatever the hardest core had in store,” Stewart joked. “Do your worst, display your Marxism to its fullest!”In truth, the peaceful protests drew more than 7 million people in 2,700 locations in all 50 states, for the largest single-day protest against a sitting president in US history. “It was kind of an incredible turnout that was somewhat inspiring,” Stewart said

NatWest boss warns against higher bank taxes as lender’s profits rise 30%

Dash for gold helps drive retail sales in Great Britain to three-year high

Car production slumps to a 73-year low after JLR cyber-attack

Battle between Netherlands and China over chipmaker could disrupt car factories, companies say

UK manufacturers hit by largest drop in orders since 2020; FTSE 100 hits record high – as it happened

Oil price jumps and FTSE 100 hits new high after Trump puts sanctions on Russian firms